Endeavour Silver Corp.

(“Endeavour” or the

“Company”) (NYSE: EXK; TSX: EDR) is

pleased to announce its unaudited financial and operating results

for the three and nine months ended September 30, 2022. All amounts

reported are in United States (US) dollars.

Dan Dickson, CEO, commented, “This quarter is a

continuation of our strong operational performance. With production

guidance reaffirmed, and a strong fourth quarter expected, we are

feeling confident about our 2022 production results. Like the rest

of the industry, profit margins are under pressure. The strength of

the USD is weighing on commodity prices, and inflation is

increasing direct costs. We are fortunate that the elevated grade

profile at Guanacevi and strong operational performance has allowed

us to stay within or near our guided cost ranges on a per ounce

basis.”

“We continue to focus on business improvement

and cost management initiatives, while being mindful of the future.

Continuing to advance the Terronera project in a deliberate and

disciplined manner towards a construction decision and the

completion of the Pitarrilla acquisition, are both significant

developments towards the future of the Company.”

Q3 2022 Highlights

-

Continued Strong Production: 1,458,448 ounces (oz)

of silver and 9,194 oz of gold for 2.2 million oz silver equivalent

(AgEq) (1) at an 80:1 silver:gold ratio, totaling 6.3 million AgEq

oz for the 9 months ended September 30, 2022. Strong year to date

production reinforces delivery of 2022 guidance.

- Revenue

Impacted by Withholding Metal Sales & Lower Realized

Prices: Generated $40.4 million from the sale of 1,327,325

oz silver and 8,852 oz gold at average realized prices of $19.24

per oz silver and $1,678 per oz gold. Management continued to carry

higher metal inventory totaling 1,527,549 oz silver and 3,210 oz

gold of bullion inventory and 2,770 oz silver and 143 oz gold in

concentrate inventory, with a market value of approximately $35

million at September 30, 2022.

-

Operating Costs per Ounce In-Line with Guidance, Despite

Industry-Wide Inflation: Cash costs(2) of $10.32 per oz

payable silver and all-in sustaining costs (AISC)(2) of $20.27 per

oz payable silver, net of gold credits.

- Negative Earnings and Lower

Cash Flow Due to Impacted Revenue: Net loss of $1.5

million or $0.01 loss per share. $7.3 million in cash flow from

operations before working capital changes(2) and mine operating

cash flow before taxes(2) of $12.3 million. The Company continued

to hold significant finished goods held at costs on the balance

sheet at quarter end.

- Healthy Balance

Sheet: Cash position of $69.2 million and $101.6 million

in working capital(2). Cash decreased in the quarter, as funds were

spent to complete the acquisition of the Pitarrilla Project with a

$35 million cash payment and early works expenditures to advance

the Terronera project.

- Strong Liquidity

Remains: While the cash balance decreased during the

quarter, the realized sale of finished goods inventory, with a

market value of approximately $35 million at quarter end, would

imply a cash balance closer to $100 million.

- Advancing the Terronera

Project: Work continued on predevelopment activities

initiated last year including detailed engineering, critical

contracts, procurement of long-lead items and road and camp

construction. The Company intends to make a formal construction

decision subject to completion of a financing package and receipt

of additional amended permits in the coming months. Budgeted

development expenditures for 2022 are estimated to be $41.0

million.

- Completed the Acquisition

of the Pitarrilla Project: The world’s largest undeveloped

silver project that will form the cornerstone of the Company’s

growth profile, together with Terronera and Parral (see News

Release dated July 6, 2022).

- Divested the El Compas Property to Grupo

ROSGO: Completed the sale of the property and the

plant for US$5 million over five years (see News Release dated

September 12, 2022).

Financial Overview (see

appendix for consolidated financial statements)

|

Three Months Ended September 30 |

Q3 2022 Highlights |

Nine Months Ended September 30 |

|

|

2022 |

2021 |

% Change |

2022 |

2021 |

% Change |

|

|

|

|

|

Production |

|

|

|

|

|

1,458,448 |

1,305,399 |

12% |

Silver ounces produced |

4,132,610 |

3,427,223 |

21% |

|

|

9,194 |

10,541 |

(13%) |

Gold ounces produced |

27,178 |

32,816 |

(17%) |

|

|

1,445,880 |

1,295,126 |

12% |

Payable silver ounces produced |

4,095,696 |

3,394,103 |

21% |

|

|

9,039 |

10,328 |

(12%) |

Payable gold ounces produced |

26,705 |

32,177 |

(17%) |

|

|

2,193,968 |

2,148,679 |

2% |

Silver equivalent ounces produced(1) |

6,306,850 |

6,052,503 |

4% |

|

|

10.32 |

8.16 |

27% |

Cash costs per silver ounce(2)(3) |

10.21 |

9.59 |

6% |

|

|

14.31 |

13.14 |

9% |

Total production costs per ounce(2)(4) |

14.56 |

15.84 |

(8%) |

|

|

20.27 |

17.46 |

16% |

All-in sustaining costs per ounce (2)(5) |

20.24 |

20.70 |

(2%) |

|

|

202,745 |

222,461 |

(9%) |

Processed tonnes |

610,253 |

673,932 |

(9%) |

|

|

131.61 |

115.57 |

14% |

Direct operating costs per tonne(2)(6) |

128.99 |

116.14 |

11% |

|

|

146.30 |

130.38 |

12% |

Direct costs per tonne(2)(6) |

147.65 |

133.12 |

11% |

|

|

13.12 |

13.98 |

(6%) |

Silver co-product cash costs(7) |

14.15 |

15.86 |

(11%) |

|

|

1,144 |

1,020 |

12% |

Gold co-product cash costs(7) |

1,163 |

1,078 |

8% |

|

|

|

|

|

Financial |

|

|

|

|

|

39.7 |

34.6 |

15% |

Revenue ($ millions) |

128.2 |

116.8 |

10% |

|

|

1,327,325 |

699,539 |

90% |

Silver ounces sold |

3,647,987 |

2,443,184 |

49% |

|

|

8,852 |

9,925 |

(11%) |

Gold ounces sold |

27,025 |

30,398 |

(11%) |

|

|

19.24 |

24.56 |

(22%) |

Realized silver price per ounce |

22.24 |

26.26 |

(15%) |

|

|

1,678 |

1,791 |

(6%) |

Realized gold price per ounce |

1,827 |

1,784 |

2% |

|

|

(1.5) |

(4.5) |

(67%) |

Net earnings (loss) ($ millions) |

(1.8) |

14.4 |

(112%) |

|

|

(3.1) |

(1.5) |

106% |

Adjusted net earnings (loss) (11) ($ millions) |

(1.1) |

(5.2) |

78% |

|

|

5.1 |

8.3 |

(38%) |

Mine operating earnings ($ millions) |

29.9 |

24.1 |

24% |

|

|

12.3 |

13.2 |

(7%) |

Mine operating cash flow before taxes ($ millions)(8) |

47.8 |

43.7 |

9% |

|

|

7.3 |

7.7 |

(4%) |

Operating cash flow before working capital changes(9) |

31.6 |

21.6 |

46% |

|

|

7.9 |

4.4 |

81% |

EBITDA(10) ($ millions) |

29.2 |

44.2 |

(34%) |

|

|

101.6 |

128.7 |

(21%) |

Working capital (12) ($ millions) |

101.6 |

128.7 |

(21%) |

|

|

|

|

|

Shareholders |

|

|

|

|

|

(0.01) |

(0.03) |

(67%) |

Earnings (loss) per share – basic ($) |

(0.01) |

0.09 |

(111%) |

|

|

0.04 |

0.04 |

(14%) |

Operating cash flow before working capital changes per

share(9) |

0.17 |

0.13 |

35% |

|

|

189,241,367 |

170,432,326 |

11% |

Weighted average shares outstanding |

180,655,842 |

166,201,727 |

9% |

|

|

|

|

|

|

|

|

|

|

(1) Silver equivalent (AgEq) is calculated using an 80:1

silver:gold ratio.

