Prairie Provident Resources Inc. (“Prairie Provident”, “PPR” or the

“Company”) is pleased to announce the results of our independent

2019 year-end reserves evaluation conducted by Sproule Associates

Limited (“Sproule”) with an effective date of December 31, 2019

(the “Sproule Report”).

2019 RESERVES HIGHLIGHTS

- Significant proved plus probable (“2P”) and total proved (“1P”)

reserves were added through exploration and development activities

in 2019, totaling 4.3 MMboe and 1.7 MMboe, respectively.

- Operating cost reductions at Michichi and improved well

performance at Princess resulted in positive technical revisions of

0.5 MMboe for 2P, 1.7 MMboe for 1P and 1.7 MMboe for proved

developed producing (“PDP”) reserves. PPR’s continued

transition to our Evi waterflood resulted in 1.5 MMboe of 2P and

1.2 MMboe of 1P improved recovery in 2019, but also led to negative

technical revisions of 1.2 MMboe for 2P and 0.9 MMboe for 1P due to

the removal of undeveloped locations, which offset some of the

positive technical revisions realized at Michichi and

Princess.

- Replaced 163% and 113% of 2019 production with reserves

additions and technical revisions, on a 2P and 1P basis,

respectively.

- Reserves totaled 34.5 MMboe, 21.7 MMboe and 10.0 MMboe for 2P,

1P and PDP, respectively. Reserves additions were offset by

the impact of Sproule’s lower price deck forecasts, which resulted

in reserves reductions of 0.4 MMboe, 0.9 MMboe and 0.8 MMboe for

2P, 1P and PDP, respectively. Excluding the impact of lower

pricing, PPR recorded year-over-year growth of 4% and 1% on a 2P

and 1P basis, respectively, on a modest $10.6 million exploration

and development program.

- Finding, development and acquisition (“FD&A”)(1) costs were

$12.48/boe, $1.29/boe and $6.16/boe for 2P, 1P and PDP,

respectively, including change in future development costs and

technical revisions, resulting in estimated FD&A recycle

ratios(1) of 1.5, 14.4 and 3.0 times, respectively, using an

estimated 2019 operating netback of $18.58/boe(1)(2).

- 2019 net present values of future net revenue before tax

discounted at 10% (“NPV10 BT”) for 2P, 1P and PDP reserves totaled

$437.7 million, $257.4 million and $135.4 million, respectively,

including asset retirement obligation (“ARO”) deductions of $29.1

million, $28.2 million and $26.8 million, respectively. Based

on Sproule’s application of new guidance added to the Canadian Oil

and Gas Evaluation Handbook (“COGEH”) in late 2019, PPR’s NPV10 BT

includes a larger component of ARO in the reserves.

Approximately 79% of PPR’s estimated ARO is now included in the

2019 reserves evaluation compared to only 26% in 2018.

Excluding the inclusion of this larger component of ARO and the

impact from Sproule’s lower price forecast, PPR’s NPV10 BT in 2019

would have been higher than in 2018.

- Net asset value (“NAV”)(1)(2) per share is $1.92, $0.87 and

$0.16 on a 2P, 1P and PDP basis, respectively.

- With a reserve life index(1) of 15.6 years, 9.8 years and 4.5

years on a 2P, 1P and PDP basis, PPR is well positioned for

long-term sustainability and to continue the measured development

of its oil and liquids-weighted asset base.

|

Notes: |

|

(1) |

"Finding, Development & Acquisition Costs", “Recycle Ratios”,

“Operating Netback”, "Net Asset Value" and “Reserve Life Index” do

not have standardized meanings. See "Cautionary Statements"

below. See also “Capital Efficiencies” and “Net Asset Value”

below. |

|

(2) |

All 2019 financial information is unaudited. See advisories. |

RESERVES

DETAIL

PPR executed a successful 2019 capital

development program which added approximately 4.3 MMboe and 1.7

MMboe of incremental 2P and 1P reserves from an exploration and

development program that was just over $10 million, and achieved

robust recycle ratios due to attractive FD&A costs and

netbacks. Significant declines in Sproule’s price forecasts

negatively impacted the Company’s overall reserves and NPV10.

Before the effects of lower forecast pricing, PPR replaced 163% and

113% of 2019 production on a 2P and 1P basis.

