Watsco, Inc. (NYSE: WSO) reported fourth quarter and full year 2024

results and provided commentary on current business trends,

technology innovation and long-term growth drivers.

Watsco also announced today an 11% increase to

its annual dividend to $12.00 per share effective with its next

regular dividend payment in April 2025.

Watsco is the leading distributor in the

HVAC/R marketplace, serving over 375,000 contractors, technicians

and installers annually from 691 locations across

the U.S., Canada and Latin America. Since entering

distribution in 1989 through the end of 2024, the compounded annual

growth rate (CAGR) of Watsco’s operating profit was 18%, dividends

were 21% and total-shareholder-return was 19%, representing strong

and consistent performance across most macroeconomic and industry

cycles.

Watsco continues to invest in technologies

that enrich the customer experience, drive growth, gain market

share and improve operating efficiency. Watsco’s digital

user-community consists of approximately 64,000 contractors and

technicians that engage with Watsco through state-of-the-art

platforms capable of influencing every aspect of their day. Since

launch, Watsco has generated higher sales growth rates

among digital customers, achieved meaningful new customer

acquisition and reduced attrition. Watsco has also begun to

establish pathways for AI-related initiatives and leverage the

substantial data streams curated by the Company.

Albert H. Nahmad, Watsco’s Chairman and CEO,

commented: “Watsco had a terrific fourth quarter, achieving record

sales and earnings, improved operating efficiency, expanded margins

and record cash flow. Looking ahead, the transition to A2L products

is well underway, providing incremental opportunities for growth

and share gains as our technology platforms gain more adoption in

the marketplace. Our teams continue to lead and innovate, and I am

optimistic that our industry-leading scale, entrepreneurial

culture, technology advantage and financial strength position us to

continue to capture growth and share.”

Mr. Nahmad added: “We are pleased to raise our

dividend, marking the 51st consecutive year that Watsco has paid

dividends. With $782 million in cash and short-term investments

along with a debt-free balance sheet, Watsco remains

well-positioned to invest in most any-sized growth opportunity to

advance its leadership position within the fragmented $74 billion

HVAC/R distribution marketplace.”

Fourth Quarter Results

- 9% sales increase to a record $1.75

billion

- 13% gross profit increase to a

record $468 million

- 90 basis-point expansion in gross

margin to 26.7%

- 8% increase in SG&A expenses

(improved 20 basis-points as a percentage of sales)

- 26% growth in operating income to

$136 million (operating margin expanded 110 basis-points to

7.8%)

- 31% increase in income before

income taxes to a record $143 million

- 17% increase in net income

(attributable to Watsco) to $97 million

- 15% increase in EPS to $2.37

- 27% increase in operating cash flow

to a record $379 million

Sales trends

- 14% increase in HVAC equipment (69%

of sales)

- Flat sales for other HVAC products

(27% of sales)

- 4% increase in commercial

refrigeration products (4% of sales)

Sales of residential equipment increased 16%

during the quarter, reflecting double digit unit growth, new

customer acquisition and market share gains, price and mix benefits

and accelerated growth in e-commerce sales. Commercial equipment

sales remained resilient and increased 9% during the quarter.

Growth rates were consistent throughout the quarter and among the

various geographies served. Results also reflect the recapture of

sales and market share related to one of the Company’s primary OEMs

that experienced supply chain issues during 2023.

It is important to note that the fourth and

first quarters of each calendar year are highly seasonal due to the

timing of the replacement of HVAC systems. Results are typically

strongest in the second and third quarters, and the Company’s

fourth quarter financial results are disproportionately affected by

seasonality.

Full-Year Results

- 5% increase in sales to a record

$7.62 billion (3% growth on a same-store basis)

- 3% increase in gross profit to a

record $2.04 billion

- Gross margin was 26.8% compared to

27.4% last year

- SG&A expenses increased 6% to

$1.29 billion (4% growth on a same-store basis)

- Operating income of $782 million

(operating margin of 10.3%)

- Income before income taxes

increased 2% to $803 million

- Net income (attributable to Watsco)

was $536 million, flat with last year

- EPS of $13.30 versus $13.67 last

year

- 38% increase in operating cash flow

to a record $773 million

Sales trends (excluding acquisitions)

- 5% increase in HVAC equipment (70%

of sales)

- 2% decline in other HVAC products

(26% of sales)

- 1% increase in commercial

refrigeration products (4% of sales)

Culture of Innovation Watsco

continues to scale its industry-leading technology platforms, both

externally to more contractors and internally across its entire

network of locations. Highlights for 2024 included:

Customer-Facing

- E-commerce sales growth rates

outpaced overall sales growth increasing 8% to $2.6 billion for the

year (35% of annual sales) and grew 16% during the fourth

quarter.

