UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)

SilverBow Resources Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

82836G102

(CUSIP Number)

Melissa Franzen

Riposte Capital LLC

888 Seventh Avenue, 4th Floor

New York, NY 10106

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

September 27, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ _ ].

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b) for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed"for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D

CUSIP No. 82836G102

1 NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Riposte Capital LLC*

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS (See Instructions)

AF

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

[ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

Number of Shares Beneficially Owned by Each Reporting Person With: 7 SOLE VOTING POWER

0

8 SHARED VOTING POWER

1,400,000

9 SOLE DISPOSITIVE POWER

0

10 SHARED DISPOSITIVE POWER

1,400,000

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,400,000

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

[ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%**

14 TYPE OF REPORTING PERSON (See Instructions)

IA

*Riposte Global Opportunity Master Fund, LP ("Master Fund") owns 1,200,000 shares of Common Stock, par value $0.01 per share ("Common Stock") of the issuer, SilverBow Resources Inc. (the "Issuer"). Khaled Beydoun is the managing member of Riposte Capital LLC and Riposte GP, LLC. Riposte GP, LLC is the general partner of Riposte Global Opportunity Master Fund, LP. Riposte Capital LLC serves as the investment manager to the Master Fund. Accordingly, Riposte Capital LLC may be deemed to share voting and dispositive power with Khaled Beydoun over the shares of Common Stock owned by the Master Fund.

**The percentage is based on 25,429,162 outstanding shares of Common Stock of the Issuer following the close of the offering on and as of September 18, 2023 and as reported by the Issuer in its prospectus supplement filed with the Securities and Exchange Commission (the "SEC") on September 15, 2023.

SCHEDULE 13D

CUSIP No. 82836G102

1 NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Riposte Global Opportunity Master Fund, LP*

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS (See Instructions)

WC

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

[ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

Number of Shares Beneficially Owned by Each Reporting Person With: 7 SOLE VOTING POWER

0

8 SHARED VOTING POWER

1,400,000

9 SOLE DISPOSITIVE POWER

0

10 SHARED DISPOSITIVE POWER

1,400,000

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,500,000

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

[ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%**

14 TYPE OF REPORTING PERSON (See Instructions)

PN

*Riposte Global Opportunity Master Fund, LP ("Master Fund") owns 1,200,000 shares of Common Stock of the Issuer. Khaled Beydoun is the managing member of Riposte Capital LLC and Riposte GP, LLC. Riposte GP, LLC is the general partner of Riposte Global Opportunity Master Fund, LP. Riposte Capital LLC serves as the investment manager to the Master Fund. Accordingly, Riposte Capital LLC may be deemed to share voting and dispositive power with Khaled Beydoun over the shares of Common Stock owned by the Master Fund.

** The percentage is based on 25,429,162 outstanding shares of Common Stock of the Issuer following the close of the offering on and as of September 18, 2023 and as reported by the Issuer in its prospectus supplement filed with the Securities and Exchange Commission (the "SEC") on September 15, 2023.

SCHEDULE 13D

CUSIP No. 82836G102

1 NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Riposte GP, LLC

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS (See Instructions)

AF

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

[ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

Number of Shares Beneficially Owned by Each Reporting Person With: 7 SOLE VOTING POWER

0

8 SHARED VOTING POWER

1,400,000

9 SOLE DISPOSITIVE POWER

0

10 SHARED DISPOSITIVE POWER

1,400,000

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,400,000

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

[ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%**

14 TYPE OF REPORTING PERSON (See Instructions)

OO

*Riposte Global Opportunity Master Fund, LP ("Master Fund") owns 1,200,000 shares of Common Stock of the Issuer. Khaled Beydoun is the managing member of Riposte Capital LLC and Riposte GP, LLC. Riposte GP, LLC is the general partner of Riposte Global Opportunity Master Fund, LP. Riposte Capital LLC serves as the investment manager to the Master Fund. Accordingly, Riposte Capital LLC may be deemed to share voting and dispositive power with Khaled Beydoun over the shares of Common Stock owned by the Master Fund.

** The percentage is based on 25,429,162 outstanding shares of Common Stock of the Issuer following the close of the offering on and as of September 18, 2023 and as reported by the Issuer in its prospectus supplement filed with the Securities and Exchange Commission (the "SEC") on September 15, 2023.