PPR delivered strong operational performance in

2019, successfully, safely and responsibly adding reserves through

our capital program. At Evi, PPR has transitioned its

development plan from infill drilling to waterflood. As a

result, an incremental 1.5 MMboe and 1.2 MMboe of 2P and 1P

undeveloped reserves (98% liquids), respectively, have been

assigned to future waterflood expansions. PPR’s continued

transition to waterflood at Evi also led to the removal of infill

locations in the waterflood areas, resulting in 1.2 MMboe and 0.9

MMboe of negative technical revisions on a 2P and 1P basis,

respectively. The transition also reduced 1P future capital

by $5.3 million, which high-graded the development economics.

At Michichi, meaningful reserves were added as a

result of improved operational efficiencies and lower overall

operating costs. Improved well economics resulted in the addition

of 1.7 MMboe of 2P undeveloped reserves and added positive

technical revisions of 1.7 MMboe and 1.6 MMboe of 2P and 1P

reserves, respectively.

In our Princess area, we extended 1.0 MMboe and

0.4 MMboe of 2P and 1P undeveloped reserves relating to Glauconite

and Ellerslie development. In addition, over 0.4 MMboe of 2P

and 0.6 MMboe of 1P positive technical revisions were realized from

improved well performance.

Commencing in 2019, Sproule has reflected a

larger proportion of the Company’s estimated ARO within our

reserves, which resulted in a decrease in value relative to 2018.

This change was made based on new guidelines added to the COGEH in

late 2019, which recommends as a best practice the inclusion of all

abandonment, decommissioning and reclamation (“ADR”) costs

associated with active assets in the reserve report. This includes

costs for both active and inactive wells, including ADR costs for

producing wells, suspended wells, service wells, gathering systems,

facilities, and surface land development for all active assets. At

year-end 2019, Sproule’s evaluation of our NPV10 BT for ARO related

to our 2P, 1P and PDP reserves was $29.1 million, $28.2 million,

and $26.8 million, respectively, an increase of $14.3 million,

$12.4 million, and $13 million compared to the corresponding ARO

measures at the end of 2018, respectively.

We expect to release PPR’s Q4 and full-year 2019

financial and operating results after market on March 25,

2020. We appreciate the ongoing support from our shareholders

and your continued confidence in PPR’s strategic direction.

Reserves Summary

Highlights

The following presentation summarizes certain

information contained in the Sproule Report, which was prepared in

accordance with National Instrument 51-101 Standards of Disclosure

for Oil and Gas Activities (“NI 51-101”) and the definitions,

standards, and procedures contained in the Canadian Oil and Gas

Evaluation Handbook (the “COGE Handbook”). Sproule evaluated

100% of the Company’s reserves. The Sproule Report is based

on forecast prices and costs and applies Sproule’s forecast

escalated commodity price deck and foreign exchange rate and

inflation rate assumptions as at December 31, 2019, as

outlined in the table below entitled "Price Forecast".

Estimated future net revenue is stated without any provisions for

interest costs, other debt service charges or general and

administrative expenses, and after the deduction of royalties,

operating costs, estimated well abandonment and reclamation costs

and estimated future development costs.

Additional information regarding the Company’s

reserves data and other oil and gas information will be included in

the Company's Annual Information Form for the year ended December

31, 2019 (the “AIF”), which will be filed under the Company's

issuer profile on SEDAR at www.sedar.com on or before March 30,

2020.

See also the “Cautionary Statements” below for

further explanations and discussions.

Summary of Corporate

Reserves(1)(2)(5)

The following table is a summary of the

Company's estimated reserves as at December 31, 2019, as evaluated

in the Sproule Report.

|

Reserves Category |

Light and Medium Oil |

Heavy Oil |

ConventionalNatural Gas(3) (other than Solution Gas) |

Conventional Natural Gas (Solution Gas) |

Natural Gas Liquids |

Barrels of Oil Equivalent(4) |

|

(Mbbl) |

(Mbbl) |

(MMcf) |

(MMcf) |

(Mbbl) |

(Mboe) |

|

Proved |

|

|

|

|

|

|

| Developed Producing |

6,065 |

403 |

9,063 |

10,381 |

329 |

10,038 |

| Developed

Non-producing |

137 |

- |

- |

253 |

4 |

183 |

|

Undeveloped |

7,910 |

459 |

- |

16,905 |

316 |

11,502 |

| Total

Proved |

14,112 |

862 |

9,063 |

27,540 |

648 |

21,723 |

|

Probable |

8,003 |

748 |

2,448 |

19,214 |

383 |

12,744 |

|

Total Proved plus Probable |

22,115 |

1,610 |

11,511 |

46,754 |

1,031 |

34,467 |

|

Notes: |

|

(1) |

Reserves are presented on a “company gross” basis, which is defined

as Prairie Provident’s working interest (operating and

non-operating) share before deduction of royalties and without

including any royalty interest of the Company. |

|

(2) |

Based on Sproule’s December 31, 2019 forecast prices and costs. The

forecast of commodity prices used in the Sproule Report can be

found at www.sproule.com. See also “Price Forecast”