(2) These are non-IFRS financial measures and

ratios. Further details on these non-IFRS financial measures and

ratios are provided at the end of this press release and in the

MD&A accompanying the Company’s financial statements, which can

be viewed on the Company’s website, on SEDAR at www.sedar.com and

on EDGAR at www.sec.gov.

For the three months ended September 30, 2022,

net revenue, increased by 15% to $39.7 million (Q3 2021: $34.6

million).

Gross sales of $40.4 million in Q3 2022

represented a 15% increase over the $35.0 million in Q3 2021.

Silver oz sold increased by 90%, due to both a 12% increase in

silver production and a significantly smaller buildup of finished

goods inventory during Q3, 2022 compared to Q3, 2021.

There was a 22% decrease in the realized silver price resulting in

a 48% increase to silver sales. Gold oz sold decreased 11% with a

6% decrease in realized gold prices resulting in a 16% decrease in

gold sales. The decrease in gold sales is primarily driven by the

decreased gold grades at the Bolañitos mine and the suspension of

production from the El Compas mine. During the period, the Company

sold 1,327,325 oz silver and 8,852 oz gold, for realized prices of

$19.24 and $1,678 per oz, respectively, compared to sales of

699,539 oz silver and 9,925 oz gold, for realized prices of $24.56

and $1,791 per oz, respectively, in the same period of 2021. For

the three months ended September 30, 2022, the realized prices of

silver and gold were within 3% of the London spot prices. Silver

and gold London spot prices averaged $19.23 and $1,729,

respectively, during the three months ended September 30, 2022

The Company increased its finished goods silver

and finished goods gold inventory to 1,530,319 oz silver and 3,353

oz gold, at September 30, 2022 compared to 1,411,764 oz silver and

3,167 oz gold at June 30, 2022. The cost allocated to these

finished goods was $22.1 million at September 30, 2022, compared to

$20.8 million at June 30, 2022 and $18.3 million at September 30,

2021. At September 30, 2022, the finished goods inventory fair

market value was $34.7 million, compared to $34.5 million at June

30, 2022. Earnings and other financial metrics, including mine

operating cash flow(2), operating cash flow(2) and EBITDA(2) were

impacted by the withholding of sales during Q3 2022.

Cost of sales for Q3, 2022 was $34.5 million, an

increase of 31% over the cost of sales of $26.3 million for Q3,

2021. The cost of sales in Q3, 2022 was impacted by increased input

costs and slightly impacted by the delay in recognition of costs

associated with the increase in the quantity of silver ounces in

finished goods at the end of the period. Overall costs for Q3, 2022

were impacted by higher labour, power and consumables costs as the

Company is experiencing significant inflationary pressures. During

Q3, 2022, the Company also recorded an allowance on the valuation

of warehouse inventory of $1.3 million (Q3, 2021 – Nil).

In Q3, 2022, the Company had an operating loss

of $1.3 million (Q3, 2021 – operating earnings of $3.0 million)

after exploration and evaluations costs of $4.0 million (Q3, 2021 –

$4.7 million), general and administrative expense of $2.2 million

(Q3, 2021 – expense recovery $0.5 million), and care and

maintenance expense of $0.2 million (Q3, 2021 – $0.4 million). In

the three months ended September 30, 2021 operating earnings

included $0.7 million in severance costs related to the suspension

of the operations at the El Compas mine.

The earnings before taxes for Q3, 2022 was $1.7

million (Q3, 2021 – loss $0.8 million) after finance costs of $0.3

million (Q3, 2021 – $0.2 million), a foreign exchange gain of $0.8

million (Q3, 2021 –foreign exchange loss of $1.2 million), gain on

assets disposal of $2.8 million (Q3, 2021 -$Nil) and investment and

other expense of $0.3 million (Q3, 2021 –$2.4 million).

The Company realized a net loss for the period

of $1.5 million (Q3, 2021 –$4.5 million) after an income tax

expense of $3.2 million (Q3, 2021 – $3.7 million). In Q3, 2022

earnings were impacted by a $1.1 million mark-to-market adjustment

resulting in an unrealized loss on investments included in

investment and other expense (Q3, 2021 - $3.0 million).

Current income tax expense increased to $1.2

million (Q3 2021 - $0.7 million) due to increased profitability

impacting the income tax and special mining duty, while deferred

income tax expense of $2.0 million is primarily due to the

estimated use of loss carryforwards to reduce taxable income

generated at both Guanaceví and Bolañitos (Q3 2021 – $3.0

million).

Direct operating costs(2) on a per tonne basis

increased to $131.61, up 14% compared with Q3 2021 due to higher

operating costs at Guanaceví and Bolañitos and a reduction in ore

tonnes processed. Guanaceví and Bolañitos have seen increased

labour, power and consumables costs and at Guanaceví, increased

third party ore purchased and operating development have increased

compared to the prior year.

Consolidated cash costs per oz(2), net of

by-product credits increased 27% to $10.32 driven by increased

direct costs per tonne(2) and a reduction in by-product gold sales,

offset by increased ore grades. AISC(2) increased by 16% on a per

oz basis compared to Q3, 2021 as a result of the increased cash

costs(2) and increased allocated general and administrative costs

offset by a slight reduction in sustaining capital expenditures

The complete financial statements and

management’s discussion & analysis can be viewed on the

Company’s website, on SEDAR at www.sedar.com and on EDGAR at

www.sec.gov. All shareholders can receive a hard copy of the

Company’s complete audited financial statements free of charge upon

request. To receive this material in hard copy, please contact

Investor Relations at 604-640-4804, toll free at 1-877-685-9775 or

by email at gmeleger@edrsilver.com.

Conference Call

A conference call to discuss the Company’s Q3

2022 financial results will be held today at 10:00 a.m. PST / 1:00

p.m. EST. To participate in the conference call, please dial the

numbers below.

|

Date & Time: |

Tuesday,

November 8, 2022 at 10:00 a.m. PST / 1:00 p.m. EST |

| |

|

| Telephone: |

Toll-free in Canada and the US +1-800-319-4610Local or

International +1-604-638-5340Please allow up to 10 minutes to be

connected to the conference call. |

| |

|

| Replay: |

A replay of the conference call will be available by dialing

(toll-free) +1-800-319-6413 in Canada and the US (toll-free)

or +1-604-638-9010 outside of Canada and the US. The replay

passcode is 9479#. The replay will also be available on the

Company’s website at www.edrsilver.com. |

About Endeavour Silver –

Endeavour is a mid-tier precious metals mining company that

operates two high-grade underground silver-gold mines in Mexico.

