- Sold 87 franchise licenses and opened 108 new studios in Q2

2024

- Quarterly run-rate average unit volume (AUV)3 of $638,000 in Q2

2024 grew 10% year-over-year, while total members of 801,000 were

up 17%

- Lowered guidance for studio openings, revenue and Adjusted

EBITDA4 in light of second quarter shortfall and current business

conditions

Xponential Fitness, Inc. (NYSE: XPOF) (“Xponential” or the

“Company”), one of the leading global franchisors of boutique

health and wellness brands, today reported financial results for

the second quarter ended June 30, 2024. All financial data included

in this release refer to global numbers, unless otherwise noted.

All KPI information is presented on an adjusted basis to include

historical information of Lindora prior to its acquisition by the

Company in January 2024, and to exclude historical information of

all brands divested by the company prior to June 30, 2024 (Row

House and Stride). Definitions for the non-GAAP measures and a

reconciliation to the corresponding GAAP measures are included in

the tables that accompany this release.

Financial Highlights: Q2 2024 Compared to Q2 2023

- Decreased revenue 1% to $76.5 million.

- Increased North America system-wide sales1 by 24% to $421.5

million.

- Reported North America same store sales2 growth of 7%, compared

to growth of 15%.

- Reported North America quarterly run-rate average unit volume

(AUV) of $638,000, compared to $581,000.

- Posted net loss of $13.7 million, or a loss of $0.29 per basic

share, on a share count of 31.8 million shares of Class A Common

Stock, compared to net income of $27.5 million, or earnings per

basic share of $1.44, on a share count of 33.0 million shares of

Class A Common Stock.

- Posted adjusted net income of $0.7 million, or a loss of $0.03

per basic share, compared to adjusted net income of $4.2 million,

or earnings per basic share of $0.05.

- Reported Adjusted EBITDA of $25.4 million, compared to $25.3

million.

“During my first six weeks, I’ve enjoyed the opportunity to meet

with many of our dedicated franchisees and employees,” said Mark

King, CEO of Xponential Fitness, Inc. “Every company I’ve led has

had strong, growing brands, passionate stakeholders, and scalable

teams with models that are poised to generate significant cash with

some fine tuning. I see the exact same things at Xponential.”

Results for the Second Quarter Ended June 30, 2024

For the second quarter of 2024, total revenue decreased $0.8

million, or 1%, to $76.5 million, down from $77.3 million in the

prior year period. The decrease was due primarily to a $6.5 million

decrease in other service revenue, largely attributable to our

strategic shift away from company-owned transition studios.

Net loss totaled $13.7 million, or a loss of $0.29 per basic

share, compared to net income of $27.5 million, or earnings per

basic share of $1.44, in the prior year period. The net loss was

the result of $4.9 million of lower overall profitability, a $30.0

million decrease in acquisition and transaction income, which

includes non-cash contingent consideration primarily related to the

Rumble acquisition, a $2.3 million increase in restructuring and

related charges from our company-owned transition studios, a $4.9

million increase in impairment of goodwill and other assets

associated with a decrease in CycleBar’s actual and forecasted cash

flows, and a $0.9 million increase in loss on brand divestiture,

partially offset by a $1.9 million decrease in non-cash

equity-based compensation expense. Please see the table at the end

of this press release for a calculation of the loss per share for

the quarter ended June 30, 2024.

Adjusted net income for the second quarter of 2024, which

excludes $1.2 million in acquisition and transaction income, $0.3

million expense related to the remeasurement of the Company’s tax

receivable agreement, $12.1 million related to the impairment of

goodwill and other assets, $0.9 million loss on brand divestiture,

and $2.3 million of restructuring and related charges, was $0.7

million, or a loss of $0.03 per basic share, on a share count of

31.8 million shares of Class A Common Stock.

Adjusted EBITDA, which is defined as net income (loss) before

interest, taxes, depreciation and amortization, adjusted for

equity-based compensation and related employer payroll taxes,

acquisition and transaction expenses, litigation expenses (outside

of the ordinary course of business), financial transaction fees and

related expenses, tax receivable agreement remeasurement,

impairment of goodwill and other assets, loss on brand divestiture,

executive transition costs, non-recurring rebranding expenses, and

restructuring and related charges, was $25.4 million for the

quarter, up slightly from $25.3 million in the prior year

period.

