Generation Mining Limited (TSX:GENM) ("Gen Mining" or the

"Company") announces that it has signed a contract with Boart

Longyear Canada for up to 8,000 metres of exploration drilling on a

number of high-prospectivity copper targets north and west of its

Marathon Palladium-Copper Project in Northwestern Ontario. Two

phases of drilling as well as numerous field programs are planned.

The winter program is focused on the Biiwobik prospect, which sits

just north of the Marathon Palladium-Copper deposit and the summer

drill program includes the Four Dams and Sally targets.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240307808472/en/

Figure 1 – Map of Marathon Palladium

project showing locations of 2024 exploration programs. (Graphic:

Business Wire)

The drill and crew have mobilized to site and drilling has

commenced. The aim of the first hole at Biiwobik is to better

define the extent of the Powerline and Chonolith domains which will

aid in determining the potential to expand the Marathon

Palladium-Copper deposit or develop a fourth pit increasing the

life of the mine beyond 13.5 years.

The winter phase of the program will comprise approximately

3,000 metres and is designed to potentially extend the northern

Marathon Pit, targeting an area adjacent to the north pit and

extending 400 metres to the north. Highlights from the 2021 drill

program (see news release dated September 2, 2021) include drill

intercepts* of 46 metres grading 0.46% copper, 1.01 g/t palladium,

0.11 g/t gold and 0.17 g/t platinum starting at a depth 50 metres

(Figures 1 and 2). These holes were drilled to follow up a 2006

hole which returned 100.5 metres grading 0.58% copper, 0.93 g/t

palladium, 0.1 g/t gold and 0.25 g/t platinum, starting at a depth

of 215.8 metres. The 2024 drilling is designed to test the downdip

and along strike extension of mineralization to better define the

upside potential of the Biiwobik prospect.

The summer phase of the program will comprise approximately

2,000 metres of exploration drilling at the Four Dams prospect and

1,000 metres at the Sally deposit.

The Four Dams prospect (Figure 3) hosts an approximately

250-metre-wide by 60-metre-thick ultramafic pipe which contains

abundant higher density minerals such as olivine and apatite along

with semi-massive to massive sulphides occurring at its base. The

concentration of these higher density minerals as well as massive

sulphides is interpreted to be the result of gravity driven

accumulation of heavier minerals which often leads to the pooling

of larger massive sulphide bodies at depth. A combination of

down-dip drilling and borehole electromagnetic surveying will be

used to vector towards these bodies. The last drill program

targeting the main Four Dams pipe occurred between 2005-2006 with

results including 0.56% copper over 62.2 metres, 0.38% copper over

100.05 metres and 0.35% copper of 73.5 metres. The pipe has only

been drilled to a vertical depth of 200 metres and remains open at

depth.

A second target will be drilled approximately 275 metres

southeast of the main pipe, where three holes drilled between 2013

and 2017 encountered similar rock units that make up the main Four

Dams pipe, with the best results being 0.27% copper over 64 metres.

Borehole electromagnetic surveys carried out in 2017 and a

subsequent magnetotelluric survey completed in 2020 both indicate

the presence of an untested conductor immediately down dip from

this intercept, which will be a focus of the 2024 drill

program.

Drilling at the Sally Deposit (Figure 4) will utilize a

helicopter portable drill rig and consist of a single hole

totalling approximately 1000 metres. This hole will follow up on

the successful drill program carried out by Gen Mining in 2019 (see

news release dated December 17, 2019). A subsequent borehole

electromagnetic survey at the end of 2019 and magnetotelluric

survey in 2020 both indicate the presence of a large untested

conductor just below the 2019 intercept. This conductor occurs

along the same geological horizon which hosts extremely high-grade

outcrop samples with grades up to 9.11% copper, 185 g/t palladium.

2.83 g/t gold and 0.45 g/t platinum.

Additional surficial field programs are planned at Sally as well

as the region between the Sally and Geordie deposits, where mapping

and sampling by past operators has indicated the potential for

economic copper mineralization (Figure 1).

The company has also engaged ALS Goldspot to carry out a 2D

prospectivity analysis of the Company’s entire exploration land

package. This project is the culmination of over four years of data

compilation by Gen Mining and will include over 60 years of

exploration data from various past operators. Gen Mining will work

closely with Goldspot’s team of geologists, geophysicists and

geochemists to prepare the data for analysis using their

proprietary artificial intelligence (AI) and machine learning

technology. Results from this program will help to guide

exploration programs in 2024 and beyond. Pending results, a 3D

analysis will be carried out following the 2024 drill program to

better define prospective targets at depth.

Gen Mining’s CEO Jamie Levy stated, “We are excited to follow up

on the positive drill results from the summer 2021 program to

better understand our land package and its potential to contain

copper rich deposits.”

* drill intercepts lengths approximate true widths

*Metal prices of US$1500/oz Pd, US$3.20/lb Cu, US$1100/oz Pt,

and US$1800/oz Au used for CuEq calculations

About Generation Mining Limited

Gen Mining’s focus is the development of the Marathon Project, a

large undeveloped palladium-copper deposit in Northwestern Ontario,

Canada. The Company released the results of the Feasibility Study

Update on March 31, 2023.

