Study finds that upgrade of U. S. Steel’s Mon

Valley Works facilities would lead to nearly 5,000 construction

jobs and $38 million in taxes

United States Steel Corporation (NYSE: X) (“U. S. Steel”)

released a new economic impact analysis today, conducted by Parker

Strategy Group, that assesses how the proposed $1 billion

investment committed by Nippon Steel Corporation (“Nippon Steel”)

to modernize U. S. Steel’s Mon Valley Works following the closing

of the pending merger with U. S. Steel would generate a significant

economic impact in Pennsylvania.

For the purposes of the study, construction ($600 million) and

equipment costs ($400 million) are separated and it is assumed that

$600 million of the $1 billion investment would be spent in

Pennsylvania.

Considering the supply chain and labor realities that would

reduce in-state spending for any major construction project in the

Mon Valley, the study looked at a range of spending scenarios.

According to the study, if just 80% of the $600 million

construction project is spent in Pennsylvania, the Nippon Steel

investment would generate a $952.9 million incremental economic

impact over a two-year timeframe.

Nippon Steel is committed to investing no less than $1 billion

in the Mon Valley Works operations following closing of the

transaction to extend the production life of integrated assets and

enhance the security of steel supply to American manufacturers.

Together with the previously announced $1.4 billion capital

expenditures in BLA-covered facilities, these investments are

strong commitments to the region and union-represented facilities

that go well beyond what is currently required by the Basic Labor

Agreement.

Among the findings, the study showed concentrated economic

impact to Southwest Pennsylvania and increased impact if

construction dollars are spent in Pennsylvania.

“Not only will this deal secure U. S. Steel’s Pennsylvania

footprint – an economic boon benefiting communities and employees –

the Nippon Steel investment in Mon Valley Works facilities would

cause a positive ripple effect across the Pennsylvania economy,”

said President and Chief Executive Officer of U. S. Steel David B.

Burritt. “While the economic impact is undeniable, what is most

heartening is the consequential economic and generational impact

this investment will have on the families and communities of the

Mon Valley.”

The study predicts that when just 40% of the investment is spent

in state it would create nearly 2,500 jobs and generate an almost

half billion-dollar economic impact (2,432 jobs, $476.4 million

total impact) over a two-year period.

When 80% of the project costs are spent in Pennsylvania, the

impact increases dramatically doubling the number of jobs created

(4,864 jobs) and generating almost $1 billion in economic impact

($952.9 million total impact) over a two-year period.

“The Nippon Steel investment makes possible a generational

upgrade at the Mon Valley Works facilities that will only occur if

the transaction closes,” said Scott Buckiso, Senior Vice President

& Chief Manufacturing Officer, North American Flat-Rolled

Segment. “With a new lease on life, these facilities would support

and sustain jobs at U. S. Steel and across the region for small

businesses that depend on our continued presence in the Mon

Valley.”

Read the full economic impact study here.

A 2023 economic impact study showed that U. S. Steel’s

operations in PA generated $3.6 billion in total economic impact,

supported and sustained 11,417 jobs through its operations and

purchases from the local supply chain, and generated $138.2 million

in state and local taxes as a result of operations and capital

spending.

About U. S. Steel

Founded in 1901, United States Steel Corporation is a leading

steel producer. With an unwavering focus on safety, the Company’s

customer-centric Best for All® strategy is advancing a more secure,

sustainable future for U. S. Steel and its stakeholders. With a

renewed emphasis on innovation, U. S. Steel serves the automotive,

construction, appliance, energy, containers, and packaging

industries with high value-added steel products such as U. S.

Steel’s proprietary XG3® advanced high-strength steel. The Company

also maintains competitively advantaged iron ore production and has

an annual raw steelmaking capability of 22.4 million net tons. U.

S. Steel is headquartered in Pittsburgh, Pennsylvania, with

world-class operations across the United States and in Central

Europe. For more information, please visit www.ussteel.com.

About Parker Strategy Group

With over 50 years of combined experience, Parker Strategy Group

is a national consulting firm specializing in economic impact with

extensive experience across the government, corporate, and

non-profit sectors. We are committed to delivering statistically

valid, industry-respected results that give organizations the

confidence that their analysis is both defensible and actionable

for internal and external audiences.

Led by Nichole Parker, a national economic impact expert with

over 30 years of experience and more than 600 economic impact

studies, Parker Strategy Group excels in producing economic

analysis that is both defensible and easily understood. Nichole’s

deep expertise as an economic analyst enables clients to

confidently explain their impact to key audiences. Past and current

clients include FGS Global, University of Washington, Penn State

University, and the Association of Independent Colleges of

Pennsylvania.

www.parkerstrategygroup.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains information regarding United States

Steel Corporation (the “Company”) that may constitute

“forward-looking statements,” as that term is defined under the

Private Securities Litigation Reform Act of 1995 and other

securities laws, that are subject to risks and uncertainties. We

intend the forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements in those sections.

Generally, such forward-looking statements are identified by using

the words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,”

“future,” “will,” “may” and similar expressions or by using future

dates in connection with any discussion of, among other things,

statements regarding the proposed transaction between the Company

and Nippon Steel Corporation and the potential impact of

investments that Nippon Steel may make in certain of the Company’s

facilities. However, the absence of these words or similar

expressions does not mean that a statement is not forward-looking.

Forward-looking statements include all statements that are not

historical facts. Many of these statements depend on matters which,

by their nature, are inherently uncertain and outside of the

Company’s control. Caution should be taken not to place undue

reliance on any such forward-looking statements because such

statements speak only as of the date when made. In addition,

forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially

from present expectations or projections. Risks and uncertainties

include without limitation: the ability of the parties to

consummate the proposed transaction between the Company and Nippon

Steel Corporation, on a timely basis or at all; the timing, receipt

and terms and conditions of any required governmental and

regulatory approvals of the proposed transaction; the occurrence of

any event, change or other circumstances that could give rise to

the termination of the definitive agreement and plan of merger

relating to the proposed transaction (the “Merger Agreement”); and

the risk that the parties to the Merger Agreement may not be able

to satisfy the conditions to the proposed transaction in a timely

manner or at all. The Company directs readers to its Form 10-K for

the year ended December 31, 2023, and Quarterly Report on Form 10-Q

for the quarter ended June 30, 2024, and the other documents it

files with the SEC for other risks associated with the Company’s

future performance. These documents contain and identify important

factors that could cause actual results to differ materially from

those contained in the forward-looking statements. The Company does

not undertake any duty to update any forward-looking statement to

conform the statement to actual results or changes in the Company’s

expectations whether as a result of new information, future events

or otherwise, except as required by law.

Disclaimer

This economic analysis report is an independent analysis of

Parker Strategy Group and is based upon certain information

provided by United States Steel Corporation and is subject to

certain assumptions. The conclusions presented in the report are

the result of Parker Strategy Group’s independent analysis and have

not been verified by United States Steel Corporation, Nippon Steel

Corporation or their affiliates. Actual outcomes may differ.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001378845/en/

U. S. Steel Media Relations T - (412) 433-1300 E -

media@uss.com

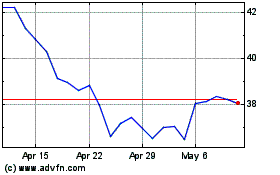

US Steel (NYSE:X)

Historical Stock Chart

From Nov 2024 to Dec 2024

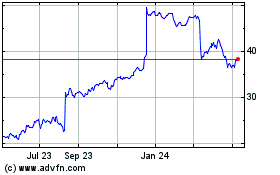

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2023 to Dec 2024