Victoria’s Secret & Co. (“Victoria’s Secret” or the “Company”)

(NYSE: VSCO) today reported financial results for the first quarter

ended May 4, 2024.

Chief Executive Officer Martin Waters commented

on the first quarter, “I am encouraged by our results in the

quarter which were at the high-end of our previously announced

preliminary results calling for adjusted operating income up to $40

million. We experienced sequential improvement in quarterly sales

trends in North America in both our stores and digital business for

both the Victoria’s Secret and PINK brands. We delivered meaningful

newness in merchandise and brand projection during the quarter and

our customers responded, particularly in April, which was our

strongest month of the quarter. The retail environment in North

America was challenging and the promotional environment was very

competitive, but importantly our gross margin rate in the quarter

was above last year as we managed our inventory and were

disciplined with traffic-driving offerings for our customers. In

stores, our customer traffic improved noticeably throughout the

quarter. In our digital business, the investments we’ve made to

improve the customer experience resulted in digital sales

performance outpacing stores. Our SG&A rate was favorable to

our expectations as we delivered incremental efficiency within our

operating model. In addition to improving North America trends, our

international business growth continued with net sales increasing

in the mid-teens again in the first quarter.”

Martin continued, “With some caution around the

broader retail environment in North America, we are planning the

business appropriately conservative in the near-term, but are

encouraged by the start to May and the second quarter. Our brands

are strong around the globe, and with the long-term health of the

business in mind, we are focused on accelerating our core and our

initiatives designed to leverage our market leadership position and

unlock our opportunity to convert our significant cultural

influence into long-term financial growth.”

First Quarter 2024 ResultsThe

Company reported a net loss of $4 million, or $0.05 per diluted

share for the first quarter of 2024. This result compares to net

income of $1 million, or $0.01 per diluted share for the first

quarter of 2023. First quarter 2024 operating income was $26

million compared to operating income of $28 million in the first

quarter of 2023.

Excluding the impact of the items described at

the conclusion of this press release, first quarter 2024 adjusted

net income was $9 million, or $0.12 per diluted share, and adjusted

operating income was $40 million. These results were at the

high-end of the range of our preliminary results announced on May 9

which estimated adjusted net income of $0.07 to $0.12 per diluted

share and adjusted operating income of $35 million to $40 million.

First quarter 2023 adjusted net income was $22 million, or $0.28

per diluted share, and adjusted operating income was $55

million.

The Company reported net sales of $1.359 billion

for the first quarter of 2024, a decrease of 3% compared to net

sales of $1.407 billion for the first quarter of 2023 and at the

high-end of our preliminary results range which estimated a net

sales decrease of 3% to 4%. Total comparable sales for the first

quarter of 2024 decreased 5%.

Second Quarter and Full Year 2024

OutlookThe Company is forecasting second quarter 2024 net

sales to decrease in the low-single digit range compared to last

year’s second quarter net sales of $1.427 billion. At this

forecasted level of sales, adjusted operating income for the second

quarter of 2024 is expected to be in the range of $30 million to

$45 million. Adjusted net income for the second quarter of 2024 is

estimated to be in the range of $0.05 to $0.20 per diluted

share.

The Company is reaffirming its full year outlook

and is forecasting 52-week fiscal year 2024 net sales to be about

$6.0 billion, or down low-single digits compared to a comparative

52-weeks from fiscal year 2023. At this forecasted level of sales,

adjusted operating income for fiscal year 2024 is expected to be

about $250 million to $275 million.

Forecasted adjusted operating income and

adjusted net income per diluted share for the second quarter and

full year 2024 exclude the financial impact of purchase accounting

items related to the Adore Me acquisition, including expense

(income) related to changes in the estimated fair value of

contingent consideration and performance-based payments, as well as

the amortization of intangible assets. The Company is not able to

provide a reconciliation of forward-looking adjusted operating

income or adjusted net income per diluted share to the most

directly comparable forward-looking GAAP financial measures because

the Company is unable to provide a meaningful or accurate

reconciliation or estimation of certain reconciling items without

unreasonable effort, due to the inherent difficulty in forecasting

the timing of, and quantifying, the various purchase accounting

items that are necessary for such reconciliation.

