FALSE000150477600015047762024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

Warby Parker Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-40825 (Commission File Number) | 80-0423634 (IRS Employer Identification No.) |

| | | | | |

233 Spring Street, 6th Floor East New York, New York (Address of Principal Executive Offices) | 10013 (Zip Code) |

(646) 847-7215

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | | WRBY | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On May 9, 2024, Warby Parker Inc. (the “Company”) issued a press release announcing the Company’s financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1, is furnished herewith and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| WARBY PARKER INC. |

| |

| Dated: May 9, 2024 | By: | /s/ Steve Miller |

| | Steve Miller |

| | Chief Financial Officer |

Warby Parker Announces First Quarter 2024 Results

Net revenue increased 16.3% year over year to $200.0 million; Company raises outlook

Average Revenue per Customer increased 9.6% year over year to $296

NEW YORK, May 9, 2024. Warby Parker Inc. (NYSE: WRBY) (“Warby Parker” or the “Company”), a direct-to-consumer lifestyle brand focused on vision for all, today announced financial results for the first quarter ended March 31, 2024.

“We entered 2024 with higher ambitions for delivering on our key metrics and are proud of what the team accomplished in Q1–we drove our highest revenue quarter growth since 2021, up 16.3% year over year, while making significant progress to improve profitability,” said Co-Founder and Co-CEO Neil Blumenthal.

“Earlier this year, we set out to reaccelerate both glasses and active customer growth. We’re encouraged to see strength in single-vision glasses as well as efficiencies across media channels, driven by our team’s strong marketing execution. In Q2 and beyond, we’ll continue to invest in customer acquisition while scaling our holistic vision care offering to drive higher customer lifetime value,” added Co-Founder and Co-CEO Dave Gilboa.

First Quarter 2024 Highlights

•Net revenue increased $28.0 million, or 16.3%, to $200.0 million, as compared to the prior year period.

•GAAP net loss of $2.7 million.

•Gross margin increased 1.6 points to 56.7%, as compared to the prior year period.

•Adjusted EBITDA(1) of $22.4 million and adjusted EBITDA margin(1) of 11.2%.

•Net cash provided by operating activities of $19.9 million.

•Free cash flow of $5.5 million.

•Opened 8 net new stores during the quarter, ending Q1 with 245 stores.

First Quarter 2024 Year Over Year Financial Results

•Net revenue increased $28.0 million, or 16.3%, to $200.0 million.

•Average Revenue per Customer increased 9.6% to $296. Active Customers increased 3.2% to 2.36 million.

•Gross profit increased 19.7% to $113.5 million.

•Gross margin was 56.7% compared to 55.1%. The increase in gross margin was primarily driven by faster growth in glasses, which is our highest margin product, efficiencies in our owned optical laboratories, and lower outbound customer shipping costs as a percent of revenue, partially offset by increased doctor salaries, as the number of stores offering eye exams grew, and sales growth of contact lenses which are sold at a lower margin.

•Selling, general, and administrative expenses (“SG&A”) were $118.6 million, up $11.4 million from the prior year, and represented 59.3% of revenue, down from 62.3% in the prior year period. The primary drivers of growth in SG&A spend were investments in

marketing and higher payroll-related costs from growth in our retail team associated with store expansion, partially offset by reduced stock-based compensation costs. Adjusted SG&A(1) was $103.4 million, or 51.7% of revenue, versus $87.2 million, or 50.7% of revenue in the prior year period.

•GAAP net loss improved $8.1 million to $2.7 million, primarily as a result of the increase in revenue described above.

•Adjusted EBITDA(1) increased $4.6 million to $22.4 million, and adjusted EBITDA margin(1) increased 0.9 points to 11.2%.

Balance Sheet Highlights

Warby Parker ended the first quarter of 2024 with $220.4 million in cash and cash equivalents.

2024 Outlook

For the full year 2024, Warby Parker is raising its guidance as follows:

•Net revenue of $753 to $761 million, representing growth of approximately 12.5% to 13.5% versus full year 2023.

•Adjusted EBITDA(1) of $70.0 million at the midpoint of our revenue range, which equates to an adjusted EBITDA margin(1) of 9.2%.

•On track for 40 new store openings this year.

“Our Q1 results are evidence of the returns we are starting to see from many of our recent investments. Going forward, we plan to maintain a balanced approach to delivering both efficient growth and incremental profitability,” said Chief Financial Officer Steve Miller.