Endeavour is currently advancing the Terronera project towards a

development decision, pending financing and final permits and

exploring its portfolio of exploration and development projects in

Mexico, Chile and the United States to facilitate its goal to

become a premier senior silver producer. Our philosophy of

corporate social integrity creates value for all stakeholders.

SOURCE Endeavour Silver Corp. Contact

InformationGalina Meleger, Vice President of Investor

Relations Tel: (604)640-4804Email: gmeleger@edrsilver.com Website:

www.edrsilver.com

Follow Endeavour Silver on Facebook, Twitter,

Instagram and LinkedIn

Endnotes

1 Silver equivalent

(AgEq)

AgEq is calculated using an 80:1 silver:gold ratio.

2 Non-IFRS and

Other Financial Measures and

Ratios

Certain non-IFRS and other non-financial

measures and ratios are included in this press release, including

cash costs per silver ounce, total production costs per ounce,

all-in costs per ounce, all-in sustaining cost (“AISC”) per ounce,

direct operating costs per tonne, direct costs per tonne, silver

co-product cash costs, gold co-product cash costs, realized silver

price per ounce, realized gold price per ounce, adjusted net

earnings (loss) adjusted net earnings (loss) per share, mine

operating cash flow before taxes, working capital, operating cash

flow before working capital adjustments, operating cash flow before

working capital changes per share, earnings before interest, taxes,

depreciation and amortization (“EBITDA”), adjusted EBITDA per share

and sustaining and growth capital.

Please see the September 30, 2022 MD&A for

explanations and discussion of these non-IFRS and other

non-financial measures and ratios. The Company believes that these

measures and ratios, in addition to conventional measures and

ratios prepared in accordance with International Financial

Reporting Standards (“IFRS”), provide management and investors an

improved ability to evaluate the underlying performance of the

Company. The non-IFRS and other non-financial measures and ratios

are intended to provide additional information and should not be

considered in isolation or as a substitute for measures or ratios

of performance prepared in accordance with IFRS. These measures and

ratios do not have any standardized meaning prescribed under IFRS,

and therefore may not be comparable to other issuers. Certain

additional disclosures for these non-IFRS measures have been

incorporated by reference and can be found in the section “Non-IFRS

Measures” in the September 30, 2022 MD&A available on SEDAR at

www.sedar.com.

Reconciliation of Working Capital

|

Expressed in thousands US

dollars |

As at September 30, 2022 |

As at December 31, 2021 |

|

Current assets |

|

$139,925 |

|

|

$161,762 |

|

|

Current liabilities |

|

38,307 |

|

|

40,554 |

|

|

Working capital |

|

$101,618 |

|

|

$121,208 |

|

| |

|

|

|

|

Reconciliation of Adjusted Net Earnings (Loss) and Adjusted Net

Earnings (Loss) Per Share

|

Expressed in thousands US dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

(except for share numbers and per share amounts) |

2022 |

2021 |

2022 |

2021 |

|

Net earnings (loss) for the period per financial statements |

($1,499) |

($4,479) |

($1,760) |

$14,426 |

|

Impairment (reversal) of non-current assets, net of tax |

- |

- |

- |

(16,791) |

|

Gain on disposal of El Cubo mine and equipment, net of tax |

- |

- |

- |

(5,807) |

|

Gain on disposal of El Compas mine and equipment, net of tax |

(2,733) |

- |

(2,733) |

- |

|

Change in fair value of investments |

1,097 |

2,959 |

3,366 |

2,968 |

|

Adjusted net earnings (loss) |

($3,135) |

($1,520) |

($1,127) |

($5,204) |

|

Basic weighted average share outstanding |

189,241,367 |

170,432,326 |

180,655,842 |

166,201,727 |

|

Adjusted net earnings (loss) per share |

($0.02) |

($0.01) |

($0.01) |

($0.03) |

| |

|

|

|

|

Reconciliation of Mine Operating Cash Flow

Before Taxes

|

Expressed in thousands US dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

2022 |

2021 |

2022 |

2021 |

|

Mine operating earnings per financial statements |

$5,129 |

$8,277 |

$29,870 |

$24,146 |

|

Share-based compensation |

113 |

105 |

353 |

334 |

|

Amortization and depletion |

5,753 |

4,843 |

16,234 |

18,963 |

|

Write down of inventory to net realizable value |

$1,323 |

- |

1,323 |

272 |

|

Mine operating cash flow before taxes |

$12,318 |

$13,225 |

$47,780 |

$43,715 |

| |

|

|

|

|

Reconciliation of Operating Cash Flow Before

Working Capital Changes and Operating Cash Flow Before Working

Capital Changes Per Share

|

Expressed in thousands US dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

(except for per share amounts) |

2022 |

2021 |

2022 |

2021 |

|

Cash from (used in) operating activities per financial

statements |

$7,417 |

($153) |

$10,602 |

$5,391 |

|

Net changes in non-cash working capital per financial

statements |

85 |

(7,808) |

(20,957) |

(16,168) |

|

Operating cash flow before working capital changes |

$7,332 |

$7,655 |

$31,559 |

$21,559 |

|

Basic weighted average shares outstanding |

189,241,367 |

170,432,326 |

180,655,842 |

166,201,727 |

|

Operating cash flow before working capital changes per share |

$0.04 |

$0.04 |

$0.17 |

$0.13 |

| |

|

|

|

|

Reconciliation of EBITDA and Adjusted EBITDA

|

Expressed in thousands US dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

|

2022 |

2021 |

2022 |

2021 |

|

Net earnings (loss) for the period per financial statements |

($1,499) |

($4,479) |

($1,760) |

$14,426 |

|

Depreciation and depletion – cost of sales |

5,753 |

4,843 |

16,234 |

18,963 |

|

Depreciation and depletion – exploration |

143 |

87 |

348 |

238 |

|

Depreciation and depletion – general & administration |

57 |

30 |

156 |

102 |

|

Depreciation and depletion – care & maintenance |

10 |

21 |

70 |

25 |

|

Depreciation and depletion – inventory write down |

- |

- |

- |

6 |

|

Finance costs |

194 |

195 |

583 |

702 |

|

Current income tax expense |

1,186 |

659 |

3,526 |

2,476 |

|

Deferred income tax expense |

2,053 |

3,017 |

10,027 |

7,260 |

|

EBITDA |

$7,897 |

$4,373 |

$29,184 |

$44,198 |

|

Share based compensation |

760 |

725 |

3,259 |

2,918 |

|

Impairment (reversal) of non-current assets, net of tax |

- |

- |

- |

(16,791) |

|

Gain on disposal of El Cubo mine and equipment, net of tax |

- |

- |

- |

(5,807) |

|

Gain on disposal of El Compas mine and equipment, net of tax |

(2,733) |

- |

(2,733) |

- |

|

Change in fair value of investments |

1,097 |

2,959 |

3,366 |

2,968 |

|

Adjusted EBITDA |

$7,021 |

$8,057 |

$33,076 |

$27,486 |

| |

|

|

|

|

Reconciliation of Cash Cost Per Silver Ounce,

Total Production Costs Per Ounce, Direct Operating Costs Per Tonne,

Direct Costs Per Tonne

|

Expressed in thousands US dollars |

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Direct production costs per financial statements |