- Watsco’s product information

management (PIM) platform expanded to more than 930,000 SKUs.

- Watsco’s authenticated user

community for HVAC Pro+ Mobile Apps expanded to approximately

64,000 users, up 15% from the prior year.

- The gross merchandise value of

products sold through OnCallAir®, Watsco’s proprietary digital

sales platform for contractors, increased 25% to approximately $1.5

billion in 2024 with quotes to homeowners increasing 22% to

approximately 313,000 households.

Operations-Focused

- Pricing optimization tools to

provide analytics and insights on more than 200,000 SKUs sold with

the goal of modernizing existing processes, enhancing

competitiveness and improving margins.

- Proprietary warehouse

management and order fulfillment systems to enable faster, more

reliable customer service, accelerate the fulfillment of orders,

and enhance warehouse efficiency.

- Transportation management systems

to improve efficiency and productivity of transportation

spend.

- Demand planning and inventory

optimization tools to improve fulfillment rates and inventory

turns.

A.J. Nahmad, Watsco’s President, commented: “Our

ongoing investments in Watsco’s industry-leading technology

platforms have been producing terrific results with clear evidence

that our customers are winning with more frequency while becoming

more loyal, long-term customers.”

A.J. Nahmad added: “We have also opened two

pathways for AI-related initiatives to leverage the substantial

data streams that we have curated over the years related to

products, technical know-how, customer information and a wealth of

transactional data. The first path is focused on how to bring

technical know-how and service to our contractor community faster,

more completely and more productively, whether assisted by our

technical support staff or through self-service. The second path is

internally focused to derive more productive content creation

across a variety of disciplines in our business. It is early

stage, but we are excited and already witnessing productivity gains

and an expansion of our historical capabilities.”

Cash Flow and DividendsWatsco

produced record operating cash flow in 2024, which increased 38% to

$773 million, or 122% of net income. Since 2019, Watsco has

generated $3.1 billion of net income along with $3.1 billion of

operating cash flow. Over this same period, the Company invested

$353 million to acquire distributors with annual dividend payments

increasing 75% to $423 million.

The Company’s philosophy is to share increasing

amounts of cash flow through higher dividends while maintaining a

conservative financial position with continued capacity to build

its distribution network. The Company raised its annual dividend

rate 11% to $12.00 per share, which will become effective

in April 2025. Future dividend increases will be considered in

light of investment opportunities, general economic conditions and

the Company’s overall financial position.

Long-Term Growth DriversWatsco

believes that various company and industry specific catalysts will

contribute to growth and profitability in the years ahead. We

believe these catalysts – coupled with Watsco’s scale,

technologies, OEM relationships and entrepreneurial culture –

provide competitive advantages that position us favorably over the

long-term.

Buy and Build Acquisition Strategy - Watsco has

acquired 70 companies since 1989, contributing to sales growth,

scale and, most importantly, its community of seasoned leaders.

Since 2019, Watsco has acquired ten companies that today represent

approximately $1.6 billion in annualized sales from 111 locations.

Watsco’s buy-and-build strategy perpetuates long-standing legacies

and builds scale through investment in new locations, new products

and by leveraging Watsco’s technology platforms. The HVAC/R

distribution landscape in North America remains highly fragmented

with more than 2,100 independent distributors.

Technology Investments - Watsco is investing to

enhance its technology advantage in the HVAC/R distribution

industry. Active users of our technology and e-commerce platforms

produce higher growth rates and exhibit approximately 60% less

attrition. Consequently, the Company believes that increased

adoption by more contractors will aid future growth and

profitability and will lower the overall cost to serve

customers.

