- Solid profitability: Adjusted Return on Sales (RoS)

reaches 13.5% (Q2 2022: 14.2%) at Mercedes-Benz Cars and 15.5% at

Mercedes-Benz Vans (Q2 2022: 10.1%); adjusted Return on Equity

(RoE) of 12.8% at Mercedes-Benz Mobility (Q2 2022: 17.1%)

- Top-End growth: Mercedes-AMG sales increased 19%,

Mercedes-Maybach rose 39% and G-Class sales up 29% in the second

quarter

- EV ramp-up: Charging options to be expanded in North

America; Mercedes-Benz battery electric car sales more than doubled

(+123%) in Q2; Mercedes-Benz Mobility tripled new EV business

volume to €1.8 billion (Q2 2022: €0.6 billion)

- Technology highlights: E-Class to be launched with

precursor of MB.OS and SAE-Level 2[1] automated lane change

functionality in Europe; ChatGPT integrated into MBUX in the United

States; SAE-Level 3 certification in California

- Outlook: Group EBIT now seen “at” prior-year level; Free

cash flow of the industrial business is now expected “slightly

above” the prior-year level; Mercedes-Benz Vans sales now seen

“significantly above” the prior-year level and adjusted Return on

Sales (RoS) now expected in the range of 13%–15% up from 11%–13%

previously

Mercedes-Benz Group’s (ticker symbol: MBG) sharpened focus on

sustainable growth through sales of desirable cars and premium

vans, combined with tight cost control, lifted second-quarter

Earnings Before Interest and Taxes (EBIT) by 8% to €5.0 billion (Q2

2022: €4.6 billion) and revenue by 5% to €38.2 billion (Q2 2022:

€36.4 billion).

At Mercedes-Benz Cars the adjusted Return on Sales (RoS) reached

13.5% in the quarter (Q2 2022: 14.2%) thanks to disciplined pricing

and strong sales of Top-End vehicles, as well as Mercedes-Benz SUV

models, including electric variants. At Mercedes-Benz Vans the Q2

adjusted RoS rose to 15.5% (Q2 2022: 10.1%) due to favorable

pricing and higher sales.

“Our solid financial performance is the result

of disciplined strategy execution in a dynamic environment. For

this I would like to thank the entire Mercedes team. We expect the

pace of sales from the first half of 2023 to continue for the

remainder of the year, given the strength of our pipeline of

desirable products: Customers will be able to choose from

additional models when the new E-Class, the CLE Coupe and GLC Coupe

hit showrooms later this year. And at the upcoming IAA we will give

a preview of how Mercedes-Benz will elevate and electrify the entry

segment based on our MMA architecture.”

Ola Kaellenius, Chief Executive Officer of

Mercedes-Benz Group AG

Transformation In the second quarter, the company continued its

transformation with several technological innovations.

Mercedes-Benz launched a beta program for the integration of

ChatGPT into Mercedes-Benz passenger cars in North America. Users

of MBUX[2] can use ChatGPT to enhance the voice assistant to not

only accept natural voice commands, but also to conduct

conversations with comprehensive answers. The data shows that

participants are twice as likely to interact with MBUX when using

the ChatGPT functionality.

The new E-Class, which comes equipped with a precursor of the

MB.OS operating system, received excellent feedback and will hit

showrooms in the second half of the year. Mercedes-Benz will offer

“Automatic Lane Change” function in Europe, an intelligent driving

assistance systems in the SAE-Level 2 in time for delivery of the

first units of the new E-Class.

The company continues to expand charging options for its

customers. In addition to advancing plans for its own Mercedes-Benz

High-Power Charging Network, it will adopt the North American

Charging Standard (NACS) giving customers access to the Tesla

supercharger network in North America in 2024 and this week

unveiled plans to develop a new a high-powered charging network

across North America together with Hyundai, Honda, Kia, General

Motors, BMW and Stellantis.

