false

0001498710

0001498710

2025-02-11

2025-02-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 12, 2025 (February 11, 2025)

____________________________

Spirit Airlines, Inc.

(Exact name of registrant as specified in its

charter)

____________________________

| Delaware |

001-35186 |

38-1747023 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

1731 Radiant Drive

Dania Beach, Florida 33004

(Address of principal executive offices, including

zip code)

(954) 447-7920

(Registrant’s

telephone number, including area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

|

Class |

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value |

|

SAVE(1) |

|

New York Stock Exchange |

(1) On December 5, 2024, the New York Stock Exchange (“NYSE”)

filed a Form 25 for Spirit Airlines, Inc., a Delaware corporation (the “Company”) in connection with the delisting of the

common stock, par value $0.0001, of the Company (the “Common Stock”) from NYSE. The delisting became effective ten days after

the Form 25 was filed. The deregistration of the Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended,

will be effective 90 days, or such shorter period as the SEC may determine, after the filing of the Form 25. The Common Stock began trading

on the OTC Pink Market on November 19, 2024 under the symbol “SAVEQ”.

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On February 11, 2025, Spirit Airlines, Inc.

(the “Company”) issued a press release titled “Spirit Airlines Proceeds With Standalone Recapitalization;

Rejects Most Recent Proposal from Frontier,” a copy of which is attached hereto as Exhibit 99.1 and incorporated by reference herein.

In addition, the Company has attached as exhibits under Item 9.01 of this Current Report on Form 8-K certain communications and other

materials exchanged between the Company and Frontier and their advisors, which are incorporated by reference into this Item 7.01.

The information included in this Current Report

on Form 8-K under Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that Section, unless the registrant

specifically states that the information is to be considered “filed” under the Exchange Act or incorporates it by reference

into a filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”).

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on Form 8-K (this “Current

Report”) contains various forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of

the Exchange Act which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on

our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements

of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking

statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,”

“plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,”

“potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements are subject

to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially

from future results expressed or implied by such forward-looking statements. Factors include, among others, the impact of the Debtors’

bankruptcy filings, the Company’s ability to refinance, extend or repay its near and intermediate term debt, the Company’s

substantial level of indebtedness and interest rates, the potential impact of volatile and rising fuel prices and impairments, the Company’s

ability to complete the equity rights offering, the restructuring process and other factors discussed in the Company’s Annual Report

on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC and other factors, as described in the Company’s filings

with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in

the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented in the Company’s Quarterly

Report on Form 10-Q for the fiscal quarters ended March 31, 2024, June 30, 2024 and September 30, 2024. Furthermore, such forward-looking

statements speak only as of the date of this Current Report. Except as required by law, we undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known

to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect

our business, financial condition, or future results.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit No. |

Description |

| 99.1 |

Press Release, “Spirit Airlines Proceeds With Standalone Recapitalization; Rejects Most Recent Proposal from Frontier,” dated February 11, 2025 |

99.2

|

Email dated February 4, 2025 |

| 99.3 |

Presentation to Spirit Airlines, Inc., dated February 4, 2025 |

| 99.4 |

Email dated February 7, 2025 |

| 99.5 |

Presentation to Frontier Group Holdings, Inc., dated February 7, 2025 |

| 99.6 |

Email dated February 10, 2025 |

| 99.7 |

Presentation to Spirit Airlines, Inc., dated February 10, 2025 |

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 12, 2025 |

SPIRIT AIRLINES, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Thomas Canfield |

| |

Name: |

Thomas Canfield |

| |

Title: |

Senior Vice President and General Counsel |

Exhibit 99.1

Spirit

Airlines Proceeds With Standalone Recapitalization; Rejects Most Recent Proposal from Frontier

DANIA BEACH, Fla., Feb. 11, 2025 -- Spirit Airlines, Inc. ("Spirit"

or the "Company") today provided an update on its restructuring process regarding a new proposal (the “New Proposal”)

for an alternative restructuring plan submitted by Frontier Group Holdings, Inc. ("Frontier"), the parent company of Frontier

Airlines, Inc.

