Brookfield Infrastructure (NYSE:BIP)(TSX:BIP.UN) today announced a number of

strategic initiatives, comprised of:

-- an agreement, together with its institutional partners, to acquire the

remaining 45% of the Autopista Vespucio Norte ("AVN") toll road, a key

artery in the ring road network surrounding Santiago, Chile;

-- an agreement to acquire an 85% interest in Inexus Group ("Inexus"), a

regulated distribution utility in the UK;

-- the issuance of 9,680,000 L.P. units in the U.S. and Canada and the

concurrent private placement of 3,860,000 redeemable partnership units

to Brookfield Asset Management Inc. ("Brookfield") (NYSE/TSX/Euronext:

BAM) for aggregate gross proceeds of $445,071,200; and

-- plans to explore strategic alternatives to divest some of its timber and

certain non-core assets.

"With these transactions, we will significantly increase the scale of our

transportation and utilities platforms. We will consolidate our ownership in one

of the leading toll roads in Chile, and we will more than double the size of our

regulated distribution business in the UK," said Sam Pollock, Chief Executive

Officer of Brookfield Infrastructure Group. "Consistent with our stated targets,

we expect to earn long-term returns of 12-15% on these new investments. As part

of our funding plan, we will explore strategic alternatives to monetize some of

our assets at favourable valuations."

In connection with these announcements, Brookfield Infrastructure is also

providing summary preliminary results for the quarter ended June 30, 2012.

Overview of Investment Initiatives

Consolidating Ownership in Chilean Toll Road

Brookfield Infrastructure and its institutional partners have executed

definitive documents to acquire the remaining 45% of the AVN toll road that they

do not currently own for approximately $590 million, comprised of $290 million

in cash and the assumption of $300 million of debt. Brookfield Infrastructure

will participate by investing approximately $165 million, which will result in

an aggregate ownership interest in AVN of 51% upon completion. This Chilean toll

road is a key artery in the ring road network surrounding Santiago, and it

benefits from an attractive revenue framework whereby tolls escalate annually at

inflation plus 3.5%. Furthermore, tolls may also increase from congestion

pricing once traffic exceeds threshold levels. AVN's traffic has increased at a

compounded annual growth rate of 8% for the past three years and 12% for the six

months year-to-date over the prior year period. The transaction, which is

subject to customary closing conditions, is expected to close in October of

2012.

Following the close of this transaction, Brookfield Infrastructure and its

institutional partners will own 100% of one of the leading toll roads in Chile.

In addition to expected benefits from projected traffic growth and tariff

increases, Brookfield Infrastructure will be well-positioned to invest

additional capital to upgrade and expand this road in order to mitigate

bottlenecks and improve its connectivity. Brookfield Infrastructure expects that

it will be able to earn attractive returns on these additional capital

expenditures.

Expansion of Utilities Platform

Brookfield Infrastructure has executed definitive agreements to acquire 85% of

Inexus, one of the largest owners and operators of gas and electricity

connections in the UK, from Challenger Infrastructure Fund ("Challenger") for

GBP 10 million (approximately $15 million), plus a contingent payment of GBP 26

million (approximately $40 million) if certain milestones are reached. The

initial payment is conditioned upon, among other things, approval of the

transaction by Challenger's unitholders on August 15, 2012 and waiver of

pre-emptive rights by the minority owners of Inexus. The contingent payment is

subject to the successful negotiation and completion of a proposed

recapitalization of Inexus and the clearance of the transaction by UK

competition authorities.

Brookfield Infrastructure's current UK regulated distribution business generates

stable cash flows that are underpinned by regulated tariffs, which adjust

annually by an inflation factor. Pursuant to the recapitalization, if completed,

Brookfield Infrastructure intends to merge Inexus into its existing UK regulated

distribution business and invest approximately $450 million, including the

contingent payment, to reduce leverage of this entity to investment grade

levels. Following the close of the transaction, Brookfield Infrastructure would

more than double its installed base of gas and electricity connections to over 1

million connections. Furthermore, this transaction, if completed, would extend

Brookfield Infrastructure's capability into high margin fibre and district

heating projects. Assuming all the conditions precedent are satisfied, the

acquisition and the recapitalization are expected to close in the fourth quarter

of 2012.

If the AVN and Inexus transactions are both completed, Brookfield Infrastructure

anticipates that it will invest a total of approximately $630 million in these

two investments.

