Arizona Sonoran Copper Company Inc. (TSX:ASCU |

OTCQX:ASCUF) (“ASCU” or the “Company”) reports the completion

of its inferred drilling program on MainSpring, within the

100%-owned Cactus Project, Arizona. The inferred drilling program

confirms a continuation of the thick enrichment blanket extending

south and up dip from the Parks/Salyer deposit onto MainSpring, as

well as the presence of enriched mineralization in MainSpring (see

FIGURES 1-12). With the final receipt of assays, a

MainSpring mineral resource model is now being generated for its

inclusion to the integrated Nuton and Cactus Preliminary Economic

Assessment (“PEA”) expected in Q3 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240429463027/en/

The completed program at 500 ft (152 m) centres between drill

holes, extended mineralization over 2,500 ft x 3,000 ft (762 m x

914 m) within an interpreted horst block. The final 10 holes

(17,916 ft | 5,460 m) from the now completed inferred program are

reported herein. Two drills are now infill drilling at Cactus West

within the primary sulphide zones, and one rig is focused on

reducing drill spacings at MainSpring from inferred to indicated

for use in an updated Prefeasibility Study which is scheduled to

initiate later this year.

Highlights:

- In support of a single mineral resource model, the drill

program successfully connected the high grade thick enriched

Parks/Salyer mineralization and the shallow lower grade MainSpring

mineralization

- *ECM-218: 1,206 ft (368 m) @ 0.56% CuT of continuous

mineralization

- *Incl 290 ft (88 m) @ 0.95% CuT, 0.56% Cu TSol, 0.088% Mo

(enriched)

- And 676 ft (206 m) @ 0.46% CuT, 0.012% Mo (primary)

- ECM-215: 1,430 ft (436 m) @ 0.32% CuT of continuous

mineralization

- Incl 388 ft (118 m) @ 0.50% CuT, 0.34% Cu TSol, 0.012% Mo

(enriched)

- And 662 ft (202 m) @ 0.26% CuT, 0.003% Mo (primary)

- ECM-222: 965 ft (294 m) @ 0.42% CuT of continuous

mineralization

- Incl 127 ft (39 m) @ 1.12% CuT, 0.88% Cu TSol, 0.025% Mo

(enriched)

- And 837 ft (255 m) @ 0.31% CuT, 0.005% Mo (primary)

- ECM-213: 25 ft (8 m) @ 1.18% CuT, 1.13% Cu TSol, 0.003% Mo

(oxide), from 137 ft (42 m)

NOTE: True widths are not known; * Interval includes 2.2 ft

(0.67 m) of missing core

George Ogilvie, Arizona Sonoran President and CEO

commented, “Drilling has performed extremely well for the

Company, outlining a new zone of copper mineralization and

extending the enrichment blanket by another 3,000 ft (914 m) to the

south of our already significant Parks/Salyer project. Most

importantly the MainSpring mineralization is near surface in the

South, gradually plunging with advancement to the North, until it

connects into the Parks/Salyer ore deposit. Our team will explore

the potential of introducing a new open pit within the property

bounds around MainSpring within the PEA expected in Q3 2024; at

this point, ASCU is well underway in generating the MainSpring

mineral resource estimate for its inclusion. The new PEA will build

upon the February 2024 PFS, integrating MainSpring as well as the

primary sulphides which utilize the NutonTM technologies within the

heap leach and SX/EW flow sheet.

“We believe the MainSpring results will continue to demonstrate

the scalability of Cactus, reinforcing the Project as a highly

compelling emerging copper developer within a Tier 1 location.”

Drilling and Geology Recap

The inferred drill program at MainSpring on 500 ft (152 m) drill

hole spacing was designed to follow up on the evaluation of legacy

drill data. The program tested for both near-surface copper

mineralization in the southern MainSpring area and for the

shallowing continuation of the high-grade Parks/Salyer deposit in

the northern gap between Parks/Salyer and MainSpring. All holes

were drilled completely through the copper mineralization hosted by

Laramide intrusive monzonite porphyry and Precambrian Oracle

Granite, to the basement fault zone and into the underlying barren

basement rocks dominantly composed of Pinal Schist, with lesser

meta-granite, meta-volcanic, gneiss and quartzite. This was done to

test both supergene enrichment mineralization and primary

mineralization below it.

The program confirmed several things, including:

- The presence of shallow supergene enriched mineralization with

primary copper mineralization beneath the enrichment zones in the

MainSpring area.

