Brookfield Infrastructure to Raise US$500 Million in Unit Offering

October 18 2011 - 5:21PM

Marketwired Canada

All dollar references are in U.S. dollars unless noted otherwise.

Brookfield Infrastructure (NYSE:BIP)(TSX:BIP.UN) today announced that it has

agreed to issue approximately 14.1 million L.P. units, on a bought deal basis,

to a syndicate of underwriters at a price of $24.75 per L.P. unit (the "Offering

Price") for aggregate gross proceeds of $350 million (the "Offering"). In

addition, Brookfield Asset Management Inc. ("Brookfield") (NYSE/TSX/Euronext:

BAM) will purchase directly or indirectly 6.1 million redeemable partnership

units of Brookfield Infrastructure's holding limited partnership ("RPUs") at the

offering price (net of underwriting commissions) concurrent with the proposed

public offering in order to maintain its approximate 30% interest in Brookfield

Infrastructure on a fully exchanged basis. The aggregate gross proceeds of the

Offering and the placement to Brookfield will be approximately $500 million. The

Offering is expected to close on or about October 26, 2011.

Brookfield Infrastructure has granted the underwriters an over-allotment option,

exercisable in whole or in part for a period of 30 days following closing, to

purchase from it up to an additional 2.1 million L.P. units at the Offering

Price, which, if exercised, would increase the gross Offering size to $403

million. If the underwriters exercise the over-allotment option, Brookfield will

have the option to purchase additional RPUs in order to maintain its approximate

30% interest in Brookfield Infrastructure on a fully exchanged basis.

The Offering will provide Brookfield Infrastructure with additional liquidity to

fund its growth strategy. Proceeds of approximately $150 million will be used to

acquire interests in two Chilean toll roads and proceeds of approximately $150

million will be used to fund growth capital expenditures at Brookfield

Infrastructure's Australian railroad. The remaining proceeds will be used to pay

down the corporate credit facility, which has been drawn over the past nine

months to invest in Brookfield Infrastructure's Australian railroad and other

organic growth initiatives.

"This equity issue will allow us to finance the completion of our near term

growth initiatives," said Sam Pollock, Chief Executive Officer of Brookfield's

Infrastructure Group. "Over the past few years, we have demonstrated our

commitment to growing our business in a measured and opportunistic manner. This

transaction leaves us with significant liquidity at an opportune time to pursue

new investment initiatives."

Chilean Toll Road Acquisitions

A Brookfield consortium recently committed to acquire a controlling interest in

two operating Chilean toll roads in a transaction with an equity investment and

proportionate enterprise value of approximately $340 million and $760 million,

respectively. Autopista Vespucio Norte ("AVN") is a 29 kilometre free-flow toll

road concession that expires in 2033 and forms part of the Santiago ring road.

Tunel San Cristobal is a 4 kilometre free-flow toll road concession that expires

in 2037 that connects to the eastern entrance point of AVN. Upon completion of

the acquisition and all related transactions, Brookfield Infrastructure will

invest approximately $150 million to acquire 24% of the two toll roads.

"With the acquisition of these toll roads, we will establish a new operating

platform within our transport and energy business in a country we know well,"

said Mr. Pollock. "We believe these toll roads are high quality infrastructure

investments that will generate substantial growth in cash flows due to their

strategic location and the favourable economic prospects for the country of

Chile."

These toll roads are key arteries in Santiago's urban roadway network with

significant excess capacity. We expect them to generate stable cash flows that

should increase with traffic growth and a tolling regime that permits annual

tariff indexation of Chilean CPI + 3.5% per year. The revenue framework also

allows the operator to charge congestion tariffs, whereby tolls can be increased

during high volume periods. This investment is expected to generate a levered,

after-tax total return on equity of 12-15%, in line with Brookfield

Infrastructure's target returns for this segment. Closing of this transaction is

expected in the fourth quarter upon the receipt of third-party consents.

Australian Railroad Expansion

As previously disclosed, Brookfield Infrastructure is in the process of

expanding and upgrading its Australian railroad to serve its customers' growth

objectives. This expansion will serve a diverse group of new mines, mine

expansions and industrial projects for new and existing customers. Brookfield

Infrastructure is currently developing and constructing six projects that are

expected to account for a 45% increase in volumes on its railroad upon

completion.

During the third quarter of 2011, Brookfield Infrastructure signed its fourth

long-term commercial track access agreement ("CTAA") relating to these expansion

projects. This 10-year contract for the Worsley alumina expansion covers

existing tonnage plus an additional 2.0 million tonnes per year. Brookfield

Infrastructure has also agreed to all major commercial terms with its customers

for the remaining two projects and documentation of these CTAAs is expected to

be finalized shortly.

"With the signing of the Worsley contract, we have fully contracted

approximately 78% of minimum take or pay revenues anticipated from these growth

projects, and we remain focused on ensuring we deliver the associated upgrades

on time and on budget," said Mr. Pollock. "We expect to generate attractive

returns on this incremental capital, reflecting the significant historical

investment that has been made in our rail system."