$15,156 |

$9,354 |

$24,510 |

$9,299 |

$6,692 |

$2,648 |

$18,639 |

|

Smelting and refining costs included in net revenue |

- |

744 |

744 |

- |

350 |

42 |

392 |

|

Opening finished goods |

(16,164) |

(681) |

(16,845) |

(6,985) |

(408) |

(1,145) |

(8,538) |

|

Finished goods NRV adjustment |

- |

- |

- |

- |

- |

- |

- |

|

Closing finished goods |

18,080 |

195 |

18,275 |

12,910 |

2,306 |

- |

15,216 |

|

Direct operating costs |

17,072 |

9,612 |

26,684 |

15,224 |

8,940 |

1,545 |

25,709 |

|

Royalties |

2,762 |

59 |

2,821 |

2,595 |

48 |

55 |

2,698 |

|

Special mining duty (1) |

241 |

(85) |

156 |

801 |

(203) |

- |

598 |

|

Direct costs |

20,075 |

9,586 |

29,661 |

18,620 |

8,785 |

1,600 |

29,005 |

|

By-product gold sales |

(5,237) |

(9,615) |

(14,852) |

(7,673) |

(7,827) |

(2,274) |

(17,774) |

|

Opening gold inventory fair market value |

4,662 |

1,061 |

5,723 |

3,349 |

633 |

1,038 |

5,020 |

|

Closing gold inventory fair market value |

(5,368) |

(240) |

(5,608) |

(2,127) |

(3,560) |

- |

(5,687) |

|

Cash costs net of by-product |

14,132 |

792 |

14,924 |

12,169 |

(1,969) |

364 |

10,564 |

|

Amortization and depletion |

3,119 |

2,634 |

5,753 |

1,683 |

3,071 |

89 |

4,843 |

|

Share-based compensation |

56 |

57 |

113 |

44 |

45 |

16 |

105 |

|

Opening finished goods depreciation and depletion |

(3,733) |

(199) |

(3,932) |

(1,333) |

(220) |

(30) |

(1,583) |

|

NRV depreciation cost adjustment |

- |

- |

- |

- |

- |

- |

- |

|

Closing finished goods depreciation and depletion |

3,776 |

60 |

3,836 |

1,920 |

1,171 |

- |

3,091 |

|

Total production costs |

$17,350 |

$3,344 |

$20,694 |

$14,483 |

$2,098 |

$439 |

$17,020 |

|

|

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Throughput tonnes |

97,728 |

105,017 |

202,745 |

105,496 |

107,752 |

9,213 |

222,461 |

|

Payable silver ounces |

1,328,193 |

117,687 |

1,445,880 |

1,170,645 |

117,078 |

7,403 |

1,295,126 |

|

Cash costs per silver ounce |

$10.64 |

$6.73 |

$10.32 |

$10.40 |

($16.82) |

$49.17 |

$8.16 |

|

Total production costs per ounce |

$13.06 |

$28.41 |

$14.31 |

$12.37 |

$17.92 |

$59.30 |

$13.14 |

|

Direct operating costs per tonne |

$174.69 |

$91.53 |

$131.61 |

$144.31 |

$82.97 |

$167.70 |

$115.57 |

|

Direct costs per tonne |

$205.42 |

$91.28 |

$146.30 |

$176.50 |

$81.53 |

$173.67 |

$130.38 |

|

Expressed in thousands US dollars |

Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Direct production costs per financial statements |

$40,837 |

$30,222 |

$71,059 |

$33,072 |

$21,567 |

$8,951 |

$63,590 |

|

Smelting and refining costs included in net revenue |

- |

2,335 |

2,335 |

- |

1,353 |

248 |

1,601 |

|

Opening finished goods |

(10,093) |

(2,857) |

(12,950) |

(1,509) |

(250) |

(642) |

(2,401) |

|

Finished goods NRV adjustment |

- |

- |

- |

- |

- |

266 |

266 |

|

Closing finished goods |

18,080 |

195 |

18,275 |

12,910 |

2,306 |

- |

15,216 |

|

Direct operating costs |

48,824 |

29,895 |

78,719 |

44,473 |

24,976 |

8,823 |

78,272 |

|

Royalties |

9,124 |

208 |

9,332 |

8,966 |

186 |

346 |

9,498 |

|

Special mining duty (1) |

1,767 |

286 |

2,053 |

1,742 |

205 |

- |

1,947 |

|

Direct costs |

59,715 |

30,389 |

90,104 |

55,181 |

25,367 |

9,169 |

89,717 |

|

By-product gold sales |

(15,978) |

(33,405) |

(49,383) |

(15,346) |

(30,265) |

(8,626) |

(54,237) |

|

Opening gold inventory fair market value |

1,900 |

4,784 |

6,684 |

735 |

746 |

1,283 |

2,764 |

|

Closing gold inventory fair market value |

(5,368) |

(240) |

(5,608) |

(2,127) |

(3,560) |

- |

(5,687) |

|

Cash costs net of by-product |

40,269 |

1,528 |

41,797 |

38,443 |

(7,712) |

1,826 |

32,557 |

|

Amortization and depletion |

7,969 |

8,265 |

16,234 |

5,763 |

10,664 |

2,536 |

18,963 |

|

Share-based compensation |

176 |

177 |

353 |

137 |

136 |

61 |

334 |

|

Opening finished goods depreciation and depletion |

(1,965) |

(635) |

(2,600) |

(271) |

(104) |

(804) |

(1,179) |

|

NRV depreciation and depletion cost adjustment |

- |

- |

- |

- |

- |

6 |

6 |

|

Closing finished goods depreciation and depletion |

3,776 |

60 |

3,836 |

1,920 |

1,171 |

- |

3,091 |

|

Total production costs |

$50,225 |

$9,395 |

$59,620 |

$45,992 |

$4,155 |

$3,625 |

$53,772 |

|

|

Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Throughput tonnes |

292,998 |

317,255 |

610,253 |

306,021 |

313,356 |

54,555 |

673,932 |

|

Payable silver ounces |

3,649,209 |

446,487 |

4,095,696 |

3,022,531 |

328,522 |

43,050 |

3,394,103 |

|

Cash costs per silver ounce |

$11.03 |

$3.42 |

$10.21 |

$12.72 |

($23.47) |

$42.42 |

$9.59 |

|

Total production costs per ounce |

$13.76 |

$21.04 |

$14.56 |

$15.22 |

$12.65 |

$84.20 |

$15.84 |

|

Direct operating costs per tonne |

$166.64 |

$94.23 |

$128.99 |

$145.33 |

$79.70 |

$161.73 |

$116.14 |

|

Direct costs per tonne |

$203.81 |

$95.79 |

$147.65 |

$180.32 |

$80.95 |

$168.07 |

$133.12 |

|

Expressed in thousands US dollars |

September 30, 2022 |

September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Closing finished goods |

