0001549922FALSE00015499222023-10-032023-10-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 3, 2023

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35666 | | 45-5200503 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrants’ telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units | SMLP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 3, 2023, Summit Midstream Partners, LP (the “Partnership,” “we” and “our”) issued a press release announcing an operational update for the third quarter of 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Item 2.02 shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission, whether or not filed under the Securities Act of 1933 or the 1934 Act, regardless of any general incorporation language in such document.

Item 8.01 Other Events.

On October 3, 2023, we announced a financial and operational update for the third quarter of 2023. We estimate that, for the quarter ended September 30, 2023, our volumes experienced growth across nearly every segment, including approximately 20% volume growth in our Northeast segment and approximately 20% liquids volume growth in the Rockies segment. Furthermore, we expect our Adjusted EBITDA (as defined below) for the quarter ended September 30, 2023 to be approximately $70 million, representing approximately 20% growth relative to the quarter ended June 30, 2023. We connected an estimated 74 wells during the quarter, resulting in an estimated 224 wells connected year-to-date, and expect to remain on pace to connect a total of approximately 300 wells by the end of 2023.

Our estimates of third quarter financial and operational data are subject to our quarterly review procedures and are subject to change. Any such change may be material. These preliminary results reflect our current estimates based on information available as of the date hereof and are the responsibility of our management. Our independent registered public accounting firm has not completed its review of our preliminary results for our quarter ended September 30, 2023, and such preliminary results have not been audited, reviewed, compiled, or had agreed upon procedures applied by our independent registered public accounting firm.

Strategic Review

Based on the Partnership’s recent and expected financial performance, as well as interest recently received from third parties for potential transactions, ranging from the sale of specific assets to consideration for the whole Partnership, the Partnership announced that its Board of Directors has engaged external advisors to evaluate strategic alternatives for the Partnership with the goal of maximizing value for the Partnership's unitholders.

These alternatives may include, but are not limited to, continued execution of the Partnership's business plan, sale of assets, refinancing parts or the entirety of its capital structure, sale of the Partnership by merger or cash, or any combination of these and other alternatives.

While the Board of Directors conducts its review, the Partnership remains focused on its operational performance and execution of its business strategy to increase unitholder value.

There is no deadline or definitive timetable set for completion of the strategic alternatives review and no guarantee that the process will result in the Partnership pursuing a transaction or other strategic outcome or, if a transaction is undertaken, the terms or timing of such a transaction. The Partnership does not intend to make further public comment regarding the review until it has been completed or the Partnership determines that a disclosure is required by law or otherwise deemed appropriate.

Volume Throughput

The below table summarizes the Partnership’s volume throughput for the quarter ended June 30, 2023 and estimates of the Partnership’s approximate volume throughput for the quarter ended September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023

Actual | | Q3 2023

Estimate | | Quarter-

over-

Quarter Change

(%) | | Current (4) |

| Average daily throughput (MMcf/d): | | | | | | | |

Northeast (1) | 629 | | | 750 | | 19 | % | | 810 |

| Rockies | 99 | | | 115 | | 16 | % | | 125 |

| Piceance | 297 | | | 310 | | 4 | % | | 300 |

| Barnett | 182 | | | 170 | | (7) | % | | 190 |

| Aggregate average daily throughput | 1,207 | | | 1,345 | | 11 | % | | 1,425 |

| | | | | | | |

| Average daily throughput (Mbbl/d): | | | | | | | |

| Rockies | 71 | | | 85 | | 20 | % | | 85 |

| Aggregate average daily throughput | 71 | | | 85 | | 20 | % | | 85 |

| | | | | | | |

Ohio Gathering average daily throughput (MMcf/d) (2) | 781 | | | 870 | | 11 | % | | N/A |

| | | | | | | |

Double E average daily throughput (MMcf/d) (3) | 243 | | | 325 | | 34 | % | | 425 |

(1)Exclusive of Ohio Gathering Company, L.L.C. and Ohio Condensate Company, L.L.C. (“Ohio Gathering”) and Double E Pipeline, LLC (“Double E”) due to equity method accounting.

(2)Gross basis, represents 100% of volume throughput for Ohio Gathering, subject to a one-month lag.