below. |

|

(3) |

Including both non-associated gas and associated gas but excluding

solution gas (gas dissolved in crude oil). |

|

(4) |

Oil equivalent amounts have been calculated using a conversion

ratio of six thousand cubic feet of natural gas to one barrel of

oil. See "Cautionary Statements – Barrels of oil equivalent"

below. |

|

(5) |

Columns may not add due to rounding of individual items. |

Net Present Values of Future Net

Revenue Before Income Taxes Discounted at

(%/year) (1)(2)(3)(4)(5)

The following table is a summary of the

estimated net present values of future net revenue (before income

taxes) associated with Prairie Provident's reserves as at December

31, 2019, discounted at the indicated percentage rates per year, as

evaluated in the Sproule Report.

|

Reserves Category |

0% |

5% |

10% |

15% |

20% |

|

(MM$) |

(MM$) |

(MM$) |

(MM$) |

(MM$) |

|

Proved |

|

|

|

|

|

| Developed Producing |

22.6 |

129.8 |

135.4 |

127.2 |

117.4 |

| Developed

Non-Producing |

4.8 |

3.9 |

3.2 |

2.7 |

2.4 |

|

Undeveloped |

249.1 |

170.5 |

118.8 |

83.7 |

59.2 |

| Total

Proved |

276.5 |

304.2 |

257.4 |

213.6 |

179.0 |

|

Probable |

342.8 |

241.3 |

180.3 |

140.5 |

112.9 |

|

Total Proved plus Probable |

619.3 |

545.5 |

437.7 |

354.1 |

291.9 |

|

|

|

|

|

|

|

|

Notes: |

|

(1) |

Based on Sproule's December 31, 2019 forecast prices and costs. The

forecast of commodity prices used in the Sproule Report can be

found at www.sproule.com. See also “Price Forecast”

below. |

|

(2) |

Estimated future net revenues are stated without any provision for

interest costs, other debt service charges or general and

administrative expenses, and after deduction of royalties,

operating costs, estimated well abandonment and reclamation costs

and estimated future development costs. |

|

(3) |

Estimated future net revenue, whether discounted or not, does not

represent fair market value. |

|

(4) |

Net present values of future net revenue after income taxes are

estimated to approximate the before income tax values based on the

estimated future revenues, available tax pools and future

deductible expenses. |

|

(5) |

Columns may not add due to rounding of individual items. |

Price

Forecast(1)

The following table summarizes Sproule's

commodity price forecast and foreign exchange rate and inflation

rate assumptions as at December 31, 2019, as applied in the Sproule

Report, for the next five years.

|

Year |

Exchange Rate |

WTI @ Cushing |

Canadian Light Sweet 40º API |

Western Canada Select 20.5º API |

EdmontonButane |

Natural gas AECO-C spot |

|

$US/$C |

(US$/bbl) |

(C$/bbl) |

(C$/bbl) |

(C$/bbl) |

(C$/MMbtu) |

| 2020 |

0.76 |

61.00 |

73.84 |

59.81 |

37.72 |

2.04 |

| 2021 |

0.77 |

65.00 |

78.51 |

63.98 |

43.90 |

2.27 |

| 2022 |

0.80 |

67.00 |

78.73 |

63.77 |

47.74 |

2.81 |

| 2023 |

0.80 |

68.34 |

80.30 |

65.04 |

48.69 |

2.89 |

| 2024 |

0.80 |

69.71 |

81.91 |

66.34 |

49.67 |

2.98 |

| Note: |

|

(1) |

Inflation is accounted for at 2.0% per year. |

Reconciliation of Company Gross Reserves Based

on Forecast Prices and

Costs(2)(3)