The guidance and forward-looking statements made in this press release and on our conference call are based on management's expectations as of the date of this press release.

(1) Please see the reconciliation of non-GAAP financial measures to the most comparable GAAP financial measure in the section titled “Non-GAAP Financial Measures” below.

Webcast and Conference Call

A conference call to discuss Warby Parker’s first quarter 2024 results, as well as second quarter and full year 2024 outlook, is scheduled for 8:00 a.m. ET on May 9, 2024. To participate, please dial 833-470-1428 from the U.S. or 404-975-4839 from international locations. The conference passcode is 976307. A live webcast of the conference call will be available on the investors section of the Company’s website at investors.warbyparker.com where presentation materials will also be posted prior to the conference call. A replay will be made available online approximately two hours following the live call for a period of 90 days.

Forward-Looking Statements

This press release and the related conference call, webcast and presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may relate to, but are not limited to, expectations of future operating results or financial performance,

including expectations regarding achieving profitability and growth in our e-commerce channel, delivering stakeholder value, growing market share, and our guidance for the quarter ending June 30, 2024 and year ending December 31, 2024; expectations regarding the number of new store openings during the year ending December 31, 2024; management’s plans, priorities, initiatives and strategies; and expectations regarding growth of our business. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “toward,” “will,” or “would,” or the negative of these words or other similar terms or expressions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at the time those statements are made and are based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management as of that time with respect to future events. These statements are subject to risks and uncertainties, many of which involve factors or circumstances that are beyond our control, that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. These risks and uncertainties include our ability to manage our future growth effectively; our expectations regarding cost of goods sold, gross margin, channel mix, customer mix, and selling, general, and administrative expenses; increases in component and shipping costs and changes in supply chain; our reliance on our information technology systems and enterprise resource planning systems for our business to effectively operate and safeguard confidential information; our ability to engage our existing customers and obtain new customers; planned new retail stores in 2024 and going forward; an overall decline in the health of the economy and other factors impacting consumer spending, such as recessionary conditions, inflation, government instability, and geopolitical unrest; our ability to compete successfully; our ability to manage our inventory balances and shrinkage; the growth of our brand awareness; our ability to recruit and retain optometrists, opticians, and other vision care professionals; the spread of new infectious diseases; the effects of seasonal trends on our results of operations; our ability to stay in compliance with extensive laws and regulations that apply to our business and operations; our ability to adequately maintain and protect our intellectual property and proprietary rights; our reliance on third parties for our products, operation and infrastructure; our duties related to being a public benefit corporation; the ability of our Co-Founders and Co-CEOs to exercise significant influence over all matters submitted to stockholders for approval; the effect of our multi-class structure on the trading price of our Class A common stock; and the increased expenses associated with being a public company. Additional information regarding these and other risks and uncertainties that could cause actual results to differ materially from the Company's expectations is included in our most recent reports filed with the SEC on Form 10-K and Form 10-Q. Except as required by law, we do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Additional information regarding these and other factors that could affect the Company’s results is included in the Company’s SEC filings, which may be obtained by visiting the SEC's website at www.sec.gov. Information contained on, or that is referenced or can be accessed through, our

website does not constitute part of this document and inclusions of any website addresses herein are inactive textual references only.

Glossary

Active Customers is defined as unique customer accounts that have made at least one purchase in the preceding 12-month period.

Average Revenue per Customer is defined as the sum of the total net revenues in the preceding 12-month period divided by the current period Active Customers.

Non-GAAP Financial Measures

We use adjusted EBITDA, adjusted EBITDA margin, adjusted cost of goods sold (“adjusted COGS”), adjusted gross margin, adjusted gross profit, adjusted selling, general, and administrative expenses (“adjusted SG&A”), and free cash flow as important indicators of our operating performance. Collectively, we refer to these non-GAAP financial measures as our “Non-GAAP Measures.” The Non-GAAP Measures, when taken collectively with our GAAP results, may be helpful to investors because they provide consistency and comparability with past financial performance and assist in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results.

Adjusted EBITDA is defined as net income (loss) before interest and other income, taxes, and depreciation and amortization as further adjusted for asset impairment costs, stock-based compensation expense and related employer payroll taxes, amortization of cloud-based software implementation costs, non-cash charitable donations, and non-recurring costs such as restructuring costs, major system implementation costs, charges for certain legal matters, and transaction costs. Adjusted EBITDA margin is defined as adjusted EBITDA divided by net revenue.

Adjusted COGS is defined as cost of goods sold adjusted for stock-based compensation expense and related employer payroll taxes.

