Zeta Global (NYSE: ZETA), the AI-Powered Marketing Cloud, today

announced increased third quarter 2024 guidance.

“The Zeta Marketing Platform with data and Artificial

Intelligence at our core is fueling our growth,” said David A.

Steinberg, Co-Founder, Chairman, and CEO of Zeta. “Through our

strong competitive positioning, we see an acceleration in the

marketing cloud replacement cycle. Coupled with increasing adoption

of generative AI, we believe this gives us continued momentum.”

"The combination of accelerating growth through the first two

months of the quarter along with high visibility across our

customer base gives us confidence to increase our guidance,” said

Chris Greiner, Zeta’s CFO. “We believe the uplift we are seeing

reflects new growth that is not the result of pull forward activity

from the fourth quarter and we are pleased with the momentum we are

experiencing."

Guidance*

Third Quarter 2024

- Increasing revenue guidance to at least $255 million, up $15.8

million from the midpoint of the prior guidance of $239.2 million.

The revised guidance represents year-over-year growth of at least

35%.

- Increasing revenue guidance from political candidates to at

least $10 million, up $5 million from the prior guidance of $5

million. Excluding political candidate revenue, the revised revenue

guidance represents year-over-year growth of at least 30%.

- Increasing Adjusted EBITDA guidance to at least $50.2 million,

up $3.1 million from the midpoint of the prior guidance of $47.1

million. The revised guidance represents year-over-year growth of

at least 49% and at these values implies an Adjusted EBITDA margin

of 19.7%.

Prior 3Q’24 Guidance Updated 3Q’24 Guidance

(midpoint) As of 9/4/24 As of 7/31/24

Revenue

$239.2M

at least $255M

% Growth Y/Y

27%

35%

Political Candidate Revenue

$5M

$10M

Revenue ex-Political Candidate Revenue

$234.2M

at least $245M

% Growth Y/Y ex-Political Candidate Rev.

24%

30%

Adjusted EBITDA

$47.1M

at least $50.2M

% Growth Y/Y

39%

49%

Adjusted EBITDA Margin

19.70%

19.7%**

**Based on values in the table

We are not updating our full year 2024 guidance at this time. We

do not believe that the uplift we are experiencing in our business

in the third quarter was driven by projected revenues from the

fourth quarter being pulled forward. We expect to discuss our

fourth quarter and full year guidance with our third quarter

earnings release, once our actual results for the third quarter are

finalized.

* This press release does not include a reconciliation of

forward-looking Adjusted EBITDA and Adjusted EBITDA margin to

forward-looking GAAP net income (loss) and net income (loss)

margin, respectively, because the Company is unable, without making

unreasonable efforts, to provide a meaningful or reasonably

accurate calculation or estimation of certain reconciling items

which could be significant to the Company’s results.

About Zeta

Zeta Global (NYSE: ZETA) is the AI-Powered Marketing Cloud that

leverages advanced artificial intelligence (AI) and trillions of

consumer signals to make it easier for marketers to acquire, grow,

and retain customers more efficiently. Through the Zeta Marketing

Platform (ZMP), our vision is to make sophisticated marketing

simple by unifying identity, intelligence, and omnichannel

activation into a single platform – powered by one of the

industry’s largest proprietary databases and AI. Our enterprise

customers across multiple verticals are empowered to personalize

experiences with consumers at an individual level across every

channel, delivering better results for marketing programs. Zeta was

founded in 2007 by David A. Steinberg and John Sculley and is

headquartered in New York City with offices around the world.

Forward-Looking Statements

This press release, together with other statements and

information publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release that are not

statements of historical fact, including statements about our third

quarter 2024 guidance, our expected growth, the acceleration of the

marketing cloud replacement cycle, rebound in automotive and

insurance verticals, and generative AI adoption, and our strong

competitive position are forward-looking statements and should be

evaluated as such. Forward-looking statements include information

concerning our anticipated future financial performance, our market

opportunities and our expectations regarding our business plan and

strategies. These statements often include words such as

“anticipate,” “believe,” “could,” “estimates,” “expect,”

“forecast,” “guidance,” “intend,” “may,” “outlook,” “plan,”

“projects,” “should,” “suggests,” “targets,” “will,” “would” and

other similar expressions. We base these forward-looking statements

on our current expectations, plans and assumptions that we have

made in light of our experience in the industry, as well as our

perceptions of historical trends, current conditions, expected

future developments and other factors we believe are appropriate

under the circumstances at such time. Although we believe that

these forward-looking statements are based on reasonable

assumptions at the time they are made, you should be aware that

many factors could affect our business, results of operations and

financial condition and could cause actual results to differ

materially from those expressed in the forward-looking statements.

These statements are not guarantees of future performance or

results.