On Feb. 4, 2025, Frontier submitted

the New Proposal to Spirit. Under the terms of the New Proposal, which was subject to various conditions, Spirit’s stakeholders

would receive $400 million principal amount of second-lien debt issued by Frontier and 19.0% of Frontier’s common equity following

the proposed combination. The New Proposal would not require the Company to complete its previously announced $350 million equity rights

offering, and required a waiver of the Bankruptcy Court-approved $35 million termination fee that would otherwise be owed under the Backstop

Commitment Agreement, dated Nov. 18, 2024, by and among the Company and the other stakeholders party thereto (the “Backstop Commitment

Agreement”). Notably, the New Proposal did not address certain material risks and issues previously identified by the Company, including

that the New Proposal would deliver less in value to the Company’s stakeholders than contemplated by the Company’s existing

plan of reorganization, is uncertain as to timing and completion, would result in extended and materially more costly and uncertain chapter

11 proceedings, and has uncertainties with regard to needed regulatory and court approvals. The Company’s management and Board of

Directors, consistent with their fiduciary duties, carefully reviewed the New Proposal in consultation with the Company’s external

legal and financial advisors.

On Feb. 4, 2025, as required by the Restructuring

Support Agreement dated Nov. 18, 2024, by and among the Company, certain of its subsidiaries and the Consenting Stakeholders (as defined

therein), the Company shared the New Proposal with the advisors for certain holders of the Company’s (i) 8.00% Senior Secured Notes

due 2025 (the holders, the “Senior Secured Noteholders”) and (ii) 4.75% Convertible Senior Notes due 2025 (the holders, the

“2025 Convertible Noteholders”) and 1.00% Convertible Senior Notes due 2026 (the holders, together with the 2025 Convertible

Noteholders, the “Convertible Noteholders”).

On Feb. 6, 2025, the Company entered into confidentiality

agreements (collectively, the “NDAs”) with certain Senior Secured Noteholders and Convertible Noteholders (the “NDA

Parties”). Pursuant to the NDAs, the Company shared Frontier’s New Proposal with the NDA Parties.

On Feb. 7, 2025, Spirit submitted

a counterproposal to Frontier (the “Spirit Counterproposal”). The aggregate value of the debt ($600 million) and equity ($1.185

billion) to be provided to Spirit stakeholders under the Spirit Counterproposal was equal to the amount of value that Frontier claimed

it was providing to Spirit stakeholders under Frontier’s New Proposal; the Spirit Counterproposal proposed market-based mechanisms

to determine the amount of the equity in the combined company equity proposed for Spirit stakeholders. The Spirit Counterproposal would

not require the Company to complete its previously announced equity rights offering but would require Frontier to pay the $35 million

termination fee that would otherwise be owed under the Backstop Commitment Agreement.

On Feb. 10, 2025, Frontier

rejected the Spirit Counterproposal in its entirety and reiterated the Feb. 4 New Proposal.

Spirit will continue swiftly

to advance and conclude its restructuring process, which will significantly deleverage the Company and position it for long-term success.

The hearing to consider confirmation of Spirit’s plan of reorganization is currently scheduled for Feb. 13, 2025 at 10am EST. Approximately

99.99% of all voting creditors have voted to accept the plan, and all but two objections have already been resolved. The Company expects

to complete the restructuring in the first quarter of 2025.

Certain communications and other materials exchanged between Spirit

and Frontier and their advisors, related to the New Proposal and Spirit Counterproposal, can be found on Spirit’s Investor Relations

website at https://ir.spirit.com/events-and-presentations.

Additional information about the Company's chapter 11 case, including

access to Court filings and other documents related to the restructuring process, is available at https://dm.epiq11.com/SpiritGoForward or

by calling Spirit's restructuring information line at (888) 863-4889 (U.S. toll free) or +1 (971) 447-0326 (international). Additional

information is also available at www.SpiritGoForward.com.

