false

0001051512

0001051512

2024-05-28

2024-05-28

0001051512

TDS:CommonShares01ParValueMember

2024-05-28

2024-05-28

0001051512

us-gaap:PreferredStockMember

2024-05-28

2024-05-28

0001051512

TDS:PreferredStockMember2Member

2024-05-28

2024-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 28, 2024

TELEPHONE AND DATA SYSTEMS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-14157 |

|

36-2669023 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

30 North LaSalle Street, Suite 4000,

Chicago, Illinois 60602

(Address of principal executive offices and zip

code)

Registrant's telephone number, including area code: (312) 630-1900

Not Applicable

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

|

|

|

| ¨ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities

registered pursuant to Section 12(b) of the Act: |

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange

on which registered |

| Common

Shares, $.01 par value |

|

TDS |

|

New

York Stock Exchange |

| Depositary Shares each representing a 1/1000th interest in a share of 6.625% Series UU Cumulative Redeemable Perpetual Preferred Stock, $.01 par value |

|

TDSPrU |

|

New

York Stock Exchange |

| Depositary Shares each representing a 1/1000th interest in a share of 6.000% Series VV Cumulative Redeemable Perpetual Preferred Stock, $.01 par value |

|

TDSPrV |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| ¨ |

Emerging

growth company |

| |

|

| ¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 8.01. Other Events

On May 28, 2024, Telephone and Data

Systems, Inc. (“TDS”) (i) issued a press release announcing that its board of directors unanimously approved

the execution of a Securities Purchase Agreement (the “Purchase Agreement”) by and among TDS, United States Cellular Corporation

(“Seller”), T-Mobile US, Inc. (“Buyer”) and USCC Wireless Holdings, LLC, pursuant to which, among other things,

Seller has agreed to sell its wireless operations and select spectrum assets to Buyer for a purchase price, subject to adjustment as specified

in the Purchase Agreement, (the “Purchase Price”) of $4,400,000,000, payable in cash and the assumption of up to approximately

$2,000,000,000 in debt (the “Transaction”) and (ii) made available an investor presentation with regard to the Transaction.

A copy of the press release is furnished herewith as Exhibit 99.1 and a copy of the investor presentation is furnished herewith as

Exhibit 99.2; both documents are incorporated in this Item 8.01 by reference.

Item 9.01. Financial Statements and Exhibits

(d) The following exhibits are being filed

herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

TELEPHONE AND DATA SYSTEMS, INC. |

| |

|

|

| Date: |

May 28, 2024 |

By: |

/s/ Vicki L. Villacrez |

| |

|

|

Vicki L. Villacrez |

| |

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

TDS Board Announces Unanimous

Support for Sale of UScellular’s Wireless Operations and Select Spectrum Assets to T-Mobile

TDS believes transaction delivers

significant value to UScellular customers and shareholders

TDS announces second quarter

2024 dividends

TDS and UScellular to hold conference

call at 8:30 a.m. Central Time

CHICAGO (May 28, 2024) – Telephone

and Data Systems, Inc. (“TDS”) (NYSE: TDS) today indicated its board of directors unanimously approved the

definitive agreement reached by TDS and United States Cellular Corporation (“UScellular”) (NYSE: USM) to sell

UScellular’s wireless operations and approximately 30% of its spectrum assets to T-Mobile for a purchase price of $4.4

billion, including a combination of cash and up to approximately $2 billion of assumed debt. The agreement follows

the thorough strategic review process announced in August 2023.

“Over the past four decades, TDS has supported the growth and

development of UScellular, its wireless business and the company’s mission to connect people to what matters most. Continuing to

deliver for UScellular’s customers requires a level of scale and investment that is best achieved by integrating its wireless operations

with those of T-Mobile. We are confident that T-Mobile is the right partner and now is the right time to divest the operations,”

said Walter C. D. Carlson, Chair of the TDS Board. “T-Mobile’s robust capabilities and offerings will enhance service, choice,

and value for UScellular’s wireless customers, while the financial terms will deliver significant shareholder value and position

UScellular with a healthy balance sheet and a transformed tower infrastructure business poised for strong growth and value creation.”