18,080 |

195 |

18,275 |

12,910 |

2,306 |

- |

15,216 |

|

Closing finished goods depletion |

3,776 |

60 |

3,836 |

1,920 |

1,171 |

- |

3,091 |

|

Finished goods inventory |

$21,856 |

$255 |

$22,111 |

$14,830 |

$3,477 |

$0 |

$18,307 |

| |

|

|

|

|

|

|

|

Reconciliation of All-In Costs Per Ounce and

AISC per ounce

|

Expressed in thousands US dollars |

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Cash costs net of by-product |

$14,132 |

$792 |

$14,924 |

$12,169 |

($1,969) |

$364 |

$10,564 |

|

Operations share-based compensation |

56 |

57 |

113 |

44 |

45 |

16 |

105 |

|

Corporate general and administrative |

1,200 |

414 |

1,614 |

(781) |

(389) |

(79) |

(1,249) |

|

Corporate share-based compensation |

405 |

125 |

530 |

436 |

216 |

44 |

697 |

|

Reclamation - amortization/accretion |

64 |

52 |

116 |

13 |

11 |

2 |

26 |

|

Mine site expensed exploration |

316 |

305 |

621 |

366 |

229 |

3 |

598 |

|

Intangible payments |

- |

- |

- |

61 |

30 |

6 |

97 |

|

Equipment loan payments |

245 |

489 |

734 |

245 |

501 |

- |

746 |

|

Capital expenditures sustaining |

7,212 |

3,439 |

10,651 |

6,322 |

4,706 |

- |

11,028 |

|

All-In-Sustaining Costs |

$23,629 |

$5,674 |

$29,303 |

$18,875 |

$3,381 |

$357 |

$22,612 |

|

Growth exploration and evaluation |

|

|

3,142 |

|

|

|

4,053 |

|

Growth capital expenditures |

|

|

6,240 |

|

|

|

2,303 |

|

All-In-Costs |

|

|

$38,685 |

|

|

|

$28,968 |

|

|

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Throughput tonnes |

97,728 |

105,017 |

202,745 |

105,496 |

107,752 |

9,213 |

222,461 |

|

Payable silver ounces |

1,328,193 |

117,687 |

1,445,880 |

1,170,645 |

117,078 |

7,403 |

1,295,126 |

|

Silver equivalent production (ounces) |

1,623,550 |

570,418 |

2,193,968 |

1,462,568 |

621,083 |

65,028 |

2,148,679 |

|

Sustaining cost per ounce |

$17.79 |

$48.21 |

$20.27 |

$16.12 |

$28.88 |

$48.16 |

$17.46 |

|

All-In-costs per ounce |

|

|

$26.76 |

|

|

|

$22.37 |

| |

|

|

|

|

|

|

|

|

Expressed in thousands US dollars |

Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Cash costs net of by-product |

$40,269 |

$1,528 |

$41,797 |

$38,443 |

($7,712) |

$1,826 |

$32,557 |

|

Operations share-based compensation |

176 |

177 |

353 |

137 |

136 |

61 |

334 |

|

Corporate general and administrative |

3,668 |

1,445 |

5,113 |

3,026 |

1,504 |

307 |

4,837 |

|

Corporate share-based compensation |

1,849 |

728 |

2,577 |

1,473 |

732 |

149 |

2,355 |

|

Reclamation - amortization/accretion |

198 |

158 |

356 |

38 |

33 |

7 |

78 |

|

Mine site expensed exploration |

1,028 |

863 |

1,891 |

1,360 |

768 |

198 |

2,326 |

|

Intangible payments |

29 |

12 |

41 |

178 |

88 |

18 |

284 |

|

Equipment loan payments |

736 |

1,466 |

2,202 |

853 |

1,593 |

- |

2,446 |

|

Capital expenditures sustaining |

19,908 |

8,653 |

28,561 |

14,222 |

10,806 |

- |

25,028 |

|

All-In-Sustaining Costs |

$67,861 |

$15,030 |

$82,891 |

$59,730 |

$7,949 |

$2,567 |

$70,245 |

|

Growth exploration and evaluation |

|

|

8,456 |

|

|

|

11,023 |

|

Growth capital expenditures |

|

|

16,778 |

|

|

|

3,737 |

|

All-In-Costs |

|

|

$108,125 |

|

|

|

$85,005 |

| |

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Throughput tonnes |

292,998 |

317,255 |

610,253 |

306,021 |

313,356 |

54,555 |

673,932 |

|

Payable silver ounces |

3,649,209 |

446,487 |

4,095,696 |

3,022,531 |

328,522 |

43,050 |

3,394,103 |

|

Silver equivalent production (ounces) |

4,524,110 |

1,782,740 |

6,306,850 |

3,786,186 |

1,882,154 |

384,163 |

6,052,503 |

|

Sustaining cost per ounce |

$18.60 |

$33.66 |

$20.24 |

$19.76 |

$24.20 |

$59.62 |

$20.70 |

|

All-In-costs per ounce |

|

|

$26.40 |

|

|

|

$25.04 |

| |

|

|

|

|

|

|

|

Reconciliation of Sustaining Capital and Growth

Capital

|

Expressed in thousands US dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

2022 |

2021 |

2022 |

2021 |

|

Capital expenditures sustaining |

$10,651 |

$11,028 |

$28,561 |

$25,028 |

|

Growth capital expenditures |

6,240 |

2,303 |

16,778 |

3,737 |

|

Acquisition capital expenditures |

35,998 |

10,042 |

35,998 |

10,042 |

|

Property, plant and equipment expenditures per Consolidated

Statement of Cash Flows |

$52,889 |

$23,373 |

$81,337 |

$38,807 |

| |

|

|

|

|

Reconciliation of Silver Co-Product Cash Costs

and Gold Co-Product Cash Costs

|

Expressed in thousands US dollars |

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Direct production costs per financial statements |

$15,156 |

$9,354 |

$24,510 |

$9,299 |

$6,692 |

$2,648 |

$18,639 |

|

Smelting and refining costs included in net revenue |

- |

744 |

744 |

- |

350 |

42 |

392 |

|

Royalties |

2,762 |

59 |

2,821 |

2,595 |

48 |

55 |

2,698 |

|

Special mining duty (1) |

241 |

(85) |

156 |

801 |

(203) |

- |

598 |

|

Opening finished goods |

(16,164) |

(681) |

(16,845) |

(6,985) |

(408) |

(1,145) |

(8,538) |

|

Closing finished goods |

18,080 |

195 |

18,275 |

12,910 |

2,306 |

- |

15,216 |

|

Direct costs |

$20,075 |

$9,586 |

$29,661 |

$18,620 |

$8,785 |

$1,600 |

$29,005 |

| |

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2022 |

Three Months Ended September 30, 2021 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Silver production (ounces) |