Liquidity and Capital Resources

As of June 30, 2024, the Company had approximately $26.0 million

of cash, cash equivalents and restricted cash and $330.1 million in

total long-term debt. Net cash provided by operating activities was

$5.7 million for the six months ended June 30, 2024.

2024 Outlook

“We saw some of the same retail softness that other consumer

companies experienced during the second quarter,” commented John

Meloun, CFO of Xponential Fitness, Inc. “When taken together with

the effects of our leadership transition and previously announced

regulatory investigations, it makes sense to temper elements of our

prior outlook.”

Based on current business conditions, the second quarter

shortfall, and the Company’s expectations as of the date of this

release, Xponential is adjusting its full year 2024 guidance as

follows:

- Gross new studio openings in the range of 500 to 520, or a

decrease of 8% at the midpoint compared to full year 2023 gross new

openings; this compares to previous guidance of 540 to 560;

- North America system-wide sales in the range of $1.705 billion

to $1.715 billion, or an increase of 22% at the midpoint compared

to full year 2023; unchanged from previous guidance;

- Revenue in the range of $310.0 million to $320.0 million, or a

decrease of 1% at the midpoint compared to full year 2023; this

compares to previous guidance of $340.0 million to $350.0 million;

and

- Adjusted EBITDA in the range of $120.0 million to $124.0

million, or an increase of 16% at the midpoint compared to full

year 2023; this compares to previous guidance of $136.0 million to

$140.0 million.

Additional key assumptions for full year 2024 include:

- Tax rate in the mid-to-high single digits;

- Share count of 31.8 million shares of Class A Common Stock for

the GAAP EPS and Adjusted EPS calculations. A full explanation of

the Company’s share count calculation and associated EPS and

Adjusted EPS calculations can be found in the tables at the end of

this press release; and

- $1.9 million in quarterly dividends paid related to the

Company’s Convertible Preferred Stock, or $2.2 million if

paid-in-kind.

We are not able to provide a quantitative reconciliation of the

estimated full year Adjusted EBITDA for fiscal year ending December

31, 2024 without unreasonable efforts to the most directly

comparable GAAP financial measure due to the high variability,

complexity and low visibility with respect to certain items such as

taxes, TRA remeasurements, and income and expense from changes in

fair value of contingent consideration from acquisitions. We expect

the variability of these items to have a potentially unpredictable

and potentially significant impact on future GAAP financial

results, and, as such, we also believe that any reconciliations

provided would imply a degree of precision that would be confusing

or misleading to investors.

Second Quarter 2024 Conference Call

The Company will host a conference call today at 1:30 p.m.

Pacific Time / 4:30 p.m. Eastern Time to discuss its second quarter

2024 financial results. Participants may join the conference call

by dialing 1-877-407-9716 (United States) or 1-201-493-6779

(International).

A live webcast of the conference call will also be available on

the Company’s Investor Relations site at

https://investor.xponential.com/. For those unable to participate

in the conference call, a telephonic replay of the call will be

available shortly after the completion of the call, until 11:59

p.m. ET on Thursday, August 15, 2024, by dialing 1-844-512-2921

(United States) or 1-412-317-6671 (International) and entering the

replay pin number: 13746851.

About Xponential Fitness, Inc.

Xponential Fitness, Inc. (NYSE: XPOF) is one of the leading

global franchisors of boutique health and wellness brands. Through

its mission to make health and wellness accessible to everyone, the

Company operates a diversified platform of nine brands spanning

across verticals including Pilates, indoor cycling, barre,

stretching, dancing, boxing, strength training, metabolic health,

and yoga. In partnership with its franchisees, Xponential offers

energetic, accessible, and personalized workout experiences led by

highly qualified instructors in studio locations throughout the

U.S. and internationally, with franchise, master franchise and

international expansion agreements in 49 U.S. states and 26

additional countries. Xponential’s portfolio of brands includes

Club Pilates, the largest Pilates brand in the United States;

CycleBar, the largest indoor cycling brand in the United States;

StretchLab, the largest assisted stretching brand in the United

States offering one-on-one and group stretching services; AKT, a

dance-based cardio workout combining toning, interval and circuit

training; YogaSix, the largest yoga brand in the United States;

Pure Barre, a total body workout that uses the ballet barre to

perform small isometric movements, and the largest Barre brand in

the United States; Rumble, a boxing-inspired full body workout;

BFT, a functional training and strength-based program; and Lindora,

a leading provider of medically guided wellness and metabolic

health solutions. For more information, please visit the Company’s

website at xponential.com.

