Bengal Energy Ltd. (TSX: BNG) (“Bengal” or the

“Company”) announces that the Company and its joint venture

partners have successfully completed a three well hydraulic

stimulation program (“frac program”) in the Cuisinier oil field on

ATP 752 Barta Block (Bengal’s working interest is 30.357%).

Hydraulic Stimulation

The frac program has exceeded Bengal’s technical

and commercial expectations. The frac program targeted Cuisinier

North-1, Shefu-1 and Cuisinier-24. Prior to the frac program, the

aggregate gross production from these three wells was 93 barrels of

oil per day (“bopd”). Subsequent to the frac program, the aggregate

initial production was 322 bopd, for an incremental increase of 229

gross bopd (an incremental 69 bopd net to Bengal).

Planning for the stimulation of a fourth well,

Cuisinier-19 is complete, with frac operations expected to take

place in calendar Q1 2019. “We are pleased with the results of our

2018 hydraulic stimulation program which has demonstrated the

potential to significantly increase the performance of select

producing wells within the Cuisinier field,” said Chayan

Chakrabarty, Bengal’s President and CEO. “We have added to our

production base, while providing an excellent foundation for future

production additions, as other low cost, low risk stimulation

opportunities are identified.”

2019 Cuisinier Drilling

Campaign

The Company and its joint venture partners have

agreed on the drilling locations for the 2019 Cuisinier drilling

campaign which is planned to occur by calendar Q3 2019. This

campaign will consist of a minimum of four wells with a fifth well

currently under consideration by the joint venture partners. Two

wells in the program will be development wells and will complement

one water injection pilot well targeting production additions,

while the remaining wells will target production additions and

further pool expansion. All wells are located within Cuisinier

Petroleum Lease 303.

Water Injection Pilot

A water injection pilot for reservoir pressure

maintenance is planned for implementation in calendar Q2 2019. The

producing Cuisinier-24 well will be converted to an injector using

produced water from the Cuisinier-6 and Cuisinier-7 wells, as

pipelined to the Cuisinier-24 location. Upon success, the pressure

maintenance program is expected to be implemented across the field,

in multiple stages.

The Cuisinier field has produced approximately

3% of the 102 million barrels of Proved plus Probable ("2P")

discovered Oil Initially-In-Place (OIIP), as presented in the GLJ

Petroleum Consultants Ltd.’s independent reserve assessment and

evaluation prepared with an effective date of March 31, 2018 (for

further information on Bengal’s reserves, see Bengal’s press

release dated June 19, 2018). A field wide pressure maintenance

program is expected to help raise reservoir pressure and reduce

natural pool production decline while significantly increasing

recovery from this high quality Murta reservoir.

“It is exciting to see that a water injection

pilot will soon be implemented at Cuisinier,” said Chayan

Chakrabarty. “We believe that the Murta formation at Cuisinier is

an ideal waterflood candidate, given the reservoir and crude oil

characteristics and the low gas oil ratio in the reservoir. We

expect to see a quick response in the offsetting producers,

increasing oil recovery and adding to the reserves potential of the

field.”

It is expected that Bengal’s strong field

netback position will continue through the development of the

aforementioned projects, resulting in increased cash flow due to

the expected improvement in production. As the current US$47

hedging program will be replaced by more profitable hedges

beginning January 1, 2019 and, assuming Brent crude oil price

averaging US$70/barrel to US$75/barrel in 2019, Bengal can expect

to realize operating netbacks in the AUS$60/barrel to AUS$65/barrel

range.

About Bengal

Bengal Energy Ltd. is an international junior

oil and gas exploration and production company with assets in

Australia. The Company is committed to growing shareholder

value through international exploration, production and

acquisitions. Bengal’s common shares trade on the Toronto Stock

Exchange under the symbol “BNG”. Additional information is

available at www.bengalenergy.ca.