Proxy Advisor Voting

RecommendationsThe Company reported that leading

independent proxy advisory firms recommend that shareholders vote

“FOR” the election of all the Company’s director nominees, “FOR”

the compensation of the Company’s named executive officers

(say-on-pay), and “FOR” the amendment of the Company’s stock plan

to increase the number of shares available for issuance under the

plan at the annual meeting of shareholders scheduled for June 13,

2024. More information about these proposals can be found in the

Company’s definitive proxy statement related to the annual meeting

filed with the Securities and Exchange Commission (“SEC”) on May 3,

2024.

Quarterly Earnings Conference

CallVictoria’s Secret & Co. will conduct its first

quarter earnings call at 8:00 a.m. Eastern on Thursday,

June 6, 2024. To listen, call 1-800-619-9066 (international

dial-in number: 1-212-519-0836); conference ID 5358727. For an

audio replay, call 1-866-363-4045 (international replay number:

1-203-369-0206); conference ID 5358727 or log onto

www.victoriassecretandco.com. The materials accompanying the

earnings call have been posted on the Investors section of the

Company’s website. The audio replay will be available approximately

two hours after the conclusion of the call.

About Victoria’s Secret &

Co. Victoria’s Secret & Co. (NYSE: VSCO) is a

specialty retailer of modern, fashion-inspired collections

including signature bras, panties, lingerie, casual

sleepwear, athleisure and swim, as well as award-winning

prestige fragrances and body care. VS&Co is comprised of

market leading brands, Victoria’s Secret and Victoria’s Secret

PINK, that share a common purpose of supporting women in all they

do, and Adore Me, a technology-led, digital first innovative

intimates brand serving women of all sizes and budgets at all

phases of life. We are committed to empowering our approximately

30,000 associates across a global footprint of more than 1,370

retail stores in nearly 70 countries. We strive to provide the best

products to help women express their confidence, sexiness and power

and use our platform to celebrate the extraordinary diversity of

women’s experiences.

Important Additional Information and

Where to Find ItThe Company has filed a definitive proxy

statement and other relevant documents with the SEC in connection

with the solicitation of proxies for the Company’s 2024 annual

meeting of stockholders. BEFORE MAKING ANY VOTING DECISION,

STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY

STATEMENT, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ALL

OTHER RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may

obtain a copy of the Company’s definitive proxy statement and other

documents filed by the Company with the SEC free of charge from the

SEC’s website at www.sec.gov. In addition, these documents can be

accessed free of charge on the Investors section of our website,

www.victoriassecretandco.com, under Annual Shareholder Meeting.

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995

We caution that any forward-looking statements

(as such term is defined in the U.S. Private Securities Litigation

Reform Act of 1995) contained in this press release or made by us,

our management, or our spokespeople involve risks and uncertainties

and are subject to change based on various factors, many of which

are beyond our control. Accordingly, our future performance and

financial results may differ materially from those expressed or

implied in any such forward-looking statements, and any future

performance or financial results expressed or implied by such

forward-looking statements are not guarantees of future

performance. Forward-looking statements include, without

limitation, statements regarding our future operating results, the

implementation and impact of our strategic plans, and our ability

to meet environmental, social, and governance goals. Words such as

“estimate,” “commit,” “will,” “target,” “goal,” “project,” “plan,”

“believe,” “seek,” “strive,” “expect,” “anticipate,” “intend,”

“continue,” “potential” and any similar expressions are intended to

identify forward-looking statements. Risks associated with the

following factors, among others, could affect our results of

operations and financial performance and cause actual results to

differ materially from those expressed or implied in any

forward-looking statements:

- we may not realize all of the

expected benefits of the spin-off from Bath & Body Works, Inc.