SCHEDULE 13D

CUSIP No. 82836G102

1 NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Khaled Beydoun*

2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) [ ]

(b) [ ]

3 SEC USE ONLY

4 SOURCE OF FUNDS (See Instructions)

OO

5 CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

[ ]

6 CITIZENSHIP OR PLACE OF ORGANIZATION

UK

Number of Shares Beneficially Owned by Each Reporting Person With: 7 SOLE VOTING POWER

0

8 SHARED VOTING POWER

1,400,000

9 SOLE DISPOSITIVE POWER

0

10 SHARED DISPOSITIVE POWER

1,400,000

11 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,400,000

12 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

[ ]

13 PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.5%**

14 TYPE OF REPORTING PERSON (See Instructions)

OO

*Riposte Global Opportunity Master Fund, LP ("Master Fund") owns 1,200,000 shares of Common Stock of the Issuer. Khaled Beydoun is the managing member of Riposte Capital LLC and Riposte GP, LLC. Riposte GP, LLC is the general partner of Riposte Global Opportunity Master Fund, LP. Riposte Capital LLC serves as the investment manager to the Master Fund. Accordingly, Riposte Capital LLC may be deemed to share voting and dispositive power with Khaled Beydoun over the shares of Common Stock owned by the Master Fund.

** The percentage is based on 25,429,162 outstanding shares of Common Stock of the Issuer following the close of the offering on and as of September 18, 2023 and as reported by the Issuer in its prospectus supplement filed with the Securities and Exchange Commission (the "SEC") on September 15, 2023.

Item 1. Security and Issuer

This Statement, Amendment No. 4 to Schedule 13D (this "Schedule 13D"or (the "Statement"), amends and supplements the beneficial ownership statement on Schedule 13D filed with the Securities and Exchange Commission on June 14, 2023 (the "Original Statement"), as amended on June 23, 2023 and on September 15, 2023 (the "Amended Statements") as it relates to common shares of beneficial interest, par value $0.01 per share (the "Shares"), of SilverBow Resources, Inc. (the "Issuer"), a Delaware incorporated company. The address of the principal executive offices of the Issuer is 920 Memorial City Way, Suite 850, Houston, Texas 77204. Except as otherwise provided herein, each Item of the Schedule 13D remains unchanged.

Item 4. Purpose of Transaction

Item 4 is hereby amended and supplemented as follows:

"The Reporting Persons continue to believe that the Issuer's and the Board continue to make value-destructive decisions that are not in the best interest of the Issuer and its shareholders.

Management's desire to grow at any cost has made it an industry outlier and was most recently highlighted by a poorly handled dilutive stock sale at a 17% discount. Whilst most E&P companies are focused on share buybacks and per-share metrics, such as free cash flow per share, the Issuer's management is issuing equity at below 2x EV/EBITDA NTM when similar Small & Mid cap peers trade at 3.5-4x.

The Board and Management continue to boldly demonstrate self-interest over shareholder value time and again. Riposte reiterates the concerns previously highlighted to Management in its letter dated June 13, 2023, and urge very practical action:

Remove value-destructive poison pill that has been widely criticized by investors and the leading proxy and corporate governance advisory firm;

Shift the Issuer's antiquated focus from production to profitability;

Overhaul management incentivization and compensation structure to be aligned with the interests of shareholders;

Retain an independent financial advisor to review strategic options including a sale."

Item 5. Interest in Securities of the Issuer

Item 5 is hereby amended and restated in its entirety as follows:

"(a), (b) The responses of each of the Reporting Persons with respect to Rows 11, 12, and 13 of the cover pages of this Schedule 13D that relate to the aggregate number and percentage of Common Stock (including but not limited to footnotes to such information) are incorporated herein by reference.

The responses of each of the Reporting Persons with respect to Rows 7, 8, 9, and 10 of the cover pages of this Schedule 13D that relate to the number of Common Stock as to which each of the persons or entities referenced in Item 2 above has sole or shared power to vote or to direct the vote of and sole or shared power to dispose of or to direct the disposition of (including but not limited to footnotes to such information) are incorporated herein by reference.

Set forth on Schedule A hereto are all transactions of Common Stock which was effectuated by a Reporting Person during the past sixty days, inclusive of any transactions effected (from July 31, 2023) through 4:30 p.m., New York City time, on September 27, 2023.

(c) No other person is known to have the right to receive or the power to direct the receipt of dividends from, or any proceeds from the sale of, the shares of Common Stock beneficially owned by any of the Reporting Persons.

(d) Not Applicable"

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Item 6 is hereby amended and supplemented as follows:

"The reporting persons have possession of 1,400,000 shares of the Common Stock par value $0.01 as of September 27, 2023."