Forward-Looking Statements

This news release contains certain

forward-looking statements or information (“forward-looking

statements”) as defined by applicable securities laws that involve

substantial known and unknown risks and uncertainties, many of

which are beyond Bengal’s control. These forward-looking statements

relate to future events or our future performance. All statements

other than statements of historical fact may be forward-looking

statements. The use of any of the words “plan”, “expect”,

“prospective”, “project”, “intend”, “believe”, “should”,

“anticipate”, “estimate”, or other similar words or statements that

certain events “may” or “will” occur are intended to identify

forward-looking statements. The projections, estimates and

beliefs contained in such forward-looking statements are based on

management’s estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to: the

current commodity price environment; the impact of economic

conditions in North America, Australia and globally; industry

conditions; changes in laws and regulations including, without

limitation, the adoption of new environmental laws and regulations

and changes in how they are interpreted and enforced;

increased competition; the availability of qualified operating or

management personnel; fluctuations in commodity prices, foreign

exchange or interest rates; stock market volatility and

fluctuations in market valuations of companies with respect to

announced transactions and the final valuations thereof; results of

exploration and testing activities; and the ability to obtain

required approvals and extensions from regulatory authorities.

Bengal believes the expectations reflected in those forward-looking

statements are reasonable but, no assurances can be given that any

of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that

Bengal will derive from them. As such, undue reliance should not be

placed on forward-looking statements.

Forward-looking statements contained herein

include, but are not limited to, statements regarding: the timing

of the frac operations on Cuisinier-19; expectations in respect of

the 2019 Cuisinier drilling campaign, including timing thereof, the

number and types of wells to be drilled and the targets of such

wells; the timing of implementation of the water injection pilot;

the expectations regarding the conversion of Cuisinier-24 and

related pressure maintenance program; the response of offsetting

producers in the Cuisinier field to water injection; the

anticipated increase in Cuisinier field production resulting from

the pressure maintenance program; the expected increase in

operating netbacks and related increase in cash flow and improved

production; and the assumption of increase in Brent oil price. The

forward-looking statements contained herein are subject to numerous

known and unknown risks and uncertainties that may cause Bengal’s

actual financial results, performance or achievement in future

periods to differ materially from those expressed in, or implied

by, these forward-looking statements, including but not limited to,

risks associated with: the failure to commence the 2019 Cuisinier

drilling campaign in the anticipated time frame or at all; the

failure to receive positive results from the water injection pilot;

the failure to maintain current operating netbacks; Bengal’s

development and exploration opportunities; fluctuations in

commodity prices, foreign exchange or interest rates; the failure

to obtain required regulatory approvals or extensions; failure to

satisfy the conditions under farm-in and joint venture agreements;

failure to secure required equipment and personnel; changes in

general global economic conditions including, without limitations,

the economic conditions in North America and Australia; increased

competition; the availability of qualified operating or management

personnel; changes in laws and regulations including, without

limitation, the adoption of new environmental and tax laws and

regulations and changes in how they are interpreted and enforced;

the results of exploration and development drilling and related

activities; the ability to access sufficient capital from internal

and external sources; and stock market volatility. Readers

are encouraged to review the material risks discussed in Bengal’s

Annual Information Form under the heading “Risk Factors” and in

Bengal’s annual management's discussion and analysis under the

heading “Risk Factors”. The Company cautions that the

foregoing list of assumptions, risks and uncertainties is not

exhaustive. The forward-looking statements contained in this

news release speak only as of the date hereof and Bengal does not

assume any obligation to publicly update or revise them to reflect

new events or circumstances, except as may be require pursuant to

applicable securities laws.

Future Oriented Financial

Information

To the extent that any forward-looking

statements presented herein constitutes future-oriented financial

information or a financial outlook (collectively, “FOFI”), as such

terms are defined in applicable securities laws, such information

has been presented to provide Bengal management's expectations

based on a number of assumptions, including the assumptions

presented herein, and such information may not be appropriate for

other purposes. The actual results of operations of Bengal

and the resulting financial results will likely vary from the

amounts presented in this news release, and such variation may be

material. Bengal and its management believe that the FOFI has been

prepared on a reasonable basis, reflecting management's best

estimates and judgments. However, because this information is

subjective and subject to numerous risks it should not be relied on

as necessarily indicative of future results. Except as required by

applicable securities laws, Bengal undertakes no obligation to

update such FOFI.