In September, Mercedes-Benz will showcase its MMA platform

(Mercedes Modular Architecture), designed to redefine the entry

segment with MB.OS and other features to elevate the product

substance.

Mercedes-Benz Group

Q2-2023

Q2-2022

Change 23/22

YTD2023

YTD2022

Change 23/22

Revenue*

38,241

36,440

+5%

75,757

71,298

+6%

Earnings before Interest and Taxes

(EBIT)*

4,988

4,622

+8%

10,492

9,851

+7%

Earnings before Interest and Taxes

(EBIT) adjusted*

5,211

4,939

+6%

10,633

10,240

+4%

Net profit/loss*

3,641

3,198

+14%

7,652

6,784

+13%

Free cash flow (industrial

business)*

3,363

1,417

+137%

5,527

2,633

+110%

Free cash flow (industrial business)

adjusted*

3,479

2,069

+68%

5,724

3,279

+75%

Earnings per share (EPS) in EUR

3.34

2.91

+15%

7.03

6.17

+14%

*in millions of €

Investments, free cash flow and liquidity The free cash flow of

the industrial business increased to €3.4 billion (Q2 2022: €1.4

billion). The positive development of working capital was mainly

due to lower inventory build-up compared to the previous year. The

inventory build-up is a result of the introduction of the direct

sales model in additional markets, ramp-ups in production due to

new model years and high levels of vehicles in the process of

delivery. The net liquidity of the industrial business rose to

€25.8 billion (end of 2022: €26.6 billion). The Group’s investments

in property, plant and equipment in the second quarter totaled €0.8

billion (Q2 2022: €0.8 billion). Research and development

expenditure amounted to €2.4 billion (Q2 2022: €2.2 billion) due to

higher investments for future platforms and technologies, including

MB.OS. Mercedes-Benz announced its third Green Bond after two years

in Europe.

Divisional results Demand for battery electric and

Top-End segment vehicles lifted sales of Mercedes-Benz Cars

by 6%, to 515,700 units in the second quarter, and by 5% to

1,019,200 units in the first half of 2023. Sales were boosted by

solid demand in Germany and the United States in particular and

growth across all regions and segments. Mercedes-Benz continues to

remain disciplined with a focus on sustainable growth, even in a

dynamic market environment. BEV sales of Mercedes-Benz Cars almost

doubled to 61,200 units (+96%) in Q2. Excluding smart, BEV sales

even surged by 123%. Sales in the Top-End segment rose by 12% to

84,800 units in Q2 and 15% to 176,600 vehicles in the first six

months of 2023. In the Core segment, sales were up 2% to 276,800

units in the second quarter impacted by a model changeover for the

GLC and E-Class. Sales in the Entry segment increased by 11% to

154,100 units in Q2 and even grew 19% in the first half of 2023,

reaching 317,500 vehicles.

Mercedes-Benz Cars

Q2-2023

Q2-2022

Change 23/22

YTD2023

YTD2022

Change 23/22

Sales in units

515,746

487,116

+6%

1,019,229

974,124

+5%

- thereof xEV

95,910

63,594

+51%

187,608

137,594

+36%

- thereof BEV

61,211

31,259

+96%

112,850

58,619

+93%

Revenue*

28,244

26,999

+5%

56,056

52,835

+6%

Earnings before Interest and Taxes

(EBIT)*

3,852

3,792

+2%

8,000

8,063

-1%

Earnings before Interest and Taxes

(EBIT) adjusted*

3,812

3,833

-1%

7,925

8,076

-2%

Return on Sales (RoS) in %

13.6%

14.0%

-0.4%pts

14.3%

15.3%

-1.0%pts

Return on Sales (RoS) adjusted in

%

13.5%

14.2%

-0.7%pts

14.1%

15.3%

-1.2%pts

Cash Flow Before Interest and Taxes

(CFBIT)*

3,769

2,393

+58%

6,750

4,240

+59%

Cash Flow Before Interest and Taxes

(CFBIT) adjusted*

3,842

2,948

+30%

6,862

4,628

+48%

Cash Conversion Rate adjusted

1.0

0.8

.

