00017848512023FYFALSEP2Yhttp://fasb.org/us-gaap/2023#ImpairmentOfLongLivedAssetsToBeDisposedOfhttp://fasb.org/us-gaap/2023#ImpairmentOfLongLivedAssetsToBeDisposedOfhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNet0.12500017848512023-01-012023-12-310001784851us-gaap:CommonStockMember2023-01-012023-12-310001784851us-gaap:WarrantMember2023-01-012023-12-3100017848512023-06-30iso4217:USD00017848512024-03-22xbrli:shares00017848512023-12-3100017848512022-12-31iso4217:USDxbrli:shares00017848512022-01-012022-12-310001784851us-gaap:CommonStockMember2021-12-310001784851us-gaap:AdditionalPaidInCapitalMember2021-12-310001784851us-gaap:RetainedEarningsMember2021-12-310001784851us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100017848512021-12-310001784851us-gaap:CommonStockMember2022-01-012022-12-310001784851us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001784851us-gaap:RetainedEarningsMember2022-01-012022-12-310001784851us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001784851us-gaap:CommonStockMember2022-12-310001784851us-gaap:AdditionalPaidInCapitalMember2022-12-310001784851us-gaap:RetainedEarningsMember2022-12-310001784851us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001784851us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001784851us-gaap:RetainedEarningsMember2023-01-012023-12-310001784851us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001784851us-gaap:CommonStockMember2023-12-310001784851us-gaap:AdditionalPaidInCapitalMember2023-12-310001784851us-gaap:RetainedEarningsMember2023-12-310001784851us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001784851shpw:ReverseRecapitalizationMembershpw:ShapewaysIncMembershpw:SubscriptionAgreementMembershpw:PipeInvestorsMember2021-09-292021-09-290001784851shpw:ReverseRecapitalizationMembershpw:ShapewaysIncMembershpw:SubscriptionAgreementMembershpw:PipeInvestorsMember2021-09-29shpw:technologyshpw:molding0001784851srt:MinimumMember2023-01-012023-12-31shpw:materialAndFinishshpw:partshpw:customershpw:country0001784851shpw:DesktopMetalMember2021-03-262021-03-260001784851shpw:DesktopMetalMember2021-03-260001784851us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-310001784851srt:MaximumMember2023-12-310001784851us-gaap:ComputerEquipmentMembersrt:MinimumMember2023-12-310001784851us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310001784851us-gaap:VehiclesMember2023-12-310001784851srt:MinimumMember2023-12-310001784851shpw:FavorableOperatingLeaseMember2023-01-012023-12-31shpw:sourcesxbrli:pure00017848512023-06-2100017848512023-06-2700017848512023-06-220001784851us-gaap:WarrantMember2023-01-012023-12-310001784851us-gaap:WarrantMember2022-01-012022-12-310001784851shpw:EarnoutSharesMember2023-01-012023-12-310001784851shpw:EarnoutSharesMember2022-01-012022-12-310001784851us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001784851us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-31shpw:segment00017848512023-06-222023-06-220001784851us-gaap:CashAndCashEquivalentsMemberus-gaap:USTreasurySecuritiesMember2023-12-310001784851us-gaap:ShortTermInvestmentsMemberus-gaap:USTreasurySecuritiesMember2023-12-310001784851us-gaap:CashAndCashEquivalentsMemberus-gaap:USTreasurySecuritiesMember2022-12-310001784851us-gaap:ShortTermInvestmentsMemberus-gaap:USTreasurySecuritiesMember2022-12-310001784851shpw:MFGcomMember2022-04-222022-04-220001784851shpw:MFGcomMember2022-04-220001784851us-gaap:CustomerRelationshipsMembershpw:MFGcomMember2022-04-220001784851us-gaap:CustomerRelationshipsMembershpw:MFGcomMember2022-04-222022-04-220001784851shpw:MFGcomMemberus-gaap:TradeNamesMember2022-04-220001784851shpw:MFGcomMemberus-gaap:TradeNamesMember2022-04-222022-04-220001784851shpw:MFGcomMembershpw:AcquiredSoftwarePlatformMember2022-04-220001784851shpw:MFGcomMembershpw:AcquiredSoftwarePlatformMember2022-04-222022-04-220001784851us-gaap:CustomerListsMembershpw:MFGcomMember2022-04-220001784851us-gaap:CustomerListsMembershpw:MFGcomMember2022-04-222022-04-220001784851shpw:LinearAMSMember2022-05-092022-05-090001784851shpw:LinearAMSMember2022-05-090001784851shpw:LinearAMSMember2023-01-012023-03-3100017848512023-04-012023-04-300001784851us-gaap:CustomerRelationshipsMembershpw:LinearAMSMember2022-05-090001784851us-gaap:CustomerRelationshipsMembershpw:LinearAMSMember2022-05-092022-05-090001784851us-gaap:TradeNamesMembershpw:LinearAMSMember2022-05-090001784851us-gaap:TradeNamesMembershpw:LinearAMSMember2022-05-092022-05-090001784851us-gaap:NoncompeteAgreementsMembershpw:LinearAMSMember2022-05-090001784851us-gaap:NoncompeteAgreementsMembershpw:LinearAMSMember2022-05-092022-05-090001784851shpw:LinearAMSMembershpw:FavorableOperatingLeaseMember2022-05-090001784851shpw:LinearAMSMembershpw:FavorableOperatingLeaseMember2022-05-092022-05-090001784851shpw:UnfavorableOperatingLeaseMembershpw:LinearAMSMember2022-05-090001784851shpw:UnfavorableOperatingLeaseMembershpw:LinearAMSMember2022-05-092022-05-090001784851shpw:MakerOSMember2022-04-132022-04-130001784851shpw:MakerOSMember2022-04-130001784851shpw:DirectSalesMember2023-01-012023-12-310001784851shpw:DirectSalesMember2022-01-012022-12-310001784851shpw:MarketPlaceSalesMember2023-01-012023-12-310001784851shpw:MarketPlaceSalesMember2022-01-012022-12-310001784851us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-12-310001784851us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-310001784851us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001784851us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001784851us-gaap:TransferredOverTimeMember2023-01-012023-12-310001784851us-gaap:TransferredOverTimeMember2022-01-012022-12-3100017848512021-01-010001784851us-gaap:MachineryAndEquipmentMember2023-12-310001784851us-gaap:MachineryAndEquipmentMember2022-12-310001784851us-gaap:ComputerEquipmentMember2023-12-310001784851us-gaap:ComputerEquipmentMember2022-12-310