1,332,190 |

126,258 |

1,458,448 |

1,174,168 |

123,883 |

7,348 |

1,305,399 |

|

Average realized silver price ($) |

19.24 |

19.24 |

19.24 |

24.56 |

24.56 |

24.56 |

24.56 |

|

Silver value ($) |

25,634,615 |

2,429,515 |

28,064,129 |

28,837,566 |

3,042,566 |

180,467 |

32,060,599 |

|

Gold production (ounces) |

3,642 |

5,552 |

9,194 |

3,605 |

6,215 |

721 |

10,541 |

|

Average realized gold price ($) |

1,678 |

1,678 |

1,678 |

1,791 |

1,791 |

1,791 |

1,791 |

|

Gold value ($) |

6,110,595 |

9,315,217 |

15,425,812 |

6,456,555 |

11,131,065 |

1,291,311 |

18,878,931 |

|

Total metal value ($) |

31,745,209 |

11,744,732 |

43,489,941 |

35,294,121 |

14,173,631 |

1,471,778 |

50,939,530 |

|

Pro-rated silver costs (%) |

81% |

21% |

65% |

82% |

21% |

12% |

63% |

|

Pro-rated gold costs (%) |

19% |

79% |

35% |

18% |

79% |

88% |

37% |

|

Pro-rated silver costs ($) |

16,211 |

1,983 |

19,140 |

15,214 |

1,886 |

196 |

18,255 |

|

Pro-rated gold costs ($) |

3,864 |

7,603 |

10,521 |

3,406 |

6,899 |

1,404 |

10,750 |

|

Silver co-product cash costs ($) |

12.17 |

15.71 |

13.12 |

12.96 |

15.22 |

26.70 |

13.98 |

|

Gold co-product cash costs ($) |

1,061 |

1,369 |

1,144 |

945 |

1,110 |

1,947 |

1,020 |

| |

|

|

|

|

|

|

|

|

Expressed in thousands US dollars |

Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Direct production costs per financial statements |

$40,837 |

$30,222 |

$71,059 |

$33,072 |

$21,567 |

$8,951 |

$63,590 |

|

Smelting and refining costs included in net revenue |

- |

$2,335 |

$2,335 |

- |

1,353 |

248 |

1,601 |

|

Royalties |

9,124 |

208 |

9,332 |

8,966 |

186 |

346 |

9,498 |

|

Special mining duty (1) |

1,767 |

286 |

2,053 |

1,742 |

205 |

- |

1,947 |

|

Opening finished goods |

(10,093) |

(2,857) |

(12,950) |

(1,509) |

(250) |

(642) |

(2,401) |

|

Finished goods NRV adjustment |

- |

- |

- |

- |

- |

266 |

266 |

|

Closing finished goods |

18,080 |

195 |

18,275 |

12,910 |

2,306 |

- |

15,216 |

|

Direct costs |

59,715 |

30,389 |

90,104 |

55,181 |

25,367 |

9,169 |

89,717 |

| |

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2022 |

Nine Months Ended September 30, 2021 |

|

|

Guanaceví |

Bolañitos |

Total |

Guanaceví |

Bolañitos |

El Compas |

Total |

|

Silver production (ounces) |

3,660,190 |

472,420 |

4,132,610 |

3,031,626 |

350,154 |

45,443 |

3,427,223 |

|

Average realized silver price ($) |

22.24 |

22.24 |

22.24 |

26.26 |

26.26 |

26.26 |

26.26 |

|

Silver value ($) |

81,394,367 |

10,505,555 |

91,899,922 |

79,610,499 |

9,195,044 |

1,193,333 |

89,998,876 |

|

Gold production (ounces) |

10,799 |

16,379 |

27,178 |

9,432 |

19,150 |

4,234 |

32,816 |

|

Average realized gold price ($) |

1,827 |

1,827 |

1,827 |

1,784 |

1,784 |

1,784 |

1,784 |

|

Gold value ($) |

19,733,100 |

29,929,479 |

49,662,578 |

16,826,688 |

34,163,600 |

7,553,456 |

58,543,744 |

|

Total metal value ($) |

101,127,467 |

40,435,033 |

141,562,500 |

96,437,187 |

43,358,644 |

8,746,789 |

148,542,620 |

|

Pro-rated silver costs (%) |

80% |

26% |

65% |

83% |

21% |

14% |

61% |

|

Pro-rated gold costs (%) |

20% |

74% |

35% |

17% |

79% |

86% |

39% |

|

Pro-rated silver costs ($) |

48,063 |

7,895 |

58,494 |

45,553 |

5,380 |

1,251 |

54,358 |

|

Pro-rated gold costs ($) |

11,652 |

22,494 |

31,610 |

9,628 |

19,987 |

7,918 |

35,359 |

|

Silver co-product cash costs ($) |

13.13 |

16.71 |

14.15 |

15.03 |

15.36 |

27.53 |

15.86 |

|

Gold co-product cash costs ($) |

1,079 |

1,373 |

1,163 |

1,021 |

1,044 |

1,870 |

1,078 |

| |

|

|

|

|

|

|

|

Reconciliation of Realized Silver Price Per

Ounce and Realized Gold Price Per Ounce

|

Expressed in thousands US

dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

2022 |

2021 |

2022 |

2021 |

|

Gross silver sales |

$25,541 |

$17,180 |

$81,123 |

$64,167 |

|

Silver ounces sold |

1,327,325 |

699,539 |

3,647,987 |

2,443,184 |

|

Realized silver price per ounces |

$19.24 |

$24.56 |

$22.24 |

$26.26 |

| |

|

|

|

|

|

Expressed in thousands US

dollars |

Three Months Ended September 30 |

Nine Months Ended September 30 |

|

2022 |

2021 |

2022 |

2021 |

|

Gross gold sales |

$14,852 |

$17,774 |

$49,383 |

$54,237 |

|

Gold ounces sold |

8,852 |

9,925 |

27,025 |

30,398 |

|

Realized gold price per ounces |

$1,678 |

$1,791 |

$1,827 |

$1,784 |

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the United States private

securities litigation reform act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding Endeavour’s

anticipated performance in 2022 including changes in mining

operations and forecasts of production levels, anticipated

production costs and all-in sustaining costs, the timing and

results of various activities and the impact of the COVID 19

pandemic on operations. The Company does not intend to and does not

assume any obligation to update such forward-looking statements or

information, other than as required by applicable law.

Forward-looking statements or information

involve known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, production

levels, performance or achievements of Endeavour and its operations

to be materially different from those expressed or implied by such

statements. Such factors include but are not limited to the

ultimate impact of the COVID 19 pandemic on operations and results,

changes in production and costs guidance, national and local

governments, legislation, taxation, controls, regulations and

political or economic developments in Canada and Mexico; financial

risks due to precious metals prices, operating or technical

difficulties in mineral exploration, development and mining

activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and

development, risks in obtaining necessary licenses and permits, and

challenges to the Company’s title to properties; as well as those

factors described in the section “risk factors” contained in the

Company’s most recent form 40F/Annual Information Form filed with

the S.E.C. and Canadian securities regulatory authorities available

at www.sedar.com.

Forward-looking statements are based on

assumptions management believes to be reasonable, including but not

limited to: the continued operation of the Company’s mining

operations, no material adverse change in the market price of

commodities, mining operations will operate and the mining products

will be completed in accordance with management’s expectations and

achieve their stated production outcomes, and such other

assumptions and factors as set out herein. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements or information, there may be other

factors that cause results to be materially different from those

anticipated, described, estimated, assessed or intended. There can

be no assurance that any forward-looking statements or information

will prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information.

