Glacier Media Inc. (TSX: GVC) (“Glacier” or the “Company”) reported

revenue and earnings for the year ended December 31, 2020.

SUMMARY RESULTS

| (thousands

of dollars) |

|

|

|

except share and per share amounts |

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

| Revenue |

|

$ |

151,304 |

|

|

$ |

184,790 |

|

| EBITDA |

|

$ |

22,941 |

|

|

$ |

7,967 |

|

| EBITDA

margin |

|

|

15.2 |

% |

|

|

4.3 |

% |

| EBITDA per

share |

|

$ |

0.18 |

|

|

$ |

0.07 |

|

| Capital

expenditures (3) |

|

$ |

4,530 |

|

|

$ |

9,765 |

|

| Net (loss)

income attributable to common shareholder |

|

$ |

(14,966 |

) |

|

$ |

34,249 |

|

| Net (loss)

income attributable to common shareholder per share |

|

$ |

(0.12 |

) |

|

$ |

0.29 |

|

| |

|

|

|

|

| Weighted

average shares outstanding, net |

|

|

125,213,346 |

|

|

|

116,783,420 |

|

| |

|

|

|

|

| Results

including joint ventures and associates: |

|

|

|

|

| Revenue

(1)(2) |

|

$ |

183,479 |

|

|

$ |

229,382 |

|

| EBITDA

(1)(2) |

|

$ |

29,760 |

|

|

$ |

16,321 |

|

| EBITDA

margin (1)(2) |

|

|

16.2 |

% |

|

|

7.1 |

% |

|

EBITDA per share (1)(2) |

|

$ |

0.24 |

|

|

$ |

0.14 |

|

| |

|

|

|

|

(1) Certain results are presented to include the Company’s

proportionate share of its joint venture and associate operations,

as this is the basis on which management bases its operating

decisions and performance. The Company’s joint ventures and

associates include Great West Media Limited Partnership, the

Victoria Times-Colonist, Rhode Island Suburban Newspapers, Inc.,

Village Media Inc. and Borden Bridge Development Corporation.

(2) The Company sold its interest in Fundata for $55.0

million in April 2019. Results were included up to March 31,

2019.

(3) Includes $3.1 million purchase of land for Canada’s

Outdoor Farm Show in Woodstock, Ontario in Q1 2019.

OPERATIONAL PERFORMANCE, SIGNIFICANT

DEVELOPMENTS IN 2020 AND OUTLOOK

Operational Performance

Consolidated revenue for the year ending

December 31, 2020 was $151.3 million, down $33.5 million or 18.1%

from the same period in the prior year. Consolidated EBITDA was

$22.9 million for the year, up $15.0 million from the prior

year.

The Company recorded wage subsidies from the

Canadian Emergency Wage Subsidy (“CEWS”) of $18.7 million for the

year. Consolidated EBITDA was $4.2 million excluding CEWS. The

Company’s EBITDA of $4.2 million also includes other grants and

subsidies received during the year.

The federal government announced that the CEWS

program will continue until June 2021, but at levels significantly

reduced from 2020. Other subsidies are also expected to continue in

2021.

The Company is reporting a net loss for the year

of $15.0 million and loss per share of $0.12 compared to net income

of $34.2 million and income per share of $0.29 in 2019. The Company

recorded an impairment charge of $23.5 million in 2020 on the

goodwill, intangible assets and investments in joint ventures and

associates, primarily within Community Media. In the prior year,

2019, the Company recognized a $47.7 million gain on sale,

primarily relating to the sale of the Company’s interest in

Fundata.

Including the Company’s share of joint ventures

and associates, revenue was $183.5 million, down $45.9 million or

20.0% and EBITDA was $29.8 million, up $13.4 million.

The Company implemented a wide variety of cost

reductions in response to the decline in revenues. These included

temporary wage roll-backs, reduced work weeks, layoffs and a wide

variety of other cost reduction measures.

The Company is monitoring conditions on an ongoing

basis and will respond accordingly. Revenues have been recovering

gradually, and the Company is working to maintain sufficient levels

of operating income within these levels, and making concerted

efforts to bring revenues back further and increase profits and

cash flow.

Sale of Non-Controlling

Interest

In July 2020, the Company sold a 45%

non-controlling interest in its ERIS and STP businesses (ERI

Environmental Risk LP) to Madison Venture Corporation (“Madison”),

a related party. The Company, through its affiliate GVIC

Communications Corp. (“GVIC”) received $11 million in cash and

retained 100% of the cash flow of the businesses relating to the

45% interest for two years. A $1.6 million receivable was recorded

at the time with respect to the additional cash flows being

received over two years. The transaction allows Madison to acquire

an additional 4% interest in the businesses at the acquisition date

pricing and an additional 2% at market value, and includes a mutual

right of first refusal. There is a buy/sell provision that is

exercisable after three years that allows either party to offer to

acquire the other party’s interest at market value.