Potential Acquisitions

Brookfield Infrastructure is currently considering a number of acquisitions in

its key sectors - utilities and transport and energy - that are consistent with

its strategy. Recently, Brookfield Infrastructure and its institutional partners

entered into discussions with Abertis Infraestructuras, S.A. ("Abertis"), one of

the leading owners and operators of toll roads in the world, to create a joint

venture to acquire a 60% interest in Obrascon Huarte Lain Brasil S.A. ("OHL

Brasil") for approximately $1.7 billion, comprised of $1.1 billion of equity and

$600 million of assumed liabilities. Brookfield Infrastructure and its

institutional partners would own 49% of the joint venture and Abertis would own

the remaining 51%. If the parties are able to execute definitive agreements to

acquire the 60% interest in OHL Brazil, the joint venture would, if required,

undertake to launch a tender offer to acquire the remaining 40% of OHL Brasil

that is publicly traded, resulting in a final ownership interest of between 60%

and 100% depending upon the outcome of the tender offer. If successful with the

potential transaction, Brookfield Infrastructure expects to initially invest

approximately $250 million, with the possibility of follow-on investment

pursuant to the tender offer.

OHL Brasil is one of the largest owners and operators of toll road concessions

in Brazil, with over 3,200 km of roads in states that account for approximately

65% of Brazil's GDP and that are home to nearly two-thirds of the country's

approximately 70 million vehicles. OHL Brasil's toll road concessions are

expected to benefit from projected increases in traffic and rates that are

indexed to inflation. With a combination of established assets and toll roads in

an expansionary phase, Brookfield Infrastructure expects the OHL Brasil

portfolio to generate stable cashflow with growth. However, there can be no

assurance of when or if a definitive agreement will be executed in respect of

this opportunity.

Funding Plan

In order to finance these investments, Brookfield Infrastructure has agreed to

issue units for $445,071,200 in gross proceeds and will explore strategic

alternatives to sell some of its assets. If any of these investments are not

completed, the net proceeds will be used for other organic and strategic growth

initiatives or for general corporate purposes. Brookfield Infrastructure intends

to draw on its corporate credit facilities for any additional funds that may be

required.

Asset Divestitures

Brookfield Infrastructure is exploring strategic alternatives to divest some of

its timber and certain non-core assets. In the current low interest rate

environment and given strong interest in infrastructure assets from

institutional and strategic buyers, Brookfield Infrastructure believes that

there could be opportunities to monetize these assets and reinvest capital in

assets that offer superior returns. No assurances can be given that Brookfield

Infrastructure will be able to sell these assets at an acceptable price or

within the time periods contemplated.

Equity Offering

Today, Brookfield Infrastructure announced that it has agreed to issue 9,680,000

L.P. units, on a bought deal basis, to a syndicate of underwriters at a price of

$33.25 per L.P. unit (the "Offering Price") for gross proceeds of $321,860,000

(the "Offering"). In addition, Brookfield will purchase, directly or indirectly,

3,860,000 million redeemable partnership units of Brookfield Infrastructure's

holding limited partnership ("RPUs") at the Offering Price (net of underwriting

commissions) concurrent with the proposed public offering in order to maintain

its approximate 30% interest in Brookfield Infrastructure on a fully exchanged

basis. The gross proceeds of the Offering and the placement of RPUs to

Brookfield will be $445,071,200. The Offering and issuance of RPUs to Brookfield

are expected to close on or about August 3, 2012.

Brookfield Infrastructure has also granted the underwriters an over-allotment

option, exercisable in whole or in part for a period of 30 days following

closing of the Offering, to purchase up to an additional 1,452,000 L.P. units at

the Offering Price. Brookfield will also have the option to subscribe for

additional RPUs in order to maintain its approximate 30% interest on a fully

exchanged basis. If both of these options are exercised, the gross offering size

would increase to $493,350,200.

Earnings Update

In connection with these announcements, Brookfield Infrastructure is providing

summary preliminary quarterly results. For the quarter ended June 30, 2012, net

income and FFO(1) compared to the quarter ended June 30, 2011 are as indicated

in the following table.