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP,

we believe non-GAAP financial measures are useful in evaluating our

operating performance. We use certain non-GAAP financial

information, such as EBITDA, Adjusted EBITDA, adjusted net income

(loss), and adjusted net earnings (loss) per share, which exclude

certain non-operating or non-recurring items, including but not

limited to, equity-based compensation expenses and related employer

payroll taxes, acquisition and transaction expenses (income),

litigation expenses, financial transaction fees and related

expenses, tax receivable agreement remeasurement, impairment of

goodwill and other assets, loss on brand divestiture, executive

transition costs, non-recurring rebranding expenses, and charges

incurred in connection with our restructuring plan that we believe

are not representative of our core business or future operating

performance, to evaluate our ongoing operations and for internal

planning and forecasting purposes. We believe that non-GAAP

financial information, when taken collectively with comparable GAAP

financial measures, is helpful to investors because it provides

consistency and comparability with past financial performance and

provides meaningful supplemental information regarding our

performance by excluding certain items that may not be indicative

of our business, results of operations or outlook. However,

non-GAAP financial information is presented for supplemental

informational purposes only, has limitations as an analytical tool,

and should not be considered in isolation or as a substitute for

financial information presented in accordance with GAAP. In

addition, other companies, including companies in our industry, may

calculate similarly titled non-GAAP measures differently or may use

other measures to evaluate their performance, all of which could

reduce the usefulness of our non-GAAP financial measures as tools

for comparison. We seek to compensate such limitations by providing

a detailed reconciliation for the non-GAAP financial measures to

the most directly comparable financial measures stated in

accordance with GAAP. Investors are encouraged to review the

related GAAP financial measures and the reconciliation of the

non-GAAP financial measures to their most directly comparable GAAP

financial measures and not rely on any single financial measure to

evaluate our business. For a reconciliation of non-GAAP to GAAP

measures discussed in this release, please see the tables at the

end of this press release.

Forward-Looking Statements

This press release contains forward-looking statements that are

based on current expectations, estimates, forecasts and projections

of future performance based on management’s judgment, beliefs,

current trends, and anticipated financial performance. These

forward-looking statements include, without limitation, statements

relating to expected growth of our business; projected number of

new studio openings; profitability; the expected impact of our

movement away from company-owned transition studios; anticipated

industry trends; projected financial and performance information

such as system-wide sales; and other statements under the section

“2024 Outlook”; our competitive position in the boutique fitness

and broader health and wellness industry; and ability to execute

our business strategies and our strategic growth drivers.

Forward-looking statements involve risks and uncertainties that may

cause actual results to differ materially from those contained in

the forward-looking statements. These factors include, but are not

limited to, our relationships with master franchisees, franchisees

and international partners; difficulties and challenges in opening

studios by franchisees; the ability of franchisees to generate

sufficient revenues; risks relating to expansion into international

markets; loss of reputation and brand awareness; general economic

conditions and industry trends; and other risks as described in our

SEC filings, including our Annual Report on Form 10-K for the full

year ended December 31, 2023, filed by Xponential with the SEC, and

other periodic reports filed with the SEC. Other unknown or

unpredictable factors or underlying assumptions subsequently

proving to be incorrect could cause actual results to differ

materially from those in the forward-looking statements. Although

we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

level of activity, performance, or achievements. You should not

place undue reliance on these forward-looking statements. All

information provided in this press release is as of today’s date,

unless otherwise stated, and Xponential undertakes no duty to

update such information, except as required under applicable

law.

Xponential Fitness,

Inc.

Condensed Consolidated Balance

Sheets

(Unaudited)

(in thousands, except per

share amounts)