In addition to the sale of the wireless operations and select spectrum

assets for $4.4 billion in cash and assumed debt, and the considerable benefits to customers as a result of the transaction, UScellular

will benefit from the potential to opportunistically monetize the retained spectrum, which represents approximately 70% of total spectrum

assets across several spectrum bands. UScellular’s tower assets will represent one of the largest tower businesses in the United

States, and following the transaction, T-Mobile will be a long-term tenant on a minimum of 2,015 incremental towers owned by UScellular,

and extend the lease term for the approximately 600 towers where T-Mobile is already a tenant. This will ensure continued, uninterrupted

service for UScellular customers and create a long-term contracted revenue stream from a strong anchor tenant for at least 15 years after

the close of the transaction. UScellular also retains its significant equity method investment interests, primarily from its wireless

partnerships, that generated $158 million of equity method income and $150 million in distributions in 2023.

While decisions regarding the distribution of proceeds from the sale

of the wireless operations will be determined solely by the UScellular board of directors, TDS will receive such proceeds in proportion

to its ownership of UScellular. To the extent cash distributions are made to UScellular shareholders, including from proceeds, if any,

related to the monetization of retained spectrum assets, TDS will utilize such proceeds in the best interests of its shareholders. Depending

on the amount of proceeds, those uses are expected to include continuing to invest in the company’s fiber build-out program and

reducing leverage levels, and may include return of capital to shareholders and the pursuit of other opportunities to grow the business.

Carlson continued, “As UScellular works to complete this transaction,

TDS remains committed to executing on our strategy to grow our fiber footprint while increasing broadband penetrations and improving profitability.

This includes bringing fiber to small and mid-sized, suburban and rural communities across the United States.”

Other Transaction Details

TDS, in its role as the 83 percent shareholder of UScellular, has delivered

its written consent approving the transaction. The transaction is expected to close in mid-2025,

subject to the receipt of regulatory approvals and the satisfaction of customary closing conditions.

For more information, please refer to the release filed today by UScellular,

which can be accessed in UScellular’s website at https://investors.uscellular.com.

Advisors

Citigroup Global Markets Inc. is serving as lead financial advisor,

Centerview Partners LLC is serving as financial advisor and Sidley Austin LLP is serving as lead legal advisor to TDS. TD Securities (USA)

LLC and Wells Fargo are also serving as financial advisors to TDS for the transaction. PJT Partners LP is serving as financial advisor

and Cravath, Swaine & Moore LLP is serving as legal advisor to the independent directors of UScellular. Clifford Chance LLP and Wilkinson

Barker Knauer, LLP are also serving as legal advisors to UScellular and TDS for the transaction.

Capital Allocation Strategy and Dividends

TDS remains confident in its plans to drive growth

and create value by investing in fiber expansion. To support those plans, TDS is resetting its approach to capital allocation. Specifically,

the Board has declared dividends for the second quarter 2024 at approximately 20% of the previous level for its Common Shares and Series

A shares. This shift in approach is expected to free up additional capital that can be used to support the company’s fiber program,

among other purposes. No changes are anticipated in the dividends to be paid on the Series UU and Series VV preferred shares.

TDS is paying a quarterly dividend of $0.04 per Common

Share and Series A Common Share payable on June 28, 2024, to holders of record on June 14, 2024.

TDS is paying a quarterly dividend of $414.0625 per

share on the company’s 6.625% Series UU Preferred shares; holders of depositary shares will receive $0.4140625 per depositary share

payable on July 1, 2024, to holders of record on June 15, 2024.

TDS is paying a quarterly dividend of $375.0000 per

share on the company’s 6.000% Series VV Preferred shares; holders of depositary shares will receive $0.3750000 per depositary share

payable on July 1, 2024, to holders of record on June 15, 2024.

The tickers for the TDS Common shares is “TDS”,

the Series UU depositary shares is “TDSPrU” and the Series VV depositary shares is “TDSPrV”.

