North American Construction Group Ltd. ("NACG") today announced

results for the second quarter ended June 30, 2023. Unless

otherwise indicated, financial figures are expressed in Canadian

dollars, and comparisons are to the prior period ended

June 30, 2022.

Second Quarter

2023 Highlights:

- Equipment

utilization of 61% benefited from the strong momentum heading into

the quarter, a quick spring break up in April, and continued steady

demand for heavy equipment but was impacted in June by unusually

wet weather as well as a required fleet remobilization in the oil

sands region.

- Reported revenue of

$193.6 million, compared to $168.0 million in the same period last

year, was generated primarily by the equipment fleet in the oil

sands region. When comparing to Q2 2022, the revenue increase

included full quarter impacts of updated equipment rates and the

acquisition of ML Northern Services Ltd.

- Combined revenue of

$277.0 million, compared to $228.0 million in the same period last

year, reflected both the demand for our heavy equipment fleet as

well as another strong quarter from the increasing capacities of

our Indigenous joint ventures.

- Our net share of

revenue from equity consolidated joint ventures of $158.5 million

compared favourably to $125.8 million in the same period last year.

Quarterly revenue was primarily generated by our Indigenous joint

ventures but activity, scope and run rates within the

Fargo-Moorhead project continue to increase.

- Adjusted EBITDA of

$51.8 million and margin of 18.7% compared favorably to the prior

period metrics of $41.6 million and 18.3%, respectively, and set a

new Q2 record for the Company as revenue increases drove higher

gross EBITDA while margin improvements were mostly offset during

the month of June from difficult working conditions and fleet

remobilization.

- Cash flows generated

from operating activities of $40.2 million, compared to $35.5

million in the same period last year, as the higher earnings

generated were largely offset by the timing of lower cash dividends

received from joint ventures and the settlement of deferred share

units that occurred during the quarter.

- Free cash flow used

in the quarter was $4.3 million as adjusted EBITDA was primarily

used for sustaining capital maintenance and cash interest. Timing

of cash distributions from our joint ventures impact quarterly free

cash flow but are expected to be realized prior to year end.

- Net debt was $394.3

million at June 30, 2023, an increase of $10.2 million from

March 31, 2023, as timing impacts of free cash flow, growth

spending, and dividends required debt financing during the

quarter.

- The equipment rebuilding program continued its momentum with

the sale and commissioning of another ultra-class unit bringing the

total Mikisew joint venture haul truck fleet to sixteen.

"The second quarter is always the most difficult to navigate

from an operating perspective, but despite the rainy weather and

fleet remobilization, the business posted historical high Q2

results in almost every fundamental metric we measure. These

results further increase my confidence in the NACG team and our

business continuing to meet or exceed expectations while advancing

our overall corporate strategy. The Fargo-Moorhead project is

hitting its stride and, as we surpass the 10% completion mark, this

project will become a meaningful contributor for several years. The

business remains focused on executing and I am excited about the

second half of the year," said Joseph Lambert, President and

CEO.

Consolidated Financial Highlights

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands, except per share amounts) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