June 30, December 31,

2024

2023

Assets Current assets: Cash, cash equivalents and restricted

cash

$

26,017

$

37,094

Accounts receivable, net

29,771

32,751

Inventories

13,273

14,724

Prepaid expenses and other current assets

8,242

5,856

Deferred costs, current portion

8,066

6,620

Notes receivable from franchisees, net

352

203

Total current assets

85,721

97,248

Property and equipment, net

18,553

19,502

Right-of-use assets

43,387

71,413

Goodwill

163,036

171,601

Intangible assets, net

120,232

120,149

Deferred costs, net of current portion

43,043

46,541

Notes receivable from franchisees, net of current portion

108

802

Other assets

1,159

1,442

Total assets

$

475,239

$

528,698

Liabilities, redeemable convertible preferred stock and

stockholders' equity (deficit) Current liabilities: Accounts

payable

$

22,694

$

19,119

Accrued expenses

14,411

14,088

Deferred revenue, current portion

29,343

34,674

Current portion of long-term debt

5,147

4,760

Other current liabilities

20,235

19,666

Total current liabilities

91,830

92,307

Deferred revenue, net of current portion

111,232

117,305

Contingent consideration from acquisitions

11,600

8,666

Long-term debt, net of current portion, discount and issuance costs

318,454

319,261

Lease liability

38,047

70,141

Other liabilities

4,831

9,152

Total liabilities

575,994

616,832

Commitments and contingencies Redeemable convertible preferred

stock, $0.0001 par value, 400 shares authorized, 115 shares issued

and outstanding as of June 30, 2024 and December 31, 2023

122,903

114,660

Stockholders' equity (deficit): Undesignated preferred stock,

$0.0001 par value, 4,600 shares authorized, none issued and

outstanding as of June 30, 2024 and December 31, 2023

—

—

Class A common stock, $0.0001 par value, 500,000 shares authorized,

32,160 and 30,897 shares issued and outstanding as of June 30, 2024

and December 31, 2023, respectively

3

3

Class B common stock, $0.0001 par value, 500,000 shares authorized,

16,090 and 16,566 shares issued, and 16,015 and 16,491 shares

outstanding as of June 30, 2024 and December 31, 2023, respectively

2

2

Additional paid-in capital

507,986

521,998

Receivable from shareholder

(16,135

)

(15,426

)

Accumulated deficit

(642,096

)

(630,127

)

Treasury stock, at cost, 75 shares outstanding as of June 30, 2024

and December 31, 2023

(1,697

)

(1,697

)

Total stockholders' deficit attributable to Xponential Fitness,

Inc.

(151,937

)

(125,247

)

Noncontrolling interests

(71,721

)

(77,547

)

Total stockholders' deficit

(223,658

)

(202,794

)

Total liabilities, redeemable convertible preferred stock and

stockholders' deficit

$

475,239

$

528,698

Xponential Fitness,

Inc.

Condensed Consolidated

Statements of Operations

(Unaudited)

(in thousands, except per

share amounts)

Three Months Ended June 30, Six Months Ended June

30,

2024

2023

2024

2023

Revenue, net: Franchise revenue

$

43,020

$

35,133

$

84,774

$

68,099

Equipment revenue

12,925

14,428

26,825

27,522

Merchandise revenue

5,882

8,401

14,055

15,565

Franchise marketing fund revenue

8,380

6,617

16,212

12,828

Other service revenue

6,310

12,761

14,172

24,016

Total revenue, net

76,517

77,340

156,038

148,030

Operating costs and expenses: Costs of product revenue

12,866

14,223

27,257

28,258

Costs of franchise and service revenue

5,834

3,714

10,955

7,746

Selling, general and administrative expenses

36,989

37,210

74,144

72,095

Impairment of goodwill and other assets

12,089

7,238

12,089

7,238

Depreciation and amortization

4,517

4,288

8,953

8,485

Marketing fund expense

7,847

5,466

14,362

10,472

Acquisition and transaction expenses (income)

(1,217

)

(31,252

)

3,298

(15,510

)

Total operating costs and expenses

78,925

40,887

151,058

118,784

Operating income (loss)

(2,408

)

36,453

4,980

29,246

Other expense (income): Interest income

(387

)

(529

)

(750

)

(1,165

)

Interest expense

11,256

8,627

22,801

16,604

Other expense

253

698

862

1,252

Total other expense

11,122

8,796

22,913

16,691

Income (loss) before income taxes

(13,530

)

27,657

(17,933

)

12,555

Income taxes

132

133

85

10

Net income (loss)

(13,662

)

27,524

(18,018

)

12,545

Less: net income (loss) attributable to noncontrolling interests

(4,560

)

9,145

(6,049

)

4,149

Net income (loss) attributable to Xponential Fitness, Inc.