Growth of Ductless HVAC Systems - the growing

acceptance of ductless HVAC systems in both residential and

commercial applications is also a long-term growth driver. Watsco

is the leading independent distributor of ductless products in

North America, representing approximately 20 brands manufactured by

several leading OEMs around the world. In 2024, sales growth of

ductless products once again exceeded the sales growth of

conventional ducted HVAC systems, consistent with recent

trends.

Scale and Product Depth - Watsco possesses the

broadest and deepest assortment of products in the industry with

approximately $1.4 billion in inventory across 200,000 SKUs

produced by more than 20 equipment OEMs and 1,500 non-equipment

vendors. Our scale and reach, coupled with our growing digital

presence, is a key differentiator given the fragmented nature of

our industry and allows Watsco to compete effectively in any

macroeconomic environment.

Use of Non-GAAP Financial

Information This release discloses certain performance

measures on a “same-store basis”, which are non-GAAP and exclude

the effects of locations closed, acquired or opened, in each case

during the immediately preceding 12 months, unless such locations

are within close geographical proximity to existing locations. The

Company believes this information provides greater comparability

regarding its ongoing operating performance. These measures should

not be considered an alternative to measurements presented in

accordance with U.S. GAAP.

Earnings Conference Call

InformationDate and time: February 18, 2025 at 10:00 a.m.

(ET)Webcast: http://investors.watsco.com (a replay will be

available on the Company’s website)Dial-in number: United States

(844) 883-3908 / International (412) 317-9254

About WatscoWatsco is the

largest distributor of heating, air conditioning and refrigeration

(HVAC/R) products with locations in the United States, Canada,

Mexico, and Puerto Rico, and on an export basis to Latin America

and the Caribbean.

The Company’s focus is on the replacement

market, which has increased in size and importance as a result of

the aging of installed systems, the introduction of higher energy

efficient models and the necessity of HVAC products in homes and

businesses. According to data published in March 2023 by the Energy

Information Administration, there are approximately 102 million

HVAC systems installed in the United States that have been in

service for more than 10 years, most of which operate well below

current minimum efficiency standards.

Accordingly, Watsco has the opportunity to be a

significant and important contributor toward climate change as it

plays an important role to lower CO2e emissions. According to the

Department of Energy, HVAC systems account for roughly half of U.S.

household energy consumption. As such, replacing older systems at

higher efficiency levels is a critical means for homeowners to

reduce electricity consumption and their carbon footprint.

Based on estimates validated by independent

sources, Watsco averted an estimated 22.8 million metric tons of

CO2e emissions from January 1, 2020 to December 31, 2024 through

the sale of replacement HVAC systems at higher-efficiency

standards, an equivalent of eliminating 5.3 million gas powered

vehicles off the road annually. More information, including sources

and assumptions used to support the Company’s estimates, can be

found at www.watsco.com.

Forward-Looking StatementsThis

document includes certain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements may address, among other things,

our expected financial and operational results and the related

assumptions underlying our expected results. These forward-looking

statements are distinguished by use of words such as “will,”

“would,” “anticipate,” “expect,” “believe,” “designed,” “plan,” or

“intend,” the negative of these terms, and similar references to

future periods. These statements are based on management's current

expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to changes in economic, business, competitive

market, new housing starts and completions, capital spending in

commercial construction, consumer spending and debt levels,

regulatory and other factors, including, without limitation, the

effects of supplier concentration, competitive conditions within

Watsco’s industry, the seasonal nature of sales of Watsco’s

products, the ability of the Company to expand its business,

insurance coverage risks and final GAAP adjustments.

Detailed information about these factors and

additional important factors can be found in the documents that

Watsco files with the Securities and Exchange Commission, such as

Form 10-K, Form 10-Q and Form 8-K. Forward-looking statements speak

only as of the date the statements were made. Watsco assumes no

obligation to update forward-looking information to reflect actual

results, changes in assumptions or changes in other factors

affecting forward-looking information, except as required by

applicable law.

