VAALCO Energy, Inc. Provides Update on Operations in Gabon

August 30 2023 - 10:24AM

VAALCO Energy, Inc. (NYSE: EGY; LSE: EGY) (“VAALCO” or the

“Company”) today provided an update on operations in offshore

Gabon.

The Company’s Gabonese production is 100%

offshore and all of VAALCO’s Gabon operations continue to operate

normally. The Etame field completed a lifting of approximately

641,000 barrels of oil from Etame on Sunday, August 27, 2023.

VAALCO has diversified its scope of operations and has ongoing

production activities in Gabon, Egypt and Canada.

About VAALCO

VAALCO, founded in 1985 and incorporated under

the laws of Delaware, is a Houston, Texas, USA based, independent

energy company with production, development and exploration assets

in Africa and Canada.

Following its business combination with

TransGlobe Energy Corporation (“TransGlobe”) in October 2022,

VAALCO owns a diverse portfolio of operated production, development

and exploration assets across Gabon, Egypt, Equatorial Guinea and

Canada.

For Further Information

|

|

|

| VAALCO Energy, Inc.

(General and Investor Enquiries) |

+00 1 713 623 0801 |

| Website: |

www.vaalco.com |

| |

|

| Al Petrie Advisors (US

Investor Relations) |

+00 1 713 543 3422 |

| Al Petrie / Chris Delange |

|

| |

|

| Buchanan (UK Financial

PR) |

+44 (0) 207 466 5000 |

| Ben Romney / Barry Archer |

VAALCO@buchanan.uk.com |

| |

|

Forward Looking Statements

This press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”) and Section 21E of the

Securities Exchange Act of 1934, as amended, which are intended to

be covered by the safe harbors created by those laws and other

applicable laws and “forward-looking information” within the

meaning of applicable Canadian securities laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

All statements other than statements of historical fact may be

forward-looking statements. The words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,”

“target,” “will,” “could,” “should,” “may,” “likely,” “plan” and

“probably” or similar words may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements in

this press release include, but are not limited to, statements

relating to (i) VAALCO’s ability to realize the anticipated

benefits and synergies expected from the acquisition of TransGlobe;

(ii) estimates of future drilling, production, sales and costs of

acquiring crude oil, natural gas and natural gas liquids; (iii)

estimates of future cost reductions, synergies, including pre-tax

synergies, savings and efficiencies; (iv) expectations regarding

VAALCO’s ability to effectively integrate assets and properties it

acquired as a result of the acquisition of TransGlobe into its

operations; (v) the amount and timing of stock buybacks, if any,

under VAALCO’s stock buyback program and VAALCO’s ability to

enhance stockholder value through such plan; (vi) expectations

regarding future exploration and the development, growth and

potential of VAALCO’s operations, project pipeline and investments,

and schedule and anticipated benefits to be derived therefrom;

(vii) expectations regarding future acquisitions, investments or

divestitures; (viii) expectations of future dividends, buybacks and

other potential returns to stockholders; (ix) expectations of

future balance sheet strength; (x) expectations of future equity

and enterprise value; (xi) expectations of the continued listing of

VAALCO’s common stock on the NYSE and LSE (xii) VAALCO’s ability to

finalize documents and effectively execute the POD for the Venus

development in Block P; and (xiii) operations in countries with

attendant political risks.

Such forward-looking statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the forward-looking statements. These risks

and uncertainties include, but are not limited to: risks relating

to any unforeseen liabilities of VAALCO or TransGlobe; the tax

treatment of the business combination with TransGlobe in the United

States and Canada; declines in oil or natural gas prices; the level

of success in exploration, development and production activities;

adverse weather conditions that may negatively impact development

or production activities; the right of host governments in

countries where we operate to expropriate property and terminate

contracts (including the Etame production sharing contract and the

Block P PSC) for reasons of public interest, subject to reasonable

compensation, determinable by the respective government in its

discretion; the final terms of the agreements pertaining to Block P

in Equatorial Guinea, which remain under negotiation; the timing

and costs of exploration and development expenditures; inaccuracies

of reserve estimates or assumptions underlying them; revisions to

reserve estimates as a result of changes in commodity prices;

impacts to financial statements as a result of impairment

write-downs; the ability to generate cash flows that, along with

cash on hand, will be sufficient to support operations and cash

requirements; the ability to attract capital or obtain debt

financing arrangements; currency exchange rates and regulations;

actions by joint venture co-owners; hedging decisions, including

whether or not to enter into derivative financial instruments;

international, federal and state initiatives relating to the

regulation of hydraulic fracturing; failure of assets to yield oil

or gas in commercially viable quantities; uninsured or underinsured

losses resulting from oil and gas operations; inability to access

oil and gas markets due to market conditions or operational

impediments; the impact and costs of compliance with laws and

regulations governing oil and gas operations; the ability to

replace oil and natural gas reserves; any loss of senior management

or technical personnel; competition in the oil and gas industry;

the risk that the business combination with TransGlobe may not

increase VAALCO’s relevance to investors in the international

E&P industry, increase capital market access through scale and

diversification or provide liquidity benefits for stockholders;

political risks to operations, including in Gabon; and other risks

described under the caption “Risk Factors” in VAALCO’s 2022 Annual

Report on Form 10-K filed with the SEC on April 6, 2023.

Dividends beyond the third quarter of 2023

have not yet been approved or declared by the Board of Directors

for VAALCO. The declaration and payment of future dividends and the

terms of share buybacks remains at the discretion of the Board and

will be determined based on VAALCO’s financial results, balance

sheet strength, cash and liquidity requirements, future prospects,

crude oil and natural gas prices, and other factors deemed relevant

by the Board. The Board reserves all powers related to the

declaration and payment of dividends and the terms of share

buybacks. Consequently, in determining the dividend to be declared

and paid on VAALCO common stock or the terms of share buybacks, the

Board may revise or terminate the payment level or buyback terms at

any time without prior notice.

Inside Information

This announcement contains inside information as

defined in Regulation (EU) No. 596/2014 on market abuse which is

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (“MAR”) and is made in accordance with the

Company’s obligations under article 17 of MAR. The person

responsible for arranging the release of this announcement on

behalf of VAALCO is Matthew Powers, Corporate Secretary of

VAALCO.

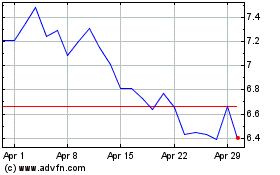

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

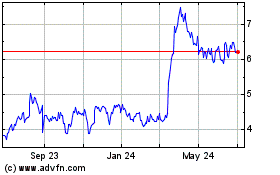

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Nov 2023 to Nov 2024