0.9

0.6

.

*in millions of €

Mercedes-Benz Vans significantly increased its global

sales in the second quarter of 2023 to 119,500 units (+19%) due to

the particularly strong contribution from commercial vans. Global

sales of all-electric vans increased notably in the second quarter

of 2023 to 5,100 units (Q2 2022: 4,300). Thus, the share of

all-electric models accounted for 4.2% of total sales. With the

recent start of sales of the EQT and eCitan, the product portfolio

now offers an electric variant in each segment. Solid net pricing

and higher unit sales helped to outweigh cost increases and

inflation while the fixed cost base saw a strong improvement.

Overall, the adjusted Return on Sales (RoS) for Mercedes-Benz Vans

rose to 15.5% (Q2 2022: 10.1%). In May, the division presented its

Strategy Update for strengthening its position as a leading

manufacturer of light commercial vehicles and received favorable

feedback from capital market representatives and media. The

midsized Van segment will receive a facelift to give private

segment vehicles a more luxurious design and to sharpen the premium

appeal in the commercial segment.

Mercedes-Benz Vans

Q2-2023

Q2-2022

Change 23/22

YTD2023

YTD2022

Change 23/22

Sales in units

119,505

100,125

+19%

218,390

188,633

+16%

Revenue*

5,123

4,107

+25%

9,738

7,794

+25%

Earnings before Interest and Taxes

(EBIT)*

806

382

+111%

1,568

730

+115%

Earnings before Interest and Taxes

(EBIT) adjusted*

792

414

+91%

1,511

880

+72%

Return on Sales (RoS) in %

15.7%

9.3%

+6.4%pts

16.1%

9.4%

+6.7%pts

Return on Sales (RoS) adjusted in

%

15.5%

10.1%

+5.4%pts

15.5%

11.3%

+4.2%pts

Cash Flow Before Interest and Taxes

(CFBIT)*

777

254

+206%

1,187

632

+88%

Cash Flow Before Interest and Taxes

(CFBIT) adjusted*

819

333

+146%

1,269

770

+65%

Cash Conversion Rate adjusted

1.0

0.8

.

0.8

0.9

.

*in millions of €

Compared to the second quarter of the previous year,

Mercedes-Benz Mobility tripled its new business volume for

battery electric vehicles to €1.8 billion (Q2 2022: €0.6 billion).

Overall, with €15.4 billion, the new business of Mercedes-Benz

Mobility increased compared to the previous year’s quarter (Q2

2022: €14.1 billion). In a challenging market environment,

especially in China, the contract volume of Mercedes-Benz Mobility

amounted to €131.4 billion (FY 2022: €132.4 billion). The adjusted

EBIT of €448 million (Q2 2022: €624 million) was mainly driven by a

declining interest margin, which was partially offset by a

normalized cost of credit risk. Profitability was impacted by lower

margins due to higher refinancing rates and intensified competition

in the financial services sector, as well as from higher

investments in charging. As a result, the adjusted Return on Equity

(RoE) decreased to 12.8% (Q2 2022: 17.1%).