Advisors

Davis Polk & Wardwell LLP is serving as the Company's restructuring

counsel, Alvarez & Marsal is serving as restructuring advisor, and Perella Weinberg Partners LP is acting as investment banker.

Akin Gump Strauss Hauer & Feld LLP is acting as legal counsel and

Evercore is acting as financial advisor to the ad hoc group of loyalty noteholders.

Paul Hastings LLP is acting as legal counsel and Ducera Partners LLC

is acting as financial advisor to the convertible bondholders.

About Spirit Airlines

Spirit Airlines is a leading low-fare carrier committed to delivering the best value in the sky by offering an enhanced travel experience

with flexible, affordable options. Spirit serves destinations throughout the United States, Latin America and the Caribbean with its

Fit Fleet®, one of the youngest and most fuel-efficient fleets in the U.S. Spirit is committed to inspiring positive change

in the communities it serves through the Spirit Charitable Foundation. Discover elevated

travel options with exceptional value at spirit.com.

Investor Inquiries:

Spirit Investor Relations

investorrelations@spirit.com

Media Inquiries:

Spirit Media Relations

Media_Relations@spirit.com

FGS Global

Spirit@fgsglobal.com

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains various forward-looking statements within

the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act which are subject to the “safe harbor”

created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently

available to our management. All statements other than statements of historical facts are “forward-looking statements” for

purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,”

“should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,”

“estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify

forward-looking statements. Forward-looking statements are subject to risks, uncertainties and other important factors that could cause

actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking

statements. Factors include, among others, the impact of the Company’s bankruptcy filings, the Company’s ability to refinance,

extend or repay its near and intermediate term debt, the Company’s substantial level of indebtedness and interest rates, the potential

impact of volatile and rising fuel prices and impairments, the Company’s ability to complete the equity rights offering, the restructuring

process and other factors discussed in the Company’s Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q filed

with the SEC and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the

detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, as supplemented in the Company’s Quarterly Report on Form 10-Q for the fiscal quarters ended March

31, 2024, June 30, 2024 and September 30, 2024. Furthermore, such forward-looking statements speak only as of the date of this press release.

Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after

the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial,

or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results.

Exhibit 99.2

From:

Link, Brian

Sent:

Tuesday, February 4, 2025 8:43 PM

To:

Diego Simonian  >; Bruce

Mendelsohn

>; Bruce

Mendelsohn

Cc:

Grier, John F  >; Patel, Sagar1

>; Patel, Sagar1  >

>

Subject:

Follow-up

On

behalf of Frontier Group Holdings, Inc. (“Frontier”), please find below key terms of Frontier’s revised proposal (“Revised

Proposal”). Also attached is a summary capitalization schedule and term sheet for the proposed “take-back” debt as

previewed on our call earlier this evening.

Key

Terms

| 1. | Our

Revised Proposal provides for the issuance of $400 million 2nd Lien Term Loan

B / Bond (“take-back debt”) and 19.0% of Frontier’s common equity

at closing, to be distributed to the Holders of Senior Secured Notes, Convertible Notes,

and Existing Interests |

| 2. | Under

the Revised Proposal, the Consenting Creditors will not be required to complete

a $350 million equity rights offering prior to the Effective Date |

| 3. | Revised

Proposal assumes a waiver of the $35 million break-up fee for terminating the equity

rights offering |

Brian

C. Link

Citigroup

Global Markets Inc.

Co-Head

of M&A, Americas

and text)

and text)

( cell,

no text)

cell,

no text)

Exhibit 99.3

Presentation to Spirit Alternative Proposal February 4, 2025 | Strictly private and confidential

