E-L Financial Corporation Limited ("E-L Financial") (TSX: ELF)(TSX:

ELF.PR.F)(TSX: ELF.PR.G) today reported that for the quarter ended

June 30, 2010, it earned net operating income(1) of $8.2 million or

$1.71 per share compared with $4.2 million or $0.52 per share for

the comparable period in 2009. The Dominion's net operating income

for the second quarter of 2010 increased from the prior year due to

improved personal property results. Empire Life's net operating

income was lower relative to the second quarter of last year as

2009 included strong earnings from locking in favourable future

investment returns.

On a year to date basis, E-L Financial earned consolidated net

operating income of $22.2 million or $5.19 per share compared with

$38.7 million or $10.12 per share for the comparable period in

2009. Net operating income for the prior period was favourably

affected by a $17.7 million income tax adjustment to Empire Life's

2009 net operating income resulting from amendments to the Income

Tax Act (Canada) related to Financial Instruments. The Dominion's

net operating income for the first six months of 2010 increased

from the prior year due to lower weather-related property losses

and rate increases in personal property.

Net income (loss)

For the second quarter of 2010 E-L Financial had a consolidated

net loss of $21.5 million or $7.26 per share compared with net

income of $73.8 million or $21.46 per share for the second quarter

of 2009. The net loss for the quarter was mainly attributable to

equity method investments that reported an after-tax loss of $25.4

million compared with after- tax income of $38.0 million in

2009.

On a year to date basis, E-L Financial had a consolidated net

income of $2.6 million resulting in a loss of $0.72 per share

compared with a net loss of $60.0 million or $19.56 per share for

the comparable period in 2009. The net loss for the first six

months of 2009 was largely due to a $113.6 million after-tax loss

on available for sale investments held by The Dominion.

Comprehensive income (loss)

For the second quarter of 2010, E-L Financial had a consolidated

comprehensive loss of $34.7 million or $11.26 per share compared

with comprehensive income of $198.7 million or $59.03 per share for

the comparable period in 2009. Other comprehensive loss ("OCL") for

the second quarter was $13.2 million or $4.00 per share compared to

other comprehensive income ("OCI") of $124.9 million or $37.57 per

share for 2009. OCL for the period reflects the decline in equity

markets during the quarter compared with the strong rebound in

equity markets during the second quarter of 2009.

On a year to date basis, E-L Financial had a consolidated

comprehensive loss of $13.5 million or $5.59 per share compared

with comprehensive income of $273.3 million or $80.71 per share for

the comparable period in 2009. On a year to date basis,

consolidated OCL was $16.1 million or $4.87 per share compared with

OCI of $333.3 million or $100.27 for the prior year. OCI for 2009

was significantly impacted by the $113.6 million in after-tax

losses being reclassified from accumulated other comprehensive

income to the consolidated income statements.

CONSOLIDATED SUMMARY OF COMPREHENSIVE INCOME (LOSS)

For the period ended June 30

----------------------------------------------------------------------------

For the three months ended

June 30, 2010

-----------------------------------------------

Corporate The Empire

(thousands of dollars) Investments Dominion Life Total

----------------------------------------------------------------------------

Net operating income (loss) $ (1,191) $ 4,288 $ 5,070 $ 8,167

Realized loss on available

for sale investments

including

impairment write downs (1,148) (666 ) (2,387) (4,201)

Loss from equity method

investments (25,451) - - (25,451)

----------------------------------------------------------------------------

Net income (loss) (27,790) 3,622 2,683 (21,485)

Other comprehensive income

(loss) 4,452 (11,651) (6,008) (13,207)

----------------------------------------------------------------------------

Comprehensive loss $ (23,338) $ (8,029) $ (3,325) $ (34,692)

-------------------------------=============================================

----------------------------------------------------------------------------

For the three months ended

June 30, 2009

-----------------------------------------------

Corporate The Empire

(thousands of dollars) Investments Dominion Life Total

----------------------------------------------------------------------------

Net operating income (loss) $ 5,679 $ (13,052) $ 11,613 $ 4,240

Realized gain (loss) on

available

for sale investments

including

impairment write downs (4,854) 36,637 (179) 31,604

Income from equity method

investments 37,991 - - 37,991

----------------------------------------------------------------------------

Net income 38,816 23,585 11,434 73,835

Other comprehensive income 43,575 50,754 30,541 124,870

----------------------------------------------------------------------------

Comprehensive income $ 82,391 $ 74,339 $ 41,975 $ 198,705

-----------------------------===============================================

CONSOLIDATED SUMMARY OF COMPREHENSIVE INCOME (LOSS)

For the period ended June 30

----------------------------------------------------------------------------

For the six months ended June 30, 2010

-----------------------------------------------

Corporate The Empire

(thousands of dollars) Investments Dominion Life Total

----------------------------------------------------------------------------

Net operating income $ 236 $ 15,791 $ 6,176 $ 22,203

Realized gain (loss) on

available

for sale investments

including

impairment write downs (1,172) (407) 8,813 7,234

Loss from equity method

investments (26,834) - - (26,834)

----------------------------------------------------------------------------

Net income (loss) (27,770) 15,384 14,989 2,603

Other comprehensive income

(loss) 3,113 (5,047) (14,184) (16,118)

----------------------------------------------------------------------------

Comprehensive income (loss) $ (24,657) $ 10,337 $ 805 $ (13,515)

-----------------------------===============================================

----------------------------------------------------------------------------

For the six months ended June 30, 2009

-----------------------------------------------

Corporate The Empire

(thousands of dollars) Investments Dominion Life Total

----------------------------------------------------------------------------

Net operating income (loss) $ 7,593 $ (11,185) $ 42,251 $ 38,659

Realized loss on available

for sale investments

including

impairment write downs (12) (113,566) (1,985) (115,563)

Income from equity method

investments 16,927 - - 16,927

----------------------------------------------------------------------------

Net income (loss) 24,508 (124,751) 40,266 (59,977)

Other comprehensive income 41,326 260,826 31,109 333,261

----------------------------------------------------------------------------

Comprehensive income $ 65,834 $ 136,075 $ 71,375 $ 273,284

-----------------------------===============================================

(1) Use of non-GAAP measures

"net operating income (loss)" is net income excluding realized

gain (loss) on available for sale investments including impairment

write downs and income (loss) from equity method investments, all

net of tax. The term net operating income (loss) does not have any

standardized meaning according to GAAP and therefore may not be

comparable to similar measures presented by other companies.

Contacts: E-L Financial Corporation Limited Mark M. Taylor

Executive Vice-President and Chief Financial Officer (416) 947-2578

(416) 362-0792 (FAX)

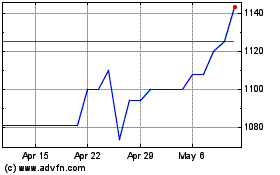

E L Financial (TSX:ELF)

Historical Stock Chart

From Oct 2024 to Nov 2024

E L Financial (TSX:ELF)

Historical Stock Chart

From Nov 2023 to Nov 2024