(f/k/a L Brands, Inc.);

- general economic conditions,

inflation, and changes in consumer confidence and consumer spending

patterns;

- market disruptions including

pandemics or significant health hazards, severe weather conditions,

natural disasters, terrorist activities, financial crises,

political crises or other major events, or the prospect of these

events;

- our ability to successfully

implement our strategic plan;

- difficulties arising from turnover

in company leadership or other key positions;

- our ability to attract, develop and

retain qualified associates and manage labor-related costs;

- our dependence on traffic to our

stores and the availability of suitable store locations on

satisfactory terms;

- our ability to successfully operate

and expand internationally and related risks;

- the operations and performance of

our franchisees, licensees, wholesalers and joint venture

partners;

- our ability to successfully operate

and grow our direct channel business;

- our ability to protect our

reputation and the image and value of our brands;

- our ability to attract customers

with marketing, advertising and promotional programs;

- the highly competitive nature of

the retail industry and the segments in which we operate;

- consumer acceptance of our products

and our ability to manage the life cycle of our brands, remain

current with fashion trends, and develop and launch new

merchandise, product lines and brands successfully;

- our ability to realize the

potential benefits and synergies sought with the acquisition of

AdoreMe, Inc.;

- our ability to incorporate artificial intelligence into our

business operations successfully and ethically while effectively

managing the associated risks;

- our ability to source materials and

produce, distribute and sell merchandise on a global basis,

including risks related to:

- political instability and

geopolitical conflicts;

- environmental hazards and natural

disasters;

- significant health hazards and

pandemics;

- delays or disruptions in shipping

and transportation and related pricing impacts; and

- disruption due to labor

disputes;

- our geographic concentration of

production and distribution facilities in central Ohio and

Southeast Asia;

- the ability of our vendors to

manufacture and deliver products in a timely manner, meet quality

standards and comply with applicable laws and regulations;

- fluctuations in freight, product

input and energy costs;

- our and our third-party service

providers’ ability to implement and maintain information technology

systems and to protect associated data and system

availability;

- our ability to maintain the

security of customer, associate, third-party and company

information;

- stock price volatility;

- shareholder activism matters;

- our ability to maintain our credit

rating;

- our ability to comply with

regulatory requirements; and

- legal, tax, trade and other

regulatory matters.

Except as may be required by law, we assume no

obligation and do not intend to make publicly available any update

or other revisions to any of the forward-looking statements

contained in this press release to reflect circumstances existing

after the date of this press release or to reflect the occurrence

of future events, even if experience or future events make it clear

that any expected results expressed or implied by those

forward-looking statements will not be realized. Additional

information regarding these and other factors can be found in “Item

1A. Risk Factors” in our Annual Report on Form 10-K filed with the

Securities and Exchange Commission on March 22, 2024.

For further information, please contact:

| Victoria’s Secret & Co.: |

|

| Investor Relations: |

Media Relations: |

| Kevin Wynk |

Brooke Wilson |

| investorrelations@victoria.com |

communications@victoria.com |

| |

|

Total Net Sales (Millions):

| |

FirstQuarter2024 |

|

FirstQuarter2023 |

|

%Inc/(Dec) |

| |

|

|

|

|

|

|

Stores – North America |

$ |

729.1 |

|

$ |

785.8 |

|

(7.2 |

%) |

| Direct |

|

448.8 |

|

|

464.5 |

|

(3.4 |

%) |

| International1 |

|

181.5 |

|

|

157.1 |

|

15.6 |

% |

| Total |

$ |

1,359.4 |

|

$ |

1,407.4 |

|

(3.4 |

%) |

1 – Results include consolidated joint venture sales in China,

royalties associated with franchised stores and wholesale

sales.

Comparable Sales Increase (Decrease):

| |

FirstQuarter2024 |

|

FirstQuarter2023 |

| |

|

|

|

|

Stores and Direct1 |

(5 |

%) |

|

(11 |

%) |

| Stores Only2 |

(8 |

%) |

|

(14 |

%) |

NOTE: Please refer to our

filings with the Securities and Exchange Commission for further

discussion regarding our comparable sales calculation.1 – Results

include company-operated stores in the U.S. and Canada,

consolidated joint venture stores in China and direct sales.2 –

Results include company-operated stores in the U.S. and Canada and

consolidated joint venture stores in China.