001784851us-gaap:LeaseholdImprovementsMember2023-12-310001784851us-gaap:LeaseholdImprovementsMember2022-12-310001784851us-gaap:FurnitureAndFixturesMember2023-12-310001784851us-gaap:FurnitureAndFixturesMember2022-12-310001784851us-gaap:VehiclesMember2022-12-310001784851shpw:AssetsToBePlacedInServiceMember2023-12-310001784851shpw:AssetsToBePlacedInServiceMember2022-12-310001784851us-gaap:CustomerRelationshipsMember2023-12-310001784851us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001784851us-gaap:TradeNamesMember2023-12-310001784851us-gaap:TradeNamesMember2023-01-012023-12-310001784851us-gaap:NoncompeteAgreementsMember2023-12-310001784851us-gaap:NoncompeteAgreementsMember2023-01-012023-12-310001784851shpw:UnfavorableOperatingLeaseMember2023-12-310001784851shpw:UnfavorableOperatingLeaseMember2023-01-012023-12-310001784851us-gaap:CustomerRelationshipsMember2022-12-310001784851us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001784851us-gaap:TradeNamesMember2022-12-310001784851us-gaap:TradeNamesMember2022-01-012022-12-310001784851shpw:AcquiredSoftwarePlatformMember2022-12-310001784851shpw:AcquiredSoftwarePlatformMember2022-01-012022-12-310001784851us-gaap:CustomerListsMember2022-12-310001784851us-gaap:CustomerListsMember2022-01-012022-12-310001784851us-gaap:NoncompeteAgreementsMember2022-12-310001784851us-gaap:NoncompeteAgreementsMember2022-01-012022-12-310001784851shpw:FavorableOperatingLeaseMember2022-12-310001784851shpw:FavorableOperatingLeaseMember2022-01-012022-12-310001784851shpw:UnfavorableOperatingLeaseMember2022-12-310001784851shpw:UnfavorableOperatingLeaseMember2022-01-012022-12-31shpw:lease00017848512023-02-012023-03-3100017848512023-03-310001784851us-gaap:AssetPledgedAsCollateralMemberus-gaap:SecuredDebtMember2023-08-310001784851us-gaap:SecuredDebtMembershpw:MitsubishiHCCapitalAmericaFinancingAgreementMember2023-01-012023-12-310001784851us-gaap:SecuredDebtMembershpw:MitsubishiHCCapitalAmericaFinancingAgreementMember2023-12-310001784851us-gaap:SecuredDebtMember2023-12-310001784851us-gaap:SecuredDebtMembershpw:FirstInsuranceFundingFinancingAgreementMember2023-10-310001784851us-gaap:SecuredDebtMembershpw:FirstInsuranceFundingFinancingAgreementMember2023-01-012023-12-310001784851us-gaap:SecuredDebtMembershpw:FirstInsuranceFundingFinancingAgreementMember2023-12-31shpw:vote0001784851shpw:PriorToMergerMembershpw:PublicWarrantsMember2021-09-280001784851shpw:PriorToMergerMembershpw:PublicWarrantsMember2021-09-282021-09-280001784851shpw:PublicWarrantsMember2021-09-280001784851shpw:PublicWarrantsMember2021-09-282021-09-2800017848512021-09-28shpw:Day0001784851shpw:PrivateWarrantsMember2021-09-280001784851shpw:ConvertibleNoteMember2023-01-012023-12-310001784851shpw:SponsorWarrantsMembershpw:ConvertibleNoteMember2023-01-012023-12-310001784851shpw:SponsorWarrantsMember2023-12-310001784851shpw:TwoThousandTenStockPlanMember2021-09-290001784851shpw:LegacyShapewaysStockOptionMembershpw:TwoThousandTenStockPlanMember2021-09-292021-09-290001784851shpw:TwoThousandTenStockPlanMember2023-01-012023-12-310001784851shpw:TwoThousandTenStockPlanMember2023-12-310001784851shpw:TwoThousandTwentyOneEquityIncentivePlanMember2022-01-012022-12-310001784851shpw:TwoThousandTwentyOneEquityIncentivePlanMember2023-12-310001784851shpw:TwoThousandTwentyTwoEquityIncentivePlanMember2023-12-310001784851srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2022-12-310001784851shpw:TwoThousandTwentyOneEquityIncentivePlanMember2023-01-012023-12-310001784851us-gaap:RestrictedStockUnitsRSUMember2022-12-310001784851us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001784851us-gaap:RestrictedStockUnitsRSUMember2023-12-310001784851us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001784851us-gaap:EmployeeStockMember2023-12-310001784851us-gaap:EmployeeStockMember2023-01-012023-12-310001784851us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001784851us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001784851us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001784851us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001784851us-gaap:FairValueInputsLevel3Membershpw:EarnoutLiabilityMember2023-01-012023-12-310001784851us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membershpw:WarrantLiabilityMember2023-12-310001784851shpw:EarnoutSharesMember2023-12-310001784851shpw:EarnoutSharesMembershpw:TradingPriceOneMember2021-09-290001784851shpw:EarnoutSharesMembershpw:TradingPriceTwoMember2021-09-290001784851shpw:TradingPriceOneMember2021-09-290001784851shpw:TradingPriceTwoMember2021-09-290001784851shpw:EarnoutSharesMember2021-09-292021-09-2900017848512021-09-292021-09-290001784851us-gaap:FairValueMeasurementsNonrecurringMembershpw:EarnoutSharesMember2021-09-290001784851shpw:EarnoutSharesMember2021-09-290001784851us-gaap:DomesticCountryMember2023-12-310001784851us-gaap:StateAndLocalJurisdictionMember2023-12-310001784851us-gaap:SalesRevenueNetMembershpw:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001784851us-gaap:SalesRevenueNetMembershpw:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001784851shpw:VendorOneMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2022-01-012022-12-310001784851us-gaap:AccountsReceivableMembershpw:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001784851us-gaap:AccountsReceivableMembershpw:CustomerOneMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001784851us-gaap:AccountsReceivableMembershpw:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001784851shpw:VendorOneMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:AccountsPayableMember2023-01-012023-12-310001784851shpw:VendorOneMemberus-gaap:SupplierConcentrationRiskMemberus-gaap:AccountsPayableMember2022-01-012022-12-310001784851shpw:DesktopMetalMemberus-gaap:SubsequentEventMember2024-01-012024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 10-K