Three months ended June 30

---------------------------

US$ millions (except per unit amounts) 2012 2011

----------------------------------------------------------------------------

FFO $ 111 $ 102

- per unit $ 0.60 $ 0.65

Net income $ (26) $ 26

- per unit $ (0.14) $ 0.17

----------------------------------------------------------------------------

The following table reconciles FFO with net income:

Three months ended June 30

---------------------------

US$ millions 2012 2011

----------------------------------------------------------------------------

Net Income $ (26) $ 26

Add back or deduct the following:

Depreciation and amortization 70 53

Fair value adjustments 3 6

Deferred taxes and other items 64 17

----------------------------------------------------------------------------

FFO $ 111 $ 102

----------------------------------------------------------------------------

On August 8, 2012 Brookfield Infrastructure expects to release its results for

the quarter ended June 30, 2012. Brookfield Infrastructure's FFO, its key

measure of operating performance, totaled $111 million ($0.60 per unit) compared

to FFO of $102 million ($0.65 per unit) in the second quarter of 2011. Results

reflect a significant increase in FFO from Brookfield Infrastructure's transport

and energy segment and a strong performance from its utilities segment, which

was partially offset by a decreased contribution from its timber business.

Brookfield Infrastructure also expects to record a net loss of $26 million (loss

of $0.14 per unit) for the quarter ended June 30, 2012, compared to net income

of $26 million ($0.17 per unit) in the second quarter of 2011 as a result of

certain non-cash charges that totaled approximately $40 million during the

current period, primarily attributable to the recent refinancing completed at

its North American gas transmission business and an impairment charge relating

to a restructuring at one of Brookfield Infrastructure's European ports, which

offset the increase in FFO. These non-cash charges are non-recurring in nature

and do not materially impact Brookfield Infrastructure's operations.

The estimates above are unaudited and represent the most current information

available to management. Since management has not completed its closing

procedures for the quarter ended June 30, 2012, these estimates are preliminary,

are based on management's internal estimates and are subject to further internal

review by management and approval by Brookfield Infrastructure's audit

committee. Brookfield Infrastructure's actual financial results could be

different from the results shown above and those differences could be material.

Accordingly, readers should not place undue reliance on these estimates. See

"Forward-Looking Statements" below. The preliminary financial data included in

this news release has been prepared by, and is the responsibility of, Brookfield

Infrastructure's management and has not been reviewed or audited or subject to

any other procedures by Brookfield Infrastructure's independent registered

public accounting firm. Accordingly, Brookfield Infrastructure's independent

registered public accounting firm does not express an opinion or any other form

of assurance with respect to this preliminary data.

Offer Documents

Brookfield Infrastructure has filed a registration statement (including a

prospectus) with the SEC in respect of the Offering. Before you invest, you

should read the prospectus in that registration statement and other documents

Brookfield Infrastructure has filed with the SEC for more complete information

about Brookfield Infrastructure and the Offering. Brookfield Infrastructure has

also filed the prospectus relating to the Offering with certain provincial

securities regulatory authorities in Canada. You may get any of these documents

for free by visiting EDGAR on the SEC website at www.sec.gov or via SEDAR at

www.sedar.com. Also, a copy of the U.S. preliminary prospectus supplement may be

obtained through this hyperlink:

http://www.brookfieldinfrastructure.com/_Global/22/img/content/file/US_Prospectus_Supplement_2012.pdf.

Alternatively, Brookfield Infrastructure, any underwriter or any dealer

participating in the offering will arrange to send you the prospectus or you may

request it in the U.S. from RBC Capital Markets, LLC, Attention: Prospectus

Department, Three World Financial Center, 200 Vesey Street, 8th Floor, New York,

New York, toll-free: 877-822-4089, Credit Suisse Securities (USA) LLC,

Attention: Prospectus Department, One Madison Avenue, New York, New York, 10010,

toll-free: 800-221-1037, email: newyork.prospectus@credit-suisse.com, Citigroup,

Brooklyn Army Terminal, 140 58th Street, 8th Floor, Brooklyn, New York 11220,

toll-free: 800-831-9146, email: batprospectusdept@citi.com or HSBC Securities

(USA) Inc., Attention: Prospectus Department, 425 Fifth Avenue, New York, New

York 10018, toll-free: 866-811-8049, email: ny.equity.syndicate@us.hsbc.com, or

in Canada from RBC Capital Markets, Attention: Distribution Centre, 277 Front

St. W., 5th Floor, Toronto, Ontario M5V 2X4 (fax: 416-313-6066).