(3)Gross basis, represents 100% of volume throughput for Double E.

(4)Represents estimated average daily volume from September 26, 2023 through September 30, 2023 for all operated assets and Double E.

The Partnership’s average daily natural gas throughput for its wholly owned operated systems is expected to increase 11% to approximately 1,345 MMcf/d, and liquids volumes are expected to increase 20% to approximately 85 Mbbl/d, relative to the second quarter of 2023. Ohio Gathering Company, L.L.C. (“OGC”) natural gas throughput expected to increase 11% to approximately 870 MMcf/d relative to the second quarter of 2023. Double E Pipeline gross volumes transported are expected to increase 34% to approximately 325 MMcf/d relative to the second quarter of 2023.

Natural gas-price driven segments:

Northeast segment volumes are expected to increase 19% on our wholly owned systems and 11% from our OGC joint venture, relative to the second quarter of 2023. 14 new wells were brought online behind our wholly owned Summit Midstream Utica (“SMU”) system and 8 new wells were connected behind our OGC joint venture during the third quarter. The 14 new wells behind our SMU system were brought online throughout the third quarter. As such, current operated volumes are trending approximately 60 MMcf/d higher than expected as-reported third quarter volumes. We expect approximately 10 new wells to be connected during the fourth quarter. There are currently three rigs running and 14 drilled but uncompleted wells (“DUCs”) behind our systems.

Piceance segment volumes expected to increase 4% relative to the second quarter of 2023, primarily due to 12 new wells connected during the third quarter. We expect approximately 20 new wells to be connected during the fourth quarter. There is currently one rig running and 21 DUCs behind the system.

Barnett segment volumes are expected to decrease 7% relative to the second quarter of 2023, primarily due to the continuation of production being temporarily shut-in by one of our customers. We estimate these curtailments impacted segment volumes by approximately 20 MMcf/d during the quarter. Our anchor customer completed 6 new wells in September that has increased segment volumes to approximately 190 MMcf/d currently. While we do not expect any new wells during the fourth quarter, our anchor customer is expected to bring online 11 new wells during the first quarter of 2024. There is currently one rig running and 18 DUCs behind the system.

Oil price-driven segments:

Permian segment volumes expected to increase 34% relative to the second quarter of 2023. Our anchor customer behind the Double E Pipeline started to increase production during the quarter and is currently running 13 rigs in New Mexico, relative to a low of two rigs during the pandemic. The volume increase occurred throughout the quarter, with current volumes trending at approximately 425 MMcf/d, or 100 MMcf/d above expected as-reported third quarter volumes. We remain confident in the fundamental long-term outlook for the Double E Pipeline with 105 rigs running in Eddy and Lea Counties, New Mexico currently and the recent and expected trajectory of our anchor customer’s production in the basin.

Rockies segment natural gas and liquids volumes expected to increase 16% and 20%, respectively, relative to the second quarter of 2023. Current natural gas volumes are trending approximately 10 MMcf/d higher than expected as-reported third quarter volumes and we continue to expect volumes to increase in the fourth quarter due to the 38 Denver-Julesburg Basin (“DJ Basin”) wells connected during the second quarter. There were 34 new wells connected during the quarter, including 6 in the DJ Basin and 28 in the Williston Basin. We expect over 50 new wells to be connected during the fourth quarter, including over 40 new wells in the DJ Basin that are expected to reach peak production in the second quarter of 2024. One of our anchor customers in the Williston announced the acquisition of our other anchor customer during the quarter. While integration has historically delayed development for a few months, we are excited about the highly contiguous pro forma dedicated acreage position. We expect this will enable our anchor customer to develop more 3-mile laterals versus 2-mile laterals, historically. There are currently three rigs running and approximately 117 DUCs behind the systems.

Adjusted EBITDA

We define Adjusted EBITDA as net income or loss, plus interest expense, income tax expense, depreciation and amortization, our proportional Adjusted EBITDA for equity method investees, adjustments related to MVC shortfall payments, adjustments related to capital reimbursement activity, unit-based and noncash compensation, impairments, items of income or loss that we characterize as unrepresentative of our ongoing operations and other noncash expenses or losses, income tax benefit, income (loss) from equity method investees and other noncash income or gains. Because Adjusted EBITDA may be defined differently by other entities in our industry, our definition of this non-GAAP financial measure may not be comparable to similarly titled measures of other entities, thereby diminishing its utility.