- The continuation of thick high-grade enriched mineralization

with primary copper mineralization beneath it trending southward

from the Parks/Salyer deposit through the gap zone and into the

southern MainSpring area.

- Supergene enriched and primary mineralization trends are open

to the west of the completed inferred drilling pattern.

The indicated drilling program, which commenced immediately

following the inferred drilling program, will first infill the

shallowest mineralization zones to 250 ft (76 m) drill hole

spacing. The drilling will move northward to infill the gap between

MainSpring and Parks/Salyer to the indicated level.

TABLE 1: Significant Drilling Intercepts

Hole

id

Zone

Feet

Meters

CuT

(%)

Cu Tsol

(%)

Mo

(%)

from

to

length

from

to

length

ECM-213

oxide

137.0

162.4

25.4

41.8

49.5

7.7

1.18

1.13

0.003

enriched

602.5

767.0

164.5

183.6

233.8

50.1

0.33

0.33

0.001

including

707.0

767.0

60.0

215.5

233.8

18.3

0.62

0.62

0.001

enriched

872.1

915.0

42.9

265.8

278.9

13.1

0.11

0.08

0.002

primary

1,030.0

1,080.0

50.0

313.9

329.2

15.2

0.12

0.01

0.001

primary

1,170.0

1,200.0

30.0

356.6

365.8

9.1

0.13

0.01

0.001

ECM-214

enriched

770.9

866.3

95.4

235.0

264.0

29.1

0.72

0.71

0.003

enriched

926.0

1,033.0

107.0

282.2

314.9

32.6

0.36

0.29

0.001

primary

1,073.0

1,103.0

30.0

327.1

336.2

9.1

0.15

0.03

0.003

primary

1,143.0

1,696.7

553.7*

348.4

517.2

168.8*

0.19

0.02

0.008

including

1,351.0

1,503.6

152.6*

411.8

458.3

46.5*

0.24

0.02

0.008

and

1,643.0

1,696.7

53.7

500.8

517.2

16.4

0.32

0.03

0.010

ECM-215

enriched

511.6

654.1

142.5

155.9

199.4

43.4

0.31

0.30

0.004

enriched

722.1

782.4

60.3

220.1

238.5

18.4

0.53

0.52

0.001

enriched

829.3

1,217.0

387.7

252.8

370.9

118.2

0.50

0.34

0.012

including

1,047.0

1,117.0

70.0

319.1

340.5

21.3

0.86

0.54

0.022

primary

1,217.0

1,878.5

661.5

370.9

572.6

201.6

0.26

0.0556

0.003

including

1,257.0

1,457.0

200.0

383.1

444.1

61.0

0.46

0.11

0.007

ECM-216

enriched

386.3

560.0

173.7

117.7

170.7

52.9

0.25

0.24

0.003

including

409.0

453.5

44.5

124.7

138.2

13.6

0.41

0.40

0.002

primary

1,147.0

1,187.0

40.0*

349.6

361.8

12.2*

0.15

0.02

0.003

primary

1,650.0

1,707.4

57.4*

502.9

520.4

17.5*

0.10

0.01

0.003

ECM-217

enriched

818.4

1,163.0

344.6

249.4

354.5

105.0

0.22

0.19

0.001

including

818.4

882.0

63.6

249.4

268.8

19.4

0.36

0.35

0.002

and

1,099.3

1,130.0

30.7

335.1

344.4

9.4

0.52

0.33

0.001

primary

1,463.0

1,493.0

30.0

445.9

455.1

9.1

0.12

0.04

0.005

ECM-218

oxide

639.0

664.2

25.2

194.8

202.4

7.7

0.53

0.52

0.010

enriched

815.5

993.6

178.1

248.6

302.8

54.3

0.45

0.44

0.003

enriched

1,055.0

1,345.0

290.0*

321.6

410.0

88.4*

0.95

0.56

0.088

including

1,127.0

1,187.0

60.0

343.5

361.8

18.3

1.38

1.33

0.057

and

1,258.7

1,345.0

86.3

383.7

410.0

26.3

1.39

0.29

0.181

primary

1,345.0

2,021.7

676.7

410.0

616.2

206.3

0.46

0.04

0.012

including

1,345.0

1,657.0

312.0

410.0

505.1

95.1

0.72

0.05

0.020

ECM-219

enriched

840.9

1,165.0

324.1

256.3

355.1

98.8

0.42

0.39

0.001

including

960.6

1,020.0

59.4

292.8

310.9

18.1

1.09

1.05

0.001

primary

1,165.0

1,419.0

254.0

355.1

432.5

77.4

0.16

0.13

0.001

including

1,294.0

1,369.0

75.0

