E-L Financial Corporation Limited Completes Offering of $100 Million of Preference Shares

April 02 2012 - 8:43AM

Marketwired Canada

E-L Financial Corporation Limited (the "Corporation") (TSX:ELF) announced today

the completion of its previously-announced sale to a syndicate of underwriters,

co-led by Scotia Capital Inc. and TD Securities Inc., of 4,000,000

Non-Cumulative Redeemable First Preference Shares, Series 3 for sale to the

public at a price of $25.00 per share and paying fixed non-cumulative quarterly

dividends that will yield 5.50% per annum. The gross proceeds of $100,000,000,

less the expenses of the offering, will be added to the Corporation's capital

base to supplement the Corporation's financial resources and used for general

corporate purposes. The First Preference Shares, Series 3 will be posted for

trading on the Toronto Stock Exchange ("TSX") under the symbol ELF.PR.H.

The First Preference Shares, Series 3 will rank in priority to the common shares

and the Series A Preference Shares of the Corporation, with respect to the

payment of dividends and with respect to the distribution of assets on the

dissolution, liquidation or winding up of the Corporation. On and after April

17, 2017, the Corporation may, subject to TSX approval, convert all or any part

of the outstanding First Preference Shares, Series 3 into freely tradeable

common shares of the Corporation. The First Preference Shares, Series 3 are also

redeemable at the option of the Corporation on and after April 17, 2017.

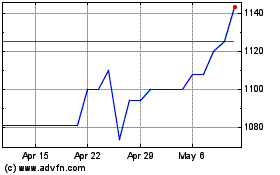

E L Financial (TSX:ELF)

Historical Stock Chart

From Jun 2024 to Jul 2024

E L Financial (TSX:ELF)

Historical Stock Chart

From Jul 2023 to Jul 2024