Seven in Ten Companies Plan to Increase Retail Media Budgets, But Scale and Measurement Remain Key Barriers

February 04 2025 - 8:00AM

TransUnion (NYSE: TRU) announced today newly commissioned research

by The Path to Purchase Institute (P2PI), the 2025 Annual Trends

Study, highlighting continued growth in retail media investment

alongside persistent challenges in optimizing these platforms. The

study reveals that 70% of companies plan to increase their retail

media budgets in 2025. However, persistent challenges such as

scale, targeting, and measurement remain key obstacles to broader

growth across the retail industry.

"Retail media is undeniably reshaping the way

brands connect with shoppers, but proving its value isn’t always

straightforward," said Mark Rose, senior director, market strategy

for TransUnion’s retail business. "Brands face challenges with

targeting and measurement consistency across retailers, as well as

comparing ROI across retail media and other digital media channels.

The key is solving these challenges with the development of aligned

best practices to broaden participation in retail media growth

industry-wide.”

Brands are optimistic on the future of

retail media Eighty percent (80%) of marketers recognize

the value of retail media, saying it is as effective or more

effective than other digital channels. Whereas annual trade budgets

have traditionally formed the basis for retail media budgets, the

survey found that 70% of retail media spending was incremental to

those annual budgets.

Accordingly, respondents reported that retail

media spending was less likely to come from trade budgets

(decreasing from 26% of retail media spending in 2024 to 20% in

2024) and increasingly from media budgets (increase from 74% of

retail media spending in 2023 to 80% in 2024).

Identifying room for improvement

However, gaps in measurement and ROI attribution across retailers

remain critical barriers. The study identifies key priorities for

marketers to address these issues, including:

- 88% seek proof of sales lift and ROI from campaigns

- 45% prioritize comparable cross-retailer measurement and

attribution

- 42% call for standardized metrics and definitions

- 39% emphasize the need for offline and online

attribution

The research found significant differences in

retail media networks across the industry. On average, brands were

3.4x more likely to rate the largest national retailer platforms as

Excellent or Very Good in capabilities related to scale, targeting,

and measurement.

“As retailers adopt industry standards they will

see improved ratings,” added Rose. “However, retailers beyond the

largest national platforms will also need to simplify and

streamline how brands can partner with them for large-reach

national campaigns.”

Areas in Which Retailers are Rated as

Having Very Good or Excellent Capabilities

|

Retailer Type |

Traffic-driving |

Targeting |

Measurement |

Sales Growth |

ROI |

|

National Platforms |

45% |

50% |

49% |

43% |

42% |

|

Broader Retail Industry* |

15% |

16% |

11% |

13% |

15% |

*National and regional retailers excluding the

national platforms

According to the report, brands currently work

with an average of eight retail media networks, with nearly half

(49%) engaging with no more than five networks. National retailer

platforms lead in adoption, reflecting their competitive advantage

in targeting, traffic-driving, and measurement

capabilities.

"Retail media can reshape how brands connect with

consumers, but we must address its challenges head-on to ensure its

actual growth meets projections, and in a way that enables broad

participation across the retail industry," Rose concluded. "Focus

on scale, targeting, and measurement is key to unlocking its full

potential for everyone involved."

Explore the full findings of the 2025 Annual

Trends Study and learn how these insights can inform your

strategy.

Click here for more information about TransUnion’s

TruAudience® marketing solutions.

About the 2025 Annual Trends

Study The 2025 Annual Trends Study was conducted by the

Path to Purchase Institute between August 26 and October 9, 2024,

surveying 67 professionals working with retailer media networks.

The study focuses on trends in retail media investment, engagement,

and performance, offering actionable insights for brands and

retailers.

About TransUnion (NYSE: TRU)

TransUnion is a global information and insights company with over

13,000 associates operating in more than 30 countries. We make

trust possible by ensuring each person is reliably represented in

the marketplace. We do this with a Tru™ picture of each person: an

actionable view of consumers, stewarded with care. Through our

acquisitions and technology investments we have developed

innovative solutions that extend beyond our strong foundation in

core credit into areas such as marketing, fraud, risk and advanced

analytics. As a result, consumers and businesses can transact with

confidence and achieve great things. We call this Information for

Good® — and it leads to economic opportunity, great experiences and

personal empowerment for millions of people around the world.

http://www.transunion.com/business

|

|

|

|

Contact |

Dave Blumberg |

|

|

TransUnion |

|

E-mail |

david.blumberg@transunion.com |

|

|

|

|

Telephone |

312-972-6646 |

|

|

|

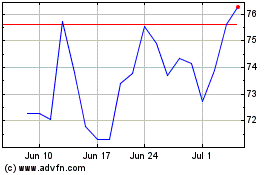

TransUnion (NYSE:TRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

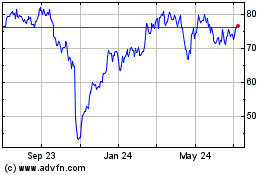

TransUnion (NYSE:TRU)

Historical Stock Chart

From Feb 2024 to Feb 2025