Appendix

ENDEAVOUR SILVER CORP.CONDENSED

CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE EARNINGS

(unaudited – prepared by management)(expressed in thousands of US

dollars, except for shares and per share amounts)

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

39,649 |

|

|

$ |

34,562 |

|

|

$ |

128,171 |

|

|

$ |

116,803 |

|

|

Cost of sales: |

|

|

|

|

|

|

|

|

|

Direct production costs |

|

|

24,510 |

|

|

|

18,639 |

|

|

|

71,059 |

|

|

|

63,590 |

|

|

Royalties |

|

|

2,821 |

|

|

|

2,698 |

|

|

|

9,332 |

|

|

|

9,498 |

|

|

Share-based payments |

|

113 |

|

|

|

105 |

|

|

|

353 |

|

|

|

334 |

|

|

Depreciation, depletion and amortization |

|

|

5,753 |

|

|

|

4,843 |

|

|

|

16,234 |

|

|

|

18,963 |

|

|

Write down of inventory to net realizable value |

|

|

1,323 |

|

|

|

- |

|

|

|

1,323 |

|

|

|

272 |

|

| |

|

|

34,520 |

|

|

|

26,285 |

|

|

|

98,301 |

|

|

|

92,657 |

|

| Mine operating earnings |

|

|

5,129 |

|

|

|

8,277 |

|

|

|

29,870 |

|

|

|

24,146 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

Exploration and evaluation |

|

|

4,023 |

|

|

|

4,660 |

|

|

|

11,023 |

|

|

|

13,815 |

|

|

General and administrative |

|

|

2,201 |

|

|

|

(522 |

) |

|

|

7,846 |

|

|

|

7,294 |

|

|

Care and maintenance costs |

|

|

203 |

|

|

|

364 |

|

|

|

582 |

|

|

|

940 |

|

|

Severance costs |

|

|

- |

|

|

|

737 |

|

|

|

- |

|

|

|

737 |

|

|

Impairment (reversal of impairment) of non-current assets, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(16,791 |

) |

|

Write off of exploration properties |

|

|

- |

|

|

|

- |

|

|

|

500 |

|

|

|

- |

|

| |

|

|

6,427 |

|

|

|

5,239 |

|

|

|

19,951 |

|

|

|

5,995 |

|

| |

|

|

|

|

|

|

|

|

| Operating earnings (loss) |

|

|

(1,298 |

) |

|

|

3,038 |

|

|

|

9,919 |

|

|

|

18,151 |

|

| |

|

|

|

|

|

|

|

|

| Finance costs |

|

|

311 |

|

|

|

195 |

|

|

|

945 |

|

|

|

702 |

|

| |

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Foreign exchange gain (loss) |

|

|

841 |

|

|

|

(1,184 |

) |

|

|

1,363 |

|

|

|

(1,219 |

) |

|

Gain on asset disposal |

|

|

2,780 |

|

|

|

- |

|

|

|

2,780 |

|

|

|

5,841 |

|

|

Investment and other |

|

|

(272 |

) |

|

|

(2,462 |

) |

|

|

(1,324 |

) |

|

|

2,091 |

|

| |

|

|

3,349 |

|

|

|

(3,646 |

) |

|

|

2,819 |

|

|

|

6,713 |

|

| Earnings (loss) before income

taxes |

|

|

1,740 |

|

|

|

(803 |

) |

|

|

11,793 |

|

|

|

24,162 |

|

|

Income tax expense: |

|

|

|

|

|

|

|

|

|

Current income tax expense |

|

|

1,186 |

|

|

|

659 |

|

|

|

3,526 |

|

|

|

2,476 |

|

|

Deferred income tax expense |

|

|

2,053 |

|

|

|

3,017 |

|

|

|

10,027 |

|

|

|

7,260 |

|

| |

|

|

3,239 |

|

|

|

3,676 |

|

|

|

13,553 |

|

|

|

9,736 |

|

| Net

earnings (loss) and comprehensive earnings (loss) for the

period |

|

$ |

(1,499 |

) |

|

$ |

(4,479 |

) |

|

$ |

(1,760 |

) |

|

$ |

14,426 |

|

|

Basic earnings (loss) per share based on net earnings |

$ |

(0.01 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.09 |

|

|

Diluted earnings (loss) per share based on net earnings |

$ |

(0.01 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.01 |

) |

|

$ |

0.09 |

|

|

Basic weighted average number of shares outstanding |

|

189,241,367 |

|

|

|

170,432,326 |

|

|

|

180,655,842 |

|

|

|

166,201,727 |

|

|

Diluted weighted average number of shares outstanding |

|

189,241,367 |

|

|

|

170,432,326 |

|

|

|

180,655,842 |

|

|

|

169,628,783 |

|

| |

|

|

|

|

|

|

|

|

ENDEAVOUR SILVER CORP.CONDENSED CONSOLIDATED

INTERIM STATEMENTS OF FINANCIAL POSITION(unaudited – prepared by

management)(expressed in thousands of US dollars)