Total Stores:

|

|

Stores at 2/3/24 |

Opened |

Closed |

Stores at 5/4/24 |

| |

|

|

|

|

|

Company-Operated: |

|

|

|

|

| U.S. |

808 |

2 |

(5) |

805 |

| Canada |

23 |

- |

- |

23 |

| Subtotal

Company-Operated |

831 |

2 |

(5) |

828 |

| |

|

|

|

|

| China Joint

Venture: |

|

|

|

|

| Beauty &

Accessories1 |

34 |

1 |

- |

35 |

| Full

Assortment |

36 |

- |

- |

36 |

| Subtotal China

Joint Venture |

70 |

1 |

- |

71 |

| |

|

|

|

|

|

Partner-Operated: |

|

|

|

|

| Beauty &

Accessories |

307 |

7 |

(4) |

310 |

| Full

Assortment |

156 |

11 |

(4) |

163 |

| Subtotal

Partner-Operated |

463 |

18 |

(8) |

473 |

| |

|

|

|

|

| Adore Me |

6 |

- |

- |

6 |

| |

|

|

|

|

|

Total |

1,370 |

21 |

(13) |

1,378 |

1 – Includes fourteen partner-operated stores at 5/4/24.

| VICTORIA'S

SECRET & CO. |

| CONSOLIDATED

STATEMENTS OF INCOME (LOSS) |

| THIRTEEN

WEEKS ENDED MAY 4, 2024 AND APRIL 29, 2023 |

|

(Unaudited) |

| (In

thousands except per share amounts) |

| |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

| Net

Sales |

$ |

1,359,442 |

|

|

$ |

1,407,380 |

|

| Costs of

Goods Sold, Buying and Occupancy |

|

(858,127 |

) |

|

|

(904,986 |

) |

| Gross

Profit |

|

501,315 |

|

|

|

502,394 |

|

| General,

Administrative and Store Operating Expenses |

|

(475,046 |

) |

|

|

(474,120 |

) |

| Operating

Income |

|

26,269 |

|

|

|

28,274 |

|

| Interest

Expense |

|

(21,735 |

) |

|

|

(22,505 |

) |

| Other

Income |

|

327 |

|

|

|

3 |

|

| Income

Before Income Taxes |

|

4,861 |

|

|

|

5,772 |

|

| Provision

for Income Taxes |

|

7,345 |

|

|

|

1,960 |

|

| Net Income

(Loss) |

|

(2,484 |

) |

|

|

3,812 |

|

| Less: Net

Income Attributable to Noncontrolling Interest |

|

1,158 |

|

|

|

3,087 |

|

| Net Income

(Loss) Attributable to Victoria's Secret & Co. |

$ |

(3,642 |

) |

|

$ |

725 |

|

| Net Income

(Loss) Per Diluted Share Attributable to Victoria's Secret &

Co. |

$ |

(0.05 |

) |

|

$ |

0.01 |

|

| Weighted

Average Shares Outstanding 1 |

|

77,949 |

|

|

|

79,671 |

|

| |

|

|

|

|

1 - Reported Weighted Average Shares Outstanding in the first

quarter of 2024 reflects basic shares due to the Net Loss. |

| |

|

|

|

| VICTORIA'S

SECRET & CO. |

| NON-GAAP

FINANCIAL INFORMATION |

|

(Unaudited) |

| (In

thousands except per share amounts) |

| In addition to our

results provided in accordance with GAAP, provided below are

non-GAAP financial measures that present operating income, net

income attributable to Victoria's Secret & Co. and net income

per diluted share attributable to Victoria's Secret & Co. on an

adjusted basis, which remove certain non-recurring, infrequent or

unusual items that we believe are not indicative of the results of

our ongoing operations due to their size and nature. The intangible

asset amortization excluded from these non-GAAP financial measures

is excluded because the amortization, unlike the related revenue,

is not affected by operations of any particular period unless an

intangible asset becomes impaired or the estimated useful life of

an intangible asset is revised. We use adjusted financial

information as key performance measures of our results of

operations for the purpose of evaluating performance internally.

These non-GAAP measurements are not intended to replace the

presentation of our financial results in accordance with GAAP.