2 Illustrative Capitalization Excluding $350mm Equity Rights Offering S o u r ce : Notes: Falcon Management, Spirit Disclosure Statement (Chapter 11 Plan of Reorganization), filed as of December 18, 2024. Based on $600mm of run - rate synergies. $ 400 Sources New 2nd Lien Term B / Bond ("take - back debt") 800 New 1st Lien Bond [ ] New Revolving Credit Facility ($400mm) $1 ,2 00 Total Sources Uses $3 00 Paydown Saturn RCF ($300M) 3 00 Paydown Saturn DIP Financing 400 New Saturn Exit Secured Notes [ 27 ] Other Saturn Transaction Fees 1 7 3 Cash to PF Balance Sheet $1 ,2 00 Total Uses Pro Forma 2/28/2025 (+/ - ) Total Adjs. ( - ) Trxn F ees (+/ - ) Debt Restructuring ( - ) Debt Paydown Saturn 2/28/2025 Falcon 2/28/2025 ($ in millions) $ 1,6 7 4 $173 ($27) $ 800 ( $ 600) $ 854 $ 647 Cash and Short Term Investments 187 ( 3 1) ( 3 1) 2 18 - - Restricted Cash $1,861 $142 $1 , 072 $ 647 Total Cash $3 51 - - - - $3 51 Pre - Delivery Credit Facility 12 - - - - 12 Floating Rate Building Note - - ( 3 00) ( 3 00) 3 00 - - RCF ($300M Capacity) - - ( 3 00) ( 3 00) 3 00 - - DIP Financing - - (1,110) (1,110) 1,110 - - 8.00% Senior Secured Notes due 2025 1,0 34 - - 1,0 34 - - Fixed - rate Term Loans due through 2039 514 - - 514 - - Saturn EETCs due 2026 - 2030 - - (25) ( 2 5) 25 - - 4.75% Convertible Senior Notes due 2025 - - (500) (500) 500 - - 1.00% Convertible Senior Notes due 2026 400 400 400 - - - - New 2nd Lien Term B / Bond ("take - back debt") 800 800 800 - - - - New 1st Lien Bond $ 3, 111 ($1,035) $ 3, 783 $ 36 3 Total Secured Debt 100 - - - - 100 Affinity Card Advance Purchase of Mileage Credits 66 - - - - 66 PSP Promisory Notes 1 21 - - 1 21 - - Term Loans due in 2031 $ 2 87 -- $1 21 $166 Total Unsecured Debt Total Debt $ 3,39 7 ($1,035) $ 3 ,903 $5 29 $ 8,1 7 0 - - $ 4,193 $3 ,9 7 7 Operating Lease Liabilities $11,567 ($1,035) $8,096 $ 4, 506 Total Lease - Adj. Debt $9,706 ( $1 , 177) $7 , 0 2 4 $ 3, 859 Total Lease - Adj. Net Debt Available Liquidity $ 1,6 7 4 $ 854 $ 647 Unrestricted Cash 400 - - - - Undrawn RCF $ 2, 074 $854 $ 647 Total Liquidity Credit Statistics $ 1,982 $ 666 $ 1, 3 16 2025E Adj. EBITDAR (Excl. Synergies) 2 ,582 2025E Adj. EBITDAR (Incl. Synergies) 5 . 8x 12.2x 3. 4x Total Lease - Adjusted Debt / 2025E Adj. EBITDAR (Excl. Synergies) 4 . 5x Total Lease - Adjusted Debt / 2025E Adj. EBITDAR (Incl. Synergies) 4 . 9x 10.5x 2. 9x Total Lease - Adjusted Net Debt / 2025E Adj. EBITDAR (Excl. Synergies) 3. 8x Total Lease - Adjusted Net Debt / 2025E Adj. EBITDAR (Incl. Synergies) Sources & Uses Pro Forma Capitalization ($ in millions) $ Amount

3 Take - Back Debt Term Sheet Term Loan B or Notes Issue $400mm Principal Amount 6 Years Tenor 11.0% Cash / 8.0% Cash + 4.0% PIK Coupon 2 nd Lien claim on the following collateral: • Falcon Loyalty Program (~$3.1bn) • Saturn Loyalty Program (~$1.1bn) • Saturn Slots (~$85mm) • Falcon Brand IP (~$1.5bn) • Saturn Co - branded Credit Card (~$1.6bn) • Saturn Spare Parts (~$140mm) • Saturn Brand IP (~$1.6bn) • Saturn Engines (~$225mm) • Other Saturn Assets (~$475mm) (3) Security( 1,2 ) NC2; par thereafter Call Protection 25% Maximum 1 st Lien LTV No Other Financial Covenants Covenants (1) Collateral values based on latest appraisals and management estimates. (2) Value of Saturn loyalty assets subject to change and may not be included in collateral package (3) Includes headquarters ($288mm), other spare engines ($123mm), hangar ($27mm), simulators ($26mm), and ground service equipment ($12mm).

