Conifex Provides Corporate and Operations Update

January 02 2025 - 5:05PM

Conifex Timber Inc. ("Conifex") (TSX: CFF) announced today that it

has amended and restated its existing credit agreement with

PenderFund Capital Management Ltd. ("Pender").

The restated agreement increases the aggregate

principal amount of the secured term loan provided thereunder to up

to $41 million, of which $5 million is available immediately, and

the remaining $11 million is subject to completion of financial

diligence. The loan continues to have a term of 5 years from

original issuance and is substantially on the same terms, including

the same annual interest rate. The loan was advanced in lieu of

Conifex’s consideration of a working capital facility to fund

ongoing working capital requirements.

“The additional borrowings will be used to fund

a build-up in sawlog inventories to support our transition to a

two-shift operation at our sawmill complex, effective January 6,

2025,” commented Conifex's Chairman and CEO, Ken Shields. The

decision to move to a two-shift operation was based on a steadily

improving backdrop for lumber prices, as evidenced by the 18%

improvement in cash prices for Spruce Pine Fir benchmark lumber

prices in the fourth quarter of 2024 relative to those in the third

quarter of 2024. Mr. Shields continued: “The benefits of spreading

our fixed costs over a larger base coupled with additional product

sales are expected to lower our cash costs and boost the operating

cash flow we expect to achieve in the first quarter of 2025 from

what we presently achieve on a one-shift basis.”

As partial consideration, subject to stock

exchange approval, Pender will receive up to 5,904,000 warrants,

with each warrant being exercisable into one common share for a

period of five years on payment of $0.50 per warrant. Pursuant to

applicable securities laws, the warrants will be subject to a hold

period of four months and one day from issuance. Concurrently,

Pender has agreed to cancel all of its existing 3,600,000

warrants.

Pender shall have the right to appoint one

director to the board of directors of Conifex on customary terms

while the loan remains outstanding. The restated agreement includes

mandatory prepayment obligations in favour of Pender, including in

the event of a major disposition by Conifex of certain of its

assets.

For further information, please contact:

Trevor PrudenChief Financial Officer(604)

216-2949

About Conifex Timber Inc.

Conifex and its subsidiaries' primary business

currently includes timber harvesting, reforestation, forest

management, sawmilling logs into lumber and wood chips, and value

added lumber finishing and distribution. Conifex's lumber products

are sold in the United States, Canadian and Japanese markets.

Conifex also produces bioenergy at its power generation facility at

Mackenzie, BC.

Forward-Looking

StatementsCertain statements in this news release may

constitute “forward-looking statements”. Forward-looking statements

are statements that address or discuss activities, events or

developments that Conifex expects or anticipates may occur in the

future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “projects”, “will”, “believes”,

“intends” “should”, “could”, “may” and other similar terminology

are intended to identify such forward-looking statements.

Forward-looking statements reflect the current expectations and

beliefs of Conifex’s management. Because forward-looking statements

involve known and unknown risks, uncertainties and other factors,

actual results, performance or achievements of Conifex or the

industry may be materially different from those implied by such

forward-looking statements. Examples of such forward-looking

information that may be contained in this news release include

statements regarding the purposes for which the Term Loan may be

used, expectations regarding Conifex's operating results in the

first quarter of 2025, and the Toronto Stock Exchange granting its

approval of the issuance of the Amendment Warrants. Assumptions

underlying Conifex's expectations regarding forward-looking

information contained in this news release include, among others,

that Conifex will successfully negotiate and execute definitive

documentation and complete a working capital facility.

Forward-looking statements involve significant uncertainties,

should not be read as a guarantee of future performance or results,

and will not necessarily be an accurate indication of whether or

not such results will be achieved. A number of factors could cause

actual results to differ materially from the results discussed in

the forward-looking statements, including, without limitation, that

Conifex will obtain all expected benefits from the Term Loan; and

other risk factors detailed in our filings with the Canadian

Securities Regulatory Authorities available on SEDAR+ at

www.sedarplus.ca. These risks, as well as others, could cause

actual results and events to vary significantly. Accordingly,

readers should exercise caution in relying upon forward-looking

statements and Conifex undertakes no obligation to publicly revise

them to reflect subsequent events or circumstances, except as

required by law.

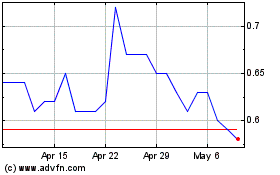

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Jan 2025 to Feb 2025

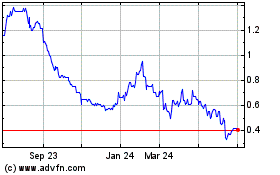

Conifex Timber (TSX:CFF)

Historical Stock Chart

From Feb 2024 to Feb 2025