|

$ |

193,573 |

|

|

$ |

168,028 |

|

|

$ |

436,178 |

|

|

$ |

344,739 |

|

| Total combined revenue(i) |

|

|

276,953 |

|

|

|

227,954 |

|

|

|

597,570 |

|

|

|

464,540 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

21,531 |

|

|

|

12,440 |

|

|

|

62,450 |

|

|

|

34,391 |

|

| Gross profit margin(i) |

|

|

11.1 |

% |

|

|

7.4 |

% |

|

|

14.3 |

% |

|

|

10.0 |

% |

| |

|

|

|

|

|

|

|

|

| Combined gross profit(i) |

|

|

36,194 |

|

|

|

21,839 |

|

|

|

91,932 |

|

|

|

54,347 |

|

| Combined gross profit

margin(i)(ii) |

|

|

13.1 |

% |

|

|

9.6 |

% |

|

|

15.4 |

% |

|

|

11.7 |

% |

| |

|

|

|

|

|

|

|

|

| Operating income |

|

|

10,270 |

|

|

|

6,301 |

|

|

|

35,797 |

|

|

|

21,943 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA(i)(iii) |

|

|

51,833 |

|

|

|

41,649 |

|

|

|

136,456 |

|

|

|

99,389 |

|

| Adjusted EBITDA

margin(i)(iii) |

|

|

18.7 |

% |

|

|

18.3 |

% |

|

|

22.8 |

% |

|

|

21.4 |

% |

| |

|

|

|

|

|

|

|

|

| Net income |

|

|

12,262 |

|

|

|

7,514 |

|

|

|

34,108 |

|

|

|

21,071 |

|

| Adjusted net earnings(i) |

|

|

12,489 |

|

|

|

4,717 |

|

|

|

37,766 |

|

|

|

19,316 |

|

| |

|

|

|

|

|

|

|

|

| Cash provided by operating

activities |

|

|

40,185 |

|

|

|

35,485 |

|

|

|

72,009 |

|

|

|

59,670 |

|

| Cash provided by operating

activities prior to change in working capital(i) |

|

|

27,145 |

|

|

|

33,373 |

|

|

|

92,980 |

|

|

|

78,227 |

|

| |

|

|

|

|

|

|

|

|

| Free cash flow(i) |

|

|

(4,282 |

) |

|

|

10,393 |

|

|

|

(30,395 |

) |

|

|

(928 |

) |

| |

|

|

|

|

|

|

|

|

| Purchase of PPE |

|

|

38,419 |

|

|

|

27,121 |

|

|

|

74,915 |

|

|

|

52,386 |

|

| Sustaining capital

additions(i) |

|

|

38,311 |

|

|

|

22,341 |

|

|

|

85,502 |

|

|

|

56,580 |

|

| Growth capital

additions(i) |

|

|

2,748 |

|

|

|

— |

|

|

|

2,748 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Basic net income per

share |

|

$ |

0.46 |

|

|

$ |

0.27 |

|

|

$ |

1.29 |

|

|

$ |

0.75 |

|

|

Adjusted EPS(i) |

|

$ |

0.47 |

|

|

$ |

0.17 |

|

|

$ |

1.43 |

|

|

$ |

0.69 |

|

(i)See "Non-GAAP Financial Measures". (ii)Combined gross profit

margin is calculated using combined gross profit over total

combined revenue.(iii)Adjusted EBITDA margin is calculated using

adjusted EBITDA over total combined revenue.

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Cash provided by operating activities |

|

$ |

40,185 |

|

|

$ |

35,485 |

|

|

$ |

72,009 |

|

|

$ |

59,670 |

|

| Cash used in investing

activities |

|

|

(39,236 |

) |

|

|

(25,092 |

) |

|

|

(80,153 |

) |

|

|

(51,903 |

) |

| Capital additions financed by

leases |

|

|

(7,979 |

) |

|

|

— |

|

|

|

(24,999 |

) |

|

|

(8,695 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

Growth capital additions(i) |

|

|

2,748 |

|

|

|

— |

|

|

|

2,748 |

|

|

|

— |

|

|

Free cash

flow(i) |

|

$ |

(4,282 |

) |

|

$ |

10,393 |

|

|

$ |

(30,395 |

) |

|

$ |

(928 |

) |

(i)See "Non-GAAP Financial Measures".

Declaration of Quarterly

Dividend

On July 25, 2023, the NACG Board of Directors declared a regular

quarterly dividend (the "Dividend") of ten Canadian cents ($0.10)

per common share, payable to common shareholders of record at the

close of business on August 31, 2023. The Dividend will be paid on

October 6, 2023, and is an eligible dividend for Canadian income

tax purposes.