|

WATSCO, INC.Condensed Consolidated Results

of Operations(In thousands, except per share

data)(Unaudited) |

| |

|

|

|

| |

Quarter Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

$ |

1,753,962 |

|

|

$ |

1,603,197 |

|

|

$ |

7,618,317 |

|

|

$ |

7,283,767 |

|

| Cost of sales |

|

1,285,878 |

|

|

|

1,188,781 |

|

|

|

5,573,604 |

|

|

|

5,291,627 |

|

| Gross profit |

|

468,084 |

|

|

|

414,416 |

|

|

|

2,044,713 |

|

|

|

1,992,140 |

|

| Gross profit margin |

|

26.7% |

|

|

|

25.8% |

|

|

|

26.8% |

|

|

|

27.4% |

|

| SG&A expenses |

|

338,489 |

|

|

|

312,461 |

|

|

|

1,293,439 |

|

|

|

1,223,507 |

|

| Other income |

|

6,593 |

|

|

|

5,793 |

|

|

|

30,501 |

|

|

|

26,177 |

|

| Operating income |

|

136,188 |

|

|

|

107,748 |

|

|

|

781,775 |

|

|

|

794,810 |

|

| Operating margin |

|

7.8% |

|

|

|

6.7% |

|

|

|

10.3% |

|

|

|

10.9% |

|

| Interest (income) expense,

net |

|

(6,713) |

|

|

|

(1,000) |

|

|

|

(20,869) |

|

|

|

4,920 |

|

| Income before income

taxes |

|

142,901 |

|

|

|

108,748 |

|

|

|

802,644 |

|

|

|

789,890 |

|

| Income taxes |

|

27,721 |

|

|

|

11,007 |

|

|

|

166,904 |

|

|

|

155,751 |

|

| Net income |

|

115,180 |

|

|

|

97,741 |

|

|

|

635,740 |

|

|

|

634,139 |

|

| Less: net income attributable

to non-controlling interest |

|

18,339 |

|

|

|

15,194 |

|

|

|

99,454 |

|

|

|

97,802 |

|

| Net income attributable to

Watsco |

$ |

96,841 |

|

|

$ |

82,547 |

|

|

$ |

536,286 |

|

|

$ |

536,337 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per

share: |

|

|

|

|

|

|

|

| Net income attributable to

Watsco shareholders |

$ |

96,841 |

|

|

$ |

82,547 |

|

|

$ |

536,286 |

|

|

$ |

536,337 |

|

| Less: distributed and

undistributed earnings allocated to restricted common stock |

|

7,578 |

|

|

|

6,707 |

|

|

|

37,369 |

|

|

|

36,932 |

|

| Earnings allocated to Watsco

shareholders |

$ |

89,263 |

|

|

$ |

75,840 |

|

|

$ |

498,917 |

|

|

$ |

499,405 |

|

| |

|

|

|

|

|

|

|

| Weighted-average Common and

Class B common shares and equivalent shares used to calculate

diluted earnings per share |

|

37,738,113 |

|

|

|

36,809,454 |

|

|

|

37,510,332 |

|

|

|

36,531,683 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per share for

Common and Class B common stock |

$ |

2.37 |

|

|

$ |

2.06 |

|

|

$ |

13.30 |

|

|

$ |

13.67 |

|

| |

|

WATSCO, INC.Condensed Consolidated Balance

Sheets (Unaudited, in thousands) |

| |

|

|

|

| |

December 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

526,271 |

|

|

$ |

210,112 |

|

| Short-term cash

investments |

|

255,669 |

|

|

|

- |

|

| Accounts receivable, net |

|

877,935 |

|

|

|

797,832 |

|

| Inventories, net |

|

1,385,436 |

|

|

|

1,347,289 |

|

| Other |

|

34,670 |

|

|

|

36,698 |

|

|

Total current assets |

|

3,079,981 |

|

|

|

2,391,931 |

|

|

|

|

|

|

| Property and equipment,

net |

|

140,535 |

|

|

|

136,230 |

|

| Operating lease right-of-use

assets |

|

419,138 |

|

|

|

368,748 |

|

| Goodwill, intangibles, net and

other |

|

839,869 |

|

|

|

832,273 |

|

|

Total assets |

$ |

4,479,523 |

|

|

$ |

3,729,182 |

|

| |

|

|

|

| Accounts payable and accrued

expenses |

$ |

873,628 |

|

|

$ |

611,747 |

|

| Current portion of lease

liabilities |

|

110,273 |

|

|

|

100,265 |

|

|

Total current liabilities |

|

983,901 |

|

|

|

712,012 |

|

|

|

|

|

|

| Borrowings under revolving

credit agreement |

|

- |

|

|

|

15,400 |

|

| Operating lease liabilities,

net of current portion |

|

321,715 |

|

|

|

276,913 |

|

| Deferred income taxes and

other liabilities |

|

109,669 |

|

|

|

108,667 |

|

|

Total liabilities |

|

1,415,285 |

|

|

|

1,112,992 |

|

|

|

|

|

|

| Watsco's shareholders’