The forward-looking statements are subject to and involve risks,

uncertainties and assumptions, and you should not place undue

reliance on these forward-looking statements. Factors that may

materially affect such forward-looking statements include, but are

not limited to: global supply chain disruptions; macroeconomic and

industry trends and adverse developments in the debt, consumer

credit and financial services markets and other macroeconomic

factors beyond Zeta’s control; increases in our borrowing costs as

a result of changes in interest rates and other factors; the impact

of inflation on us and on our customers; potential fluctuations in

our operating results, which could make our future operating

results difficult to predict; underlying circumstances, including

cash flows, cash position, financial performance, market conditions

and potential acquisitions; prevailing stock prices, general

economic and market condition; the impact of future pandemics,

epidemics and other health crises on the global economy, our

customers, employees and business; the war in Ukraine and

escalating geopolitical tensions as a result of Russia’s invasion

of Ukraine; the escalating conflict in Israel, Gaza and in the

surrounding areas; our ability to innovate and make the right

investment decisions in our product offerings and platform; the

impact of new generative AI capabilities and the proliferation of

AI on our business; our ability to attract and retain customers,

including our scaled and super-scaled customers; our ability to

manage our growth effectively; our ability to collect and use data

online; the standards that private entities and inbox service

providers adopt in the future to regulate the use and delivery of

email may interfere with the effectiveness of our platform and our

ability to conduct business; a significant inadvertent disclosure

or breach of confidential and/or personal information we process,

or a security breach of our or our customers’, suppliers’ or other

partners’ computer systems; and any disruption to our third-party

data centers, systems and technologies. These cautionary statements

should not be construed by you to be exhaustive and the

forward-looking statements are made only as of the date of this

press release. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

If we update one or more forward-looking statements, no inference

should be drawn that we will make additional updates with respect

to those or other forward-looking statements.

The third quarter 2024 guidance provided herein is based on

Zeta’s current estimates and assumptions and is not a guarantee of

future performance. The guidance provided is subject to significant

risks and uncertainties, including the risk factors discussed in

the Company's reports on file with the Securities and Exchange

Commission (“SEC”), that could cause actual results to differ

materially. There can be no assurance that the Company will achieve

the results expressed by this guidance or the targets.

Non-GAAP Measures

In order to assist readers of our consolidated financial

statements in understanding the core operating results that our

management uses to evaluate the business and for financial planning

purposes, we describe our non-GAAP measures below. We believe these

non-GAAP measures are useful to investors in evaluating our

performance by providing an additional tool for investors to use in

comparing our financial performance over multiple periods.

- Adjusted EBITDA is a non-GAAP

financial measure defined as net loss adjusted for interest

expense, depreciation and amortization, stock-based compensation,

income tax (benefit) / provision, acquisition related expenses,

restructuring expenses, change in fair value of warrants and

derivative liabilities, certain dispute settlement expenses, gain

on extinguishment of debt, certain non-recurring IPO related

expenses, including the payroll taxes related to vesting of

restricted stock and restricted stock units upon the completion of

the IPO, and other expenses. Acquisition related expenses and

restructuring expenses primarily consist of severance and other

employee-related costs which we do not expect to incur in the

future as acquisitions of businesses may distort the comparability

of the results of operations. Change in fair value of warrants and

derivative liabilities is a non-cash expense related to

periodically recording “mark-to-market” changes in the valuation of

derivatives and warrants. Other expenses consist of non-cash

expenses such as changes in fair value of acquisition related

liabilities, gains and losses on extinguishment of acquisition

related liabilities, gains and losses on sales of assets and

foreign exchange gains and losses. In particular, we believe that

the exclusion of stock-based compensation, certain dispute

settlement expenses and non-recurring IPO related expenses that are

not related to our core operations provides measures for

period-to-period comparisons of our business and provides

additional insight into our core controllable costs. We exclude

these charges because these expenses are not reflective of ongoing

business and operating results.

- Adjusted EBITDA margin is a

non-GAAP financial measure defined as Adjusted EBITDA divided by

the total revenues for the same period.

Adjusted EBITDA and Adjusted EBITDA margin provide us with

useful measures for period-to-period comparisons of our business as

well as comparison to our peers. We believe that these non-GAAP

financial measures are useful to investors in analyzing our

financial and operational performance. Nevertheless our use of

Adjusted EBITDA and Adjusted EBITDA margin has limitations as an

analytical tool, and you should not consider these measures in

isolation or as a substitute for analysis of our financial results

as reported under GAAP. Other companies may calculate

similarly-titled non-GAAP financial measures differently than us,

thereby limiting the usefulness of these non-GAAP financial

measures as a comparative tool. Because of these and other

limitations, you should consider our non-GAAP measures only as

supplemental to other GAAP-based financial performance measures,

including revenues and net loss.

We calculate forward-looking Adjusted EBITDA and Adjusted EBITDA

margin based on internal forecasts that omit certain amounts that

would be included in forward-looking GAAP net income (loss). We do

not attempt to provide a reconciliation of forward-looking Adjusted

EBITDA and Adjusted EBITDA margin guidance to forward looking GAAP

net income (loss) and GAAP net income (loss) margin, respectively,

because forecasting the timing or amount of items that have not yet

occurred and are out of our control is inherently uncertain and

unavailable without unreasonable efforts. Further, we believe that

such reconciliations would imply a degree of precision and

certainty that could be confusing to investors. Such items could

have a substantial impact on GAAP measures of financial

performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904622808/en/

Investor Relations Scott Schmitz ir@zetaglobal.com Press James

A. Pearson press@zetaglobal.com

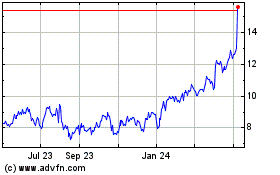

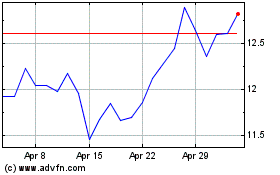

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Zeta Global (NYSE:ZETA)

Historical Stock Chart

From Nov 2023 to Nov 2024