$54.7 Billion in 4Q20 Loan Volume; 4Q20

Production grows 71% as Compared to Q419

UWM Holdings Corporation (NYSE: UWMC), the publicly

traded indirect parent of United Wholesale Mortgage (“UWM”), the #1

wholesale mortgage lender in America, today announced UWM’s results

for the fourth quarter and full year ended December 31, 2020. UWM

reported 4Q20 net income of $1.37 billion and FY20 net income of

$3.38 billion, an 821% and 715% increase over 4Q19 and FY19

respectively. The Board of Directors of UWMC declared its first

regular quarterly dividend of $0.10 per share on the outstanding

shares of Class A Common Stock. The dividend is payable on April 6,

2021 to stockholders of record at the close of business on March

10, 2021.

Mat Ishbia, President and CEO of UWM said: “The fourth quarter

and 2020 overall was phenomenal for UWM and the wholesale channel

by any measure. We are very proud of what we accomplished in 2020

but have shifted our focus to 2021 and beyond. By going public and

accessing the debt markets, we now have the capital and liquidity

to not only invest in technology and service as we have always

done, but also the ability to take advantage of higher profit

opportunities when available or otherwise returning excess cash to

our stockholders. Independent mortgage brokers are the best place

for a consumer to get a loan, and as we progress through 2021, our

100% focus on the wholesale channel remains steadfast. We will

continue to work with the growing number of independent mortgage

brokers to provide the fastest, easiest and most cost effective way

to get a mortgage, helping even more families achieve their dream

of home ownership.”

Fourth Quarter and Full Year 2020 Financial

Highlights

- Record originations of $54.7 billion in loan volume, a 71%

increase from the 4Q19 $31.9 billion loan volume, bringing UWM’s

full year 2020 production to $182.5 billion, which is 69% higher

than UWM’s prior record production for 2019 of $107.8 billion.

- Total gain margin of 305 bps in 4Q20 compared to 110 bps in

4Q19.

- Reported fourth quarter net income of $1.37 billion, as

compared to $148.9 million for 4Q19.

- Increased UWM’s equity to $2.37 billion at December 31, 2020 as

compared to $661.3 million at December 31, 2019.

- Closed private senior notes offering of $800 million, ending

4Q20 with non-funding debt to equity ratio of 0.49 (non-GAAP metric

– see discussion below).

- Increased the unpaid principal balance of mortgage servicing

rights from $72.6 billion at Q419 to $188.3 billion at Q420.

Production and Income Statement

Highlights (dollars in thousands)

Closed loan volume(1)

Total gain margin(1)(2)

Q4 2020

Q4 2019

$

54,678,923

$

31,908,320

3.05

%

1.10

%

Net income

$

1,371,791

$

148,858

Comparable net income(3)

$

1,001,925

$

108,723

(1) Key operational metric – see

discussion below.

(2) Represents total loan production

income divided by total production.

(3) Non-GAAP metric – see discussion

below.

Balance Sheet Highlights (dollars in

thousands)

Q4 2020

Q4 2019

Cash and cash equivalents

$

1,223,837

$

133,283

Mortgage loans at fair value

$

7,916,515

$

5,446,310

Mortgage servicing rights, net

$

1,756,864

$

731,353

Total assets

$

11,493,476

$

6,654,094

Non-funding debt (1)

$

1,159,283

$

406,000

UWM equity

$

2,374,280

$

661,323

Non-funding debt to equity (1)

0.49

0.61

(1) Non-GAAP metric – please see

discussion below.

Mortgage Servicing Rights (dollars in

thousands)

Q4 2020

Q4 2019

Unpaid principal balance

$

188,268,883

$

72,589,639

Weighted average interest rate

3.13%

3.98%

Weighted average age (months)

6

3

Operational Highlights

- UWM maintained an average application to clear to close time

(“Days to Close”) of approximately 18 days in Q420, while

management’s estimate of the industry average grew to approximately

52 days1, 10 days higher than the nine month average of 42 days1 as

of September 2020. For the month of December, UWM Days to Close was

approximately 16 days, while management’s estimate of the industry

average grew to approximately 54 days.1

- Our commitment to high credit quality is evidenced by a

weighted average FICO of 760 for the loans closed in the fourth

quarter 2020 and 757 for the full year 2020. The credit quality of

UWM originations is reflected in the MSR 60+ delinquency and

forbearance rates which are well below industry averages.

- UWM’s highly successful Conquest program launch grew even

further in the fourth quarter with the addition of the FHA product,

joining previously released Conquest programs for Conventional and

VA products. With this announcement, UWM is extending access to

these very low interest rates to a larger consumer base. Conquest

program loans represented 87.6% of total production in 4Q20.

- Increased the number of team members from 4,907 at December 31,

2019 to 7,475 at December 31, 2020 with plans to continue growing

throughout 2021.

- Enhanced the Pontiac campus by completing a walking bridge to

tie our approximately 600,000 square foot “North Campus” to our

more recently added “South Campus” which is located in a 900,000

square foot building owned by a UWM affiliate. During fourth

quarter 2020, an affiliate of UWM also purchased a neighboring

facility of approximately 378,000 square feet.