Mercedes-Benz Mobility

Q2-2023

Q2-2022

Change 23/22

YTD2023

YTD2022

Change 23/22

Revenue*

6,506

6,715

-3%

13,145

13,497

-3%

New business*

15,415

14,115

+9%

30,116

28,655

+5%

Contract volume (June, 30)*

131,375

134,986

-3%

131,375

132,379**

-1%

Earnings before Interest and Taxes

(EBIT)*

172

624

-72%

711

1,357

-48%

Earnings before Interest and Taxes

(EBIT) adjusted*

448

624

-28%

987

1,357

-27%

Return on Equity (RoE) in %

4.9%

17.1%

-12.2%pts

10.2%

18.6%

-8.4%pts

Return on Equity (RoE) adjusted in

%

12.8%

17.1%

-4.3%pts

14.2%

18.6%

-4.4%pts

*in millions of €

** Year-end figure

Outlook With regional differences, the overall growth momentum

of the world economy is likely to remain rather subdued in the

second half of the year. Despite an ongoing monthly decrease in the

rate of inflation, inflation is expected to remain above average in

many places, which is likely to result in continued restrictive

monetary policies by major central banks. These developments are

likely to continue to weigh on consumers, companies and weaken

economic growth accordingly. In addition, geopolitical

imponderables remain another uncertainty factor. By contrast,

energy prices are expected to remain at a significantly lower level

than in the previous year for the rest of 2023 and also on average

for the year as a whole. The noticeably improved supply chain

situation should continue to benefit the development of automotive

markets in the second half of the year, although market demand is

expected to remain subdued in important markets.

Sales Guidance Mercedes-Benz Cars: Order intake is stabilizing

with a strong product substance in the market and also considering

the product launches to come in 2023 and in 2024. The rate of sales

from first-half 2023 is seen remaining at approximately the same

level, and full-year sales are thus seen at prior-year level.

Unit sales and revenue at Mercedes-Benz Cars are seen at

the prior-year level. The adjusted RoS is seen at 12%–14% and the

adjusted Cash Conversion Rate at 0.8–1.0. Investments in property,

plant and equipment and into research and development are seen

significantly above the prior-year level.

At Mercedes-Benz Vans, unit sales are now seen at

“significantly above” the prior-year's level, up from the previous

expectation of a slight rise in sales. The adjusted RoS is now

expected in the range of 13%–15% up from 11%–13% previously. The

adjusted Cash Conversion Rate is now expected at 0.7–0.9, up from

0.6–0.8 previously. Investments in property, plant and equipment

and into research and development are still seen significantly

above the prior-year level.

At Mercedes-Benz Mobility the adjusted RoE remains

unchanged at 12%–14%.

The Mercedes-Benz Group expects revenue at the prior-year

level. Group EBIT is now seen “at prior-year level,” up from

“slightly below” resulting from the adjusted Van guidance. Free

cash flow of the industrial business is now expected “slightly

above” the prior-year level.

Link to press information “Sales figures Q2 2023”: Mercedes-Benz

Cars: group-media.mercedes-benz.com/Sales-Q2/cars Mercedes-Benz

Vans: group-media.mercedes-benz.com/Sales-Q2/vans

Link to capital market presentation Q2 2023:

group.mercedes-benz.com/q2-2023/en

[1] The Mercedes-Benz driving assistance and safety systems are

aids, and do not relieve the driver of their responsibility. Please

note the information in the Owner's Manual and the system limits

which are described therein.

[2] All vehicles with MBUX of model series A 238, C 118, C 167,

C 238, C 253, C 254, C 257, H 247, N 293, R 232, S 213, V 167, V

177, V 295, V 297, W 206, W 213, WV 223, X 167, X 243, X 247, X

253, X 254, X 294, X 296, Z 223 and Z 296.

Further information on Mercedes-Benz Group AG is available at:

media.mercedes-benz.com and

group.mercedes-benz.com

Forward-looking statements: This document contains

forward-looking statements that reflect our current views about

future events. The words “anticipate,” “assume,” “believe,”

“estimate,” “expect,” “intend,” “may,” ”can,” “could,” “plan,”