____________________

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____to _____

Commission file number: 001-39092

____________________

SHAPEWAYS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

____________________

| | | | | |

| Delaware | 87-2876494 |

| (State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

12163 Globe St

Livonia, MI 48150

(Address of principal executive offices) (Zip Code)

(734) 422-6060

(Registrant’s telephone number, including area code)

____________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Stock, par value $0.0001 per share | | SHPW | | The Nasdaq Stock Market LLC |

| Warrants to purchase Common Stock | | SHPWW | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.0405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| | | |

| Non-accelerated filer | x | Smaller reporting company | x |

| | | |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b2 of the Exchange Act). Yes ☐ No ☒

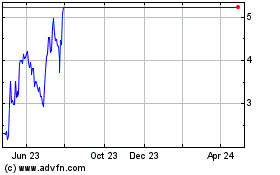

The aggregate market value of voting stock held by non-affiliates of the registrant, as of June 30, 2023, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $20.4 million (based on the last reported sale price of the registrant's common stock of $3.76 per share on June 30, 2023 on the New York Stock Exchange). The registrant has no non-voting stock outstanding.

As of March 22, 2024 the registrant had 6,616,465 shares of common stock outstanding.

Documents Incorporated by Reference

Portions of the registrant's definitive proxy statement related to the registrant's 2024 Annual Meeting of Shareholders to be filed hereafter are incorporated by reference into Part III of this Annual Report on Form 10-K. The 2024 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Report”), including, without limitation, the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of present or historical fact included in or incorporated by reference in this Report, regarding the future financial performance of Shapeways Holdings, Inc. (the “Company”, “Shapeways,” “we,” “us” or “our”), as well as the Company’s strategy, future operations, future operating results, financial position, estimated revenue, and losses, projected costs, prospects, plans and objectives of management and ability to implement additional cost-reduction measures or consummate capital raises or strategic alternatives, including a sale or liquidation of some or all of the Company's assets via merger, business combination, or other strategic transaction to maximize shareholder value, and the timing and/or impact of any such potential transactions or cost-reduction measures are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would,” “will,” “seek,” “target,” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on information available as of the date of this Report and on the current expectations, forecasts and assumptions of the management of the Company, involve a number of judgments, risks and uncertainties and are inherently subject to changes in circumstances and their potential effects and speak only as of the date of such statements. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed, contemplated or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under Part I, Item 1A: “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described under Part I, Item 1A: “Risk Factors” may not be exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future performance and the Company’s actual results of operations, financial condition and liquidity, and developments in the industry in the Company operates may differ materially from those made in or suggested by the forward-looking statements contained in this Report. In addition, even if the Company’s results or operations, financial condition and liquidity, and developments in the industry in which it operates are consistent with the forward-looking statements contained in this Report, those results or developments may not be indicative of results or developments in subsequent periods.