Conference Call Information

TDS and UScellular will hold a joint conference call on May 28, 2024,

at 8:30 a.m. Central Time.

| · | Access

the live call on TDS Events & Presentations or UScellular Events & Presentations

or at https://events.q4inc.com/attendee/598119900 |

| · | Access the call by phone at (800) 715-9871 (U.S./Canada), conference ID:

2264212 |

Before the call, information to be discussed during the call will

be posted to TDS Events & Presentations. The call will be archived on TDS Events & Presentations and UScellular

Events & Presentations.

About TDS

Telephone and Data Systems, Inc. (TDS), a Fortune 1000® company,

provides wireless; broadband, video and voice; and hosted and managed services to approximately 6 million connections nationwide through

its businesses, UScellular, TDS Telecom, and OneNeck IT Solutions. Founded in 1969 and headquartered in Chicago, TDS employed approximately

8,600 associates as of March 31, 2024.

Visit investors.tdsinc.com for comprehensive financial information,

including earnings releases, quarterly and annual filings, shareholder information and more.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995: Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: All information set forth

in this news release, except historical and factual information, represents forward-looking statements. This includes all statements about

the company’s plans, beliefs, estimates, and expectations about the consummation and benefits of the proposed transactions, including

anticipated synergies, and T-Mobile’s, UScellular’s and TDS’ plans, objectives, expectations and intentions, and the

expected timing of completion of the proposed transaction. These statements are based on current plans, estimates, projections, and assumptions,

and the anticipated timing of completion of the proposed transactions, which involve certain risks and uncertainties that could cause

actual results to differ materially from those in the forward-looking statements. Important factors that may affect these forward-looking

statements include, but are not limited to: the failure to obtain, or delays in obtaining, required regulatory approvals and the risk

that such approvals may be conditioned upon or result in the imposition of terms or conditions that could adversely affect the expected

benefits of the proposed transaction; the failure to satisfy any of the other conditions to the proposed transaction on a timely basis,

or at all; the occurrence of events that may allow one or more parties to terminate the definitive agreement; the adverse effects on TDS’,

UScellular’s or T-Mobile’s common stock and on TDS’, UScellular’s or T-Mobile’s operating results because

of a failure to complete the proposed transactions in the anticipated timeframe or at all; adverse changes in the ratings of TDS’,

UScellular’s or T-Mobile’s debt securities or adverse conditions or disruptions in the financial or credit markets; negative

effects of the announcement, pendency or consummation of the transaction on TDS’ or UScellular’s operating results, including

as a result of changes in key customer, supplier, employee or other business relationships; significant transaction costs and unknown

liabilities; failure to realize the expected benefits and synergies of the proposed transaction in the expected timeframes or at all;

costs or difficulties related to the integration of UScellular’s network and operations into T-Mobile’s; the risk of litigation

or regulatory actions, including antitrust litigation; the risk that certain contractual restrictions contained in the definitive agreement

during the pendency of the proposed transaction could adversely affect TDS’ or UScellular’s ability to pursue business opportunities

or strategic transactions; effects of changes in the state or federal regulatory environment in which TDS, UScellular and T-Mobile operate;

intense competition; the ability of UScellular to obtain or maintain leases for its towers; the ability of TDS, UScellular and T-Mobile

to retain and attract people of outstanding talent throughout all levels of the organization; ’advances in technology; impacts of

costs, integration problems or other factors associated with expansion of TDS’ businesses; the ability of UScellular to successfully

construct and manage its towers; difficulties involving third parties with which TDS and UScellular does business; uncertainties in TDS’

and UScellular’s future cash flows and liquidity and access to the capital markets; the ability to make payments on TDS and UScellular

indebtedness or comply with the terms of debt covenants; changes in tax rules or pronouncements; inability to timely and successfully

execute on its fiber expansion plans or to realize significant incremental revenue from its deployment; the possibility that the Board

of Directors of TDS or UScellular will not declare dividends; conditions in the U.S. telecommunications industry; the value of assets

and investments; pending and future litigation; cyber-attacks or other breaches of network or information technology security; control

by the TDS Voting Trust; deterioration of U.S. or global economic conditions; unpredictability and severity of catastrophic events, including

but not limited to acts of terrorism, war or hostilities, as well as management’s response to any of the aforementioned factors;

and the impact, duration and severity of public health emergencies. Investors are encouraged to consider these and other risks and uncertainties

that are more fully described under “Risk Factors” in the most recent filing of TDS’ Form 10-K.