Financial Results for the Three Months Ended

June 30, 2023

Revenue of $193.6 million represented a $25.5 million (or 15%)

increase from Q2 2022. Revenue across all major sites in the oil

sands region has continued to see year-over-year revenue growth

with our heavy equipment fleet at Fort Hills driving the largest

increase as the site continues to ramp up. Equipment utilization of

61% benefited from the strong momentum heading into the quarter, a

quick spring break up in April, and continued steady demand for

heavy equipment but was significantly impacted in June by unusually

wet weather as well as a required fleet remobilization in the oil

sands region. Maintenance headcount levels have remained consistent

which continues to lower equipment repair backlog and increased

mechanical availability. The purchase of ML Northern Services

Ltd.'s ("ML Northern") fuel and lube fleet, which occurred on

October 1, 2022, and DGI Trading had modest impacts on revenue

increases with services and sales provided to external customers.

Lastly, another ultra-class haul truck was sold to and commissioned

by the Mikisew North American Limited Partnership ("MNALP"),

bringing its haul truck fleet to sixteen.

Combined revenue of $277.0 million represented a $49.0 million

(or 21%) increase from Q2 2022. Our share of revenue generated in

Q2 2023 by joint ventures and affiliates was $83.4 million,

compared to $59.9 million in Q2 2022 (an increase of 39%).

Consistent with the prior year, top-line performance was driven by

the Nuna Group of Companies ("Nuna"), as they continued their

project execution at the gold mine in Northern Ontario. The other

drivers of the revenue increases were the joint ventures dedicated

to the Fargo-Moorhead flood diversion project, which posted solid

top-line revenue as the project ramps up, and the aforementioned

expanding revenue capacity from rebuilt ultra-class and 240-ton

haul trucks directly owned by MNALP.

Adjusted EBITDA of $51.8 million represented an increase of

$10.2 million (or 24%) from the Q2 2022 result of $41.6 million,

consistent with increases in combined revenue. The adjusted EBITDA

margin of 18.7% reflected normal impacts typically incurred in the

second quarter during the transition from winter to spring at the

mine sites, particularly in Fort McMurray. In addition, the

difficult wet conditions in June had a significant impact on margin

as low equipment utilization of less than 50% in the month resulted

in fixed costs both at the operational sites and corporate

facilities becoming a factor in impacting the overall EBITDA

margins.

Depreciation of our equipment fleet was 12.6% of revenue in the

quarter, compared to 15.7% in Q2 2022, benefiting from efficient

and productive use of the equipment fleet. Our internal maintenance

programs continue to produce low-cost and longer life components

which is impacting depreciation rates. In addition to these

factors, our lower capital intensive services continue to have

noticeable impacts on the depreciation percentage when comparing to

previous benchmarks.

General and administrative expenses (excluding stock-based

compensation) were $7.2 million, or 3.7% of revenue, compared to

$6.9 million, or 4.1% of revenue in Q2 2022. Consistent costs were

incurred as increases from ML Northern and cost items impacted by

inflation were mostly offset by cost discipline in discretionary

areas and incremental G&A recoveries from our joint

ventures.

Cash related interest expense (See "Non-GAAP Financial

Measures".) for the quarter was $7.2 million at an average cost of

debt of 6.9%, compared to 5.2% in Q2 2022, as rate increases posted

by the Bank of Canada directly impact our Credit Facility and have

a delayed impact on the rates for secured equipment-backed

financing. Total interest expense was $7.5 million in the quarter,

compared to $5.6 million in Q2 2022.

Adjusted EPS of $0.47 on adjusted net earnings of $12.5 million

is up 176% from the prior year figure of $0.17 and is consistent

with adjusted EBIT performance as tax and interest tracked fairly

consistently with the prior year. Weighted-average common shares

levels for the second quarters of 2023 and 2022 reflected a

decrease at 26,409,357 and 27,968,510, respectively, net of shares

classified as treasury shares, due to the share purchases and

cancellations which occurred in the third quarter of 2022.