- Commenced plans to restart jumbo offerings which are expected

to go live in March 2021 and will also materially increase purchase

volume during the remainder of 2021.

The wholesale channel, UWM’s sole focus, continues to be viewed

as the growth channel of the residential mortgage industry,

represented 17.2% of the total mortgage market for the nine months

ended September 30, 2020, which is the most recent data point

available2. Likewise, UWM continued its dominant position in the

wholesale channel, growing its market share to 34.3% for the nine

months ended September 30, 2020, which is the most recent data

point available3.

Technology Update

- Launched UWM InTouch, a mobile app that provides the ability

for Independent Mortgage Brokers to navigate everything from

Underwriting until the loan is Cleared to Close from anywhere they

have their phone. Including, document upload, e-sign capabilities,

push notifications and more.

- Launched Blink+, an enhancement to the online mortgage

application launched in 2016, which includes the ability to

automatically pull credit, e-sign docs and co-browse screens with

borrowers, Blink+ is a Point of Sale (POS), Loan Origination System

(LOS) and Customer Relationship Manager (CRM) all-in-one package

that UWM makes available as one of its many partnership initiatives

to Independent Mortgage Brokers.

1

Internal company data and Ellie Mae

Origination Insight Report (the “Ellie Mae Report”). The Ellie Mae

Report reflects application to close, as such for comparative

purposes, management has reduced the average by an estimate of 4

days.

2

Source: Inside Mortgage Finance – Direct

Funded First-Lien Mortgage Origination Data, Copyright 2020

3

Source: Inside Mortgage Finance – Top

Wholesale Broker Channels Data, Copyright 2020

Product and Investor Mix -

Unpaid Principal Balance (dollars in thousands)

Purchase:

Q4 2020

YTD 2020

Q4 2019

YTD 2019

Conventional

$

10,638,926

$

33,717,939

$

7,485,001

$

33,091,673

Jumbo

661

583,299

620,186

3,570,532

Government

1,457,197

8,619,874

3,457,882

13,151,943

Total Purchase

$

12,096,784

$

42,921,112

$

11,563,069

$

49,814,148

Refinance:

Q4 2020

YTD 2020

Q4 2019

YTD 2019

Conventional

$

37,647,428

$

119,807,647

$

15,518,218

$

43,116,040

Jumbo

—

897,409

663,074

2,425,666

Government

4,934,711

18,921,473

4,163,959

12,411,318

Total Refinance

$

42,582,139

$

139,626,529

$

20,345,251

$

57,953,024

Total Originations

$

54,678,923

$

182,547,641

$

31,908,320

$

107,767,172

- UWM’s purchase volume for 4Q2020 increased to $12.1 billion, as

compared to $11.6 billion in 4Q19. For FY20, purchase volume

decreased to $42.9 billion, as compared to $49.8 billion in total

purchase volume in FY19, primarily due to a strategic reduction in

the jumbo and government purchase business.

- UWM originated $42.6 billion in refinance volume during 4Q20,

as compared to $20.3 billion in 4Q19. UWM originated $139.6 billion

in refinance volume in FY20 and $57.9 billion in FY19. UWM’s 2020

production mix was comprised of 76% refinance and 24%

purchase.

- UWM’s primary focus is originating conventional loans. In 2020,

conventional loans represented 84% of total production.

First Quarter 2021 Outlook

We expect the following ranges compared to the year-earlier

period:

- Closed loan volume between $52 billion and $57 billion, which

would represent an increase of 22.6% and 34.4% as compared to $42.4

billion in the first quarter of 2020.

- Total gain margin of 200-235 bps, which would be an increase of

110.5%-142.1% compared to 95 bps in the first quarter of 2020.

Earnings Conference Call Details

As previously announced, UWMC will hold a conference call for

financial analysts and investors on Thursday, February 4 at 10 AM

ET to review the results and answer questions. The call in numbers

are:

- Conference ID 6596094

- Participant Toll-Free Dial-In Number: (833) 794-1164

- Participant International Dial-In Number: (236) 714-2757

- Conference Call name: UWM Holdings Corporation 4Q 2020 Earnings

Call

Please dial in at least 15 minutes in advance to ensure a timely

connection to the call. Audio, webcast, taped replay and transcript

will be available on the UWM investor relations website at

https://investors.uwm.com/.

Key Operational Metrics

“Closed loan volume” and “Total gain margin” are key operational

metrics that UWM management uses to evaluate the performance of the

business. “Closed loan volume” is the aggregate principal of the

residential mortgage loans originated by UWM during a period.

“Total gain margin” represents total loan production income divided

by total production.

Non-GAAP Metrics

As UWM is a pass-through entity, Net income does not reflect

income tax that would otherwise be payable by UWM with respect to

its income if it were a C Corporation. Therefore, for comparison

purposes, UWM provides “Comparable net income”, which is our net

income adjusted for a 27% estimated effective tax rate. “Comparable

net income” is a Non-GAAP Metric. Commencing with first quarter

2021 results, UWMC will be reporting Net income at the UWMC level

on an after-tax basis, along with Net Income attributable to UWMC

shareholders and Net Income Attributable to the Non-Controlling

Interest in UWM.