“project,” “should” and similar expressions are used to identify

forward-looking statements. These statements are subject to many

risks and uncertainties, including an adverse development of global

economic conditions, in particular a decline of demand in our most

important markets; a deterioration of our refinancing possibilities

on the credit and financial markets; events of force majeure

including natural disasters, pandemics, acts of terrorism,

political unrest, armed conflicts, industrial accidents and their

effects on our sales, purchasing, production or financial services

activities; changes in currency exchange rates, customs and foreign

trade provisions; a shift in consumer preferences towards smaller,

lower-margin vehicles; a possible lack of acceptance of our

products or services which limits our ability to achieve prices and

adequately utilize our production capacities; price increases for

fuel, raw materials or energy; disruption of production due to

shortages of materials or energy, labor strikes or supplier

insolvencies; a decline in resale prices of used vehicles; the

effective implementation of cost-reduction and

efficiency-optimization measures; the business outlook for

companies in which we hold a significant equity interest; the

successful implementation of strategic cooperations and joint

ventures; changes in laws, regulations and government policies,

particularly those relating to vehicle emissions, fuel economy and

safety; the resolution of pending governmental investigations or of

investigations requested by governments and the outcome of pending

or threatened future legal proceedings; and other risks and

uncertainties, some of which are described under the heading “Risk

and Opportunity Report” in this Annual Report. If any of these

risks and uncertainties materializes or if the assumptions

underlying any of our forward-looking statements prove to be

incorrect, the actual results may be materially different from

those we express or imply by such statements. We do not intend or

assume any obligation to update these forward-looking statements

since they are based solely on the circumstances at the date of

publication.

Mercedes-Benz Group at a glance Mercedes-Benz Group AG is

one of the world's most successful automotive companies. With

Mercedes-Benz AG, the Group is one of the leading global suppliers

of high-end passenger cars and premium vans. Mercedes-Benz Mobility

AG offers financing, leasing, car subscription and car rental,

fleet management, digital services for charging and payment,

insurance brokerage, as well as innovative mobility services. The

company founders, Gottlieb Daimler and Carl Benz, made history by

inventing the automobile in 1886. As a pioneer of automotive

engineering, Mercedes-Benz sees shaping the future of mobility in a

safe and sustainable way as both a motivation and obligation. The

company's focus therefore remains on innovative and green

technologies as well as on safe and superior vehicles that both

captivate and inspire. Mercedes-Benz continues to invest

systematically in the development of efficient powertrains and sets

the course for an all-electric future: The brand with the

three-pointed star pursues the goal to go all-electric by 2030,

where market conditions allow. Shifting from electric-first to

electric-only, the world’s pre-eminent car company is accelerating

toward a fully electric and software-driven future. The company's

efforts are also focused on the intelligent connectivity of its

vehicles, autonomous driving and new mobility concepts as

Mercedes-Benz regards it as its aspiration and obligation to live

up to its responsibility to society and the environment.

Mercedes-Benz sells its vehicles and services in nearly every

country of the world and has production facilities in Europe, North

and Latin America, Asia and Africa. In addition to Mercedes-Benz,

the world's most valuable luxury automotive brand (source:

Interbrand study, 03 Nov. 2022), Mercedes-AMG, Mercedes-Maybach,

Mercedes-EQ and Mercedes me as well as the brands of Mercedes-Benz

Mobility: Mercedes-Benz Bank, Mercedes-Benz Financial Services and

Athlon. The company is listed on the Frankfurt and Stuttgart stock

exchanges (ticker symbol MBG). In 2022, the Group had a workforce

of around 170,000 and sold around 2.5 million vehicles. Group

revenues amounted to €150.0 billion and Group EBIT to €20.5

billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726938112/en/

Tobias Just, +49 711 17 41341, tobias.just@mercedes-benz.com

Edward Taylor, +49 176 30 94 1776, edward.taylor@mercedes-benz.com

Andrea Berg, phone +1 917 667 2391,

andrea.a.berg@mercedes-benz.com

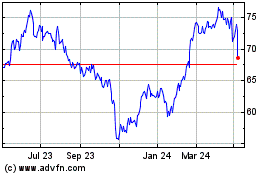

MercedesBenz (TG:MBG)

Historical Stock Chart

From Feb 2025 to Mar 2025

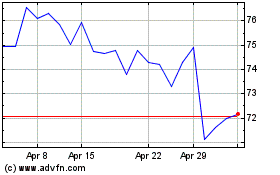

MercedesBenz (TG:MBG)

Historical Stock Chart

From Mar 2024 to Mar 2025