394.4

417.3

22.9

0.31

0.30

0.001

ECM-220

enriched

882.0

973.0

91.0

268.8

296.6

27.7

0.61

0.61

0.006

enriched

1,068.0

1,398.0

330.0

325.5

426.1

100.6

0.18

0.17

0.020

including

1,171.1

1,211.0

39.9

357.0

369.1

12.2

0.32

0.32

0.018

primary

1,398.0

2,021.0

623.0

426.1

616.0

189.9

0.20

0.03

0.009

ECM-221

oxide

426.0

463.0

37.0

129.8

141.1

11.3

0.15

0.13

0.001

enriched

591.0

632.0

41.0

180.1

192.6

12.5

0.43

0.40

0.005

enriched

665.0

960.7

295.7

202.7

292.8

90.1

0.34

0.33

0.005

including

677.0

703.5

26.5

206.3

214.4

8.1

1.01

0.99

0.002

enriched

1,080.0

1,225.0

145.0

329.2

373.4

44.2

0.41

0.31

0.013

including

1,080.0

1,114.0

34.0

329.2

339.5

10.4

0.93

0.91

0.002

primary

1,225.0

1,891.0

666.0

373.4

576.4

203.0

0.23

0.03

0.017

including

1,697.0

1,891.0

194.0

517.2

576.4

59.1

0.32

0.03

0.019

ECM-222

oxide

843.0

926.0

83.0

256.9

282.2

25.3

0.49

0.47

0.009

including

892.0

917.0

25.0

271.9

279.5

7.6

0.78

0.75

0.009

enriched

1,170.8

1,298.2

127.4

356.9

395.7

38.8

1.12

0.88

0.025

including

1,217.0

1,227.0

10.0

370.9

374.0

3.0

5.68

5.53

0.028

primary

1,298.2

2,135.5

837.3

395.7

650.9

255.2

0.31

0.03

0.005

including

1,298.2

1,328.0

29.8

395.7

404.8

9.1

0.61

0.06

0.002

and

1,397.0

1,477.0

80.0

425.8

450.2

24.4

0.52

0.03

0.009

and

2,008.0

2,048.0

40.0

612.0

624.2

12.2

0.45

0.04

0.006

- Intervals are presented in core length and are drilled with

vertical, or steep dip angles.

- Drill assays assume a mineralized cut-off grade of 0.1% CuT

reflecting the potential for heap leaching of open pit material in

the case of Oxide and Enriched and 0.1% CuT, in the case of Primary

material, to provide typical average grades. Holes were terminated

below the basement fault.

- Assay results are not capped. Intercepts are aggregated within

geological confines of major mineral zones.

- True widths are not known.

- * Indicates interval includes missing core. Missing core

intervals ranged in length from 2.2 ft (0.67 m) to 5.1 ft (1.55

m).

Table 2: Drilling details

Hole

Easting (m)

Northing (m)

Elevation (ft)

TD (ft)

Azimuth

Dip

ECM-213

421847.6

3644497.3

1364.9

1402.7

0.0

-90.0

ECM-214

421848.1

3644651.6

1369.7

1714.6

0.0

-90.0

ECM-215

421695.4

3644651.6

1367.1

1893.2

0.0

-90.0

ECM-216

421543.1

3644351.8

1358.0

1731.3

0.0

-90.0

ECM-217

422004.3

3644725.1

1373.4

1609.9

0.0

-90.0

ECM-218

421545.1

3644652.3

1365.0

2040.7

0.0

-90.0

ECM-219

422153.7

3644726.6

1375.9

1444.7

0.0

-90.0

ECM-220

421391.1

3644352.3

1356.2

2041.5

0.0

-90.0

ECM-221

421543.2

3644503.8

1361.4

1893.8

0.0

-90.0

ECM-222

421390.8

3644505.8

1359.1

2143.1

0.0

-90.0

Note:. All collar coordinates were surveyed using high precision

GPS by Harvey Land Surveying Inc.

Quality Assurance / Quality Control

Drilling completed on the project between 2020 and 2024 was

supervised by on-site ASCU personnel who prepared core samples for

assay and implemented a full QA/QC program using blanks, standards,

and duplicates to monitor analytical accuracy and precision. The

samples were sealed on site and shipped to Skyline Laboratories in

Tucson AZ for analysis. Skyline’s sample prep, analytical

methodologies, and quality control system complies with global

certifications for Quality ISO9001:2008.