PART I

Item 1. Business

Company Overview

Shapeways Holdings, Inc. ("Shapeways") is a leading digital manufacturer combining high quality, flexible on-demand manufacturing with purpose-built proprietary software to offer customers an end-to-end digital manufacturing platform on which they can rapidly transform digital designs into physical products. Our manufacturing platform offers customers access to high quality manufacturing from start to finish through automation, innovation and digitization. Our proprietary software, wide selection of materials and technologies, and global supply chain lower manufacturing barriers and accelerate delivery of manufactured parts from prototypes to finished end parts. We combine deep digital manufacturing know-how and software expertise to deliver high quality, flexible on-demand digital manufacturing to a range of customers, from project-focused engineers to large enterprises. Digital manufacturing is the complete digitization of the end-to-end manufacturing process that enables the transition of a digital file to a physical product.

We have manufacturing facilities in Livonia and Charlotte, Michigan within the United States and in Eindhoven, the Netherlands. In addition, as of December 31, 2023, we had 40 strategic supply chain partners who provide incremental capacity and production technologies to help us scale with customer demand and support us in efficiently launching new materials and manufacturing technologies. Approximately 35% of our revenue in 2023 was earned through those strategic outsourced supply chain partners.

We support our customers through the design, pre-production, manufacturing and delivery process across a range of industries, materials, part volumes and delivery options. Our software is deeply integrated with our customers’ workflows and often is mission critical to their businesses. We make industrial-grade additive manufacturing and traditional manufacturing accessible by fully digitizing the end-to-end manufacturing process, and by providing a broad range of solutions utilizing 12 additive manufacturing technologies, 13 injection molding and computer numerical control ("CNC") manufacturing technologies and more than 120 materials and finishes, with the ability to easily scale new innovation. Shapeways has delivered over 24 million parts to over one million customers in over 180 countries as of December 31, 2023. Our platform is agnostic as to manufacturing hardware, materials and design software providers.

We use our proprietary software to automate production that passes through our manufacturing platform. Our software supports ordering, part analysis, manufacturing planning, pre-production and manufacturing. This software enables us to offer high quality, low-volume, complex part production. In an environment increasingly focused on mass customization and speed of part delivery, we believe that our core competency in low-volume, high-mix production at scale appeals to customers.

We launched the first phase of our software offering to third-party manufacturers, under the brand OTTO, in the fourth quarter of 2021. In April 2022 we acquired MFG.com ("MFG") and MakerOS, Inc. ("MakerOS"), which expanded our software offering's customer base and feature set. In July 2023, we announced the launch of a 3D Model Viewer for our software offering deployed via the MFG brand. This feature is available for manufacturers on the MFG.com platform and is intended to accelerate and improve the quoting process. The 3D Model Viewer provides manufacturers with a unified platform and the latest technology for viewing 3D models of custom parts, which streamlines the quoting process, and allows for greater accuracy and speed. In addition to providing multiple benefits for manufacturers, the enhanced 3D capability also streamlines the purchasing experience for buyers because they can receive faster, more precise quotes.

Our Strategy

The key elements of our strategy for growth are:

•Expand materials offering. Our materials portfolio has historically been focused on polymers. We plan to continue to expand our polymers offerings while adding capabilities in industrial metals, composites and ceramics. We believe that by expanding our materials capabilities and offering a comprehensive and innovative materials portfolio, we will be able to unlock additional opportunities in key markets such as industrial, medical, automotive and aerospace.

•Expand within and beyond additive manufacturing. We plan to continue to expand our reach within additive manufacturing through new hardware and expanded materials capabilities. We also plan to expand into other digital manufacturing technologies such as computer numerical control, injection molding and sheet metal, all of which are generally suited to complex, low-volume part production. As our customers scale in volume, they often

graduate into these traditional methods; therefore, we believe adding these capabilities will allow us to capture a larger portion of customer spend and grow with our customers’ needs. We plan to leverage our strategic outsourced supply chain partners to support these manufacturing capabilities while we focus our internal manufacturing capabilities on additive manufacturing.

Our Competitive Strengths

•Diverse, global customer base. Our customers today include businesses of all sizes, ranging from small and medium enterprises to Fortune 500 organizations, and span many industries, including aerospace, robotics, consumer products, architecture, gaming, jewelry and medical devices. To date we have primarily served customers based in North America and Europe.

•High quality, flexible on-demand manufacturing with proprietary purpose-built software. Our manufacturing platform adjusts to customers’ needs to optimize for speed, cost and quality. Our platform is designed to be highly configurable to meet the needs of our customers and suited for industrial-grade, high quality, low-volume, complex one-part production at scale. We offer high quality, flexible on-demand manufacturing services to deliver finished end parts to our customers in days instead of the weeks or months that are generally required by traditional manufacturers.

•Platform scalability and quick adaptability to market shifts. We do not depend on the success of any one hardware provider, manufacturing technology, or materials vendor. Our software is designed to be highly configurable and integrate easily with new hardware technologies and materials allowing us to adapt and shift in response to market changes. We expect to continue adding new hardware providers, manufacturing technologies and materials. We believe that we will benefit from innovation in hardware and materials across the additive manufacturing market, which will allow us to offer even more materials to our customers.

