Novagali Pharma: 2010 Annual Results

April 26 2011 - 12:40PM

Business Wire

Regulatory News:

- Cash burn in line with

expectations

- Major clinical milestones since the

IPO

- Unique status as a pure player in

ophthalmology reinforced

Novagali Pharma (Paris:NOVA), a pharmaceutical company that

develops innovative ophthalmic products, today announces its

audited results for the financial year ending December 31, 2010 as

approved by the Executive Board on April 20, 2011.

In thousands of euros - IFRS

FY 2010 FY

2009 Revenue Sales 580 426 Research contracts and

licence revenues 10 5 Subsidies, public funding and research tax

credit 933 1,870

Total income 1,523 2,301

Operating costs of which: raw materials & consumables

expenses 928 786 of which: employee & benefit expenses 3,523

3,276 of which: external expenses 4,266 6,399

Total operating

costs 9,120 10,848

Operating loss -7,596

-8,547

Net loss -7,464 -8,452

- Buoyant increase in Cationorm®

salesNovagali Pharma’s 2010 annual revenue, reflecting sales

of Cationorm®, totalled €580k, an increase of +36.1% by value and

+54.7% by volume. This acceleration in growth was associated with

the marketing of Cationorm® in new countries, notably Italy and

Portugal. Hence, on December 31, 2010, Cationorm® was marketed in

10 countries.In line with expectations, other income was down,

essentially because of the reduction in the amount of research tax

credit paid in 2010, following the completion of some research

studies.All in all, total income totalled €1,523k in 2010, compared

to €2,301k in 2009.

- Operating expenses under controlOperating expenses were

down -15.9% to €9,120k in 2010, versus €10,848k in 2009. This

change was essentially the result of the slowdown in clinical

research programmes over the 1st half of the year, prior to the

IPO. Over the second half, operating expenses rose by +18% compared

to the second half of 2009. This increase in operating expenses in

the last six months of the year is however limited given the major

strategic milestones recorded over the second half of 2010 that

resulted in the launch of the Phase II clinical trials for

Catioprost® at the end of the year and the launch, in the 1st

quarter of 2011, of the confirmatory pivotal Phase III clinical

study for Cyclokat®.Once a positive financial income of €133.3k is

taken into account, the net loss for the year was -€7,464k,

compared to -€8,452k in 2009.

- Financial situationNovagali Pharma went public on

Euronext Paris in July 2010. This allowed the Company to raise €22m

(net produce of €19.7m), thus enabling it to have a sound financial

structure in order to implement its strategy of development and the

acceleration of its Research & Development programmes for its

innovative products.At December 31, 2010, Novagali Pharma had a

cash position of €18.2m, and thus the “cash-burn” for the year was

just €6.6m, taking into account the receipt of €1.8m in research

tax credit. However, it should be noted that the Company expects to

spend a larger amount of cash in 2011 than in 2010, mainly due to

the ramp-up of the clinical trial programmes launched at the end of

2010 and in early 2011 for Catioprost® and Cyclokat®.

- Milestones and recent events

- Marketing

developments: sales launch of Cationorm® in new

countries

- Clinical

developments

- Launch of Phase II clinical trials for Catioprost®

(December 2010) and finalising of the patient recruitment

(April 2011)

- EMA gives positive advice for Phase III trials for

Cyclokat® (January 2011) and launch of the recruitment of

the first patients (March 2011)

- Strengthening

of the Company’s organisation: recruitment of Dr. Ronald

R. Buggage as Scientific Director of Novagali Pharma

Jérôme Martinez, Chairman of Novagali Pharma, concludes: “The

various announcements made throughout 2010 and the first few months

of 2011, as well as our 2010 results, reflect both a product

portfolio that is reaching major milestones and limited cash

consumption. In particular, in recent months, we have

substantially increased the medical value of our flagship products

Cyclokat® and Catioprost®. Further major milestones should be

achieved in 2011 with, for one, the publication of the results of

the Phase II clinical trial for Catioprost® in the United States.

These major milestones will further contribute to the strengthening

of Novagali Pharma’s unique status as a pure player in

ophthalmology as well as its increasing prominence in a

fast-growing and consolidating market.”

About NOVAGALI Pharma

(www.novagali.com)

Founded in 2000, Novagali Pharma SA is a pharmaceutical company

that develops ophthalmic innovative products for all segments of

the eye. Thanks to its three proprietary technology platforms, the

Company has an advanced portfolio of highly innovative products,

one of which is already on sale and two of which are undergoing

phase III clinical trials.In 2009, Frost & Sullivan recognised

Novagali with the Award for Industry Innovation & Advancement

of the Year, for its proprietary emulsion technology platforms, and

Siemens awarded the company the “Health Award” Grand Prix de

l’Innovation for Novasorb®.In April 2010, Novagali Pharma and its

partners in the Vitrena project obtained €9.4 million in funding

from Oséo for this diabetic retinopathy project. Novagali Pharma

carried out a successful IPO in July 2010 enabling the Company to

raise €22 million.Novagali Pharma is listed on NYSE Euronext Paris

- Compartment C. ISIN code: FR0010915553 - Ticker: NOVA

Disclaimer

This press release contains forward-looking statements. Although

Novagali Pharma considers these statements to be based on

reasonable assumptions, they could be affected by risks and

uncertainties causing actual results to differ significantly from

these forward-looking statements. For details of the risks and

uncertainties that could potentially affect Novagali Pharma’s

results, financial situation, performances or achievements and thus

result in a variation in these figures compared to the

forward-looking statements contained in this document, please refer

to the Risk Factors section of the Document de Base source document

registered with the French Autorité des Marches Financiers (“AMF”)

and available on the AMF (http://www.amf-france.org) and Novagali

Pharma (www.novagali.com) websites.This press release and the

information contained herein do not constitute an offer to sell or

subscribe to, or a solicitation of an offer to buy or subscribe to,

shares in Novagali Pharma in any country.

Next press release:

Revenue for the 1st quarter of 2011 on May

12th, 2011

(after market)

Novagali Pharma is listed on NYSE Euronext Paris - Compartment

C

ISIN code: FR0010915553 - Ticker: NOVA

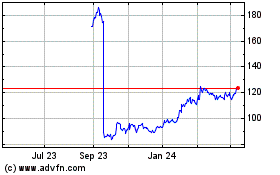

Novo Nordisk (TG:NOVA)

Historical Stock Chart

From Dec 2024 to Jan 2025

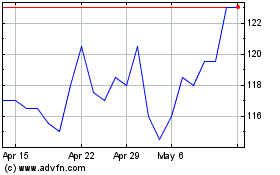

Novo Nordisk (TG:NOVA)

Historical Stock Chart

From Jan 2024 to Jan 2025