Adjusted gross profit is defined as net revenue minus adjusted COGS. Adjusted gross margin is defined as adjusted gross profit divided by net revenue.

Adjusted SG&A is defined as SG&A adjusted for stock-based compensation expense and related employer payroll taxes, non-cash charitable donations, and non-recurring costs such as restructuring costs, major system implementation costs, charges for certain legal matters, and transaction costs.

Free Cash Flow is defined as net cash provided by operating activities minus purchases of property and equipment.

The Non-GAAP Measures are presented for supplemental informational purposes only. A reconciliation of historical GAAP to Non-GAAP financial information is included under “Selected Financial Information” below.

We have not reconciled our adjusted EBITDA margin guidance to GAAP net income (loss) margin, or net margin, or adjusted EBITDA guidance to GAAP net income (loss) because we do not provide guidance for GAAP net margin or GAAP net income (loss) due to the uncertainty and potential variability of stock-based compensation and taxes, which are reconciling items between GAAP net margin and adjusted EBITDA margin and GAAP net income (loss) and adjusted

EBITDA, respectively. Because such items cannot be reasonably provided without unreasonable efforts, we are unable to provide a reconciliation of the adjusted EBITDA margin guidance to GAAP net margin and adjusted EBITDA guidance to GAAP net income (loss). However, such items could have a significant impact on GAAP net margin and GAAP net income (loss).

About Warby Parker

Warby Parker (NYSE: WRBY) was founded in 2010 with a mission to inspire and impact the world with vision, purpose, and style–without charging a premium for it. Headquartered in New York City, the co-founder-led lifestyle brand pioneers ideas, designs products, and develops technologies that help people see, from designer-quality prescription glasses (starting at $95) and contacts, to eye exams and vision tests available online and in our 245 retail stores across the U.S. and Canada.

Warby Parker aims to demonstrate that businesses can scale, do well, and do good in the world. Ultimately, the Company believes in vision for all, which is why for every pair of glasses or sunglasses sold, it distributes a pair to someone in need through its Buy a Pair, Give a Pair program. To date, Warby Parker has worked alongside its nonprofit partners to distribute more than 15 million glasses to people in need.

Selected Financial Information

Warby Parker Inc. and Subsidiaries

Consolidated Balance Sheets (Unaudited)

(Amounts in thousands, except share data) | | | | | | | | | | | |

| March 31,

2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 220,384 | | | $ | 216,894 | |

| Accounts receivable, net | 1,167 | | | 1,779 | |

| Inventory | 56,450 | | | 62,234 | |

| Prepaid expenses and other current assets | 18,116 | | | 17,712 | |

| Total current assets | 296,117 | | | 298,619 | |

| | | |

| Property and equipment, net | 156,722 | | | 152,332 | |

| Right-of-use lease assets | 129,561 | | | 122,305 | |

| Other assets | 10,492 | | | 7,056 | |

| Total assets | $ | 592,892 | | | $ | 580,312 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 26,699 | | | $ | 22,456 | |

| Accrued expenses | 43,200 | | | 46,320 | |

| Deferred revenue | 21,240 | | | 31,617 | |

| Current lease liabilities | 24,462 | | | 24,286 | |

| Other current liabilities | 2,939 | | | 2,411 | |

| Total current liabilities | 118,540 | | | 127,090 | |

| | | |

| Non-current lease liabilities | 156,988 | | | 150,171 | |

| Other liabilities | 1,177 | | | 1,264 | |

| Total liabilities | 276,705 | | | 278,525 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Common stock, $0.0001 par value; Class A: 750,000,000 shares authorized at March 31, 2024 and December 31, 2023, 99,005,197 and 98,368,239 issued and outstanding at March 31, 2024 and December 31, 2023, respectively; Class B: 150,000,000 shares authorized at March 31, 2024 and December 31, 2023, 19,734,125 and 19,788,682 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively, convertible to Class A on a one-to-one basis | 12 | | | 12 | |

| Additional paid-in capital | 987,305 | | | 970,135 | |

| Accumulated deficit | (669,510) | | | (666,831) | |

| Accumulated other comprehensive loss | (1,620) | | | (1,529) | |

| Total stockholders’ equity | 316,187 | | | 301,787 | |

| Total liabilities and stockholders’ equity | $ | 592,892 | | | $ | 580,312 | |

Warby Parker Inc. and Subsidiaries

Consolidated Statements of Operations (Unaudited)