Free cash flow was a use of cash of $4.3 million and was

primarily the result of adjusted EBITDA of $51.8 million, as

detailed above, offset by sustaining capital additions ($38.3

million) and cash interest paid ($8.4 million). Free cash flow was

also impacted by the cash settlement of certain deferred share

units ($7.3 million). As stated in the previous disclosures

regarding our annual capital spending, our program is front-loaded

in the year and the first half spending is considered typical and

consistent with the annual sustaining capital range provided.

BUSINESS UPDATES

2023 Strategic Focus Areas

- Safety - focus on

people and relationships as we maintain an uncompromising

commitment to health and safety while elevating the standard of

excellence in the field.

- Sustainability -

commitment to the continued development of sustainability targets

and consistent measurement of progress to those targets.

- Execution - enhance

our record of operational excellence with respect to fleet

maintenance, availability and utilization through leverage of our

reliability programs, technical improvements and management

systems.

- Diversification -

continue to pursue further diversification of customers, resources

and geography through strategic partnerships, industry expertise

and/or investment in Indigenous joint ventures.

Liquidity

Our current liquidity positions us well moving forward to fund

organic growth and the required correlated working capital

investments. Including equipment financing availability and

factoring in the amended Credit Facility agreement, total available

capital liquidity of $159.4 million includes total liquidity of

$120.4 million and $27.3 million of unused finance lease borrowing

availability as at June 30, 2023. Liquidity is primarily

provided by the terms of our $300.0 million credit facility which

allows for funds availability based on a trailing twelve-month

EBITDA as defined in the agreement and is now scheduled to expire

in October 2025.

|

|

|

June 30,2023 |

|

|

December 31,2022 |

|

|

Credit Facility limit |

|

$ |

300,000 |

|

|

$ |

300,000 |

|

| Finance lease borrowing

limit |

|

|

175,000 |

|

|

|

175,000 |

|

| Other

debt borrowing limit |

|

|

20,000 |

|

|

|

20,000 |

|

|

Total borrowing limit |

|

$ |

495,000 |

|

|

$ |

495,000 |

|

|

Senior debt(i) |

|

|

(257,421 |

) |

|

|

(265,931 |

) |

| Letters of credit |

|

|

(31,348 |

) |

|

|

(32,030 |

) |

| Joint venture guarantees |

|

|

(68,615 |

) |

|

|

(53,744 |

) |

|

Cash |

|

|

21,749 |

|

|

|

69,144 |

|

|

Total capital liquidity(i) |

|

$ |

159,365 |

|

|

$ |

212,439 |

|

(i)See "Non-GAAP Financial Measures".

NACG’s Outlook

For information regarding management's outlook for 2023, please

refer to the press release issued subsequent to the release of the

Q2 2023 Report.

Conference Call and Webcast

Management will hold a conference call and

webcast to discuss our financial results for the quarter ended

June 30, 2023, tomorrow, Thursday, July 27, 2023, at 6:00

am Mountain Time (8:00 am Eastern Time).

|

The call can be accessed by dialing: |

|

Toll free: 1-888-886-7786 |

|

Conference ID: 47287641 |

| A replay will be available

through September 1, 2023, by dialing: |

|

Toll Free: 1-877-674-7070 |

|

Conference ID: 47287641 |

|

Playback Passcode: 287641 |

|

|

The Q2 2023 earnings presentation for the webcast will be

available for download on the company’s website at

www.nacg.ca/presentations/

The live presentation and webcast can be accessed at:

https://viavid.webcasts.com/starthere.jsp?ei=1624616&tp_key=5ac36a78e5

A replay will be available until September 1, 2023, using the

link provided.

Basis of Presentation

We have prepared our consolidated financial

statements in conformity with accounting principles generally

accepted in the United States ("US GAAP"). Unless otherwise

specified, all dollar amounts discussed are in Canadian dollars.

Please see the Management’s Discussion and Analysis ("MD&A")

for the quarter ended June 30, 2023, for further detail on the

matters discussed in this release. In addition to the MD&A,

please reference the dedicated Q2 2023 Results Presentation for

more information on our results and projections which can be found

on our website under Investors - Presentations.