equity |

|

2,656,990 |

|

|

|

2,229,839 |

|

| Non-controlling interest |

|

407,248 |

|

|

|

386,351 |

|

| Shareholders’ equity |

|

3,064,238 |

|

|

|

2,616,190 |

|

|

Total liabilities and shareholders’ equity |

$ |

4,479,523 |

|

|

$ |

3,729,182 |

|

|

|

|

WATSCO, INC.Condensed Consolidated

Statements of Cash Flows (Unaudited, in

thousands) |

|

|

| |

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

Net income |

$ |

635,740 |

|

|

$ |

634,139 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

40,822 |

|

|

|

35,090 |

|

|

Share-based compensation |

|

35,022 |

|

|

|

30,000 |

|

|

Non-cash contribution to 401(k) plan |

|

8,735 |

|

|

|

8,862 |

|

|

Provision for doubtful accounts |

|

4,285 |

|

|

|

7,158 |

|

|

Other income from investment in unconsolidated entity |

|

(30,501) |

|

|

|

(26,177) |

|

|

Other, net |

|

765 |

|

|

|

(7,322) |

|

|

Changes in working capital, net of effects of acquisitions |

|

|

|

|

Accounts receivable, net |

|

(85,555) |

|

|

|

(36,035) |

|

|

Inventories, net |

|

(41,678) |

|

|

|

64,620 |

|

|

Accounts payable and other liabilities |

|

197,765 |

|

|

|

(162,042) |

|

|

Other, net |

|

7,702 |

|

|

|

13,661 |

|

| Net cash provided by operating

activities |

|

773,102 |

|

|

|

561,954 |

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

Purchases of short-term cash investments |

|

(255,669) |

|

|

|

- |

|

|

Capital expenditures, net |

|

(29,828) |

|

|

|

(34,172) |

|

|

Business acquisitions, net of cash acquired |

|

(5,173) |

|

|

|

(3,822) |

|

|

Other, net |

|

- |

|

|

|

(3,349) |

|

| Net cash used in investing

activities |

|

(290,670) |

|

|

|

(41,343) |

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

Net proceeds from the sale of Common stock |

|

281,784 |

|

|

|

15,179 |

|

|

Net repayments under revolving credit agreement |

|

(15,400) |

|

|

|

(41,000) |

|

|

Dividends on Common and Class B Common stock |

|

(423,521) |

|

|

|

(382,646) |

|

|

Other, net |

|

(1,393) |

|

|

|

(51,609) |

|

| Net cash used in financing

activities |

|

(158,530) |

|

|

|

(460,076) |

|

| Effect of foreign exchange

rate changes on cash and cash equivalents |

|

(7,743) |

|

|

|

2,072 |

|

| Net increase in cash and cash

equivalents |

|

316,159 |

|

|

|

62,607 |

|

| Cash and cash equivalents at

beginning of period |

|

210,112 |

|

|

|

147,505 |

|

| Cash and cash equivalents at

end of period |

$ |

526,271 |

|

|

$ |

210,112 |

|

| |

|

|

|

|

|

|

|

Barry S. LoganWatsco, Inc.Executive Vice

President(305) 714-4102e-mail: blogan@watsco.com

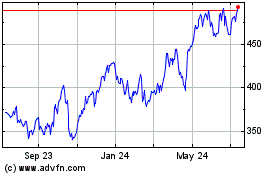

Watsco (NYSE:WSO)

Historical Stock Chart

From Jan 2025 to Feb 2025

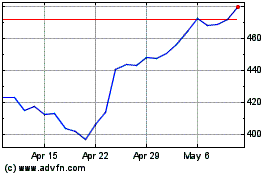

Watsco (NYSE:WSO)

Historical Stock Chart

From Feb 2024 to Feb 2025