Technical aspects of this news release have been reviewed and

verified by Allan Schappert – CPG #11758, who is a qualified person

as defined by National Instrument 43-101– Standards of Disclosure

for Mineral Projects.

Links from the Press Release

Figures 1-12:

https://arizonasonoran.com/projects/exploration/maps-and-figures/

Neither the TSX nor the regulating authority has approved or

disproved the information contained in this press release.

About Arizona Sonoran Copper Company

(www.arizonasonoran.com | www.cactusmine.com)

ASCU’s objective is to become a mid-tier copper producer with

low operating costs and to develop the Cactus and Parks/Salyer

Projects that could generate robust returns for investors and

provide a long term sustainable and responsible operation for the

community and all stakeholders. The Company's principal asset is a

100% interest in the Cactus Project (former ASARCO, Sacaton mine)

which is situated on private land in an infrastructure-rich area of

Arizona. Contiguous to the Cactus Project is the Company’s

100%-owned Parks/Salyer deposit that could allow for a phased

expansion of the Cactus Mine once it becomes a producing asset. The

Company is led by an executive management team and Board which have

a long-standing track record of successful project delivery in

North America complemented by global capital markets expertise.

Forward-Looking Statements

This news release contains “forward-looking statements” and/or

“forward-looking information” (collectively, “forward-looking

statements”) within the meaning of applicable securities

legislation. All statements, other than statements of historical

fact, are forward-looking statements. Generally, forward-looking

statements can be identified by the use of forward-looking

terminology such as “plans”, “expect”, “is expected”, “in order

to”, “is focused on” (a future event), “estimates”, “intends”,

“anticipates”, “believes” or variations of such words and phrases

or statements that certain actions, events or results “may”,

“could”, “would”, or the negative connotation thereof. In

particular, statements regarding ASCU’s future operations, future

exploration and development activities or other development plans

constitute forward-looking statements. By their nature, statements

referring to mineral reserves or mineral resources constitute

forward-looking statements. Forward-looking statements in this news

release include, but are not limited to statements with respect to

the results (if any) of further exploration work; the mineral

resources and mineral reserves estimates of the Cactus Project (and

the assumptions underlying such estimates); the ability of

exploration work (including drilling) to accurately predict

mineralization; the timing and ability of ASCU to produce a

preliminary economic assessment (including the MainSpring property)

(if at all); the timing and ability of ASCU to produce the Nuton

Case PFS (if at all); the scope of any future technical reports and

studies conducted by ASCU; and any other information herein that is

not a historical fact. Forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of ASCU to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Factors that could affect the outcome include, among

others: future prices and the supply of metals; the results of

drilling; inability to raise the money necessary to incur the

expenditures required to retain and advance the properties;

environmental liabilities (known and unknown); general business,

economic, competitive, political and social uncertainties; results

of exploration programs; accidents, labour disputes and other risks

of the mining industry; political instability, terrorism,

insurrection or war; or delays in obtaining governmental approvals,

projected cash operating costs, failure to obtain regulatory or

shareholder approvals and the additional risks described in ASCU’s

most recently filed Annual Information Form, annual and interim

management’s discussion and analysis, copies of which are available

on SEDAR+ (www.sedarplus.ca) under ASCU’s issuer profile.

Although ASCU has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be

other factors that cause actions, events or results to differ from

those anticipated, estimated or intended. Forward-looking

statements contained herein are made as of the date of this news

release and ASCU disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, except as required by

applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429463027/en/

Alison Dwoskin, Director, Investor Relations 647-233-4348

adwoskin@arizonasonoran.com

George Ogilvie, President, CEO and Director 416-723-0458

gogilvie@arizonasonoran.com

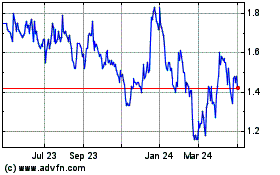

Arizona Sonoran Copper (TSX:ASCU)

Historical Stock Chart

From Dec 2024 to Jan 2025

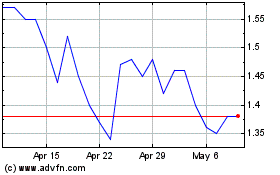

Arizona Sonoran Copper (TSX:ASCU)

Historical Stock Chart

From Jan 2024 to Jan 2025