Forward-Looking Information

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

"anticipate", "believe", "expect", "should" or similar expressions

and include all information provided under the above heading

"NACG's Outlook".

The material factors or assumptions used to develop the above

forward-looking statements and the risks and uncertainties to which

such forward-looking statements are subject, are highlighted in the

MD&A for the three and six months ended June 30, 2023. Actual

results could differ materially from those contemplated by such

forward-looking statements because of any number of factors and

uncertainties, many of which are beyond NACG’s control. Undue

reliance should not be placed upon forward-looking statements and

NACG undertakes no obligation, other than those required by

applicable law, to update or revise those statements. For more

complete information about NACG, please read our disclosure

documents filed with the SEC and the CSA. These free documents can

be obtained by visiting EDGAR on the SEC website at

www.sec.gov or on the CSA website at www.sedar.com.

Non-GAAP Financial Measures

This press release presents certain non-GAAP financial measures

because management believes that they may be useful to investors in

analyzing our business performance, leverage and liquidity. The

non-GAAP financial measures we present include "adjusted EBIT",

"adjusted EBITDA", "adjusted EPS", "adjusted net earnings", "cash

provided by operating activities prior to change in working

capital", "combined gross profit", "equity investment depreciation

and amortization", "equity investment EBIT", "free cash flow",

"growth capital", "margin", "net debt", "senior debt", "sustaining

capital", "total capital liquidity", and "total combined revenue".

A non-GAAP financial measure is defined by relevant regulatory

authorities as a numerical measure of an issuer's historical or

future financial performance, financial position or cash flow that

is not specified, defined or determined under the issuer’s GAAP and

that is not presented in an issuer’s financial statements. These

non-GAAP measures do not have any standardized meaning and

therefore are unlikely to be comparable to similar measures

presented by other companies. They should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with GAAP. Each non-GAAP financial measure used in

this press release is defined and reconciled to its most directly

comparable GAAP measure in the "Non-GAAP Financial Measures"

section of our Management’s Discussion and Analysis filed

concurrently with this press release.

Reconciliation of total reported revenue to total

combined revenue

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue from wholly-owned entities per financial statements |

|

$ |

193,573 |

|

|

$ |

168,028 |

|

|

$ |

436,178 |

|

|

$ |

344,739 |

|

| Share of revenue from

investments in affiliates and joint ventures |

|

|

158,485 |

|

|

|

125,774 |

|

|

|

347,970 |

|

|

|

251,204 |

|

|

Elimination of joint venture subcontract revenue |

|

|

(75,105 |

) |

|

|

(65,848 |

) |

|

|

(186,578 |

) |

|

|

(131,403 |

) |

|

Total combined revenue(i) |

|

$ |

276,953 |

|

|

$ |

227,954 |

|

|

$ |

597,570 |

|

|

$ |

464,540 |

|

(i)See "Non-GAAP Financial Measures".

Reconciliation of reported gross profit to combined

gross profit

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Gross profit from wholly-owned entities per financial

statements |

|

$ |

21,531 |

|

$ |

12,440 |

|

$ |

62,450 |

|

$ |

34,391 |

| Share

of gross profit from investments in affiliates and joint

ventures |

|

|

14,663 |

|

|

9,399 |

|

|

29,482 |

|

|

19,956 |

|

Combined gross profit(i) |

|

$ |

36,194 |

|

$ |

21,839 |

|

$ |

91,932 |

|

$ |

54,347 |

(i)See "Non-GAAP Financial Measures".