| |

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

69,193 |

|

|

$ |

103,303 |

|

|

|

Other investments |

|

|

8,146 |

|

|

|

11,200 |

|

|

|

Accounts and other receivable |

|

|

11,301 |

|

|

|

14,462 |

|

|

|

Income tax receivable |

|

|

2,474 |

|

|

|

177 |

|

|

|

Inventories |

|

|

36,528 |

|

|

|

27,485 |

|

|

|

Prepaid expenses |

|

|

11,369 |

|

|

|

5,135 |

|

|

|

Loans receivable |

|

|

914 |

|

|

|

- |

|

|

| Total current assets |

|

|

139,925 |

|

|

|

161,762 |

|

|

| Non-current deposits |

|

|

565 |

|

|

|

599 |

|

|

| Non-current income tax

receivable |

|

|

3,570 |

|

|

|

3,570 |

|

|

| Non-current other

investments |

|

|

1,993 |

|

|

|

- |

|

|

| Non-current IVA

receivable |

|

|

7,507 |

|

|

|

4,256 |

|

|

| Non-current loans

receivable |

|

|

2,718 |

|

|

|

- |

|

|

| Deferred income tax asset |

|

|

- |

|

|

|

936 |

|

|

| Intangible assets |

|

|

- |

|

|

|

40 |

|

|

| Right-of-use leased

assets |

|

|

563 |

|

|

|

664 |

|

|

| Mineral

properties, plant and equipment |

|

|

215,863 |

|

|

|

122,197 |

|

|

|

Total assets |

|

$ |

372,704 |

|

|

$ |

294,024 |

|

|

| |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

27,740 |

|

|

$ |

31,991 |

|

|

|

Income taxes payable |

|

|

4,631 |

|

|

|

4,228 |

|

|

|

Loans payable |

|

|

5,791 |

|

|

|

4,128 |

|

|

|

Lease liabilities |

|

|

145 |

|

|

|

207 |

|

|

| Total current liabilities |

|

|

38,307 |

|

|

|

40,554 |

|

|

| Loans payable |

|

|

8,242 |

|

|

|

6,366 |

|

|

| Lease liabilities |

|

|

680 |

|

|

|

794 |

|

|

| Provision for reclamation and

rehabilitation |

|

|

7,592 |

|

|

|

7,397 |

|

|

| Deferred income tax

liability |

|

|

10,597 |

|

|

|

1,506 |

|

|

|

Total liabilities |

|

|

65,418 |

|

|

|

56,617 |

|

|

| |

|

|

|

|

|

| Shareholders' equity |

|

|

|

|

|

| Common shares,

unlimited shares authorized, no par value, issued, issuable |

|

|

|

|

| and outstanding

189,989,563 shares (Dec 31, 2021 - 170,537,307 shares) |

|

657,833 |

|

|

|

585,406 |

|

|

| Contributed surplus |

|

|

5,543 |

|

|

|

6,331 |

|

|

| Retained earnings

(deficit) |

|

|

(356,090 |

) |

|

|

(354,330 |

) |

|

|

Total shareholders' equity |

|

|

307,286 |

|

|

|

237,407 |

|

|

|

Total liabilities and shareholders' equity |

|

$ |

372,704 |

|

|

$ |

294,024 |

|

|

| |

|

|

|

|

|

ENDEAVOUR SILVER CORP.CONDENSED CONSOLIDATED

INTERIM STATEMENTS OF CASH FLOWS(unaudited – prepared by

management)(expressed in thousands of US dollars)

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended |

|

Nine months ended |

| |

|

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

|

|

|

Net earnings (loss) for the period |

|

|

$ |

(1,499 |

) |

|

$ |

(4,479 |

) |

|

$ |

(1,760 |

) |

|

$ |

14,426 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Items not affecting cash: |

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

|

760 |

|

|

|

725 |

|

|

|

3,259 |

|

|

|

2,918 |

|

|

Depreciation, depletion and amortization |

|

|

|

6,023 |

|

|

|

4,980 |

|

|

|

16,809 |

|

|

|

19,327 |

|

|

Impairment (reversal of impairment) of non-current assets,

net |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(16,791 |

) |

|

Write off of exploration properties |

|

|

|

- |

|

|

|

- |

|

|

|

500 |

|

|

|

- |

|

|

Deferred income tax expense |

|

|

|

2,053 |

|

|

|

3,017 |

|

|

|

10,027 |

|

|

|

7,260 |

|

|

Unrealized foreign exchange loss (gain) |

|

|

|

89 |

|

|

|

140 |

|

|

|

(131 |

) |

|

|

87 |

|

|

Finance costs |

|

|

|

312 |

|

|

|

195 |

|

|

|

946 |

|

|

|

702 |

|

|

Write down of inventory to net realizable value |

|

|

|

1,323 |

|

|

|

- |

|

|

|

1,323 |

|

|

|

272 |

|

|

Loss (gain) on asset disposal |

|

|

|

(2,826 |

) |

|

|

- |

|

|

|

(2,780 |

) |

|

|

(5,807 |

) |

|

Loss (gain) on other investments |

|

|

|

1,097 |

|

|

|

3,077 |

|

|

|

3,366 |

|

|

|

(835 |

) |

|

Net changes in non-cash working capital |

|

|

|

85 |

|

|

|

(7,808 |

) |

|

|

(20,957 |

) |

|

|

(16,168 |

) |

| Cash

from (used in) operating activities |

|

|

|

7,417 |

|

|

|

(153 |

) |

|

|

10,602 |

|

|

|

5,391 |

|

| |

|

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

|

|

Proceeds on disposal of property, plant and equipment |

|

|

250 |

|

|

|

- |

|

|

|

332 |

|

|

|

7,541 |

|

|

Mineral property, plant and equipment |

|

|

|

(52,889 |

) |

|

|

(23,373 |

) |

|

|

(81,337 |

) |

|

|

(38,807 |

) |

|

Reclamation and rehabilitation change in estimate |

|

|

|

(157 |

) |

|

|

- |

|

|

|

(157 |

) |

|

|

- |

|

|

Purchase of investments |

|

|

|

- |

|

|

|

- |

|

|

|

(2,119 |

) |

|

|

(832 |

) |

|

Proceeds from disposal of marketable securities |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

9,288 |

|

|

Redemption of (investment in) non-current deposits |

|

|

30 |

|

|

|

1 |

|

|

|

34 |

|

|

|

- |

|

|

Cash from (used) in investing activities |

|

|

|

(52,766 |

) |

|

|

(23,372 |

) |

|

|

(83,247 |

) |

|

|

(22,810 |

) |

| |

|

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

|

|

Repayment of loans payable |

|

|

|

(1,268 |

) |

|

|

(843 |

) |

|

|

(3,565 |

) |

|

|

(2,730 |

) |

|

Repayment of lease liabilities |

|

|

|

(55 |

) |

|

|

(46 |

) |

|

|

(161 |

) |

|

|

(131 |

) |

|

Interest paid |

|

|

|

(204 |

) |

|

|

(159 |

) |

|

|

(585 |

) |

|

|

(526 |

) |

|

Public equity offerings |

|

|

|

- |

|

|

|

864 |

|

|

|

46,001 |

|

|

|

59,998 |

|

|

Exercise of options |

|

|

|

20 |

|

|

|

- |

|

|

|

1,598 |

|

|

|

4,583 |

|

|

Share issuance costs |

|

|

|

(93 |

) |

|

|

(27 |

) |

|

|

(2,905 |

) |

|

|

(1,293 |

) |

|

Deferred share unit redemption |

|

|

|

- |

|

|

|

- |

|

|

|

(6 |

) |

|

|

- |

|

|

Performance share unit redemption |

|

|

|

- |

|

|

|

(189 |

) |

|

|

(1,897 |

) |

|

|

(2,363 |

) |

|

Cash from (used) financing activities |

|

|

|

(1,600 |

) |

|

|

(400 |

) |

|

|

38,480 |

|

|

|

57,538 |

|

| |

|

|

|

|

|

|

|

|

|

| Effect

of exchange rate change on cash and cash equivalents |

|

(84 |

) |

|

|

(190 |

) |

|

|

55 |

|

|

|

(126 |

) |

| |

|

|

|

|

|

|

|

|

|

| Increase (decrease) in cash

and cash equivalents |

|

|

|

(46,949 |

) |

|

|

(23,925 |

) |

|

|

(34,165 |

) |

|

|

40,119 |

|

|

Cash and cash equivalents, beginning of the period |

|

|

116,226 |

|

|

|

125,191 |

|

|

|

103,303 |

|

|

|

61,083 |

|

|

Cash and cash equivalents, end of the period |

|

$ |

69,193 |

|

|

$ |

101,076 |

|

|

$ |

69,193 |

|

|

$ |

101,076 |

|

| |

|

|

|

|

|

|

|

|

|

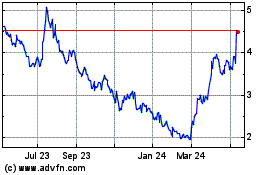

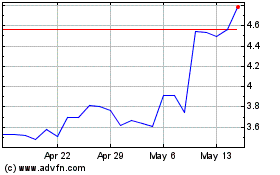

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Feb 2024 to Feb 2025