|

|

Mboe |

|

FACTORS |

Proved |

|

Probable |

|

Proved plus

Probable |

|

| December 31, 2018 |

22,360 |

|

11,504 |

|

33,863 |

|

|

Acquisitions |

0 |

|

0 |

|

0 |

|

|

Dispositions |

0 |

|

0 |

|

0 |

|

|

Drilling (Extensions and Improved Recovery(1)) |

1,724 |

|

2,554 |

|

4,278 |

|

|

Discoveries |

0 |

|

0 |

|

0 |

|

|

Technical Revisions |

781 |

|

(1,443 |

) |

(662 |

) |

|

Pricing (Economic Factors) |

(930 |

) |

129 |

|

(802 |

) |

|

Production |

(2,212 |

) |

0 |

|

(2,212 |

) |

|

December 31, 2019 |

21,723 |

|

12,744 |

|

34,467 |

|

|

Notes: |

|

(1) |

Reserves additions under Infill Drilling, Improved Recovery and

Extensions are combined and reported as "Extensions and Improved

Recovery". |

|

(2) |

Columns may not add due to rounding. |

|

(3) |

Company Gross Reserves exclude royalty volumes. |

Future Development Costs

(“FDC”)

The following table provides a summary of the

estimated FDC required to bring Prairie Provident’s 1P and 2P

undeveloped and non-producing reserves to production, as reflected

in the Sproule Report, which costs have been deducted in Sproule’s

estimation of future net revenue associated with such reserves.

|

|

Total |

Total Proved |

|

Future Development Costs (MM$)(1) |

Proved |

plus Probable |

| 2020 |

46.7 |

64.1 |

| 2021 |

73.4 |

104.7 |

| 2022 |

32.0 |

68.2 |

| 2023 |

36.9 |

66.5 |

|

Remainder |

0.1 |

0.1 |

| Total FDC

undiscounted |

189.1 |

303.6 |

| Total

FDC discounted at 10% |

160.0 |

253.4 |

|

Note: |

|

(1) |

FDC as per Sproule Report, based on Sproule's December 31, 2019

forecast prices and costs. |

Capital

Efficiencies(2)(4)

The following table sets out our calculation of

FD&A costs. See also "Cautionary Statements - Finding,

Development and Acquisition costs" below.

|

Finding, Development and Acquisition Costs (2019) |

Proved Developed Producing |

Total Proved |

|

Total Proved plus Probable |

|

Exploration and development capital(1) (MM$) |

10.3 |

10.3 |

|

10.3 |

|

Change in FDC(2) (MM$) |

0 |

(7.1 |

) |

34.8 |

|

Total FD&A costs, including change in FDC (MM$) |

10.3 |

3.2 |

|

45.1 |

|

Total reserves additions, including technical revisions (Mboe) |

1,675 |

2,505 |

|

3,616 |

|

FD&A costs, including change in FDC

($/boe) |

6.16 |

1.29 |

|

12.48 |

|

Notes: |

|

(1) |

Exploration and development capital (unaudited) related to: land

acquisition and retention; drilling; completions; tangible well

site; tie-ins; and facilities. |

|

(2) |

FDC as per Sproule Report, based on Sproule’s December 31, 2019

forecast prices and costs. |

|

(3) |

Columns may not add due to rounding. |

Net Asset

Value

The following table sets out a calculation of

NAV based on the estimated before-tax estimated net present value

of future net revenue (discounted at 10%) ("NPV10 BT") associated

with our PDP, 1P and 2P reserves, as evaluated in the Sproule

Report, our estimated long-term debt, and the number of PPR common

shares outstanding, all as of December 31, 2019. See also

"Cautionary Statements – Net Asset Value" below.

|

|

PDP |

|

1P |

|

2P |

|

| NPV10 BT (MM$) |

135.4 |

|

257.4 |

|

437.7 |

|

|

Estimated long-term debt, less cash collateralized letters of

credit (unaudited) (MM$) |

(108.7 |

) |

(108.7 |

) |

(108.7 |

) |

|

Net Asset Value (MM$) |

26.7 |

|

148.7 |

|

329.0 |

|

| |

|

|

|

|

Basic shares outstanding (MM) |

171.4 |

|

171.4 |

|

171.4 |

|

|

Estimated NAV/share ($) |

0.16 |

|

0.87 |

|

1.92 |

|

ABOUT PRAIRIE PROVIDENT:

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at the

Michichi and Princess areas in Southern Alberta targeting the

Banff, the Ellerslie and the Lithic Glauconite formations, along

with an established and proven waterflood project at our Evi area

in the Peace River Arch. Prairie Provident protects its balance

sheet through an active hedging program and manages risk by

allocating capital to opportunities offering maximum shareholder

returns.