$

(9,102

)

$

18,379

$

(11,969

)

$

8,396

Net income (loss) per share of Class A common stock: Basic

$

(0.29

)

$

1.44

$

(0.59

)

$

0.16

Diluted

$

(0.29

)

$

0.09

$

(0.59

)

$

0.08

Weighted average shares of Class A common stock outstanding: Basic

31,806

33,045

31,465

31,906

Diluted

31,806

41,593

31,465

50,059

Xponential Fitness,

Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited)

(in thousands)

Six Months Ended June 30,

2024

2023

Cash flows from operating activities: Net income (loss)

$

(18,018

)

$

12,545

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: Depreciation and amortization

8,953

8,485

Amortization and write off of debt issuance costs

124

296

Amortization and write off of discount on long-term debt

2,201

1,218

Change in contingent consideration from acquisitions

2,770

(15,510

)

Non-cash lease expense

3,937

3,347

Bad debt expense

1,467

897

Equity-based compensation

8,138

12,111

Non-cash interest

(649

)

(856

)

Loss (gain) on disposal of assets

(6,660

)

133

Impairment of goodwill and other assets

12,089

7,238

Changes in assets and liabilities, net of effect of acquisition:

Accounts receivable

1,715

(2,022

)

Inventories

1,451

(983

)

Prepaid expenses and other current assets

(2,386

)

(5,280

)

Operating lease liabilities

(2,699

)

(2,636

)

Deferred costs

2,051

(1,192

)

Notes receivable, net

2

2

Accounts payable

3,419

9,302

Accrued expenses

35

1,174

Other current liabilities

3,197

663

Deferred revenue

(11,404

)

1,945

Other assets

282

(59

)

Other liabilities

(4,319

)

(253

)

Net cash provided by operating activities

5,696

30,565

Cash flows from investing activities: Purchases of property and

equipment

(2,984

)

(4,360

)

Proceeds from sale of assets

346

—

Purchase of studios

—

(164

)

Purchase of intangible assets

(1,016

)

(1,431

)

Notes receivable issued

—

(31

)

Notes receivable payments received

393

373

Acquisition of business

(8,500

)

—

Net cash used in investing activities

(11,761

)

(5,613

)

Cash flows from financing activities: Borrowings from long-term

debt

38,701

126,100

Payments on long-term debt

(41,178

)

(1,824

)

Debt issuance costs

(269

)

(115

)

Payment of preferred stock dividend

(1,968

)

(2,612

)

Payments for taxes related to net share settlement of restricted

share units

—

(8,111

)

Proceeds from issuance of common stock in connection with

stock-based compensation plans

74

—

Payment for tax receivable agreement

(136

)

(1,163

)

Payments for redemption of preferred stock

—

(130,766

)

Payments for distributions to Pre-IPO LLC Members

(236

)

(532

)

Payment received from shareholder

—

1,290

Loan to shareholder

—

(4,400

)

Net cash used in financing activities

(5,012

)

(22,133

)

Increase (decrease) in cash, cash equivalents and restricted cash

(11,077

)

2,819

Cash, cash equivalents and restricted cash, beginning of period

37,094

37,370

Cash, cash equivalents and restricted cash, end of period

$

26,017

$

40,189

Xponential Fitness,

Inc.

Net Income (Loss) to GAAP EPS

Per Share

(in thousands, except per

share amounts)

Three months ended June 30, Six months ended June

30,

2024

2023

2024

2023

Numerator: Net income (loss)

$

(13,662

)

$

27,524

$

(18,018

)

$

12,545

Less: net (income) loss attributable to noncontrolling interests

4,607

(23,740

)

9,546

849

Less: dividends on preferred shares

(2,150

)

(1,857

)

(4,013

)

(3,926

)

Less: deemed contribution (dividend)

2,012

45,551

(6,094

)

(17,109

)

Add: deemed contribution from redemption of convertible preferred

stock

—

—

—

12,679

Net income (loss) attributable to XPO Inc. - basic

(9,193

)

47,478

(18,579

)

5,038

Add: net income (loss) attributable to non-controlling interests

—

—

—

(849

)

Add: dividends on preferred shares

—

1,857

—

—

Less: deemed (contribution) dividend

—

(45,551

)

—

—

Net income (loss) attributable to XPO Inc. - diluted

$

(9,193

)

$

3,784

$

(18,579

)

$

4,189

Denominator: Weighted average shares of Class A common stock

outstanding - basic

31,806

33,045

31,465

31,906

Effect of dilutive securities: Restricted stock units

—

585

—

590

Convertible preferred stock

—

7,963

—

—

Conversion of Class B common stock to Class A common stock

—

—

—

17,563

Weighted average shares of Class A common stock outstanding -

diluted

31,806

41,593

31,465

50,059

Net earnings (loss) per share attributable to Class A common

stock - basic

$

(0.29

)