Management uses Adjusted EBITDA in making financial, operating and planning decisions and in evaluating our financial performance. Furthermore, management believes that Adjusted EBITDA may provide external users of our financial statements, such as investors, commercial banks, research analysts and others, with additional meaningful comparisons between current results and results of prior periods as they are expected to be reflective of our core ongoing business.

Adjusted EBITDA is used as a supplemental financial measure to assess:

•the ability of our assets to generate cash sufficient to make future potential cash distributions and support our indebtedness;

•the financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

•our operating performance and return on capital as compared to those of other entities in the midstream energy sector, without regard to financing or capital structure;

•the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities; and

•the financial performance of our assets without regard to (i) income or loss from equity method investees, (ii) the impact of the timing of minimum volume commitment shortfall payments under our gathering agreements or (iii) the timing of impairments or other income or expense items that we characterize as unrepresentative of our ongoing operations.

Adjusted EBITDA has limitations as an analytical tool and investors should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. For example:

•certain items excluded from Adjusted EBITDA are significant components in understanding and assessing an entity’s financial performance, such as an entity’s cost of capital and tax structure;

•Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

•Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and

•although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements.

We compensate for the limitations of Adjusted EBITDA as an analytical tool by reviewing the comparable GAAP financial measures, understanding the differences between the financial measures and incorporating these data points into our decision-making process.

We do not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because we are unable to predict, without unreasonable effort, certain components thereof including, but not limited to, (i) income or loss from equity method investees and (ii) asset impairments. These items are inherently uncertain and depend on various factors, many of which are beyond our control. As such, any associated estimate and its impact on our GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.

Forward Looking Statements

This Current Report on Form 8-K includes certain statements concerning expectations for the future that are forward-looking within the meaning of the federal securities laws. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would,” and “could”, any statement concerning future financial or operational performance (including future revenues, earnings or growth rates), ongoing business strategies, the timing and outcome of our strategic review and possible actions taken by us or our subsidiaries are also forward-looking statements. Forward-looking statements also contain known and unknown risks and uncertainties (many of which are difficult to predict and beyond management’s control) that may cause the Partnership’s actual results in future periods to differ materially from anticipated or projected results. An extensive list of specific material risks and uncertainties affecting the Partnership is contained in its 2022 Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2023, as amended and updated from time to time. Any forward-looking statements in this Current Report on Form 8-K are made as of the date of this Current Report on Form 8-K, and the Partnership undertakes no obligation to update or revise any forward-looking statements to reflect new information or events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Summit Midstream Partners, LP |

| | (Registrant) |

| | |

| | By: | Summit Midstream GP, LLC (its general partner) |

| | |

| Dated: | October 5, 2023 | /s/ William J. Mault |

| | William J. Mault, Executive Vice President and Chief Financial Officer |

| | | | | |

|

Summit Midstream Partners, LP 910 Louisiana Street, Suite 4200 Houston, TX 77002 |

Summit Midstream Partners, LP Provides Operational Update, Announces Review of Strategic Alternatives and Schedules Third Quarter 2023 Earnings Call

Houston, Texas (October 3, 2023) – Summit Midstream Partners, LP (NYSE: SMLP) (“Summit”, “SMLP” or the “Partnership”) announced today an operational update for the third quarter of 2023. In connection with this operational update, SMLP also announced that its Board of Directors has initiated a formal review process to evaluate strategic alternatives for the Partnership with a view of maximizing unitholder value.