Reconciliation of net income to adjusted net earnings,

adjusted EBIT, and adjusted EBITDA

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Net income |

|

$ |

12,262 |

|

|

$ |

7,514 |

|

|

$ |

34,108 |

|

|

$ |

21,071 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

(Gain) loss on disposal of property, plant and equipment |

|

|

(713 |

) |

|

|

1,087 |

|

|

|

500 |

|

|

|

1,164 |

|

|

Stock-based compensation expense (benefit) |

|

|

4,804 |

|

|

|

(1,843 |

) |

|

|

10,741 |

|

|

|

(566 |

) |

|

Loss on equity investment customer bankruptcy claim settlement |

|

|

759 |

|

|

|

— |

|

|

|

759 |

|

|

|

— |

|

|

Net realized and unrealized gain on derivative financial

instruments |

|

|

(1,852 |

) |

|

|

— |

|

|

|

(4,361 |

) |

|

|

— |

|

|

Equity investment net realized and unrealized gain on derivative

financial instruments |

|

|

(1,655 |

) |

|

|

(2,215 |

) |

|

|

(1,221 |

) |

|

|

(2,215 |

) |

|

Tax effect of the above items |

|

|

(1,116 |

) |

|

|

174 |

|

|

|

(2,760 |

) |

|

|

(138 |

) |

|

Adjusted net

earnings(i) |

|

|

12,489 |

|

|

|

4,717 |

|

|

|

37,766 |

|

|

|

19,316 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

Tax effect of the above items |

|

|

1,116 |

|

|

|

(174 |

) |

|

|

2,760 |

|

|

|

138 |

|

|

Interest expense, net |

|

|

7,511 |

|

|

|

5,565 |

|

|

|

14,822 |

|

|

|

10,247 |

|

|

Income tax expense |

|

|

1,757 |

|

|

|

1,557 |

|

|

|

10,159 |

|

|

|

5,201 |

|

|

Equity earnings in affiliates and joint ventures |

|

|

(9,408 |

) |

|

|

(8,335 |

) |

|

|

(18,931 |

) |

|

|

(14,576 |

) |

|

Equity investment EBIT(i) |

|

|

9,605 |

|

|

|

9,421 |

|

|

|

19,569 |

|

|

|

17,109 |

|

|

Adjusted

EBIT(i) |

|

|

23,070 |

|

|

|

12,751 |

|

|

|

66,145 |

|

|

|

37,435 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

24,664 |

|

|

|

26,572 |

|

|

|

61,355 |

|

|

|

57,459 |

|

|

Equity investment depreciation and amortization(i) |

|

|

4,099 |

|

|

|

2,326 |

|

|

|

8,956 |

|

|

|

4,495 |

|

|

Adjusted

EBITDA(i) |

|

$ |

51,833 |

|

|

$ |

41,649 |

|

|

$ |

136,456 |

|

|

$ |

99,389 |

|

(i)See "Non-GAAP Financial Measures".

Reconciliation of equity earnings in affiliates and

joint ventures to equity investment EBIT

| |

|

Three months ended |

|

Six months ended |

|

|

|

June 30, |

|

June 30, |

|

(dollars in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

Equity earnings in affiliates and joint ventures |

|

$ |

9,408 |

|

|

$ |

8,335 |

|

$ |

18,931 |

|

|

$ |

14,576 |

| Adjustments: |

|

|

|

|

|

|

|

|

|

Interest (income) expense, net |

|

|

(530 |

) |

|

|

555 |

|

|

(173 |

) |

|

|

1,312 |

|

Income tax expense |

|

|

722 |

|

|

|

480 |

|

|

846 |

|

|

|

1,170 |

|

Loss (gain) on disposal of property, plant and equipment |

|

|

5 |

|

|

|

51 |

|

|

(35 |

) |

|

|

51 |

|

Equity investment

EBIT(i) |

|

$ |

9,605 |

|

|

$ |

9,421 |

|

$ |

19,569 |

|

|

$ |

17,109 |

|

Depreciation |

|

$ |

3,919 |

|

|

$ |

2,150 |

|

$ |

8,596 |

|

|

$ |

4,143 |

|

Amortization of intangible assets |

|

|

180 |

|

|

|

176 |

|

|

360 |

|

|

|

352 |

|

Equity investment depreciation and

amortization(i) |

|

$ |

4,099 |

|

|

$ |

2,326 |

|

$ |

8,956 |

|

|

$ |

4,495 |

(i)See "Non-GAAP Financial Measures".