Acquisition of GeoSearch

In November 2020, the Company, through its

subsidiaries ERIS Information Inc. and ERIS Information LP

(together “ERIS”), acquired the assets of GeoSearch LLC

(“GeoSearch”) for estimated total consideration of $15.2 million.

Cash of $3.6 million was paid up front with the remainder

consisting of a fixed deferred purchase price of $7.7 million

payable over the next three years, as well as a contingent

consideration amount based on future GeoSearch net income that was

estimated at $3.9 million. GeoSearch is a U.S. based environmental

risk information business with complimentary products to ERIS. The

acquisition increases the revenue, cash flow and competitiveness of

ERIS. The Company’s minority partner who owns 45% of ERIS is

expected to provide $5.1 million in funding toward the deferred

purchase obligations. The Company’s share of the total purchase

price was $8.3 million and paid $2.0 million at closing and expects

to pay the remaining $6.3 million over four years.

Subsequent Events

- On March 12, 2021, the Company sold its energy information

business to geoLOGIC systems ltd for $4.5 million in cash at

closing plus an earn-out of up to $3.5 million, for a total of up

to $8.0 million. The earn-out is revenue based and payable over

three years.

- The Company has entered into a definitive arrangement agreement

under which Glacier will acquire all of the Class B common voting

shares and Class C non-voting shares of GVIC Communications Corp.

not currently held by Glacier and its subsidiary, or by a

wholly-owned limited partnership of GVIC, through a share exchange.

The GVIC shareholders have approved the arrangement and it is

expected to close on March 31, 2021, subject to certain closing

conditions. The Company will issue 7.54 million shares as a result

of this transaction.

Outlook

Overall, the Company expects that as the

COVID-19 pandemic abates, revenues will recover. Due to the

uncertainty surrounding the continued magnitude and impact of the

pandemic on the economy, it remains unclear what the impact will be

on the Company’s operations and financial position in the

short-term.

The Company is working to reach the inflection

point where the revenue, profit and cash flow from its data,

analytics and intelligence products and digital media products

exceeds the decline of its print advertising related profit and

cash flow. The Company had made good progress in this regard in the

first two months of the first quarter of 2020 before the impact of

the pandemic set in. The Company can operate at lower levels of

revenue from its digital media, data and information operations in

the future and generate strong profit and cash flow without print

newspapers.

Financial Position. As at

December 31, 2020, senior debt was nil down from $8.0 million as at

September 30, 2020. Total current and long-term debt was $2.6

million at December 31, 2020.

The Company has net $7.7 million of deferred

purchase price obligations to be paid over the next four years.

This amount is net of $5.0 million in expected contributions from

minority partners. The Company has a $7.5 million vendor-take back

receivable over the next three years resulting from the sale of the

Company’s interest in Fundata.

Shares in Glacier are traded on the Toronto

Stock Exchange under the symbol GVC.

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

ABOUT THE COMPANY

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. The Company’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

FINANCIAL MEASURES

To supplement the consolidated financial

statements presented in accordance with International Financial

Reporting Standards, Glacier uses certain non-IFRS measures that

may be different from the performance measures used by other

companies. These non-IFRS measures include earnings before

interest, taxes, depreciation and amortization (EBITDA) and all

measures including joint ventures and associates which are not

alternatives to IFRS financial measures. These non-IFRS measures do

not have any standardized meanings prescribed by IFRS and

accordingly they are unlikely to be comparable to similar measures

presented by other issuers.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, the Company’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to our

expectations; our expectations regarding continued federal

government wage subsidies at reduced levels; and the Company’s

expectation that revenues will recover as the pandemic abates.

These forward-looking statements are based on certain assumptions,

including continued economic growth and recovery and the

realization of cost savings in a timely manner and in the expected

amounts, which are subject to risks, uncertainties and other

factors which may cause results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed

on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve the intended results from our

strategic initiatives, the failure to reduce debt and the other

risk factors listed in our Annual Information Form under the

heading “Risk Factors” and in our MD&A under the heading

“Business Environment and Risks”, many of which are out of our

control. These other risk factors include, but are not limited to,

the impact of Coronavirus, that future cash flow from operations

and the availability under existing banking arrangements are

believed to be adequate to support financial liabilities and that

the Company expects to be successful in its objection with CRA, the

ability of the Company to sell advertising and subscriptions

related to its publications, foreign exchange rate fluctuations,

the seasonal and cyclical nature of the agricultural and energy

sectors, discontinuation of government grants, general market

conditions in both Canada and the United States, changes in the

prices of purchased supplies including newsprint, the effects of

competition in the Company’s markets, dependence on key personnel,

integration of newly acquired businesses, technological changes,

tax risk, financing risk, debt service risk and cybersecurity

risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

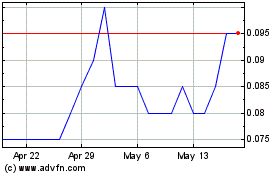

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

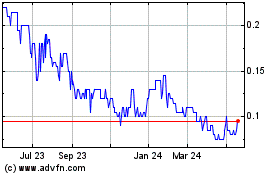

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024