Additional Information and Where to Find It

UScellular will prepare an information statement on Schedule 14C for

its shareholders with respect to the transaction described herein. When completed, the information statement will be delivered to UScellular’s

shareholders. You may obtain copies of all documents filed by UScellular with the SEC regarding this transaction, free of charge, at the

SEC’s website, www.sec.gov or from UScellular’s website at https://investors.uscellular.com.

Exhibit 99.2

| Sale of Wireless Operations and

Select Spectrum Assets

May 28, 2024 |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

Forward-Looking Statements

2

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: All information set forth in this presentation, except historical and factual information,

represents forward-looking statements. This includes all statements about the company’s plans, beliefs, estimates, and expectations about the consummation and benefits of the

proposed transactions, including anticipated synergies, and T-Mobile’s and UScellular’s plans, objectives, expectations and intentions, and the expected timing of completion of the

proposed transaction. These statements are based on current plans, estimates, projections, and assumptions, and the anticipated timing of completion of the proposed transactions,

which involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Important factors that may affect these

forward-looking statements include, but are not limited to: the failure to obtain, or delays in obtaining, required regulatory approvals and the risk that such approvals may be

conditioned upon or result in the imposition of terms or conditions that could adversely affect the expected benefits of the proposed transaction; the failure to satisfy any of the other

conditions to the proposed transaction on a timely basis, or at all; the occurrence of events that may allow one or more parties to terminate the definitive agreement; the adverse

effects on UScellular’s or T-Mobile’s common stock and on UScellular’s or T-Mobile’s operating results because of a failure to complete the proposed transactions in the anticipated

timeframe or at all; adverse changes in the ratings of UScellular’s or T-Mobile’s debt securities or adverse conditions or disruptions in the financial or credit markets; negative effects

of the announcement, pendency or consummation of the transaction on UScellular’s operating results, including as a result of changes in key customer, supplier, employee or other

business relationships; significant transaction costs and unknown liabilities; failure to realize the expected benefits and synergies of the proposed transaction in the expected

timeframes or at all; costs or difficulties related to the integration of UScellular’s network and operations into T-Mobile’s; the risk of litigation or regulatory actions, including antitrust

litigation; the risk that certain contractual restrictions contained in the definitive agreement during the pendency of the proposed transaction could adversely affect UScellular’s ability

to pursue business opportunities or strategic transactions; effects of changes in the state or federal regulatory environment in which UScellular and T-Mobile operate; intense

competition; the ability of UScellular and T-Mobile to retain and attract people of outstanding talent throughout all levels of the organization; the ability of UScellular to obtain or

maintain leases for its towers; advances in technology; the ability of the company to successfully construct and manage its towers; difficulties involving third parties with which

UScellular does business; uncertainties in UScellular’s future cash flows and liquidity and access to the capital markets; the ability to make payments on UScellular indebtedness or

comply with the terms of debt covenants; changes in tax rules or pronouncements; the possibility that the Board of Directors of UScellular will not declare dividends; conditions in the

U.S. telecommunications industry; the value of assets and investments; pending and future litigation; cyber-attacks or other breaches of network or information technology security;

potential conflicts of interests between TDS and UScellular; deterioration of U.S. or global economic conditions; unpredictability and severity of catastrophic events, including but not

limited to acts of terrorism, war or hostilities, as well as management’s response to any of the aforementioned factors; and the impact, duration and severity of public health

emergencies. Investors are encouraged to consider these and other risks and uncertainties that are more fully described under “Risk Factors” in the most recent filing of UScellular’s

Form 10-K.