About the Company

North American Construction Group Ltd. is a

premier provider of heavy civil construction and mining services in

Canada, the U.S. and Australia. For 70 years, NACG has provided

services to the mining, resource and infrastructure construction

markets.

For further information contact:

Jason VeenstraChief Financial OfficerNorth American Construction

Group Ltd.(780) 960-7171IR@nacg.cawww.nacg.ca

Interim Consolidated Balance Sheets

(Expressed in thousands of Canadian

Dollars)(Unaudited)

|

|

|

|

June 30,2023 |

|

|

December 31,2022 |

|

|

Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash |

|

|

$ |

21,749 |

|

|

$ |

69,144 |

|

|

Accounts receivable |

|

|

|

78,916 |

|

|

|

83,811 |

|

|

Contract assets |

|

|

|

10,688 |

|

|

|

15,802 |

|

|

Inventories |

|

|

|

56,169 |

|

|

|

49,898 |

|

|

Prepaid expenses and deposits |

|

|

|

9,526 |

|

|

|

10,587 |

|

|

Assets held for sale |

|

|

|

869 |

|

|

|

1,117 |

|

|

|

|

|

|

177,917 |

|

|

|

230,359 |

|

| Property, plant and equipment,

net of accumulated depreciation of $402,462 (December 31, 2022 –

$387,358) |

|

|

|

683,822 |

|

|

|

645,810 |

|

| Operating lease right-of-use

assets |

|

|

|

13,542 |

|

|

|

14,739 |

|

| Investments in affiliates and

joint ventures |

|

|

|

82,981 |

|

|

|

75,637 |

|

| Other assets |

|

|

|

6,779 |

|

|

|

5,808 |

|

| Intangible assets |

|

|

|

6,199 |

|

|

|

6,773 |

|

|

Deferred tax assets |

|

|

|

77 |

|

|

|

387 |

|

|

Total assets |

|

|

$ |

971,317 |

|

|

$ |

979,513 |

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

|

$ |

80,946 |

|

|

$ |

102,549 |

|

|

Accrued liabilities |

|

|

|

23,234 |

|

|

|

43,784 |

|

|

Contract liabilities |

|

|

|

— |

|

|

|

1,411 |

|

|

Current portion of long-term debt |

|

|

|

42,319 |

|

|

|

42,089 |

|

|

Current portion of operating lease liabilities |

|

|

|

1,937 |

|

|

|

2,470 |

|

|

|

|

|

|

148,436 |

|

|

|

192,303 |

|

| Long-term debt |

|

|

|

369,735 |

|

|

|

378,452 |

|

| Operating lease

liabilities |

|

|

|

11,762 |

|

|

|

12,376 |

|

| Other long-term

obligations |

|

|

|

24,488 |

|

|

|

18,576 |

|

|

Deferred tax liabilities |

|

|

|

80,273 |

|

|

|

71,887 |

|

|

|

|

|

|

634,694 |

|

|

|

673,594 |

|

|

Shareholders' equity |

|

|

|

|

|

| Common shares (authorized –

unlimited number of voting common shares; issued and outstanding –

June 30, 2023 - 27,827,282 (December 31, 2022 – 27,827,282)) |

|

|

|

229,455 |

|

|

|

229,455 |

|

| Treasury shares (June 30, 2023

- 1,418,362 (December 31, 2022 - 1,406,461)) |

|

|

|

(16,701 |

) |

|

|

(16,438 |

) |

| Additional paid-in

capital |

|

|

|

24,578 |

|

|

|

22,095 |

|

| Retained earnings |

|

|

|

99,347 |

|

|

|

70,501 |

|

|

Accumulated other comprehensive (loss) income |

|

|

|

(56 |

) |

|

|

306 |

|

|

Shareholders' equity |

|

|

|

336,623 |

|

|

|

305,919 |

|

|

Total liabilities and shareholders’ equity |

|

|

$ |

971,317 |

|

|

$ |

979,513 |

|

See accompanying notes to interim consolidated financial

statements.