Highlights

•Significant quarterly volume growth across nearly every segment, including ~20% volume growth in our Northeast segment and ~20% liquids volume growth in the Rockies segment

•Connected 74 wells during the third quarter, resulting in 224 wells connected year-to-date and remain on pace to connect a total of ~300 wells by the end 2023

•Expect third quarter Adjusted EBITDA of ~$70 million, representing ~20% growth relative to second quarter

•Reiterating fourth quarter Adjusted EBITDA guidance of $75 million to $85 million

•Active customer base with eight drilling rigs and more than 170 DUCs behind our systems

•Launched strategic alternatives review with the goal of maximizing unitholder value

Management Commentary

Heath Deneke, President, Chief Executive Officer, and Chairman, commented, “After a slower than expected start to the first half of the year, primarily driven by low commodity prices and well completion timing delays, we have reestablished significant positive momentum with robust growth in quarterly Adjusted EBITDA, natural gas and liquids volume and well interconnects. And while we are optimistic about our outlook, which includes significant free cash flow generation and debt reduction, we also believe that our current unit price does not reflect the true value of the Partnership and that the best way to maximize unitholder value is to explore our options, while remaining focused on the Partnership’s operational performance and execution of its business strategy.”

Strategic Review

Based on the Partnership’s recent and expected financial performance, as well as interest recently received from third parties for potential transactions, ranging from the sale of specific assets to consideration for the whole Partnership, SMLP is announcing that its Board of Directors has engaged external advisors to evaluate strategic alternatives for the Partnership with the goal of maximizing value for the Partnership’s unitholders.

These alternatives may include, but are not limited to, continued execution of the Partnership’s business plan, sale of assets, refinancing parts or the entirety of its capital structure, sale of the Partnership by merger or cash, or any combination of these and other alternatives.

While the Board conducts its review, the Partnership remains focused on its operational performance and execution of its business strategy to increase unitholder value.

There is no deadline or definitive timetable set for completion of the strategic alternatives review and no guarantee that the process will result in the Partnership pursuing a transaction or other strategic outcome or, if a transaction is undertaken, the terms or timing of such a transaction. SMLP does not intend to make further public comment regarding the review until it has been completed or SMLP determines that a disclosure is required by law or otherwise deemed appropriate.

Volume Throughput Summary

| | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023

Actual | | Q3 2023

Estimate | | Q-o-Q

% Change | | Current (4) |

| Average daily throughput (MMcf/d): | | | | | | | |

Northeast (1) | 629 | | | ~750 | | 19 | % | | ~810 |

| Rockies | 99 | | | ~115 | | 16 | % | | ~125 |

| Piceance | 297 | | | ~310 | | 4 | % | | ~300 |

| Barnett | 182 | | | ~170 | | (7) | % | | ~190 |

| Aggregate average daily throughput | 1,207 | | | ~1,345 | | 11 | % | | ~1,425 |

| | | | | | | |

| Average daily throughput (Mbbl/d): | | | | | | | |

| Rockies | 71 | | | ~85 | | 20 | % | | ~85 |

| Aggregate average daily throughput | 71 | | | ~85 | | 20 | % | | ~85 |

| | | | | | | |

Ohio Gathering average daily throughput (MMcf/d) (2) | 781 | | | ~870 | | 11 | % | | N/A |

| | | | | | | |

Double E average daily throughput (MMcf/d) (3) | 243 | | | ~325 | | 34 | % | | ~425 |

_________

(1)Exclusive of Ohio Gathering and Double E due to equity method accounting.

(2)Gross basis, represents 100% of volume throughput for Ohio Gathering, subject to a one-month lag.

(3)Gross basis, represents 100% of volume throughput for Double E.

(4)Represents estimated average daily volume from 9/26/2023 through 9.30/2023 for all operated assets and Double E.

Volume Highlights

SMLP’s average daily natural gas throughput for its wholly owned operated systems is expected to increase 11% to approximately 1,345 MMcf/d, and liquids volumes are expected to increase 20% to approximately 85 Mbbl/d, relative to the second quarter of 2023. OGC natural gas throughput expected to increase 11% to approximately 870 MMcf/d relative to the second quarter of 2023. Double E Pipeline gross volumes transported are expected to increase 34% to approximately 325 MMcf/d relative to the second quarter of 2023.

Natural gas-price driven segments:

•Northeast segment volumes are expected to increase 19% on our wholly owned systems and 11% from our OGC joint venture, relative to the second quarter of 2023. 14 new wells were brought online behind our wholly owned Summit Midstream Utica (“SMU”) system and 8 new wells were connected behind our OGC joint venture during the third quarter. The 14 new wells behind our SMU system were brought online throughout the third quarter. As such, current operated volumes are trending approximately 60 MMcf/d higher than expected as-reported third quarter volumes. We expect approximately 10 new wells to be connected during the fourth quarter. There are currently three rigs running and 14 DUCs behind our systems.