Additional Information and Where to Find It

UScellular will prepare an information statement on Schedule 14C for its shareholders with respect to the approval of the transaction described herein. When completed, the

information statement will be mailed to UScellular’s shareholders. You may obtain copies of all documents filed by UScellular with the SEC regarding this transaction, free of charge,

at the SEC’s website, www.sec.gov or from UScellular’s website at https://investors.uscellular.com. |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

3

Call Participants

Laurent “LT” Therivel

President and Chief Executive Officer, UScellular

Doug Chambers

Executive Vice President, Chief Financial Officer and

Treasurer, UScellular

Vicki Villacrez

Executive Vice President and

Chief Financial Officer, TDS |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

Transaction Overview

4

• Sale of wireless operations and select spectrum assets to T-Mobile for $4.4 billion purchase price payable in

combination of cash and up to $2 billion in assumed debt

• Wireless operations include: subscribers, network assets and operations (excluding owned towers), sales and

distribution, and customer care

• Up to $100 million of the purchase price is contingent on certain financial and operational metrics between

signing and closing and is subject to other adjustments as specified in the purchase agreement

• Transaction expected to close in mid-2025, subject to regulatory approval and satisfaction of customary

closing conditions

Wireless

Operations

• T-Mobile to enter into a new, 15-year Master License Agreement (MLA) with UScellular on a minimum of

2,015 incremental UScellular towers following the transaction

• T-Mobile to extend the term of its tenancy on the ~600 sites where T-Mobile is already a tenant for 15 years

post-transaction

Tower

MLA

• T-Mobile will acquire approximately 30% of UScellular’s spectrum portfolio, including all of the company’s 600

MHz(1) and 2.5 GHz, as well as the majority of its 700 MHz A Block, AWS and PCS holdings Spectrum

(1) ~39% subject to a put/call agreement. To the extent the put/call is exercised, an incremental $106 million of purchase price will be due. |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

Transaction Delivers Significant Benefits to Customers

5

Lower Prices

UScellular customers will

have the opportunity to

change to T-Mobile's

lower-priced comparable

plans with no switching

costs

Increased Rural

Coverage

Significantly expands

coverage across rural

America for the customers

of both companies

Better Network

Experience

Customers will get a

superior performance

and speed experience

on the integrated

network

More Choices

Access to T-Mobile’s

“Un-carrier” benefits

including content offers,

additional savings for

seniors, and more

robust customer service

options |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

Unlocking Value for All Stakeholders – “What’s Staying”

6

Retained Spectrum

UScellular retains a

majority of existing

wireless spectrum portfolio

– including Cellular, C-Band,

and 3.45 GHz

Transformed Tower

Business

Long-term MLA with T-Mobile

+ Existing third-party

colocations solidify the 5

th

largest tower portfolio in

the US

Equity Method

Investment Interests

Retained equity method

investment interests

generate meaningful

income and distributions |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

UScellular is Retaining ~70% of its Spectrum Portfolio

7

Spectrum

• T-Mobile to acquire bands of

UScellular’s spectrum that most

seamlessly integrate into their

existing network

• UScellular will seek to

opportunistically monetize

retained spectrum

Acquired Retained

Low & Mid-Band MHz POPs (1)

4,161mm MHz POPs(3)

1,969mm MHz POPs(3)

594

319

563

443

50

8,973

700 MHz (A Block) (30%)

700 MHz (B/C Block)

Cellular

AWS (4%)

PCS (7%)

3.45 GHz

CBRS

C-Band

28 GHz(3)

37/39 GHz(3)

(1) King Street and Advantage MHz POPs are included in the graph.

(2) ~39% subject to a put/call agreement. To the extent the put/call is exercised, an incremental $106 million of

purchase price will be due.

(3) Quantification of mmWave MHz POPs not included in the graph.

133

333

663

25

33

1,252

78

1,644

7,492

9,967

Band MHz POPs

600 MHz(2)

700 MHz (A Block) (70%)

AWS (96%)

PCS (93%)

2.5 GHz

24 GHz(3)

Band MHz POPs |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

A Transformed UScellular Tower Business

8

• T-Mobile to become a long-term tenant on a minimum of 2,015(2)

incremental towers with expected minimum incremental cash rentals of

$56 million in the first full year post-close

• MLA term is subject to annual escalators at customary market rates

• T-Mobile to extend its tenancy on the ~600 sites where T-Mobile is a

tenant today for 15 years following the close of the transaction

• 15-year committed term for new and existing T-Mobile tower leases

provides substantial contracted revenue for UScellular

• T-Mobile to have an interim lease on remaining towers to ensure a

smooth network integration for T-Mobile and a seamless transition

experience for UScellular’s wireless customers

• Additional financial details on the tower business will be provided at a

future date

• Transaction solidifies position as the 5th largest tower company in the

U.S.