$

1.44

$

(0.59

)

$

0.16

Net earnings (loss) per share attributable to Class A common stock

- diluted

$

(0.29

)

$

0.09

$

(0.59

)

$

0.08

Anti-dilutive shares excluded from diluted loss per share of

Class A common stock: Restricted stock units

2,263

—

2,263

—

Conversion of Class B common stock to Class A common stock

16,016

16,574

16,016

—

Convertible preferred stock

8,112

—

8,112

7,963

Treasury share options

75

—

75

—

Rumble contingent shares

2,024

2,024

2,024

2,024

Profits interests, time vesting

1

2

1

2

Xponential Fitness,

Inc.

Reconciliations of GAAP to

Non-GAAP Measures

(in thousands, except per

share amounts)

Three Months Ended June 30, Six Months Ended June

30,

2024

2023

2024

2023

(in thousands) Net income (loss)

$

(13,662

)

$

27,524

$

(18,018

)

$

12,545

Interest expense, net

10,869

8,098

22,051

15,439

Income taxes

132

133

85

10

Depreciation and amortization

4,517

4,288

8,953

8,485

EBITDA

1,856

40,043

13,071

36,479

Equity-based compensation

4,196

6,055

8,138

12,111

Employer payroll taxes related to equity-based compensation

109

91

422

565

Acquisition and transaction expenses (income)

(1,217

)

(31,252

)

3,298

(15,510

)

Litigation expenses

3,388

2,299

4,086

4,344

Financial transaction fees and related expenses

425

79

620

1,644

TRA remeasurement

253

698

862

1,252

Impairment of goodwill and other assets

12,089

7,238

12,089

7,238

Loss on brand divestiture

922

—

1,201

—

Executive transition costs

690

—

690

—

Non-recurring rebranding expenses

331

—

331

—

Restructuring and related charges

2,325

—

10,389

—

Adjusted EBITDA

$

25,367

$

25,251

$

55,197

$

48,123

Three Months Ended June 30, Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

$

(13,662

)

$

27,524

$

(18,018

)

$

12,545

Acquisition and transaction expenses (income)

(1,217

)

(31,252

)

3,298

(15,510

)

TRA remeasurement

253

698

862

1,252

Impairment of goodwill and other assets

12,089

7,238

12,089

7,238

Loss on brand divestiture

922

—

1,201

—

Restructuring and related charges

2,325

—

10,389

—

Adjusted net income

$

710

$

4,208

$

9,821

$

5,525

Adjusted net income attributable to noncontrolling interest

240

1,406

3,393

1,902

Adjusted net income attributable to Xponential Fitness, Inc.

470

2,802

6,428

3,623

Dividends on preferred shares

(1,423

)

(1,237

)

(2,641

)

(2,527

)

Earnings (loss) per share - basic numerator

$

(953

)

$

1,565

$

3,787

$

1,096

Add: Adjusted net income (loss) attributable to noncontrolling

interest

—

1,406

3,393

1,902

Add: Dividends on preferred shares

—

1,237

2,641

2,527

Earnings (loss) per share - diluted numerator

$

(953

)

$

4,208

$

9,821

$

5,525

Adjusted net earnings (loss) per share - basic

$

(0.03

)

$

0.05

$

0.12

$

0.03

Weighted average shares of Class A common stock outstanding - basic

31,806

33,045

31,465

31,906

Adjusted net earnings (loss) per share - diluted

$

(0.03

)

$

0.07

$

0.18

$

0.10

Effect of dilutive securities: Restricted stock units

—

585

—

590

Convertible preferred stock

—

7,963

8,112

7,963

Conversion of Class B common stock to Class A common stock

—

16,574

16,356

17,563

Weighted average shares of Class A common stock outstanding -

diluted

31,806

58,167

55,933

58,022

Shares excluded from dilutive earnings per share of Class A

common stock Restricted stock units

2,263

—

2,263

—

Convertible preferred stock

8,112

—

—

—

Conversion of Class B common stock to Class A common stock

16,016

—

—

—

Treasury share options

75

—

75

—

Rumble contingent shares

2,024

2,024

2,024

2,024

Profits interests, time vesting

1

2

1

2

Note: The above adjusted net income (loss) per

share is computed by dividing the adjusted net income (loss)

attributable to holders of Class A common stock by the weighted

average shares of Class A common stock outstanding during the

period. Total share count does not include potential future shares

vested upon achieving certain earn-out thresholds. Net income,

however, continues to take into account the non-cash contingent

liability primarily attributable to Rumble.