In addition, we disclose “Non-funding debt” and the “Non-funding

debt to equity ratio” as a Non-GAAP metric. We define “Non-funding

debt” as UWM’s total of operating lines of credit, senior notes,

equipment note payable, and finance leases as reported on our

balance sheet, and the “Non-funding debt to equity ratio” as

Non-funding debt divided by UWM’s total equity.

Management believes that these Non-GAAP metrics provide useful

information to investors. These measures are not financial measures

calculated in accordance with GAAP and should not be considered as

a substitute for any other operating performance measure calculated

in accordance with GAAP, and may not be comparable to a similarly

titled measure reported by other companies.

The following table presents these non-GAAP financial measures

along with their most directly comparable financial measure

calculated in accordance with GAAP (dollars in thousands):

Comparable net income

Q4 2020

Q4 2019

Net Income

$

1,371,791

$

148,858

Impact of estimated effective tax rate of

27%

(369,866

)

(40,135

)

Comparable net income

$

1,001,925

$

108,723

Non-funding debt and non-funding debt

to equity

Q4 2020

Q4 2020

Senior note bond

$

789,323

$

—

Line of credit, net

320,300

376,000

Equipment note payable

26,528

30,000

Finance leases

23,132

—

Total non-funding debt

$

1,159,283

$

406,000

Total equity

$

2,374,280

$

661,323

Non-funding debt to equity

0.49

0.61

Forward Looking Statements

This press release contains and the earnings call will contain

forward-looking statements. These forward-looking statements are

generally identified by the use of words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” and similar words indicating that these

reflect our views with respect to future events. These

forward-looking statements include (1) the impact of the going

public and accessing the debt markets on our ability to invest in

technology and services as well as other higher profit

opportunities or the ability to return cash to our stockholders,

(2) impact of the Conquest program and our restart of jumbo

offerings on our future financial and operational results, and (3)

our expectations for 2021 financial and operational results. These

statements are based on our management’s current expectations, but

are subject to risks and uncertainties, many of which are outside

of our control, and could cause future events or results to be

materially different from those stated or implied in this document,

including (i) UWM’s dependence on macroeconomic and U.S.

residential real estate market conditions, including changes in

U.S. monetary policies that affect interest rates; (ii) UWM’s

reliance on its warehouse facilities; the risk of a decrease in the

value of the collateral underlying certain of its facilities

causing an unanticipated margin call; (iii) UWM’s ability to sell

loans in the secondary market; (iv) UWM’s dependence on the

government sponsored entities such as Fannie Mae and Freddie Mac;

(v) changes in the GSEs’, FHA, USDA and VA guidelines or GSE and

Ginnie Mae guarantees; (vi) UWM’s dependence on Independent

Mortgage Advisors to originate mortgage loans; (vii) the risk that

an increase in the value of the MBS UWM sells in forward markets to

hedge its pipeline may result in an unanticipated margin call;

(viii) UWM’s inability to continue to grow, or to effectively

manage the growth of, its loan origination volume; (ix) UWM’s

ability to continue to attract and retain its Independent Mortgage

Advisor relationships; (x) UWM’s ability to implement technological

innovation; (xi) UWM’s ability to continue to comply with the

complex state and federal laws regulations or practices applicable

to mortgage loan origination and servicing in general; and (xii)

other risks and uncertainties indicated from time to time in our

filings with the Securities and Exchange Commission including those

under “Risk Factors” therein. You are cautioned not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made.

About UWM Holdings Corporation and United Wholesale

Mortgage

Headquartered in Pontiac, Michigan, UWM Holdings Corporation is

the publicly traded indirect parent of United Wholesale Mortgage

(“UWM”). UWM is the #1 wholesale lender in the nation six years in

a row, providing state-of-the-art technology and unrivaled client

service. UWM underwrites and provides closing documentation for

residential mortgage loans originated by independent mortgage

brokers, correspondents, small banks and local credit unions. UWM

is known for its highly efficient, accurate and expeditious lending

support. UWM’s exceptional teamwork and focus on technology result

in the delivery of innovative mortgage solutions that drive the

company’s ongoing growth in market share and its leadership

position as the foremost advocate for independent mortgage brokers.

For more information, visit www.uwm.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210203005942/en/

For inquiries regarding UWM, please contact: INVESTOR

CONTACT MATT ROSLIN InvestorRelations@uwm.com MEDIA CONTACT NICOLE

YELLAND Media@uwm.com

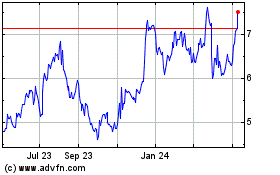

UWM (NYSE:UWMC)

Historical Stock Chart

From Dec 2024 to Jan 2025

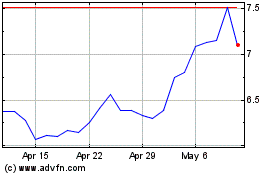

UWM (NYSE:UWMC)

Historical Stock Chart

From Jan 2024 to Jan 2025