The Feasibility Study Update estimated a Net Present Value

(using a 6% discount rate) of C$1.16 billion, an Internal Rate of

Return of 25.8%, and a 2.3-year payback. The mine is expected to

produce an average of 166,000 ounces of payable palladium and 41

million pounds of payable copper per year over a 13-year mine life

(“LOM”). Over the LOM, the Marathon Project is anticipated to

produce 2,122,000 ounces of palladium, 517 million lbs of copper,

485,000 ounces of platinum, 158,000 ounces of gold and 3,156,000

ounces of silver in payable metals. For more information, please

review the Feasibility Study Update dated March 31, 2023, filed

under the Company’s profile at www.sedarplus.com or on the

Company’s website at

https://genmining.com/projects/feasibility-study/.

The Marathon Property covers a land package of approximately

22,000 hectares, or 220 square kilometres. Gen Mining owns a 100%

interest in the Marathon Project.

Qualified Person

The scientific and technical content of this news release was

reviewed, verified, and approved by Drew Anwyll, P.Eng., M.Eng,

Chief Operating Officer of the Company, and a Qualified Person as

defined by Canadian Securities Administrators’ National Instrument

43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information

and forward-looking statements, as defined in applicable securities

laws (collectively referred to herein as "forward-looking

statements"). Forward-looking statements reflect current

expectations or beliefs regarding future events or the Company’s

future performance. All statements other than statements of

historical fact are forward-looking statements. Often, but not

always, forward-looking statements can be identified by the use of

words such as "plans", "expects", "is expected", "budget",

"scheduled", "estimates", "continues", "forecasts", "projects”,

“predicts”, “intends”, “anticipates”, “targets” or “believes”, or

variations of, or the negatives of, such words and phrases or state

that certain actions, events or results “may”, “could”, “would”,

“should”, “might” or “will” be taken, occur or be achieved,

including statements relating to the final location and depth of

drill holes, surveys and targets; the life of mine; mineral

production estimates; payback period; and financial returns from

the Marathon Project.

Although the Company believes that the expectations expressed in

such statements are based on reasonable assumptions, such

statements are not guarantees of future performance and actual

results or developments may differ materially from those in the

statements. There are certain factors that could cause actual

results to differ materially from those in the forward-looking

information. These include the timing for a construction decision;

the progress of development at the Marathon Project, including

progress of project expenditures and contracting processes, the

Company’s plans and expectations with respect to liquidity

management, continued availability of capital and financing, the

future price of palladium and other commodities, permitting

timelines, exchange rates and currency fluctuations, increases in

costs, requirements for additional capital, and the Company’s

decisions with respect to capital allocation, and the impact of

COVID-19, inflation, global supply chain disruptions, global

conflicts, including the wars in Ukraine and Israel, the project

schedule for the Marathon Project, key inputs, staffing and

contractors, commodity price volatility, continued availability of

capital and financing, uncertainties involved in interpreting

geological data, environmental compliance and changes in

environmental legislation and regulation, the Company’s

relationships with First Nations communities, results from planned

exploration and drilling activities, local access conditions for

drilling, and general economic, market or business conditions, as

well as those risk factors set out in the Company’s annual

information form for the year ended December 31, 2022, and in the

continuous disclosure documents filed by the Company on SEDAR+ at

www.sedarplus.ca. Readers are cautioned that the foregoing list of

factors is not exhaustive of the factors that may affect

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. The forward-looking

statements in this news release speak only as of the date of this

news release or as of the date or dates specified in such

statements.

Forward-looking statements are based on a number of assumptions

which may prove to be incorrect, including, but not limited to,

assumptions relating to: the availability of financing for the

Company’s operations; operating and capital costs; results of

operations; the mine development and production schedule and

related costs; the supply and demand for, and the level and

volatility of commodity prices; timing of the receipt of regulatory

and governmental approvals for development projects and other

operations; the accuracy of Mineral Reserve and Mineral Resource

Estimates, production estimates and capital and operating cost

estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not

guarantees of future performance and actual results or developments

may differ materially from those projected in the forward-looking

information. For more information on the Company, investors are

encouraged to review the Company’s public filings on SEDAR+ at

www.sedarplus.ca. The Company disclaims any intention or obligation

to update or revise any forward- looking information, whether as a

result of new information, future events or otherwise, other than

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240307808472/en/

Jamie Levy President and Chief Executive Officer (416) 640-2934

(O) (416) 567-2440 (M) jlevy@genmining.com

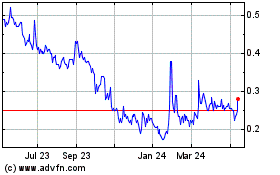

Generation Mining (TSX:GENM)

Historical Stock Chart

From Feb 2025 to Mar 2025

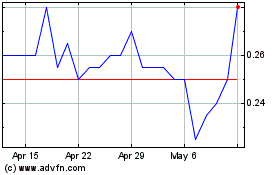

Generation Mining (TSX:GENM)

Historical Stock Chart

From Mar 2024 to Mar 2025