•Piceance segment volumes expected to increase 4% relative to the second quarter of 2023, primarily due to 12 new wells connected during the third quarter. We expect approximately 20 new wells to be connected during the fourth quarter. There is currently one rig running and 21 DUCs behind the system.

•Barnett segment volumes are expected to decrease 7% relative to the second quarter of 2023, primarily due to the continuation of production being temporarily shut-in by one of our customers. We estimate these curtailments impacted segment volumes by approximately 20 MMcf/d during the quarter. Our anchor customer completed 6 new wells in September that has increased segment volumes to approximately 190 MMcf/d currently. While we do not expect any new wells during the fourth quarter, our anchor customer is expected to bring online 11 new wells during the first quarter of 2024. There is currently one rig running and 18 DUCs behind the system.

Oil price-driven segments

•Permian segment volumes expected to increase 34% relative to the second quarter of 2023. Our anchor customer behind the Double E Pipeline started to increase production during the quarter and is currently running 13 rigs in New Mexico, relative to a low of two rigs during the pandemic. The volume increase occurred throughout the quarter, with current volumes trending at approximately 425 MMcf/d, or 100 MMcf/d above expected as-reported third quarter volumes. We remain confident in the fundamental long-term outlook for the Double E Pipeline with 105 rigs running in Eddy and Lea Counties, New Mexico currently and the recent and expected trajectory of our anchor customer’s production in the basin.

•Rockies segment natural gas and liquids volumes expected to increase 16% and 20%, respectively, relative to the second quarter of 2023. Current natural gas volumes are trending approximately 10 MMcf/d higher than expected as-reported third quarter volumes and we continue to expect volumes to increase in the fourth quarter due to the 38 DJ Basin wells connected during the second quarter. There were 34 new wells connected during the quarter, including 6 in the DJ Basin and 28 in the Williston Basin. We expect over 50 new wells to be connected during the fourth quarter, including over 40 new wells in the DJ Basin that are expected to reach peak production in the second quarter of 2024. One of our anchor customers in the Williston announced the acquisition of our other anchor customer during the quarter. While integration has historically delayed development for a few months, we are excited about the highly contiguous pro forma dedicated acreage position. We expect this will enable our anchor customer to develop more 3-mile laterals versus 2-mile laterals, historically. There are currently three rigs running and approximately 117 DUCs behind the systems.

Third Quarter 2023 Earnings Call

SMLP will host a conference call at 10:00 a.m. Eastern on November 3, 2023, to discuss its quarterly operating and financial results. The call can be accessed via teleconference at: Q3 2023 Summit Midstream Partners LP Earnings Conference Call (https://register.vevent.com/register/BIc42a8b051b4d40e8902304edf61e8ef7). Once registration is completed, participants will receive a dial-in number along with a personalized PIN to access the call. While not required, it is recommended that participants join 10 minutes prior to the event start. The conference call, live webcast and archive of the call can be accessed through the Investors section of SMLP's website at www.summitmidstream.com.

Use of Non-GAAP Financial Measures

We report financial results in accordance with U.S. generally accepted accounting principles (“GAAP”). We also present adjusted EBITDA, Distributable Cash Flow, and Free Cash Flow, non-GAAP financial measures.

Adjusted EBITDA

We define adjusted EBITDA as net income or loss, plus interest expense, income tax expense, depreciation and amortization, our proportional adjusted EBITDA for equity method investees, adjustments related to MVC shortfall payments, adjustments related to capital reimbursement activity, unit-based and noncash compensation, impairments, items of income or loss that we characterize as unrepresentative of our ongoing operations and other noncash expenses or losses, income tax benefit, income (loss) from equity method investees and other noncash income or gains. Because adjusted EBITDA may be defined differently by other entities in our industry, our definition of this non-GAAP financial measure may not be comparable to similarly titled measures of other entities, thereby diminishing its utility.

Management uses adjusted EBITDA in making financial, operating and planning decisions and in evaluating our financial performance. Furthermore, management believes that adjusted EBITDA may provide external users of our financial statements, such as investors, commercial banks, research analysts and others, with additional meaningful comparisons between current results and results of prior periods as they are expected to be reflective of our core ongoing business.