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Riposte Capital LLC

By: /s/ Khaled Beydoun

___________________

Name: Khaled Beydoun

Title: Managing Member

Riposte Global Opportunity Master Fund, LP

By: /s/ Khaled Beydoun

___________________

Name: Khaled Beydoun

Title: Authorized Signatory

Riposte GP, LLC

By: /s/ Khaled Beydoun

___________________

Name: Khaled Beydoun

Title: Authorized Signatory

Khaled Beydoun

By: /s/ Khaled Beydoun

___________________

Name: Khaled Beydoun

Title: Individually

The statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person by his authorized representative (other than an executive officer or general partner of this filing person), evidence of the representative's authority to sign on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

SCHEDULE A

This Schedule A sets forth information with respect to each purchase and sale of shares of Common Stock which was effectuated by a Reporting Person during the past sixty days, inclusive of any transactions effected (from July 31, 2023) through 4:30 p.m., New York City time, on September 28, 2023. Unless otherwise indicated, all transactions were effectuated in the open market through a broker.

Trade Date Shares Purchased (Sold) Price Per Share

7/31/2023 19,255 35.6521

7/31/2023 5,000 35.4587

8/1/2023 645 35.0374

8/1/2023 100 34.7800

8/3/2023 2,800 32.6370

8/3/2023 2,200 36.2925

8/7/2023 (3,304) 38.8468

8/7/2023 (1,696) 38.8469

8/8/2023 (15,000) 39.4622

8/8/2023 (12,000) 39.6400

8/9/2023 (441) 40.5302

8/9/2023 (2,559) 40.3092

8/14/2023 (10,000) 41.1242

8/14/2023 (3,813) 41.6378

8/14/2023 (2,600) 41.6335

8/14/2023 (15,000) 41.5300

8/15/2023 (3,287) 41.6030

8/15/2023 (1,928) 41.4493

8/15/2023 (6,421) 41.8060

8/17/2023 (3,568) 41.3878

8/18/2023 12,551 40.9984

8/21/2023 (20,976) 42.1057

8/21/2023 (2,300) 42.3178

8/22/2023 6,800 41.6421

8/22/2023 3,500 41.6983

8/23/2023 (1,403) 42.2999

8/24/2023 15,000 41.5802

8/25/2023 15,000 41.7619

8/28/2023 2,991 41.6522

8/29/2023 2,544 41.7888

8/29/2023 2,877 41.6296

8/29/2023 3,000 41.6752

8/30/2023 5,000 42.0504

8/31/2023 2,500 42.5978

8/31/2023 10,000 42.7178

9/1/2023 (26,997) 43.1789

9/1/2023 (23,470) 42.6000

9/5/2023 (4,921) 41.9500

9/5/2023 (102) 41.9000

9/5/2023 (47,936) 41.9003

9/5/2023 (100,000) 41.5004

9/5/2023 (2,133) 42.4556

9/5/2023 (60,367) 41.9472

9/6/2023 (39,275) 41.8000

9/6/2023 (45,541) 41.7855

9/7/2023 (286) 42.4840

9/7/2023 (50,500) 42.2393

9/7/2023 (20,000) 41.7512

9/11/2023 13,255 41.1229

9/13/2023 (72,194) 38.4800

9/14/2023 (50,000) 36.9495

9/20/2023 75,000 34.5280

9/21/2023 15,000 33.0493

9/21/2023 7,500 33.0404

9/22/2023 6,000 33.0133

9/22/2023 6,000 33.0423

9/25/2023 5,000 33.7039

9/25/2023 5,000 33.7358

9/25/2023 4,000 34.1147

9/25/2023 5,000 34.1488

9/26/2023 10,000 34.4037

9/26/2023 2,500 34.3248

9/26/2023 9,000 34.2972

9/26/2023 1,000 34.3837

9/26/2023 5,682 34.4257

9/27/2023 15,000 35.1306

9/27/2023 8,318 35.0189

9/27/2023 4,000 34.8582

9/27/2023 6,211 35.6703

9/27/2023 4,700 35.5949

9/27/2023 5,089 35.6413

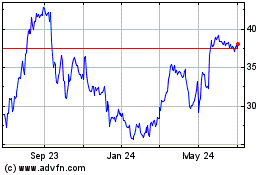

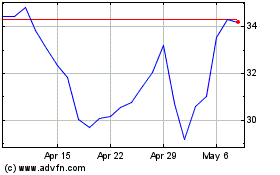

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Oct 2024 to Nov 2024

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Nov 2023 to Nov 2024