Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 23 2024 - 6:08AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number 001-34919

SUMITOMO MITSUI FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

1-2, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

|

|

Form 20-F ☒ |

|

|

|

Form 40-F ☐ |

|

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY

REFERENCE INTO THE PROSPECTUS FORMING A PART OF SUMITOMO MITSUI FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-276219) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH

THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

| Sumitomo Mitsui Financial Group, Inc. |

|

By: |

|

/s/ Jun Okahashi |

|

|

Name: |

|

Jun Okahashi |

|

|

Title: |

|

Executive Officer & General Manager, Financial Accounting Dept |

Date: July 23, 2024

July 23, 2024

Sumitomo Mitsui Financial Group,Inc.

(Securities Code: 8316)

Notice Concerning Tendering to Tender Offer for Own Shares

by TOYOTA MOTOR CORPORATION

(Voluntary Disclosure)

TOKYO, July 23, 2024 --- Sumitomo Mitsui Financial Group, Inc. (President and Group CEO: Toru Nakashima, collectively “SMBC

Group”), Sumitomo Mitsui Banking Corporation (President and CEO: Akihiro Fukutome) and SMBC Nikko Securities Inc. (President and CEO: Shuji Yoshioka), announced today that have decided to tender a part of the common shares of TOYOTA MOTOR

CORPORATION (“TOYOTA”) held by SMBC Group in the tender offer for own shares by TOYOTA, which was resolved at the meeting of the Board of Directors of TOYOTA today (the “Tender Offer”). Brief details are provided as follows.

| 1. |

Outline of the tendering to the Tender Offer |

|

|

|

|

|

| SMBC Group will tender the common shares of TOYOTA held by SMBC Group in the Tender Offer as

follows: |

| l |

|

Number of shares to be tendered |

|

48,668,475 common shares |

| l |

|

Tender offer price |

|

2,781 yen per share |

| l |

|

Total amount to be sold |

|

135,347,028,975 yen |

(Note) The figure for the total amount to be sold represents the number

of total amount expected to be sold if the Tender Offer is carried out as planned and all 48,668,475 common shares of TOYOTA held by SMBC Group are purchased by TOYOTA through the Tender Offer. However, since the upper limit for the shares to be

purchased by TOYOTA through the Tender Offer is 290,122,345 and other companies may also tender their shares, there is no guarantee that all 48,668,475 common shares tendered by SMBC Group will be purchased by TOYOTA.

| 2. |

Reason for tendering shares in the Tender Offer |

Currently, SMBC Group is reallocating its business portfolio to improve capital efficiency and reducing equity holdings based

on the reduction plan announced in May 2023.

Under these circumstances, SMBC Group has been engaged in thorough dialogue

with TOYOTA regarding equity holdings. After that, TOYOTA made a proposal for the Tender Offer and SMBC Group decided to tender the Tender Offer as a result of comprehensive consideration of its terms and conditions.

Capital surplus, including the proceeds from the sale through the Tender Offer, will continue to be allocated in a balanced

manner to shareholder returns and investment for growth, while securing financial soundness.

The SMBC Group is recognizing

and discussing various issues with TOYOTA revealed through progressing the transformation from the automobile industry to the mobility industry. In this way, we will consider and strengthen initiatives that contribute to “Japan’s

Regrowth” which is one of the five priority issues of SMBC Group, such as supporting customers’ business model transformation, creating innovation and new industries.

If the shares to be tendered by SMBC Group are purchased by TOYOTA, the number of shares of TOYOTA held by SMBC Group will

decrease, but TOYOTA and SMBC Group believe that we can maintain a good relationship going forward.

In addition, to

enhance corporate value and realize an era of “Fulfilled growth”, we will continue to co-create, leveraging the strengths of both companies.

| 3. |

Status of shares held before and after the tendering to the Tender Offer |

|

|

|

|

|

|

(1) Number of shares held before the Tender Offer |

|

|

|

194,672,475 shares

(The percentage of the total number of outstanding shares :1.44%) |

|

(2) Number of shares to be tendered through the Tender Offer |

|

|

|

48,668,475 shares (The percentage

of the total number of outstanding shares :0.36%) |

|

(3) Number of shares held after the Tender Offer |

|

|

|

146,004,000 shares

(The percentage of the total number of outstanding shares :1.08%) |

(Note 1) The figure for the number of shares held after the Tender

Offer represents the number of shares to be held if the Tender Offer is carried out as planned and all 48,668,475 common shares of TOYOTA held by the Company are purchased by TOYOTA through the Tender Offer. However, because the upper limit for the

shares to be purchased by TOYOTA through the Tender Offer is 290,122,345 and other companies may also tender their shares, all 48,668,475 common shares that SMBC Group tenders to sell will not be able to be purchased by TOYOTA.

(Note 2) The figures for the percentage of the total

number of outstanding shares above are calculated based on the total number of outstanding shares (13,474,172,027 shares), excluding treasury shares, of TOYOTA as of March 31, 2024, as stated in the “Consolidated Financial Statements for

the Fiscal Year Ending March 31, 2024 (IFRS accounting standards)”, announced as of May 8, 2024, and the figures have been rounded to three decimal places.

| 4. |

Schedule for the Tender Offer (Planned) |

|

|

|

|

|

| |

|

|

| Announcement of tender offer

|

|

|

|

July 24,

2024 |

| |

|

|

| Tender offer period

|

|

|

|

From July

24, 2024 to August 26, 2024 |

| |

|

|

| Commencement of settlement

|

|

|

|

September 18, 2024 |

| 5. |

Impact on business results |

Although a certain amount of profit is expected by the sale through the Tender Offer, the impact on SMBC Group consolidated

earnings forecast for the fiscal year ending March 2025 will be appropriately disclosed if necessary, in consideration of other factors. (Although this matter does not meet the criteria for timely disclosure rules of the Tokyo Stock Exchange, it is

disclosed on a voluntary basis.)

End

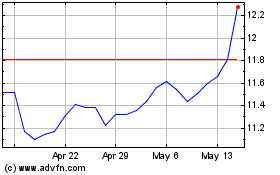

Sumitomo Mitsui Financial (NYSE:SMFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

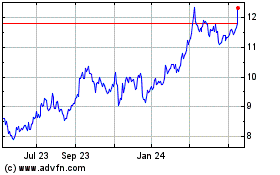

Sumitomo Mitsui Financial (NYSE:SMFG)

Historical Stock Chart

From Nov 2023 to Nov 2024