Footnotes

1. System-wide sales represent gross sales by all North America

studios. System-wide sales include sales by franchisees that are

not revenue realized by us in accordance with GAAP. While we do not

record sales by franchisees as revenue, and such sales are not

included in our consolidated financial statements, this operating

metric relates to our revenue because we receive approximately 7%

and 2% of the sales by franchisees as royalty revenue and marketing

fund revenue, respectively. We believe that this operating measure

aids in understanding how we derive our royalty revenue and

marketing fund revenue and is important in evaluating our

performance. System-wide sales growth is driven by new studio

openings and increases in same store sales. Management reviews

system-wide sales weekly, which enables us to assess changes in our

franchise revenue, overall studio performance, the health of our

brands and the strength of our market position relative to

competitors.

2. Same store sales refer to period-over-period sales

comparisons for the base of studios. In accordance with industry

standard, we define the same store sales base to include studios in

North America that are in traditional studio locations and that

have generated positive sales for at least 13 consecutive calendar

months as of the measurement date. Any transfer of ownership of an

existing studio does not affect this metric. We measure same store

sales based solely upon monthly sales as reported by franchisees.

This measure highlights the performance of existing studios, while

excluding the impact of new studio openings. Management reviews

same store sales to assess the health of the franchised

studios.

3. AUV is calculated by dividing sales during the applicable

period for all studios being measured by the number of studios

being measured. Quarterly run-rate AUV consists of average

quarterly sales activity for all North America traditional studio

locations that are at least 6 months old at the beginning of the

respective quarter, and that have non-zero sales in the period,

multiplied by four. Monthly run-rate AUV is calculated as the

monthly AUV multiplied by twelve, for studios that are at least 6

months old at the beginning of the respective month, operate in

traditional locations and have non-zero sales. AUV growth is

primarily driven by changes in same store sales and is also

influenced by new studio openings. Management reviews AUV to assess

studio economics.

4. We define Adjusted EBITDA as EBITDA (net income/loss before

interest, taxes, depreciation and amortization), adjusted for the

impact of certain non-cash and other items that we do not consider

in our evaluation of ongoing operating performance. These items

include equity-based compensation and related employer payroll

taxes, acquisition and transaction expenses (income) (including

change in contingent consideration and transaction bonuses),

litigation expenses (consisting of legal and related fees for

specific proceedings that arise outside of the ordinary course of

our business), fees for financial transactions, such as secondary

public offering expenses for which we do not receive proceeds

(including bonuses paid to executives related to completion of such

transactions) and other contemplated corporate transactions,

expense related to the remeasurement of our TRA obligation, expense

related to loss on impairment or write down of goodwill and other

assets, loss on brand divestiture, executive transition costs

(consisting of costs associated with the transition of our former

CEO, such as professional services, legal fees, executive

recruiting costs and other related costs), non-recurring rebranding

expenses, and restructuring and related charges incurred in

connection with our restructuring plan that we do not believe

reflect our underlying business performance and affect

comparability. EBITDA and Adjusted EBITDA are also frequently used

by analysts, investors and other interested parties to evaluate

companies in our industry. We believe that Adjusted EBITDA, viewed

in addition to, and not in lieu of, our reported GAAP results,

provides useful information to investors regarding our performance

and overall results of operations because it eliminates the impact

of other items that we believe reduce the comparability of our

underlying core business performance from period to period and is

therefore useful to our investors in comparing the core performance

of our business from period to period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801996576/en/

Addo Investor Relations investor@xponential.com (310)

829-5400

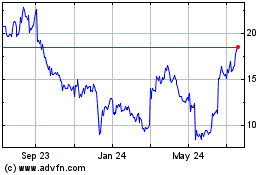

Xponential Fitness (NYSE:XPOF)

Historical Stock Chart

From Feb 2025 to Mar 2025

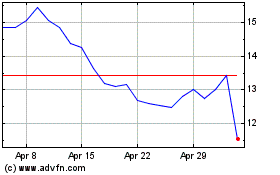

Xponential Fitness (NYSE:XPOF)

Historical Stock Chart

From Mar 2024 to Mar 2025