Instead, we believe that the presentation of adjusted financial

information provides additional information to investors to

facilitate the comparison of past and present operations. Further,

our definition of non-GAAP financial measures may differ from

similarly titled measures used by other companies. The table below

reconciles the most directly comparable GAAP financial measure to

each non-GAAP financial measure. |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

First Quarter |

| |

|

|

|

2024 |

|

|

|

2023 |

|

|

Reconciliation of Reported to Adjusted Operating

Income |

|

|

|

|

|

Reported Operating Income - GAAP |

|

$ |

26,269 |

|

|

$ |

28,274 |

|

|

Adore Me Acquisition-related Items (a) |

|

|

7,053 |

|

|

|

9,321 |

|

|

Amortization of Intangible Assets (b) |

|

|

6,284 |

|

|

|

6,284 |

|

|

Restructuring Charge (c) |

|

|

- |

|

|

|

11,125 |

|

|

Adjusted Operating Income |

|

$ |

39,606 |

|

|

$ |

55,004 |

|

| |

|

|

|

|

|

|

Reconciliation of Reported to Adjusted Net Income (Loss)

Attributable to Victoria's Secret & Co. |

|

|

|

|

|

Reported Net Income (Loss) Attributable to Victoria's Secret &

Co. - GAAP |

|

$ |

(3,642 |

) |

|

$ |

725 |

|

|

Adore Me Acquisition-related Items (a) |

|

|

8,148 |

|

|

|

10,416 |

|

|

Amortization of Intangible Assets (b) |

|

|

6,284 |

|

|

|

6,284 |

|

|

Restructuring Charge (c) |

|

|

- |

|

|

|

11,125 |

|

|

Tax Effect of Adjusted Items |

|

|

(1,685 |

) |

|

|

(6,640 |

) |

|

Adjusted Net Income Attributable to Victoria's Secret &

Co. |

|

$ |

9,105 |

|

|

$ |

21,910 |

|

| |

|

|

|

|

|

| Reconciliation

of Reported to Adjusted Net Income (Loss) Per Diluted Share

Attributable to Victoria's Secret & Co. |

|

Reported Net Income (Loss) Per Diluted Share Attributable to

Victoria's Secret & Co. - GAAP |

|

$ |

(0.05 |

) |

|

$ |

0.01 |

|

|

Adore Me Acquisition-related Items (a) |

|

|

0.10 |

|

|

|

0.10 |

|

|

Amortization of Intangible Assets (b) |

|

|

0.06 |

|

|

|

0.06 |

|

|

Restructuring Charge (c) |

|

|

- |

|

|

|

0.10 |

|

|

Adjusted Net Income Per Diluted Share Attributable to Victoria's

Secret & Co. |

|

$ |

0.12 |

|

|

$ |

0.28 |

|

| |

|

|

|

|

|

|

(a) |

In the first quarter of 2024, we recognized an $8.1 million pre-tax

charge ($8.1 million net of tax of less than $0.1 million), $7.0

million included in general, administrative and store operating

expense and $1.1 million included in interest expense, related to

the financial impact of purchase accounting items related to the

acquisition of Adore Me. In the first quarter of 2023, we

recognized a $10.4 million pre-tax charge ($8.2 million net of tax

of $2.2 million), $8.6 million included in costs of goods sold,

$1.1 million included in interest expense, and $0.7 million

included in general, administrative and store operating expense,

related to the financial impact of purchase accounting items and

professional service costs related to the acquisition of Adore

Me. |

|

(b) |

In both the first quarter of 2024 and 2023, we recognized $6.3

million of amortization expense ($4.7 million net of tax of $1.6

million) included in general, administrative and store operating

expense related to the acquisition of Adore Me. |

|

(c) |

In the first quarter of 2023, we recognized an $11.1 million

pre-tax charge ($8.4 million net of tax of $2.7 million), $7.8

million included in general, administrative and store operating

expense and $3.3 million included in buying and occupancy expense,

related to restructuring activities to continue to reorganize and

improve our organizational structure. |

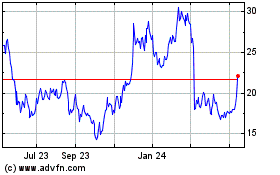

Victoria's Secret (NYSE:VSCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

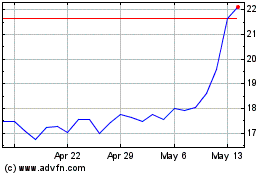

Victoria's Secret (NYSE:VSCO)

Historical Stock Chart

From Jan 2024 to Jan 2025