Magna Announces CAD Senior Notes Offering

May 27 2024 - 6:54PM

Magna International Inc. (TSX: MG; NYSE: MGA) today announced that

it has entered into an agency agreement providing for the issuance,

by way of private placement in each of the provinces of Canada, of

CAD$450 million aggregate principal amount of senior unsecured

notes due 2029. The notes will bear interest at an annual rate of

4.80% and will mature on May 30, 2029. The offering is expected to

close on May 30, 2024, subject to customary closing conditions.

Magna intends to use the net proceeds from this

offering for general corporate purposes, which may include the

repayment of its existing indebtedness.

RBC Capital Markets, Scotiabank, TD Securities

and CIBC Capital Markets are acting as joint bookrunners for the

offering.

This release shall not constitute an offer to

sell or a solicitation of an offer to buy any securities, nor shall

there be any sale of these securities, in any province or

jurisdiction in which such an offer, solicitation or sale would be

unlawful. The notes have not been and will not be qualified for

distribution to the public by prospectus under the securities laws

of any province or territory of Canada and will not be registered

under the Securities Act of 1933, as amended, or any state

securities laws and will not be offered or sold in the United

States, nor will they be offered or sold in any country other than

Canada. The notes will be offered on a private placement basis in

Canada to “accredited investors” who are not individuals, unless

such individuals are also "permitted clients" under applicable

Canadian securities laws.

INVESTOR CONTACT

Louis Tonelli, Vice-President, Investor

Relationslouis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT

Tracy Fuerst, Vice-President, Corporate

Communications & PRtracy.fuerst@magna.com │ 248.761.7004

OUR BUSINESS1

Magna is more than one of the world’s largest

suppliers in the automotive space. We are a mobility technology

company built to innovate, with a global, entrepreneurial-minded

team of over 179,0002 employees across 343 manufacturing operations

and 105 product development, engineering and sales centres spanning

28 countries. With 65+ years of expertise, our ecosystem of

interconnected products combined with our complete vehicle

expertise uniquely positions us to advance mobility in an expanded

transportation landscape.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release

constitute "forward-looking information" or "forward-looking

statements" (collectively, "forward-looking statements"). Any such

forward-looking statements are intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Forward-looking statements in this

press release include, but are not limited to, the expected closing

date of the offering and the intended use of the net proceeds from

the offering and are subject to, and expressly qualified by, the

cautionary disclaimers that are set out in Magna's regulatory

filings. Please refer to Magna's most current Management's

Discussion and Analysis of Results of Operations and Financial

Position, Annual Information Form and Annual Report on Form 40-F,

as replaced or updated by any of Magna's subsequent regulatory

filings, which set out the cautionary disclaimers, including the

risk factors that could cause actual events to differ materially

from those indicated by such forward-looking statements.

_______________1 Manufacturing operations,

product development, engineering and sales centres include certain

operations accounted for under the equity method.

2 Number of employees includes over 168,000

employees at our wholly owned or controlled entities and over

11,000 employees at certain operations accounted for under the

equity method.

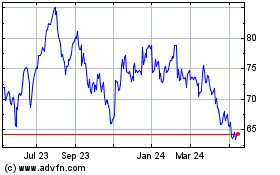

Magna (TSX:MG)

Historical Stock Chart

From Dec 2024 to Jan 2025

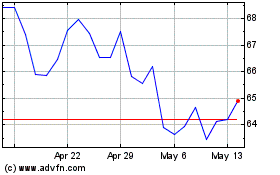

Magna (TSX:MG)

Historical Stock Chart

From Jan 2024 to Jan 2025