For further information, please contact:

Prairie Provident Resources Inc. Tim Granger President and Chief

Executive Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca

Cautionary Statements

Unaudited financial

information

Certain financial and operating information

included in this news release for the quarter and year ended

December 31, 2019, including finding, development and acquisition

costs, are based on estimated unaudited financial results for the

quarter and year then ended, and are subject to the same

limitations as discussed under "Forward-looking information" set

out below. These estimated amounts may change upon the completion

of audited financial statements for the year ended December 31,

2019 and changes could be material.

Disclosure of Oil and Gas

Reserves Data and Operational Information

Prairie Provident’s Statement of Reserves Data

and Other Oil and Gas Information for the year ended December 31,

2019, providing additional information regarding our reserves data

and oil and gas activities in accordance with NI 51-101, will be

contained in our Annual Information Form for the year ended

December 31, 2019, which will be filed under the Company's issuer

profile on SEDAR at www.sedar.com on or before March 30, 2020. The

reserves data estimates contained herein are estimates only and

there is no guarantee that the estimated reserves will be recovered

or that the related estimates of future net revenues will be

realized. There can be no assurance that the forecast prices and

cost assumptions applied by Sproule in evaluating the Company's

reserves will be attained, and variances between actual and

forecast prices and costs could be material. Actual reserves

may be greater than or less than the estimated volumes provided

herein, and it should not be assumed that the estimates of future

net revenues presented herein represent the fair market value of

the reserves. Estimates in respect of individual properties

may not reflect the same confidence level as estimates of reserves

and future net revenue for all properties, due to the effects of

aggregation. The Company's belief that it will establish

additional reserves over time with conversion of probable

undeveloped reserves into proved reserves is a forward-looking

statement and is based on certain assumptions and is subject to

certain risks, as discussed below under the heading

"Forward-looking information".

This news release discloses certain metrics

commonly used in the oil and natural gas industry – namely

"finding, development and acquisition costs", "net asset

value" and “reserve life index” – that do not have standardized

meanings or methods of calculation under applicable laws,

International Financial Reporting Standards, the COGE Handbook or

other applicable professional standards. Accordingly, such

measures, as determined by the Company, may not be comparable to

similarly defined or labelled measures presented by other

companies, and therefore should not be used to make such

comparisons. These metrics have been included herein to provide

readers with additional information to evaluate the Company's

performance, but should not be relied upon for comparative

purposes. Management uses oil and gas metrics for its own

performance measurements and to provide shareholders with measures

to compare Prairie Provident's operations over time. Readers are

cautioned that the information provided by these metrics, or that

can be derived from the metrics presented in this news release,

should not be relied upon for investment or other purposes.

Finding, Development and

Acquisition costs (“FD&A costs”)

The Company calculates FD&A costs by

dividing the sum of exploration and development capital and all

acquisition costs (net of disposition proceeds) for the period,

plus the change in estimated FDC required to bring the reserves

within the specified reserves category on production, by the change

in reserves relating to discoveries, infill drilling, improved

recovery, extensions and technical revisions inclusive of changes

due to acquisitions and dispositions for the same period. FD&A

costs have been presented in this news release because acquisitions

and dispositions can have a significant impact on Prairie

Provident’s ongoing reserves replacement costs and excluding these

amounts could result in an inaccurate portrayal of its cost

structure. Management uses FD&A as measure of its ability to

execute its capital programs (and success in doing so) and of its

asset quality.

Operating

Netback

Operating netback is a non-IFRS measure commonly

used in the oil and gas industry. This measurement assists

management and investors to evaluate the specific operating

performance at the oil and gas lease level. Operating

netbacks included in this release are based on 2019 (unaudited)

realized operating netback before any hedging gains/losses, and

were determined by taking (oil and gas revenues less royalties less

operating costs) divided by gross working interest production.

Operating netback, including realized commodity (loss) and gain,

adjusts the operating netback for only realized gains and losses on

derivatives.

Recycle

Ratio

Recycle ratio is defined as operating netback

per boe divided by FD&A costs on a per boe basis. PPR’s

operating netback in 2019, used in the above calculations, averaged

$18.58 per boe (unaudited).

Net Asset Value

(“NAV”)

The Company calculates NAV by subtracting its

long-term debt balance from the net present values of estimated

future net revenues (before income taxes and discounted at 10% per

year) associated with its reserves, as evaluated in the Sproule

Report. Management uses NAV as a measure of the Company’s oil

and gas asset value attributable to its shareholders.

Reserve Life Index

(“RLI”)

The Company calculates RLI based on the amount

for the relevant reserves category prepared by Sproule, divided by

2019 annual production.