Exhibit 99.4

From: Ted Christie

Date: February 7, 2025

at 2:24:19 PM MST

To:

Bill Franke  , Andrew Broderick

, Andrew Broderick  ,

,

Brian Franke

Cc: Thomas Canfield  >

>

Subject: Counter

Bill:

Thank you again for your

constructive proposal earlier this week. We very much appreciate the move, and have worked diligently to re-restrict our key stakeholders

and coordinate with them on a counterproposal (including multiple calls today). The key terms of our counterproposal are outlined in

the attached document. A few thoughts:

| 1. | We

are aligned on the “price” / value to be provided to Spirit and its stakeholders,

as re- affirmed by Frontier earlier this morning on its Q4/2024 earnings call |

| · | Given

the difference in approaches to valuing a fixed split of the combined equity (to get our

shareholders the offered $1.15 per share and pay the bonds par), we have moved to a market-based

mechanism to value the equity consideration and determine the number of shares provided to

Spirit (e.g., VWAP or mandatory convertible note with potential collar to be discussed) |

| · | We

will need collectively to agree on the exact mechanic |

| · | Based

on your latest proposal, the total value to be provided to Spirit and its stakeholders should

be $1.785 billion in total (par plus accrued interest to the bonds, plus a $1.15 per-share

recovery to existing equity holders as outlined in Citi’s presentation) |

| 2. | The

counter provides for $600M of takeback debt which will be structured to trade at par, and

the balance in equity |

| · | The

debt is first lien alongside any incremental financing required to address Spirit’s

existing DIP and RCF outstanding and capitalize the combined company balance sheet |

| · | Bondholders

have also expressed willingness to assist in raising new debt on the combined company through

backstopping / anchoring the new money debt raise, subject to diligence on the terms and

structure |

| 3. | To

address concerns over closing and the attendant costs and risks of an extended stay in chapter

11, we have proposed a regulatory efforts undertaking up to a material |

adverse effect standard

and a reverse termination fee payable to Spirit if a transaction is terminated as a result of a regulatory failure

| 4. | We

agree that confirmatory diligence can and should be completed in a timely manner (10 business

days or less per your latest proposal), during which time Spirit and its stakeholders will

have the opportunity to perform reverse diligence on key operational and legal matters, in

addition to an evaluation of the proposed debt / collateral structure |

As you and your team are

well aware, time is of the essence as we speedily approach confirmation of our stand alone plane this Thursday. We are prepared

to work nonstop through the weekend, and are ready to discuss as soon as you are ready.

I am also asking PWP to reach

out to Citi to discuss.

Ted

Exhibit 99.5

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents 1 Project Galaxy Transaction Proposal February 7, 2025 Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents Transaction Proposal 2 Spirit (2/7) Frontier (2/4) ▪ Agreed ▪ Agreed ▪ Agreed ▪ Frontier and Spirit to combine as part of Spirit’s ongoing chapter 11 proceedings with securities of the combined enterprise provided to Spirit stakeholders as consideration for the combination transaction ▪ Frontier to raise $800M New Money First Lien debt to facilitate paydown of existing DIP and RCF facilities, in addition to any transaction fees and accrued interest at closing ▪ New $400M RCF to be issued and [undrawn] at close Structure ▪ Spirit and its stakeholders to receive $600M First Lien Takeback debt to trade at par , pari passu with New Money First Lien debt ▪ To discuss potential backstop of new debt issuance by Spirit stakeholders, subject to further diligence ▪ Spirit and its stakeholders to receive $400M Second Lien debt Debt Consideration ▪ Spirit and its stakeholders provided $1,185M of market - determined equity value in the combined business (implies par recovery on funded debt, plus $1.15 per - share recovery to existing equity holders per current Frontier proposal) ▪ To discuss market mechanism and timing to determine valuation of equity in the combined enterprise to Spirit stakeholders (e.g., VWAP, mandatory convertible note, etc. with potential collar to be discussed) ▪ Spirit and its stakeholders provided 19.0% of the pro forma combined company on a fully - diluted basis – Illustratively assumes 52,865,110 shares based on current Frontier shares outstanding, subject to refinement at closing Equity Consideration ▪ Required parties to receive $35M ERO break - up fee at transaction close ▪ Required parties agree to waive existing $35M ERO break - up fee ERO Break - Up Fee