Netbacks

Netback is a term commonly used in the oil and

gas industry that is not defined under International Financial

Reporting Standards and is used by Bengal as a supplemental measure

in evaluating Bengal’s financial position and performance. Bengal

calculates netbacks as revenues minus royalties and transportation

and operation costs divided by the total production of the Company

measured in BOE or barrels. The Company's calculation of

netback included herein may differ from the calculation of similar

measures by other issuers. Therefore, the Company's netback measure

may not be comparable to other similar measures used by other

issuers. For additional details relating to these non-IFRS

measures, see Bengal’s most recent management's discussion and

analysis.

Oil and Gas Advisory

The reserves information contained in this news

release has been prepared in accordance with NI 51-101. Complete NI

51- 101 reserves disclosure are included in Bengal's annual

information form for the year ended March 31, 2018 filed on SEDAR

June 28, 2018. Listed below are cautionary statements

applicable to our reserves information that are specifically

required by NI 51-101:

- The recovery and reserve estimates of the Company's crude oil,

natural gas liquids and natural gas reserves provided in this news

release are estimates only and there is no guarantee that the

estimated reserves will be recovered. Actual crude oil, natural gas

and natural gas liquids reserves may be greater than or less than

the estimates provided herein.

- Reserves included herein are stated on a company interest basis

(before royalty burdens and including royalty interests) unless

noted otherwise as well as on a gross and net basis as defined in

NI 51-101. "Company interest" is not a term defined by NI 51-101

and as such the estimates of Company interest reserves herein may

not be comparable to estimates of "gross" reserves prepared in

accordance with NI 51-101 or to other issuers' estimates of company

interest reserves.

- In this news release, the Company has referred to discovered

OIIP, meaning discovered oil initially-in-place or "discovered

petroleum initially-in-place". Discovered petroleum

initially-in-place is the quantity of petroleum that is estimated,

as of a given date, to be contained in known accumulations prior to

production. The recoverable portion of discovered petroleum

initially-in-place includes production, reserves and contingent

resources; the remainder is unrecoverable. A recovery project

cannot be defined for these volumes of discovered petroleum

initially-in-place at this time. There is no certainty that it will

be commercially viable to produce any portion of the

resources.

"Proved" reserves are those reserves that can be

estimated with a high degree of certainty to be

recoverable. It is likely that the actual remaining quantities

recovered will exceed the estimated proved reserves.

"Probable" reserves are those additional

reserves that are less certain to be recovered than proved

reserves. It is equally likely that the actual remaining

quantities recovered will be greater or less than the sum of the

estimated proved plus probable reserves.

Barrels of Oil Equivalent

When converting natural gas to equivalent

barrels of oil, Bengal uses the widely recognized standard of 6 mcf

to one BOE. However, a BOE may be misleading, particularly if used

in isolation. A BOE conversion ratio of 6 million cubic feet: 1

barrels is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Internal Estimates

Certain information contained herein is based on

estimated values the Company believes to be reasonable and are

subject to the same limitations as discussed under "Forward-looking

Statements" above.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Bengal Energy

Ltd.Chayan Chakrabarty, President & Chief

Executive OfficerMatthew Moorman, Chief Financial

Officer Phone: (403)

205-2526Email:

investor.relations@bengalenergy.caWebsite:

www.bengalenergy.ca

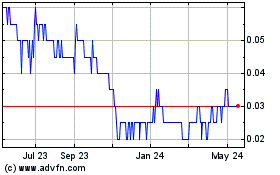

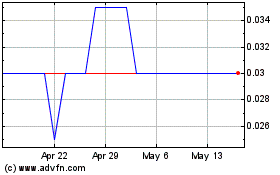

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Nov 2023 to Nov 2024