•Enabling platform adoption across customer types and industries. Our customer base is diversified across sizes, industries and geographies. Unlike hardware providers, we have the opportunity to capture business from small to medium sized manufacturers that are unlikely to invest the capital required to deploy and support their own digital manufacturing capabilities.

•Experienced management team with strong investor support. Our leadership team has decades of category and operational experience, including our engineering, sales and manufacturing teams. We have a proven history in successfully operating and scaling businesses with experience in both technology and manufacturing. Investors with deep domain expertise have supported our business, providing resources and knowledge in the development of our end-to-end digital manufacturing platform and underlying software.

Our Platform

Shapeways Digital Manufacturing Platform

We offer a broad set of digital manufacturing tools and services to help customers innovate faster, lower costs and scale more efficiently. Our end-to-end digital manufacturing platform is differentiated through three key areas, design, production, and scale and is powered by our proprietary, purpose-built software:

•Design. We provide our customers with advanced design technology and services to help correct and optimize their files to enable successful manufacturability. Through our software and in-house experts, we assist with file optimization, file correction, material and technology consultation, and prototyping. We also review digital files so they are optimized for materials, strength, structure, and cost, working closely with our customers to ensure quality and end-user satisfaction. Finally, we offer custom rapid-prototyping services that can accelerate product development by allowing our customers to iterate designs both virtually and physically prior to production.

•Production. Through our digital manufacturing platform, our customers have access to numerous innovative additive manufacturing hardware technologies and materials. We built our platform with process visibility and quality in mind, and we offer our customers the ability to track production via real-time dashboards. Our manufacturing technology is able to deliver thousands of unique parts per day and can track by machine, material, operator, and process. Our production capabilities include 12 hardware technologies and more than 120 materials and finishes. We offer advanced finishing, including painting, polish, chemical treatment, color and metal plating, as well as performance and fit testing, quality checks and assembly for finished end-parts. We also offer custom-

branded packing and fulfillment. Shapeways provides high quality, low-volume production with a 30-day average of approximately 98% on-time deliveries globally with a less than 1% customer complaint rate for the years ended December 31, 2023 and 2022. By shipping products directly to our customers’ end customers, we can help reduce the potential for issues related to order fulfillment. The table below shows 12 common materials offered by Shapeways and the 12 types of technologies that are used to manufacture end parts using the material, in each case as of December 31, 2023.

| | | | | | | | | | | | | | |

Name | | Material | | Technology |

| Accura 60, Accura Xtreme, Accura Xtreme 200, Grey Primed SLA | | Accura 60, Accura Xtreme, Accura Xtreme 200, LT9000 | | SLA |

| MJF Plastic PA12, PA12GB, Polypropylene | | Nylon 12, Nylon 12 Glass Bead Filled, Polypropylene | | MJF |

| PA11, TPU, Versatile Plastic, Nylon 6 Mineral Filled , Arnite® T AM1210, TPE | | Nylon 11, Thermoplastic Polyurethane, Nylon 12, Nylon 6 Mineral Filled, PBT, TPC | | SLS |

| Multi-Color Polyjet | | Vero | | Polyjet |

| Stainless Steel 316L, Stainless Steel 17-4PH, 4140 Steel, Copper | | Stainless Steel 316L, Stainless Steel 17-4PH, 4140 Steel, Copper | | BMD |

| High Definition Full Color, Fine Detail Plastic | | Mimaki MH-100, Visijet M3 Crystal | | Material Jetting |

| BHDA, Ultracur3D® RG 35, 5015 Elastomeric Shore A 70, 3843 Tough HDT80, 3172 Tough High Impact | | R5 Gray, Ultracur3D® RG 35, 5015 Elastomeric Shore A 70, 3843 Tough HDT80, 3172 Tough High Impact | | DLP |

| EPU 40, RPU 70, UMA 90 | | Elastomeric Polyurethane, Rigid Polyurethane, Urethane Methacrylate | | DLS |

| Aluminum, MS1 | | Aluminum, Maraging Steel (MS1) | | L-PBF |

| Steel, Stainless Steel 316L | | 420 Steel / Bronze (60:40),Stainless Steel 316L, Stainless Steel 17-4PH, Gypsum | | Binder Jetting |

| Bronze, Brass, Copper, Gold Plated Brass, Gold, Platinum, Rhodium Plated Brass, Silver | | Wax Casting | | Casting |

| Titanium | | Ti-6AI-4V (Titanium) | | E-PBF |

•Scale. Our Application Programming Interface (“API”) integrations allow us to easily scale and grow with our customers’ businesses. With our API integrations, customers can seamlessly integrate custom websites or web applications into our platform, enabling them to efficiently scale and leverage our fulfillment capability. We also have integrations with leading third party e-commerce providers, allowing our customers who sell consumer-facing goods to connect their stores directly to our platform. Further, our customers have access to our service and support teams, who provide them with deep domain expertise in digital manufacturing technology, materials and production processes.

Shapeways' Proprietary, Purpose-Built Software

Our ability to deliver high quality, flexible on-demand manufacturing is powered by our proprietary, purpose-built software. That internal-use software, "InShape," enables us to fully digitize the end-to-end manufacturing workflow, including:

Ordering. Our software enables customized order intake allowing our customers to offer secure upload and immediate pricing through automated configurations of model, material, finish, and fulfillment requirements. Our software provides order management to simplify manufacturing status monitoring, sales tracking, and repeat ordering. Files that are uploaded can be saved to a digital inventory, allowing the customer to facilitate future orders.

