Currency Exchange International, Corp. (the “Group” or “CXI”) (TSX:

CXI; OTCBB: CURN) today reported its financial results and

Management’s Discussion and Analysis (“MD&A”) for the three and

six-months ended April 30, 2024 (all figures are in U.S. dollars

except where otherwise indicated). The complete financial

statements and MD&A can be found on the Company's SEDAR profile

at www.sedarplus.ca.

Randolph Pinna, CEO of the Group, stated, “CXI

delivered revenue growth over the prior period which aligns with

our strategy. Our balance sheet is strong, our business model is

diverse, and we continue to grow our revenue with a heightened

focus on expense management. We remain committed to executing

against our strategy, including developing scale in our global

payments offering and the international banknote marketplace, and

increasing our penetration of financial institutions. Growing our

direct-to-consumer reach through our online and agent platforms as

well as company-owned locations remains a strategic pillar, while

ensuring that the Company has the infrastructure to support this

growth. I am confident that CXI will continue to grow as a global

leader in the supply of currency and exchange services. In the

second quarter, Management reassessed the recoverability of its

deferred tax asset, specifically related to the unused loss carry

forwards in its wholly-owned subsidiary, Exchange Bank of Canada.

As a result, the deferred tax asset was reduced and a corresponding

increase in deferred tax expense in the amount of $1.4 million was

recorded in the statement of income. This change in the deferred

tax expense resulted in a material increase in the effective tax

rate for the three and six-month periods ended April 30, 2024.”

Financial Highlights for the three-months ended April

30, 2024 compared to the three-months ended April 30,

2023:

- Revenue increased

by 7% or $1.4 million to $20.1 million compared to $18.7 million.

Payments revenue grew 30% or $0.9 million over the prior period and

Banknotes revenue grew by 3% or $0.5 million;

- Net operating

income increased by 2% or $0.1 million to $3.8 million from $3.7

million;

- Reported net income

declined by 77% or $1.7 million to $0.5 million from $2.2 million.

As stated above, the results were impacted by the reduction of the

deferred tax assets in Canada. Adjusted net income1 declined by 14%

or $0.3 million to $1.9 million from $2.2 million;

- Reported earnings

per share was $0.08 on a basic and a fully diluted basis (adjusted

earnings per share1 were $0.30 and $0.29 on a basic and a fully

diluted basis, respectively) compared to reported earnings per

share of $0.35 and $0.33, respectively; and

- The Group had

strong liquidity and capital positions of $72.8 million in net

working capital and $79.9 million in total equity as at April 30,

2024.

________________1 This is a non-GAAP measure. For further

information, refer to the non-GAAP financial metrics and measures

section on page 3 of this document

Financial Highlights for the six-months ended April 30,

2024 compared to the six-months ended April 30, 2023:

- Revenue increased

by 7% or $2.6 million to $38.2 million compared to $35.6 million.

Banknotes revenue grew 6% or $1.8 million over the prior period and

Payments revenue grew by 11% or $0.8 million;

- Net operating

income declined by 6% or $0.4 million to $6.1 million from $6.5

million;

- Reported net income

declined by 65% or $2.4 million to $1.4 million from $3.8 million.

As stated above, the results were impacted by the reduction of the

deferred tax assets in Canada. Adjusted net income2 declined by 27%

or $1.0 million to $2.8 million from $3.8 million;

- Reported earnings

per share was $0.21 on a basic and a fully diluted basis (adjusted

earnings per share2 were $0.44 and $0.42 on a basic and a fully

diluted basis, respectively) compared to reported earnings per

share of $0.60 and $0.57, respectively; and

- Cash flows from

operating activities, excluding the changes in working capital

amounted to $6.9 million compared to $7.0 million.

Corporate Highlights for the three-months ended April

30, 2024:

- The Group continued

to grow its Banknotes product line as a result of the strong

consumer demand for foreign currencies as international travel

continued to strengthen. This is supported by the rate of travelers

passing through TSA check points in United States airports which

increased 8% compared to the same time last year;

- The financial

institutions sector in the U.S. continues to grow with the addition

of 104 new clients, representing 147 transacting locations;

- The Group continued

expanding its OnlineFX platform, adding the State of Wisconsin to

its network, making it the 42nd State in which the Group provides

its services through the platform; and

- The Payments

product line processed 37,107 payments transactions, representing

$3.39 billion in volume compared to 30,394 transactions and $2.59

billion in volume in the prior period.

Selected Financial Data

The following table summarizes the performance

of the Group over the last eight fiscal quarters3:

|

Three-month period ended |

Revenue |

Net operating income |

Net income |

Total assets |

Total equity |

Earnings pershare (diluted) |

|

|

$ |

$ |

$ |

$ |

$ |

$ |

|

4/30/2024 |

20,095,168 |

3,818,275 |

506,522 |

159,910,390 |

79,940,478 |

0.08 |

|

1/31/2024 |

18,106,918 |

2,247,267 |

849,874 |

133,780,438 |

80,520,993 |

0.13 |

|

10/31/2023 |

22,786,072 |

5,818,667 |

2,303,822 |

132,049,444 |

79,232,981 |

0.34 |

|

7/31/2023 |

23,587,589 |

6,438,354 |

4,056,478 |

129,643,409 |

77,590,126 |

0.60 |

|

4/30/2023 |

18,694,919 |

3,743,069 |

2,243,708 |

134,697,253 |

73,104,851 |

0.33 |

|

1/31/2023 |

16,886,189 |

2,734,159 |

1,589,499 |

133,072,968 |

71,448,732 |

0.24 |

|

10/31/2022 |

19,800,463 |

5,401,678 |

4,383,876 |

125,528,832 |

69,305,509 |

0.66 |

|

7/31/2022 |

21,145,189 |

7,321,521 |

4,585,808 |

155,757,016 |

65,598,381 |

0.70 |

________________2 This is a non-GAAP measure. For further

information, refer to the non-GAAP financial metrics and measures

section on page 3 of this document3 Certain historical numbers in

this table have been restated to conform with the numbers presented

in the current period’s financial statements

Conference Call

The Company plans to host a conference call on

Thursday, June 13, 2024, at 8:30 AM

(EDT).

To participate in or listen to the call, please

dial the appropriate number:

Toll Free - North America: (+1) 800 717

1738

Conference ID Number: 82344

About Currency Exchange International,

Corp.

Currency Exchange International is in the

business of providing comprehensive foreign exchange technology and

processing services for banks, credit unions, businesses, and

consumers in the United States and select clients globally. Primary

products and services include the exchange of foreign currencies,

wire transfer payments, Global EFTs, and foreign cheque clearing.

Wholesale customers are served through its proprietary FX software

applications delivered on its web-based interface,

www.cxifx.com (“CXIFX”), its related APIs

with core banking platforms, and through personal relationship

managers. Consumers are served through Group-owned retail branches,

agent retail branches, and its e-commerce

platform, order.ceifx.com (“OnlineFX”).

The Group’s wholly-owned Canadian subsidiary,

Exchange Bank of Canada, based in Toronto, Canada, provides foreign

exchange and international payment services in Canada and select

international foreign jurisdictions. Customers are served through

the use of its proprietary software,

www.ebcfx.com (“EBCFX”), related APIs to core

banking platforms, and personal relationship managers.

Contact Information

For further information please contact: Bill

MitoulasInvestor Relations(416) 479-9547Email:

bill.mitoulas@cxifx.com Website: www.cxifx.com

NON-GAAP FINANCIAL METRICS AND

MEASURES

The Company measures and evaluates its

performance in this document using a number of financial metrics

and measures, such as adjusted net income, which do not have

standardized meanings under generally accepted accounting

principles (GAAP) and may not be comparable to other companies. The

Company’s management believes that these measures are more

reflective of its operating results and provide the readers of this

document with a better understanding of management’s perspective on

the performance. These measures enhance the comparability of our

financial performance for the current period with the corresponding

period in the prior year.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This press release includes forward-looking

information within the meaning of applicable securities laws. This

forward-looking information includes, or may be based upon,

estimates, forecasts, and statements as to management’s

expectations with respect to, among other things, demand and market

outlook for wholesale and retail foreign currency exchange products

and services, future growth, the timing and scale of future

business plans, results of operations, performance, and business

prospects and opportunities. Forward-looking statements are

identified by the use of terms and phrases such as “anticipate”,

“believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”,

“predict”, “preliminary”, “project”, “will”, “would”, and similar

terms and phrases, including references to assumptions.

Forward-looking information is based on the

opinions and estimates of management at the date such information

is provided, and on information available to management at such

time. Forward-looking information involves significant risks,

uncertainties and assumptions that could cause the Company’s actual

results, performance, or achievements to differ materially from the

results discussed or implied in such forward-looking information.

Actual results may differ materially from results indicated in

forward-looking information due to a number of factors including,

without limitation, the competitive nature of the foreign exchange

industry, the impact of COVID-19 or the evolving situation in

Ukraine on factors relevant to the Company’s business, currency

exchange risks, the need for the Company to manage its planned

growth, the effects of product development and the need for

continued technological change, protection of the Company’s

proprietary rights, the effect of government regulation and

compliance on the Company and the industry in which it operates,

network security risks, the ability of the Company to maintain

properly working systems, theft and risk of physical harm to

personnel, reliance on key management personnel, global economic

deterioration negatively impacting tourism, volatile securities

markets impacting security pricing in a manner unrelated to

operating performance and impeding access to capital or increasing

the cost of capital as well as the factors identified throughout

this press release and in the section entitled “Risks and

Uncertainties” of the Company’s Management’s Discussion and

Analysis for the three and six-month periods ended April 30, 2024

and 2023. Forward-looking information contained in this press

release represents management’s expectations as of the date hereof

(or as of the date such information is otherwise stated to be

presented) and is subject to change after such date. The Company

disclaims any intention or obligation to update or revise any

forward-looking information whether as a result of new information,

future events or otherwise, except as required under applicable

securities laws.

The Toronto Stock Exchange does not accept

responsibility for the adequacy or accuracy of this press release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained in

this press release.

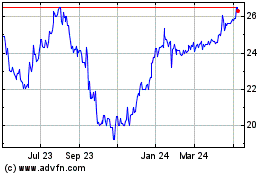

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Dec 2024 to Jan 2025

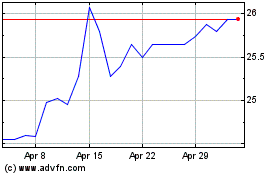

Currency Exchange (TSX:CXI)

Historical Stock Chart

From Jan 2024 to Jan 2025