Forward-looking

information

This news release contains certain statements

("forward-looking statements") that forward-looking information

within the meaning of applicable securities laws.

Forward-looking statements relate to future performance, events or

circumstances, and are based upon internal assumptions, plans,

intentions, expectations and beliefs. All statements other

than statements of current or historical fact are forward-looking

statements. Forward-looking statements are typically, but not

always, identified by words such as "expect", "anticipate",

"continue", "estimate", "may", "will", "project", "should",

"believe", "plan", "intend", "budget", "potential", "target" and

similar words or expressions suggesting future outcomes or events

or statements regarding an outlook.

In particular, but without limiting the

foregoing, this news release contains forward-looking statements

pertaining to: estimated volumes of Prairie Provident's oil and gas

reserves and their categorization; estimated net present values of

future net revenue associated with evaluated reserves; future

growth; potential opportunity for expanded drilling; Evi-area

development through waterflood expansion; the volume and product

mix of Prairie Provident's oil and gas production; future oil and

natural gas prices; future results from operations and operating

metrics, potential for lower costs and efficiencies going forward;

future development, exploration, acquisition and disposition

activities (including drilling, completion and infrastructure plans

and associated timing and costs); and related production

expectations.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such but which may prove

to be incorrect. Although Prairie Provident believes that the

expectations reflected in such forward-looking statements are

reasonable, undue reliance should not be placed on forward-looking

statements because Prairie Provident can give no assurance that

such expectations will prove to be correct. In addition to other

factors and assumptions which may be identified herein, assumptions

have been made regarding, among other things: that Prairie

Provident will continue to conduct its operations in a manner

consistent with past operations; results from drilling and

development activities consistent with past operations; the quality

of the reservoirs in which Prairie Provident operates and continued

performance from existing wells; the continued and timely

development of infrastructure in areas of new production; the

accuracy of the estimates of Prairie Provident's reserve volumes;

certain commodity price and other cost assumptions; continued

availability of debt and equity financing and cash flow to fund

Prairie Provident's current and future plans and expenditures; the

impact of increasing competition; the general stability of the

economic and political environment in which Prairie Provident

operates; the general continuance of current industry conditions;

the timely receipt of any required regulatory approvals; the

ability of Prairie Provident to obtain qualified staff, equipment

and services in a timely and cost efficient manner; drilling

results; the ability of the operator of the projects in which

Prairie Provident has an interest in to operate the field in a

safe, efficient and effective manner; the ability of Prairie

Provident to obtain financing on acceptable terms; field production

rates and decline rates; the ability to replace and expand oil and

natural gas reserves through acquisition, development and

exploration; the timing and cost of pipeline, storage and facility

construction and expansion and the ability of Prairie Provident to

secure adequate product transportation; future commodity prices;

currency, exchange and interest rates; regulatory framework

regarding royalties, taxes and environmental matters in the

jurisdictions in which Prairie Provident operates; and the ability

of Prairie Provident to successfully market its oil and natural gas

products.

The forward-looking statements included in this

news release are not guarantees of future performance and should

not be unduly relied upon. Such information and statement,

including the assumptions made in respect thereof, involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to defer materially from those anticipated

in such forward-looking statements including, without limitation:

changes in commodity prices; changes in the demand for or supply of

Prairie Provident's products, the early stage of development of

some of the evaluated areas and zones; the potential for variation

in the quality of the lithic gluconate formation;

unanticipated operating results or production declines; changes in

tax or environmental laws, royalty rates or other regulatory

matters; changes in development plans of Prairie Provident or by

third party operators of Prairie Provident's properties, increased

debt levels or debt service requirements; inaccurate estimation of

Prairie Provident's oil and gas reserve volumes; limited,

unfavourable or a lack of access to capital markets; increased

costs; a lack of adequate insurance coverage; the impact of

competitors; and certain other risks detailed from time-to-time in

Prairie Provident's public disclosure documents, (including,

without limitation, those risks identified in this news release and

Prairie Provident's Annual Information Form).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Barrels of oil equivalent

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand

cubic feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure,

particularly if used in isolation. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

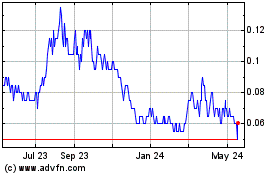

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

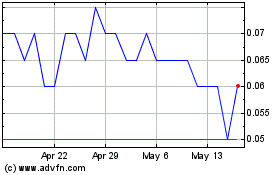

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025