Today's Logistics Report: Shipping's Bet on Trade; Amazon's Soaring Costs; Stores' Opening Hours

May 01 2020 - 1:25PM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Shipping companies aren't betting against globalization over the

long term even if as they pull back ocean-going capacity this year.

The turbulent response around the world to the coronavirus

pandemic, with supply chains rattled and shortages of critical

goods in many countries, has some world leaders calling for

reshoring of manufacturing. Ship owners aren't buying it, the WSJ

Logistics Report's Costas Paris writes in a Shipping Matters

column, reasoning that the pandemic and the crumbling trade economy

is a detour from global growth and not a sea change. BIMCO's Peter

Sand says China's sprawling factory sector and its extensive

shipping infrastructure gives the country too big an advantage for

companies to ignore. Germany's Hapag-Lloyd AG is among the

operators committed to ultralarge container ships, and the operator

isn't changing course. Manufacturers may add factories close to

home, the carrier says, but they won't walk away from China.

E-COMMERCE

Amazon.com Inc.'s soaring sales growth in a stormy retail market

is coming at a high cost. The company's sales jumped 26% in the

first quarter as consumers locked down at home by the coronavirus

restrictions rushed to order goods online. The WSJ's Dana Mattioli

reports the company's profit also tumbled 29% to $2.54 billion and

that shipping costs in the normally slower quarter skyrocketed 49%

to $10.94 billion. The results reflect the central role Amazon has

played during the crisis, delivering goods to people stranded at

home by shelter-in-place orders. They also show the rapid

adjustment the company has undertaken. Amazon carried nearly twice

as much inventory on its balance sheet as it counted in the

year-ago quarter, and it is adding 175,000 warehouse and delivery

workers to handle the surge. The company now projects about $4

billion in costs in the second quarter related to the Covid-19

outbreak.

SUPPLY CHAIN STRATEGIES

The doors to U.S. retail stores will soon start cracking open a

bit. Macy's Inc. plans to reopen 68 stores on Monday in states that

have loosened restrictions, the WSJ's Suzanne Kapner reports,

joining a handful of other retailers that are limping back to life

after the coronavirus forced them to shut stores. Macy's Chief

Executive Jeff Gennette expects to open all the company's roughly

775 stores in the next six weeks, assuming continued progress in

lowering infection rates in the U.S. Best Buy is also looking to

open about 200 stores this month, and both retailers will have

sharply restrictive operations meant to keep shoppers and consumers

safe. The opening plans suggest the growing urgency across a retail

sector that's taken big financial hits from the lockdowns meant to

slow the coronavirus spread. Sales at department stores plummeted

nearly 20% from February to March, according to federal

figures.

QUOTABLE

IN OTHER NEWS

Consumer spending fell 7.5% in March, the steepest decline in

records dating to 1959. (WSJ)

At least 30.3 million Americans have filed new unemployment

claims since mid-March. (WSJ)

The eurozone economy shrank at the fastest pace on record during

the first three months of this year. (WSJ)

China's official manufacturing index slipped as factories

reported slackening export demand. (WSJ)

Mexico's economy contracted 1.6% in the first quarter. (WSJ)

The White House is confident China will meet its obligations

under a trade deal and increase imports from the U.S. by $200

billion over 2017 levels. (WSJ)

Boeing Inc. launched a $25 billion bond offering. (WSJ)

Apple Inc.'s revenue ticked up 1% in its second quarter despite

the coronavirus impact in China. (WSJ)

Apparel retailer J.Crew Group Inc. is preparing to file for

bankruptcy protection. (WSJ)

Major restaurant suppliers say orders suggest the industry is

getting ready to resume more normal operations. (WSJ)

Changes in consumer behavior under the pandemic helped push

McDonald Corp's sales down 6% in the first quarter. (WSJ)

Qualcomm Inc. says semiconductor shipments fell 17% in the first

quarter and handset demand declined 21%. (WSJ)

American Airlines Group Inc, is reducing its fleet amid plans to

cut flying by 70% by June. (WSJ)

Small U.S. oil companies are shutting down wells faster than

anticipated. (WSJ)

Shopify launched a shopping platform that connects merchants,

logistics operators and consumers. (TechCrunch)

Shopping network QVC is closing its Lancaster County, Pa.,

distribution center as it consolidates regional operations at a

bigger site in Bethlehem, Pa. (PennLive)

Australia is subsidizing cargo flights used by freight

forwarders to help the country's agriculture exporters. (The

Loadstar)

Maritime insurer TT Club warned that warehousing capacity at

port terminals and inland depots is filling up amid supply chain

upheaval. (Port Technology)

More ships sailing between Europe and Asia are taking the long

route around the Cape of Good Hope to avoid the Suez Canal.

(Lloyd's List)

Tesla Inc. is shifting delivery of its first Semi truck to 2021,

putting the vehicle two years behind schedule. (Commercial Carrier

Journal)

Freight broker C.H. Robinson Worldwide Inc, is furloughing or

reducing hours for 7% of its workforce after cash flow from

operations fell 77% in the first quarter. (Fox Business)

Truckload carrier U.S. Xpress Enterprises Inc. lost $7.3 million

in the first quarter despite a 4.1% gain in revenue. (Chattanooga

Times Free Press)

Werner Enterprises Inc. says an early risk assessment of

customers helped the truckload carrier minimize the pandemic's

financial fallout. (Transport Dive)

Freight forwarder DSV A/S will l ay off 3,000 workers after

reporting slimmer first-quarter margins. (ShippingWatch)

Kuehne + Nagel International AG expects shipping markets to

rebound in the second half of the year. (Lloyd's Loading List)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow the WSJ

Logistics Report team: @PaulPage , @jensmithWSJ and @CostasParis.

Follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

May 01, 2020 13:10 ET (17:10 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

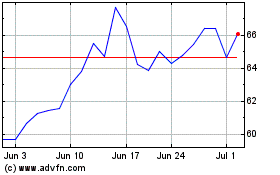

Shopify (NYSE:SHOP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Sep 2023 to Sep 2024