Brookfield Infrastructure operates high quality, long-life assets that generate

stable cash flows, require relatively minimal maintenance capital expenditures

and, by virtue of barriers to entry and other characteristics, tend to

appreciate in value over time. Its current business consists of the ownership

and operation of premier utilities, transport and energy, and timber assets in

North and South America, Australasia, and Europe. Units trade on the New York

and Toronto Stock Exchanges under the symbols BIP and BIP.UN, respectively. For

more information, please visit Brookfield Infrastructure's website at

www.brookfieldinfrastructure.com.

Forward-Looking Statements

This news release contains forward-looking information within the meaning of

Canadian provincial securities laws and "forward-looking statements" within the

meaning of Section 27A of the U.S. Securities Act of 1933, as amended, Section

21E of the U.S. Securities Exchange Act of 1934, as amended, "safe harbor"

provisions of the United States Private Securities Litigation Reform Act of 1995

and in any applicable Canadian securities regulations. The words, "will",

"could", "estimate", "tend to", "continue", "believe", "expect", "target",

"anticipate", "plan", "intend" and other expressions which are predictions of or

indicate future events, trends or prospects and which do not relate to

historical matters identify the above mentioned and other forward-looking

statements. Forward-looking statements in this news release include statements

regarding the expansion of Brookfield Infrastructure's business and funds from

operations through growth opportunities within its operations and acquisitions

of new businesses and the level of distribution growth over the next several

years, projected increases in traffic and toll road tariffs, projected returns

on invested capital, merger and investment plans in connection with Brookfield

Infrastructure's UK regulated distribution business, the outcome of negotiations

on potential acquisitions as well as its ability to access corporate debt at a

low cost.

Although Brookfield Infrastructure believes that these forward-looking

statements and information are based upon reasonable assumptions and

expectations, the reader should not place undue reliance on them, or any other

forward looking statements or information in this news release. The future

performance and prospects of Brookfield Infrastructure are subject to a number

of known and unknown risks and uncertainties. Factors that could cause actual

results of the Partnership and Brookfield Infrastructure to differ materially

from those contemplated or implied by the statements in this news release

include general economic conditions in Australia, Chile, Canada, the United

States and other jurisdictions in which it operates and elsewhere which may

impact the markets for its products; the ability to effectively negotiate and

complete new acquisitions in the competitive infrastructure space (including the

acquisitions described in this news release) and to integrate acquisitions into

existing operations; the ability to achieve growth within Brookfield

Infrastructure's businesses and in particular completion on time and on budget

of various large capital projects within certain of its businesses; Brookfield

Infrastructure's ability to divest certain of its assets; foreign currency risk,

including, without limitation, foreign exchange risk as a result of Brookfield

Infrastructure's participation in transactions (including the acquisitions

described in this news release) in currencies other than the U.S. dollar; the

high level of government regulation, both economic and non-economic, affecting

the business of Brookfield Infrastructure (including in respect of the

acquisitions described in this news release) and the resulting risk that changes

in legislation, regulations, government policy or the interpretation of any of

these by a regulator (including any change in the regulated Chilean toll road

and UK distribution tariffs) can have a significant impact on the performance of

our business; the fact that success of Brookfield Infrastructure is dependent on

market demand for an infrastructure company, which is unknown; the availability

of equity and debt financing for Brookfield Infrastructure (including the

Offering described in this news release); traffic volumes on the Chilean toll

road discussed in this news release; and other risks and factors described in

the documents filed by Brookfield Infrastructure with the securities regulators

in Canada and the United States including under "Risk Factors" in Brookfield

Infrastructure's most recent Annual Report on Form 20-F and other risks and

factors that are described therein. Except as required by law, Brookfield

Infrastructure undertakes no obligation to publicly update or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise.

References to Brookfield Infrastructure are to the Partnership together with its

subsidiary and operating entities.

References to the Partnership are to Brookfield Infrastructure Partners L.P.

(1) Funds from operations (FFO) is equal to net income, plus depreciation and

amortization, deferred taxes and certain other items.

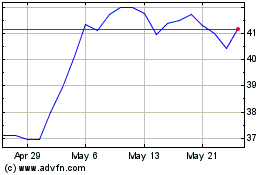

Brookfield Infrastructur... (TSX:BIP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brookfield Infrastructur... (TSX:BIP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024