Analysis. Currently approximately 85% of files that are uploaded to our platform must be revised for successful manufacturability. Our software provides automated printability analysis, including file correction and optimization, and can automatically correct common issues with 3D models. If the file is determined to be unprintable based on model

geometry, past print successes, and material guidelines, our software enables automated workflows to communicate feedback and printability issues with the customer and offer them paths for resolution.

Planning. Our software enables production planning across a supply chain network, including both our internal manufacturing facilities and external supply chain outsource partners. Our software automates the assignment and allocation of orders through the supply chain using smart demand allocation, based on cost, manufacturing capacity, part specification, geography, and fulfillment speed.

Pre-Production. Our software includes manufacturing preparation technology, 2D and 3D tray planning, and machine integration. This allows for optimized asset utilization, materials usage, and machine capacity utilization.

Manufacturing. Our software includes technology that spans production, asset monitoring, material monitoring, traceability, post-production processes, and certification. This includes robust tools to monitor all steps of the manufacturing process and enable continuous iterations and improvements to adjust to emerging technologies and capabilities. Our platform connects directly with additive manufacturing hardware, providing an integrated platform for monitoring production, maintenance, and printer status across both internal manufacturing and outsource supply chain capabilities. We provide full historical logging capabilities, capturing key touch points from pre-print to production to reduce machine downtime and enable gross margin improvements.

Our software also supports post-production processes, inspection, and assembly. This enables us to incorporate custom workflows, including improved quality assurance processes and assembly instructions. Our quality assurance feedback process creates a feedback loop between customers and manufacturers to achieve optimal product standards.

Our software enables global distribution and delivery of finished products direct to the end customer. We ship efficiently via a distribution center network and shipping service integrations. Our customer service team has deep domain expertise in additive manufacturing technology, materials, and production processing and offers end-to-end support to both our customers and their end customers.

Strategic Alternatives Update

As previously disclosed, we have been working with advisors in considering strategic alternatives, including, without limitation, a sale of a material portion of our assets, merger, business combination, liquidation of certain assets or other strategic transaction to maximize shareholder value. Based on market checks conducted by our advisors, as well as preliminary discussions with and feedback from potential purchasers, and in light of continued macroeconomic and industry pressures, we are actively taking steps to sell a material portion of our assets. In the course of these preliminary discussions, potential purchasers have indicated an interest in acquiring either our manufacturing business or software business, but not both.

We are continuing to evaluate strategic alternatives with regard to our core manufacturing and software businesses, including ongoing discussions with potential acquirers. We have not signed a definitive agreement with respect to either our software or manufacturing assets, and there can be no assurance that any of these processes will result in any transaction. Please see Part I, Item 1A: “Risk Factors—Risks Related to Our Business—We may not be successful in identifying and implementing one or more strategic alternatives for our business, and any strategic alternative that we may consummate could have material adverse consequences for us” and Note 3 of our consolidated financial statements included in Part II, Item 8: Financial Statements and Supplementary Data, of this Annual Report on Form 10-K.

Customers

We have delivered over 24 million parts to over one million customers in over 180 countries from inception through 2023. A key component of our growth has been our relationships with our customers, which has led to a high level of repeat revenue. In 2023, one customer accounted for approximately 17% of our revenue. Our customers range from small and medium-sized enterprises to Fortune 500 companies and are diversified across a range of industries. Shapeways supports customers’ manufacturing needs from design, prototyping, optimization, and finished part production.

Research and Development

Our research and development efforts are focused primarily on software development and the evaluation of new manufacturing technologies and materials to add to the Shapeways digital manufacturing platform, both internally and through our strategic outsourced supply chain partners. The digital manufacturing landscape is evolving quickly, with new technologies and materials being brought to market at an increasingly rapid pace. Our research and development, operations and supply chain teams have deep relationships with leading hardware and materials providers, allowing us to stay current on new technologies coming to market. Our research and development team regularly evaluates opportunities in new technologies and materials across a range of factors including customer demand, technology maturity, and production workflow. Additionally, our research and development team work closely with hardware original equipment manufacturers (“OEMs”) and materials providers to ensure production quality and efficiency for our customers.

Sales and Marketing

Historically, Shapeways has been a self-service digital manufacturing platform growing through our customers and through organic customer acquisition. We are focused on direct sales and marketing efforts to both expand our customer base and retain our existing customer base. We have strong brand recognition due to our long-standing relationships with hardware OEMs and materials providers, who have also served as channels for customer acquisition. Our marketing strategy has historically focused on inbound marketing, and we plan to expand our outbound efforts, primarily focused on larger potential customers and expanding our reach in key verticals.

Our marketing strategies are focused on supporting sales growth by driving awareness of digital manufacturing and of our platform. We develop comprehensive sales and marketing content, tools, and campaigns, often in parallel with our partner network. Our internal marketing team develops content specifically aimed at both corporate executives and engineers in multiple formats such as case studies, newsletters, and webinars in order to facilitate sales and customer engagement. We regularly release communications through trade press and attend industry events and conferences to augment our vertical market strategy and build strategic relationships.