Adjusted EBITDA is used as a supplemental financial measure to assess:

•the ability of our assets to generate cash sufficient to make future potential cash distributions and support our indebtedness;

•the financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

•our operating performance and return on capital as compared to those of other entities in the midstream energy sector, without regard to financing or capital structure;

•the attractiveness of capital projects and acquisitions and the overall rates of return on alternative investment opportunities; and

•the financial performance of our assets without regard to (i) income or loss from equity method investees, (ii) the impact of the timing of MVC shortfall payments under our gathering agreements or (iii) the timing of impairments or other income or expense items that we characterize as unrepresentative of our ongoing operations.

Adjusted EBITDA has limitations as an analytical tool and investors should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. For example:

•certain items excluded from adjusted EBITDA are significant components in understanding and assessing an entity's financial performance, such as an entity's cost of capital and tax structure;

•adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

•adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and

•although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and adjusted EBITDA does not reflect any cash requirements for such replacements.

We compensate for the limitations of adjusted EBITDA as an analytical tool by reviewing the comparable GAAP financial measures, understanding the differences between the financial measures and incorporating these data points into our decision-making process.

We do not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because we are unable to predict, without unreasonable effort, certain components thereof including, but not limited to, (i) income or loss from equity method investees and (ii) asset impairments. These items are inherently uncertain and depend on various factors, many of which are beyond our control. As such, any associated estimate and its impact on our GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.

About Summit Midstream Partners, LP

SMLP is a value-driven limited partnership focused on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in the continental United States. SMLP provides natural gas, crude oil and produced water gathering, processing and transportation services pursuant to primarily long-term, fee-based agreements with customers and counterparties in five unconventional resource basins: (i) the Appalachian Basin, which includes the Utica and Marcellus shale formations in Ohio and West Virginia; (ii) the Williston Basin, which includes the Bakken and Three Forks shale formations in North Dakota; (iii) the Denver-Julesburg Basin, which includes the Niobrara and Codell shale formations in Colorado and Wyoming; (iv) the Fort Worth Basin, which includes the Barnett Shale formation in Texas; and (v) the Piceance Basin, which includes the Mesaverde formation as well as the Mancos and Niobrara shale formations in Colorado. SMLP has an equity method investment in Double E Pipeline, LLC, which provides interstate natural gas transportation service from multiple receipt points in the Delaware Basin to various delivery points in and around the Waha Hub in Texas. SMLP also has an equity method investment in Ohio Gathering, which operates extensive natural gas gathering and condensate stabilization infrastructure in the Utica Shale in Ohio. SMLP is headquartered in Houston, Texas.

Forward-Looking Statements

This press release includes certain statements concerning expectations for the future that are forward-looking within the meaning of the federal securities laws. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements and may contain the words "expect," "intend," "plan," "anticipate," "estimate," "believe," "will be," "will continue," "will likely result," and similar expressions, or future conditional verbs such as "may," "will," "should," "would," and "could”, any statement concerning future financial or operational performance (including future revenues, earnings or growth rates) guidance, ongoing business strategies and possible actions taken by us or our subsidiaries are also forward-looking statements. Forward-looking statements also contain known and unknown risks and uncertainties (many of which are difficult to predict and beyond management’s control) that may cause SMLP’s actual results in future periods to

differ materially from anticipated or projected results. An extensive list of specific material risks and uncertainties affecting SMLP is contained in its 2022 Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 1, 2023, as amended and updated from time to time. Any forward-looking statements in this press release are made as of the date of this press release and SMLP undertakes no obligation to update or revise any forward-looking statements to reflect new information or events.

Contact: ir@summitmidstream.com

SOURCE: Summit Midstream Partners, LP

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

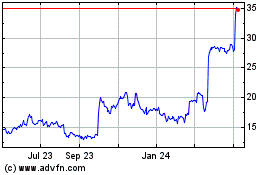

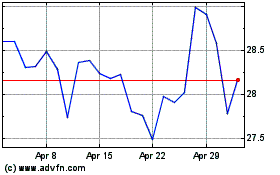

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jul 2023 to Jul 2024