false

0001166003

0001166003

2024-09-04

2024-09-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): September 4, 2024

XPO,

INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-32172 |

|

03-0450326 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

Five

American Lane, Greenwich,

Connecticut 06831

(Address of principal executive offices)

(855)

976-6951

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

XPO |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405

of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| Emerging

growth company ¨ |

| |

| If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

Item 7.01. Regulation FD Disclosure

On September 4, 2024, XPO, Inc. (the “Company”)

issued a press release providing preliminary operating metrics for its North American Less-Than-Truckload segment for August 2024.

A copy of the press release is attached as Exhibit 99.1.

The Company is providing final operating metrics for its North American Less-Than-Truckload segment for the month of July 2024. In the

month of July 2024 weight per day decreased 0.8%, as compared with July 2023, attributable to a year-over-year increase of 0.1% in

shipments per day and a decrease of 0.8% in weight per shipment.

The information furnished in this Item 7.01, including Exhibit 99.1,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed to be incorporated by reference into any

filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, except to the extent that the registrant specifically

incorporates any such information by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: September 4, 2024 |

XPO, INC. |

| |

|

|

| |

By: |

/s/ Kyle Wismans |

| |

|

Kyle Wismans |

| |

|

Chief Financial Officer |

Exhibit 99.1

XPO Provides

North American LTL Operating Data for August 2024

GREENWICH, Conn. – September 4,

2024 – XPO (NYSE: XPO), a leading provider of freight transportation in North

America, today reported certain preliminary LTL segment operating metrics for August 2024. LTL tonnage per day decreased

4.6%, as compared with August 2023, attributable to a year-over-year decrease of 4.5% in shipments per day and a decrease of

0.1% in weight per shipment. Actual results for August 2024 may vary from the preliminary results reported above.

Mario Harik, chief executive officer

of XPO, said, “In August, we managed our variable costs effectively in a soft demand environment, supporting our outlook for margin

expansion. The industry pricing backdrop remains constructive, and we’re executing our company-specific initiatives to deliver

strong above-market yield growth. Our ongoing service improvements and network investments will further accelerate our results when industry

demand rebounds.”

About XPO

XPO, Inc. (NYSE: XPO) is a leader

in asset-based less-than-truckload (LTL) freight transportation in North America. The company’s customer-focused organization

efficiently moves 18 billion pounds of freight per year, enabled by its proprietary technology. XPO serves approximately 53,000 customers

with 615 locations and 38,000 employees in North America and Europe, with headquarters in Greenwich, Conn., USA. Visit xpo.com

for more information, and connect with XPO on LinkedIn, Facebook, X, Instagram and YouTube.

Forward-looking Statements

This release includes forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements.

In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,”

“believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,”

“predict,” “should,” “will,” “expect,” “objective,” “projection,”

“forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,”

“trajectory” or the negative of these terms or other comparable terms. These forward-looking statements are based on certain

assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected

future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements

are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance

or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied

by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our

filings with the SEC, and the following: the effects of business, economic, political, legal, and regulatory impacts or conflicts upon

our operations; supply chain disruptions and shortages, strains on production or extraction of raw materials, cost inflation and labor

and equipment shortages; our ability to align our investments in capital assets, including equipment, service centers, and warehouses

to our customers’ demands; our ability to implement our cost and revenue initiatives; the effectiveness of our action plan, and

other management actions, to improve our North American LTL business; our ability to benefit from a sale, spin-off or other divestiture

of one or more business units or to successfully integrate and realize anticipated synergies, cost savings and profit opportunities from

acquired companies; goodwill impairment; issues related to compliance with data protection laws, competition laws, and intellectual property

laws; fluctuations in currency exchange rates, fuel prices and fuel surcharges; the expected benefits of the spin-offs of GXO Logistics, Inc.

and RXO, Inc.; our ability to develop and implement suitable information technology systems; the impact of potential cyber-attacks

and information technology or data security breaches or failures; our indebtedness; our ability to raise debt and equity capital; fluctuations

in interest rates; seasonal fluctuations; our ability to maintain positive relationships with our network of third-party transportation

providers; our ability to attract and retain key employees including qualified drivers; labor matters; litigation; and competition and

pricing pressures. We caution that our operating results for August 2024 are not necessarily indicative of the results that may

be expected for future periods.

All forward-looking statements set

forth in this release are qualified by these cautionary statements and there can be no assurance that the actual results or developments

anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on

us or our business or operations. Forward-looking statements set forth in this release speak only as of the date hereof, and we do not

undertake any obligation to update forward-looking statements except to the extent required by law.

Investor Contact

Brian Scasserra

+1-617-607-6429

brian.scasserra@xpo.com

Media Contact

Cole Horton

+1-203-609-6004

cole.horton@xpo.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

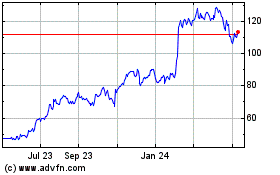

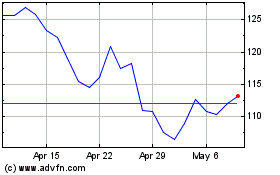

XPO (NYSE:XPO)

Historical Stock Chart

From Oct 2024 to Nov 2024

XPO (NYSE:XPO)

Historical Stock Chart

From Nov 2023 to Nov 2024