(Amounts in thousands, except share and per share data)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Net revenue | $ | 200,003 | | | $ | 171,968 | |

| Cost of goods sold | 86,544 | | | 77,177 | |

| Gross profit | 113,459 | | | 94,791 | |

| | | |

| Selling, general, and administrative expenses | 118,586 | | | 107,221 | |

| Loss from operations | (5,127) | | | (12,430) | |

| | | |

| Interest and other income, net | 2,556 | | | 1,879 | |

| | | |

| Loss before income taxes | (2,571) | | | (10,551) | |

| Provision for income taxes | 108 | | | 261 | |

| Net loss | $ | (2,679) | | | $ | (10,812) | |

| | | |

| Net loss per share attributable to common stockholders, basic and diluted | $ | (0.02) | | | $ | (0.09) | |

| Weighted average shares used in computing net loss per share attributable to common stockholders, basic and diluted | 119,143,534 | | | 116,159,428 | |

Warby Parker Inc. and Subsidiaries

Consolidated Statements of Cash Flows (Unaudited)

(Amounts in thousands) | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (2,679) | | | $ | (10,812) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 10,583 | | | 9,140 | |

| Stock-based compensation | 14,048 | | | 19,780 | |

| | | |

| Asset impairment charges | 399 | | | 395 | |

| Amortization of cloud-based software implementation costs | 1,073 | | | 363 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable, net | 612 | | | 473 | |

| Inventory | 5,784 | | | 4,442 | |

| Prepaid expenses and other assets | (2,913) | | | (657) | |

| Accounts payable | 3,327 | | | (921) | |

| Accrued expenses | (108) | | | (7,826) | |

| Deferred revenue | (10,377) | | | (6,744) | |

| Other current liabilities | 528 | | | 119 | |

| Right-of-use lease assets and current and non-current lease liabilities | (263) | | | 988 | |

| Other liabilities | (87) | | | (97) | |

| Net cash provided by operating activities | 19,927 | | | 8,643 | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (14,437) | | | (12,385) | |

| Investment in optical equipment company | (2,000) | | | — | |

| Net cash used in investing activities | (16,437) | | | (12,385) | |

| Cash flows from financing activities | | | |

| Proceeds from stock option exercises | 91 | | | 81 | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | 91 | | | 81 | |

| Effect of exchange rates on cash | (91) | | | (662) | |

| Net change in cash and cash equivalents | 3,490 | | | (4,323) | |

| Cash and cash equivalents, beginning of period | 216,894 | | | 208,585 | |

| Cash and cash equivalents, end of period | $ | 220,384 | | | $ | 204,262 | |

| Supplemental disclosures | | | |

| Cash paid for income taxes | $ | 69 | | | $ | 97 | |

| Cash paid for interest | 76 | | | 50 | |

| Cash paid for amounts included in the measurement of lease liabilities | 10,400 | | | 10,849 | |

| Non-cash investing and financing activities: | | | |

| Purchases of property and equipment included in accounts payable and accrued expenses | $ | 4,582 | | | $ | 2,957 | |

Warby Parker Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

The following table reconciles adjusted EBITDA and adjusted EBITDA margin to the most directly comparable GAAP measure, which is net loss:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| (unaudited, in thousands) |

| Net loss | $ | (2,679) | | | $ | (10,812) | |

| Adjusted to exclude the following: | | | |

| Interest and other income, net | (2,556) | | | (1,878) | |

| Provision for income taxes | 108 | | | 261 | |

| Depreciation and amortization expense | 10,583 | | | 9,140 | |

| Asset impairment charges | 399 | | | 395 | |

Stock-based compensation expense(1) | 14,315 | | | 19,866 | |

| | | |

Amortization of cloud-based software implementation costs(2) | 1,073 | | | 363 | |

ERP implementation costs(3) | — | | | 403 | |

Other costs(4) | 1,135 | | | — | |

| Adjusted EBITDA | $ | 22,378 | | | $ | 17,738 | |

| Adjusted EBITDA margin | 11.2 | % | | 10.3 | % |

(1) Represents expenses related to the Company’s equity-based compensation programs and related employer payroll taxes, which may vary significantly from period to period depending upon various factors including the timing, number, and the valuation of awards granted, and vesting of awards including the satisfaction of performance conditions. For the three months ended March 31, 2024 and 2023, the amount includes $0.3 million and $0.1 million, respectively, of employer payroll taxes associated with releases of RSUs and option exercises.