Manufacturing and Suppliers

Our manufacturing capabilities include ISO 9001: 2015, IATF 16949, and ITAR compliant facilities in Livonia and Charlotte, Michigan and in Eindhoven, the Netherlands, as well as a network of outsourced supply chain partners, all of which are managed through our proprietary software platform. Our strategic outsourced supply chain partners focus on overflow capacity to help us meet peak demand, as well as support us in efficiently launching new materials and technologies on our platform. Our internal manufacturing and supply chain teams collaborate closely with our strategic outsourced supply chain partners to ensure production quality.

We source and purchase manufacturing equipment from the leading hardware providers in the additive manufacturing ecosystem, such as 3D Systems, Carbon, EnvisionTec, EOS, ExOne, Formlabs, HP, Origin, Prodways and Desktop Metal. We source materials from these hardware providers as well as from leading chemicals companies such as BASF, DSM/Covestro, and Henkel. As the hardware and materials landscape continues to evolve, we expect to partner with additional hardware and materials providers, either by bringing their capabilities in house or by outsourcing to our strategic outsourced supply chain partners.

Our Competition

The industry in which we operate is fragmented and competitive. We compete for customers with a range of digital manufacturing platforms, including Materialise NV, Proto Labs, Inc., service bureaus, digital manufacturing brokers, and small local manufacturers. We believe we are differentiated from our competitors as we provide solutions that combine proprietary software and digital manufacturing capabilities.

In particular, we believe we compare favorably to other industry participants on the basis of the following competitive factors:

•Wide range of plastic materials offerings;

•Growing portfolio of metals offerings with ability to supply new materials as they become available;

•Part quality and consistency across over 24 million parts;

•Serving a broad range of customers and industries;

•End-to-end digital manufacturing solution from design and repair to production and distribution;

•Proprietary software platform to streamline customer operations;

•Strategic ecosystem of partner integrations; and

•Opportunity to expand to traditional manufacturing capabilities and capture more customers’ share of wallet.

Intellectual Property

Our ability to drive innovation in the digital manufacturing market depends in part upon our ability to protect our core technology and software know-how. We attempt to protect our intellectual property rights through a combination of patent, trademark, domain names, copyright and trade secret laws, as well as through contractual provisions and restrictions on access to our proprietary technology which includes both nondisclosure and invention assignment agreements with our consultants and employees and non-disclosure agreements with our vendors and business partners. While unpatented research, development, know-how and engineering skills are important to our business, we pursue patent protection when we believe it is possible and consistent with our overall strategy for safeguarding intellectual property. Our existing patents are expected to expire between 2031 through 2038.

As of December 31, 2023, we owned 26 issued patents, including 10 United States patents and 16 foreign patents. Shapeways’ patents and patent applications are directed to proprietary technology used in mass customization design tools, part costing, evaluating manufacturability, manufacturing planning, and the manufacturing process.

We have registered “Shapeways” as a trademark in Australia, Canada, China, the European Union, India, Israel, Japan, New Zealand, Singapore, South Korea, Taiwan, the United Kingdom, and the United States.

We have registered “OTTO” as a trademark in the United Kingdom, the United States, Singapore and Israel. “OTTO” trademark registrations are pending in Australia, Canada, India, New Zealand, and Taiwan.

Seasonality

Our revenues and operating results may fluctuate from quarter-to-quarter and year-to-year due to our sales cycle and seasonal reductions in business activity among our customers, particularly during the summer months in Europe.

Mission, Values and Human Capital

Our mission is to reshape manufacturing by offering advanced manufacturing solutions and a full suite of software tools and services to enable manufacturing digitization. At Shapeways, we hold ourselves accountable for upholding our corporate responsibility and sustainability practices. Our values govern our internal and external relationships. They set the foundation for what we stand for and the behaviors we promote. And in an ever-changing world, our values remain the moral compass guiding our decision making.

•ONE TEAM: Together We Go Far

•INNOVATE: Fail Fast, Learn Faster

•THINK CRITICALLY: Be Inquisitive

•DRIVE RESULTS: Move the Needle

•BE PASSIONATE: Believe in the Mission

Workforce Demographics

As of December 31, 2023, we had 220 total employees, of which 203 were full time employees and 17 were part time employees. We also regularly use independent contractors and other temporary employees to supplement our regular staff. We believe that our future success will depend partly on our continued ability to attract, hire and retain qualified, diverse and inclusive personnel.

We are an equal opportunity employer, and we believe that having a diverse workforce drives innovation and resilience. Gender and ethnic diversity, inclusion, and performance go hand in hand. Our workforce is comprised of

engineers, technicians, salespeople, and business professionals, of which approximately 35% were racially diverse as of December 31, 2023.

The success of our business is fundamentally connected to our employees and their well-being. We are committed to the health, safety, and wellness of our employees around the globe. We provide our employees with a wide range of benefits, including benefits directed to their health, safety, and long-term financial security.

Total Rewards

A competitive total rewards program is integral to our success, which depends considerably on our ability to attract and retain highly engaged employees in a dynamic and changing business environment.

We review base compensation for non-senior level management employees semiannually, and we review equity, benefits, and perquisites annually. To do so, we analyze many factors, including individual and corporate performance, managers’ feedback, and market data from third-party compensation surveys.