34%

27%

26%

13%

AT&T Verizon T-Mobile Other

Current Tower Revenue Post-Transaction Tower Details

Distribution(1)

(as of 4Q’23)

(1) Excluding the impact of new MLA. (2) Total commitment of 2,100 incremental towers; 2,015 towers in UScellular’s consolidated group,

and 85 towers in entities where UScellular owns a noncontrolling interest |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

UScellular Shareholders to Continue to Benefit from

Cash Flows from Equity Method Investment Interests

• UScellular to retain its non-operating equity method investment interests

that generated $158 million of equity method income and $150 million in

distributions in 2023

• Equity method investments expected to continue to deliver steady

source of cash flows to UScellular

9 |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

Exchange Offer for UScellular Debt Holders

T-Mobile to conduct exchange offer at par under which debt holders of the following UScellular debt

will have the choice to exchange their UScellular debt for T-Mobile debt with the same coupon,

maturity, and principal value

10

Exchangeable Notes Maturity Principal Value

($ in millions)

Unsecured 6.7% Senior Notes Due 2033 Dec ’33 $544

Unsecured 6.3% Senior Notes Due 2069 Sep ’69 $500

Unsecured 5.5% Senior Notes Due 2070 Mar ’70 $500

Unsecured 5.5% Senior Notes Due 2070 Jun ’70 $500 |

| Contains UScellular confidential information. Not for external use or disclosure without proper authorization.

TDS Fully Supports the Transaction

• Successful outcome creates significant value for UScellular and TDS stakeholders

• Potential return of capital to UScellular shareholders (including TDS) would:

• Enhance funding of the fiber program to expand broadband throughout the U.S.

• Growing fiber footprint through the fiber expansion program

• Bringing higher speeds to rural America though the Enhanced A-CAM program

• Strengthen the TDS balance sheet

• Resetting TDS capital allocation strategy:

• Support advancement of fiber deployment

• Improved leverage over time

• Continue paying common share dividend but at a lower rate than previous levels

11

TDS remains committed to bringing connectivity to communities across the United States |

| Q&A |

Cover

|

May 28, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 28, 2024

|

| Entity File Number |

001-14157

|

| Entity Registrant Name |

TELEPHONE AND DATA SYSTEMS, INC.

|

| Entity Central Index Key |

0001051512

|

| Entity Tax Identification Number |

36-2669023

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

30 North LaSalle Street, Suite 4000

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60602

|

| City Area Code |

312

|

| Local Phone Number |

630-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Shares, $.01 par value [Member] |

|

| Title of 12(b) Security |

Common

Shares, $.01 par value

|

| Trading Symbol |

TDS

|

| Security Exchange Name |

NYSE

|

| Preferred Stock [Member] |

|

| Title of 12(b) Security |

Depositary Shares each representing a 1/1000th interest in a share of 6.625% Series UU

|

| Trading Symbol |

TDSPrU

|

| Security Exchange Name |

NYSE

|

| Depositary Shares each representing a 1/1000th interest in a share of 6.000% Series VV Cumulative Redeemable Perpetual Preferred Stock, $.01 par value [Member] |

|

| Title of 12(b) Security |

Depositary Shares each representing a 1/1000th interest in a share of 6.000% Series VV

|

| Trading Symbol |

TDSPrV

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TDS_CommonShares01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TDS_PreferredStockMember2Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

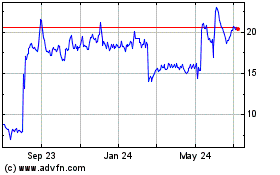

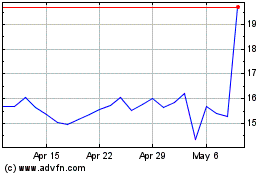

Telephone and Data Systems (NYSE:TDS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Telephone and Data Systems (NYSE:TDS)

Historical Stock Chart

From Dec 2023 to Dec 2024