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents Transaction Proposal (Cont.) 3 Spirit (2/7) Frontier (2/4) ▪ Agreed ▪ Spirit stakeholders provided opportunity to conduct reverse diligence on key operational and legal matters, in addition to evaluation of the proposed debt / collateral structure in a manner satisfactory to Spirit and its stakeholders ▪ Frontier to complete confirmatory within 10 business days. ▪ Scope of confirmatory diligence limited to: – A limited review of Spirit’s Q4 results – Update on recent sales trends – Updated 2 - year cash forecast (incl. any impact of bankruptcy) – Disclosure of any material contracts or changes to the business since conclusion of prior engagement – Select tax diligence Diligence ▪ Frontier required to take any steps required by regulators for closing unless they would cause a materially adverse effect on the combined enterprise ▪ To the extent transaction is terminated as a result of failure to achieve regulatory approval or any reason other than a Spirit breach, Frontier to provide Spirit a reverse termination fee on transaction enterprise value in line with market precedents for similar situations ▪ N/A Reverse Break - Up Fee / Regulatory Approval

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents Takeback Debt Terms 4 Spirit (2/7) Frontier (2/4) ▪ $600M ▪ $400M Quantum ▪ First Lien Takeback debt to receive equivalent terms as New Money First Lien debt and trade at par ▪ 11.0% Cash / 8.0% Cash + 4.0% PIK Rate ▪ First Lien Takeback debt to receive equivalent terms as New Money First Lien debt and trade at par ▪ February 2031 Maturity ▪ First Lien Takeback debt to receive equivalent terms as New Money First Lien debt and trade at par ▪ NC2; Par Thereafter Call Protection ▪ Agreed ▪ Falcon Loyalty Program, Falcon Brand IP, Saturn Brand IP, Saturn Loyalty Program, Saturn Cobranded Credit Card, Saturn Engines, Saturn Slots, Saturn Spare Parts, Other Saturn Assets 1 Security ▪ First Lien ▪ Second Lien Priority ▪ To be discussed ▪ 25% Maximum First Lien LTV Covenants and Other

Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents 5 Privileged and Confidential – Subject to NDA Prepared at the Direction of Counsel Subject to FRE 408 and State Equivalents

Exhibit 99.6

From:

"Biffle, Barry"  >

>

Date:

February 10, 2025 at 3:03:43 PM MST

To: Ted

Christie < >

>

Subject:

Update

Dear

Ted,

Dear Ted, Attached is in response to your email dated 2/07/2025.

As we advised you when we sent our last proposal, eliminating the $350

million equity rights offering was a significant concession and we would not agree to materially alter any of the other commercial terms

of our proposal. As compared to your standalone plan, we remain of the view that this represents a superior proposal to your various stakeholders.

We have consistently used the same assumptions described in your standalone plan to calculate the value of our proposal. We believe this

approach is the only way to fairly compare the two plans and we have detailed in our prior correspondence that our proposal is superior

even using reduced valuation metrics to calculate the value delivered by either plan. We leave it up to your stakeholders to ultimately

determine how to split the $400 million of takeback debt and the approximately 53 million shares.

As before, we remain available to address

any questions you may have and are prepared to move forward quickly.