The remaining capital costs for this expansion and network upgrade program are

forecast to be approximately A$500 million. Approximately $150 million of equity

is required for this project and will be funded from the proceeds of the

Offering.

Offer Documents

Brookfield Infrastructure has filed a registration statement (including a

prospectus) with the SEC in respect of the Offering. Before you invest, you

should read the prospectus in that registration statement and other documents

Brookfield Infrastructure has filed with the SEC for more complete information

about Brookfield Infrastructure and the Offering. Brookfield Infrastructure has

also filed the prospectus relating to the Offering with certain provincial

securities regulatory authorities in Canada. You may get any of these documents

for free by visiting EDGAR on the SEC website at www.sec.gov or via SEDAR at

www.sedar.com. Also, a copy of the United States preliminary prospectus

supplement may be obtained through this hyperlink:

http://www.brookfieldinfrastructure.com/_Global/22/img/content/file/US-Prospectus-Supplement.pdf.

Alternatively, Brookfield Infrastructure, any underwriter or any dealer

participating in the Offering will arrange to send you the prospectus if you

request it in the U.S. from RBC Capital Markets, toll-free 877-822-4089, Credit

Suisse, toll-free at 800-221-1037, Citigroup, toll-free at 877-858-5407 or HSBC,

toll-free at 866-811-8049, or in Canada from RBC Capital Markets, Attention:

Distribution Centre, 277 Front St. W., 5th Floor Toronto, Ontario M5V 2X4 (fax:

416-313-6066) (no toll free number).

Brookfield Infrastructure operates high quality, long-life assets that generate

stable cash flows, require relatively minimal maintenance capital expenditures

and, by virtue of barriers to entry and other characteristics, tend to

appreciate in value over time. Its current business consists of the ownership

and operation of premier utilities, transport and energy, and timber assets in

North and South America, Australasia, and Europe. Units trade on the New York

and Toronto Stock Exchanges under the symbols BIP and BIP.UN, respectively. For

more information, please visit Brookfield Infrastructure's website at

www.brookfieldinfrastructure.com.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any securities of Brookfield Infrastructure in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

Note: This news release contains forward-looking information within the meaning

of Canadian provincial securities laws and "forward-looking statements" within

the meaning of Section 27A of the U.S. Securities Act of 1933, as amended,

Section 21E of the U.S. Securities Exchange Act of 1934, as amended, "safe

harbor" provisions of the United States Private Securities Litigation Reform Act

of 1995 and in any applicable Canadian securities regulations. Forward-looking

statements in this news release include statements regarding the offering of

limited partnership units. The words "anticipated", "intends", "will",

"expected", "tend", "seeks" and other expressions which are predictions of or

indicate future events, trends or prospects and which do not relate to

historical matters identify the above mentioned and other forward-looking

statements. Although Brookfield Infrastructure believes that these

forward-looking statements and information are based upon reasonable assumptions

and expectations, the reader should not place undue reliance on them, or any

other forward looking statements or information in this news release. The future

performance and prospects of Brookfield Infrastructure are subject to a number

of known and unknown risks and uncertainties.

Factors that could cause actual results of Brookfield Infrastructure to differ

materially from those contemplated or implied by the statements in this news

release include general economic conditions in Australia, Chile, Canada, the

United States and elsewhere; the ability to effectively complete new

acquisitions in the competitive infrastructure space (including, without

limitation, the ability to complete the acquisition of the interests in the

Chilean toll roads discussed herein) and to integrate acquisitions into existing

operations; foreign currency risk; the high level of government regulation

affecting the business of Brookfield Infrastructure, including, without

limitation, in respect of the toll road acquisitions and railroad operations

discussed herein; the fact that the success of Brookfield Infrastructure is

dependent on market demand for an infrastructure company, which is unknown; the

availability of equity and debt financing for Brookfield Infrastructure; the

completion of various large capital projects by mining customers of Brookfield

Infrastructure's railroad business, which themselves rely on access to capital

and continued favorable commodity prices; construction risks relating to

Brookfield Infrastructure's Australian railroad operations (including, without

limitation, risks relating to the occurrence of non-budgeted costs, construction

delays and disruption of operations); traffic volumes on the Chilean toll roads

discussed herein; acts of God or similar events outside of our control; and

other risks and factors described in the documents filed by Brookfield

Infrastructure with the securities regulators in Canada and the United States

including under "Risk Factors" in Brookfield Infrastructure's annual report on

Form 20-F and other risks and factors that are described in the annual report.

Except as required by law, Brookfield Infrastructure undertakes no obligation to

publicly update or revise any forward-looking statements or information, whether

as a result of new information, future events or otherwise.

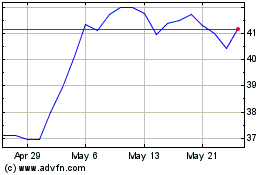

Brookfield Infrastructur... (TSX:BIP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brookfield Infrastructur... (TSX:BIP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024