(2) Represents the amortization of costs capitalized in connection with the implementation of cloud-based software.

(3) Represents internal and external non-capitalized costs related to the implementation of our new Enterprise Resource Planning (“ERP”) system.

(4) Represents other non-recurring costs, including charges for certain legal matters.

Warby Parker Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

The following table presents our non-GAAP, or adjusted, financial measures for the periods presented as a percentage of revenue. Each cost and operating expense is adjusted for stock-based compensation expense and related employer payroll taxes, non-cash charitable donations, and non-recurring costs such as restructuring costs, major system implementation costs, charges for certain legal matters, and transaction costs.

| | | | | | | | | | | | | | | | | | | | | | | |

| Reported | | Adjusted |

| Three Months Ended March 31, | | Three Months Ended March 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (unaudited, in thousands) | | (unaudited, in thousands) |

| Cost of goods sold | $ | 86,544 | | | $ | 77,177 | | | $ | 86,300 | | | $ | 76,979 | |

| % of Revenue | 43.3 | % | | 44.9 | % | | 43.1 | % | | 44.8 | % |

| | | | | | | |

| Gross profit | $ | 113,459 | | | $ | 94,791 | | | $ | 113,703 | | | $ | 94,989 | |

| % of Revenue | 56.7 | % | | 55.1 | % | | 56.9 | % | | 55.2 | % |

| | | | | | | |

| Selling, general, and administrative expenses | $ | 118,586 | | | $ | 107,221 | | | $ | 103,380 | | | $ | 87,150 | |

| % of Revenue | 59.3 | % | | 62.3 | % | | 51.7 | % | | 50.7 | % |

Warby Parker Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Measures (Unaudited)

The following table reflects a reconciliation of each non-GAAP, or adjusted, financial measure to its most directly comparable financial measure prepared in accordance with GAAP:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| (unaudited, in thousands) |

| Cost of goods sold | $ | 86,544 | | | $ | 77,177 | |

| Adjusted to exclude the following: | | | |

Stock-based compensation expense(1) | 244 | | | 198 | |

| Adjusted cost of goods sold | $ | 86,300 | | | $ | 76,979 | |

| | | |

| Gross profit | $ | 113,459 | | | $ | 94,791 | |

| Adjusted to exclude the following: | | | |

Stock-based compensation expense(1) | 244 | | | 198 | |

| Adjusted gross profit | $ | 113,703 | | | $ | 94,989 | |

| | | |

| Selling, general, and administrative expenses | $ | 118,586 | | | $ | 107,221 | |

| Adjusted to exclude the following: | | | |

Stock-based compensation expense(1) | 14,071 | | | 19,668 | |

| | | |

ERP implementation costs(2) | — | | | 403 | |

Other costs(3) | 1,135 | | | — | |

| Adjusted selling, general, and administrative expenses | $ | 103,380 | | | $ | 87,150 | |

| | | |

| Net cash provided by operating activities | $ | 19,927 | | | $ | 8,643 | |

| Purchases of property and equipment | (14,437) | | (12,385) |

| Free cash flow | $ | 5,490 | | | $ | (3,742) | |

(1) Represents expenses related to the Company’s equity-based compensation programs and related employer payroll taxes, which may vary significantly from period to period depending upon various factors including the timing, number, and the valuation of awards granted, and vesting of awards including the satisfaction of performance conditions. For the three months ended March 31, 2024 and 2023, the amount includes $0.3 million and $0.1 million, respectively, of employer payroll taxes associated with releases of RSUs and option exercises.

(2) Represents internal and external non-capitalized costs related to the implementation of our new ERP system.

(3) Represents other non-recurring costs, including charges for certain legal matters.

Contacts

Investor Relations:

Jaclyn Berkley, Head of Investor Relations

Brendon Frey, ICR

investors@warbyparker.com

Media:

Ali Weltman

ali@derris.com

Source: Warby Parker Inc.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

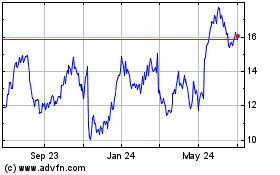

Warby Parker (NYSE:WRBY)

Historical Stock Chart

From Oct 2024 to Nov 2024

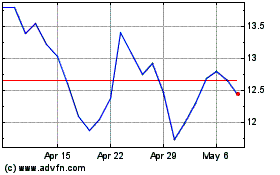

Warby Parker (NYSE:WRBY)

Historical Stock Chart

From Nov 2023 to Nov 2024