Regards,

Bill and Barry

Exhibit 99.7

Transaction Proposal

| |

Frontier

(2/4) |

Spirit

(2/7) |

Frontier

(2/9) |

| Structure |

· Frontier

and Spirit to combine

· Frontier

to raise $800 million new money first lien debt

· New

$400 million revolver to be issued at close |

· Agreed

· Agreed

· Agreed |

· Agreed

· Agreed

· Agreed |

Debt

Consideration

|

· Spirit

and its stakeholders to receive $400 million second lien debt |

· Spirit

and its stakeholders to receive $600 million first lien takeback debt to trade at par, pari passu with new money first lien debt |

· Spirit

and its stakeholders to receive $400 million second lien debt |

Equity

Consideration

|

· Spirit

and its stakeholders provided 52,865,110 shares of the combined company based on Frontier shares currently outstanding |

· Spirit

and its stakeholders provided $1,185 million of market determined equity value in the combined company

· To

discuss market mechanism and timing |

· Spirit

and its stakeholders provided 52,865,110 shares of the combined company based on Frontier shares currently outstanding

· Spirit

and its stakeholders to determine appropriate allocation of the 52,865,110 |

| |

|

to determine valuation of equity in the combined enterprise

(e.g., VWAP) |

shares between the various Spirit creditors and equity holders |

| ERO Breakup Fee |

· Required parties agree to

waive existing $35 million

ERO breakup fee |

· Required parties to receive $35 million ERO break up fee at transaction close |

· Required parties agree to waive existing $35 million ERO breakup fee |

| Diligence |

· To complete confirmatory

diligence in 10 days |

· Agreed

· Spirit

stakeholders to conduct

reverse diligence on key legal / operational matters, to include evaluation of proposed debt / collateral structure |

· Agreed

· Spirit

to conduct reverse diligence in the same 10 day period as Frontier

· Frontier

to provide Spirit with terms of proposed debt structure |

|

Reverse

Breakup Fee

|

· N/A |

· Frontier

to take steps required by regulators for closing unless they would result in a material adverse effect on the combined company |

· Regulatory

efforts covenants to be consistent with 2022 executed merger agreement. |

| |

|

· If

transaction is terminated for any reason other than a Spirit breach, Frontier to provide Spirit

a reverse termination fee |

· No

reverse termination fee |

Takeback Debt Terms

| |

Frontier (2/4) |

Spirit (2/7) |

|

| Quantum |

· $400 million |

· $600 million |

· $400 million |

| Rate |

· 11.0% cash / 8.0% cash

+ 4% PIK |

· First lien takeback debt to receive equivalent terms as new money first lien debt and trade at par |

· 11.0%

cash / 8.0% cash

+ 4% PIK

|

| Maturity |

· February 2031 |

· First lien takeback debt to receive equivalent terms as new money first lien debt and trade at par |

· February 2031 |

| Call Protection |

· NC2; Par Thereafter |

· First lien takeback debt to receive equivalent terms as |

· NC2; Par Thereafter |

| |

|

new money first lien debt and trade at par |

|

| Security |

· Falcon Loyalty Program, Falcon Brand IP, Saturn Brand IP, Saturn Loyalty Program, Saturn Cobranded Credit Card, Saturn Engines, Saturn Slots, Saturn Spare Parts, Other Saturn Assets |

· Agreed |

· Generally

agreed (but note you put a footnote on this issue with no description)

|

| Priority |

· Second Lien |

· First Lien |

· Second Lien |

| Covenants |

· 25% Maximum First Lien LTV |

· To be discussed |

· 25% Maximum First Lien LTV |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

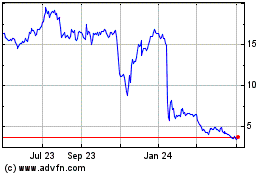

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

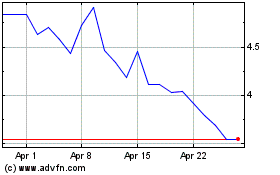

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Mar 2024 to Mar 2025