Interim Consolidated Statements of Operations and

Comprehensive Income

(Expressed in thousands of Canadian Dollars, except per share

amounts)(Unaudited)

| |

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenue |

|

|

$ |

193,573 |

|

|

$ |

168,028 |

|

|

$ |

436,178 |

|

|

$ |

344,739 |

|

| Cost of sales |

|

|

|

147,690 |

|

|

|

129,248 |

|

|

|

312,991 |

|

|

|

253,316 |

|

|

Depreciation |

|

|

|

24,352 |

|

|

|

26,340 |

|

|

|

60,737 |

|

|

|

57,032 |

|

|

Gross profit |

|

|

|

21,531 |

|

|

|

12,440 |

|

|

|

62,450 |

|

|

|

34,391 |

|

| General and administrative

expenses |

|

|

|

11,974 |

|

|

|

5,052 |

|

|

|

26,153 |

|

|

|

11,284 |

|

| (Gain)

loss on disposal of property, plant and equipment |

|

|

|

(713 |

) |

|

|

1,087 |

|

|

|

500 |

|

|

|

1,164 |

|

|

Operating income |

|

|

|

10,270 |

|

|

|

6,301 |

|

|

|

35,797 |

|

|

|

21,943 |

|

| Interest expense, net |

|

|

|

7,511 |

|

|

|

5,565 |

|

|

|

14,822 |

|

|

|

10,247 |

|

| Equity earnings in affiliates

and joint ventures |

|

|

|

(9,408 |

) |

|

|

(8,335 |

) |

|

|

(18,931 |

) |

|

|

(14,576 |

) |

| Net

realized and unrealized gain on derivative financial

instruments |

|

|

|

(1,852 |

) |

|

|

— |

|

|

|

(4,361 |

) |

|

|

— |

|

|

Income before income taxes |

|

|

|

14,019 |

|

|

|

9,071 |

|

|

|

44,267 |

|

|

|

26,272 |

|

| Current income tax

expense |

|

|

|

567 |

|

|

|

335 |

|

|

|

1,703 |

|

|

|

497 |

|

|

Deferred income tax expense |

|

|

|

1,190 |

|

|

|

1,222 |

|

|

|

8,456 |

|

|

|

4,704 |

|

|

Net income |

|

|

$ |

12,262 |

|

|

$ |

7,514 |

|

|

$ |

34,108 |

|

|

$ |

21,071 |

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation loss (gain) |

|

|

|

417 |

|

|

|

(25 |

) |

|

|

362 |

|

|

|

(16 |

) |

|

Comprehensive income |

|

|

$ |

11,845 |

|

|

$ |

7,539 |

|

|

$ |

33,746 |

|

|

$ |

21,087 |

|

|

Per share information |

|

|

|

|

|

|

|

|

|

|

Basic net income per share |

|

|

$ |

0.46 |

|

|

$ |

0.27 |

|

|

$ |

1.29 |

|

|

$ |

0.75 |

|

|

Diluted net income per share |

|

|

$ |

0.42 |

|

|

$ |

0.25 |

|

|

$ |

1.12 |

|

|

$ |

0.69 |

|

See accompanying notes to interim consolidated financial

statements.

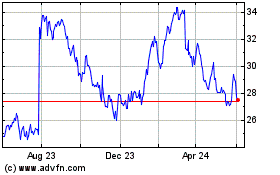

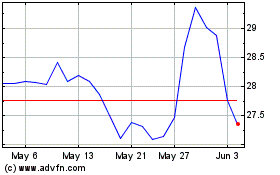

North American Construct... (TSX:NOA)

Historical Stock Chart

From Oct 2024 to Nov 2024

North American Construct... (TSX:NOA)

Historical Stock Chart

From Nov 2023 to Nov 2024