Diversity, Equity, and Inclusion ("DEI")

We believe it is important to foster a culture of belonging and acceptance, and to create a workplace environment free of bias. To do this we are dedicated to driving DEI efforts from committees composed of employees and management of all levels, which are focused on creating business case initiatives championing our diversity strategy. We also hold annual employee, board, and contractor trainings on DEI matters.

Engagement

Having a highly engaged workforce is necessary for retaining talent and ensuring the continued success of our organization. To do so, we continually gather employee feedback both internally through employee lifecycle surveys (onboarding, satisfaction, pulse, and exit) and externally (Glassdoor). We analyze the data throughout the year to identify our strengths and weaknesses, patterns, and issues. Our goal is to focus on continuous improvement, whether by growing our areas of strength or improving where we are weakest.

Learning and Development

We invest in our employees through on-the-job training. We provide all employees with a membership to an online learning platform on their first day, where they have access to thousands of business, creative, and technology courses free of charge.

Semi-annually we request employees provide feedback on their career goals and aspirations. These surveys focus on employees’ current skills and knowledge, and identify skills gaps and areas of interest for further development. Our human resources team analyzes the responses and collects managers’ input to create individual development plans for every employee.

Product Responsibility

We strive to foster a community and marketplace where our customers can convert their ideas into reality. However, that range of expression has its limits. For example, there have been news reports that 3D printers were used to print guns or other weapons. While we implement a weapons and content policy, we have little, if any, control over what objects our customers print using our offerings, and it may be difficult, if not impossible, for us to monitor and prevent customers from printing weapons with our services. While we are not aware of our platform being used to print guns or other weapons, there can be no assurance that we will not be held liable if someone were injured or killed by a weapon or other dangerous object containing a component part or parts manufactured for a customer using one of our offerings.

Employees throughout the sales and production process are trained to identify and reject problematic models. Our manufacturing partners are also required to comply with this policy and inform Shapeways of any non-complying products.

Workplace Safety

We are committed to creating a safe, secure, and healthy work environment for our employees. Our focus is on reducing significant safety risks and driving a strong safety culture through communication, awareness, and visible leadership. To assist in achieving this commitment, we provide safety trainings and necessary personal protective equipment (“PPE”) at all facilities. We monitor injury and illness health and safety metrics across our organization to continually evaluate our safety programs to meet the needs of our teams.

Environmental

We strive to maximize recycling in our facilities. We recycle metal, plastic, and paper. The minimal hazardous waste streams are handled by reputable third party providers. Beyond this, we have introduced several materials offerings that are plant-based and have high recycling rates within our manufacturing process. One of the benefits of 3D printing is that additive manufacturing uses only the material needed to produce the final part, and as a result there is substantially less production waste than with traditional manufacturing.

Facilities

We lease a 17,250 square foot manufacturing facility in Livonia, Michigan which expires in March 2026 and a 100,000 square foot manufacturing facility in Charlotte, Michigan which expires in April 2026. We lease a 18,837 square foot facility in Eindhoven, Netherlands, and the lease of this facility expires in September 2024. We believe that our facilities are adequate for our current needs and, should we need additional space, that we will be able to obtain additional space on commercially reasonable terms.

Government Regulations

We are subject to various laws, regulations and permitting requirements of federal, state, and local authorities, including related to environmental, health and safety, anti-corruption, and export controls. We believe that we are in material compliance with all such laws, regulations, and permitting requirements.

Prior to utilizing Shapeways’ services, all Shapeways customers must agree to Shapeways Terms and Conditions wherein, among other things, customers warrant that any files they upload are their original creation and not copied from any third party or entity. The Shapeways Terms and Conditions also contain additional legal safeguards designed to protect Shapeways from intellectual property infringement by its customers, such as their acknowledgement of their compliance with all applicable laws, rules and regulations and their indemnification of Shapeways for any claims resulting from their infringement of any third party intellectual property.

In addition to the Shapeways Terms and Conditions, we implement other safeguards and policies to eliminate or reduce exposure to third party intellectual property infringement. Specifically, we utilize a keyword filter that screens all product listings for specific terms prior to the listings’ publication on the Shapeways marketplace. The keyword filter screens terms (i) related to products where Shapeways has observed substantial prior unauthorized intellectual property use, and (ii) added upon request by certain intellectual property rights holders who have sent Shapeways notices under the Digital Millennium Copyright Act (“DMCA”). The keyword filter is periodically updated. Once a listing has been flagged by Shapeways’ keyword filter, the listing enters into a queue for manual review by Shapeways’ content review team and/or the legal department. The content review team and/or the legal department reviews the listing for unauthorized use of intellectual property.

The primary intellectual property-related statute that applies to our business is the DMCA, which, among other things, provides a copyright safe harbor for online service providers and a formal procedure for submitting copyright takedown notices. The takedown procedure consists of six requirements which establish the proper standing of the individual or organization providing notice, and specify the infringing and infringed material. Once a proper DMCA takedown notice is received, we promptly remove the content and inform the customer of the takedown notice that we received. The customer then has an opportunity to file a counter notice to reinstate the content. Although there is no DMCA equivalent for trademarks, we apply a similar takedown procedure for those instances.

Environmental Matters

We are subject to domestic and foreign environmental laws and regulations governing our operations, including, but not limited to, emissions into the air and water and the use, handling, disposal, and remediation of hazardous substances. A certain risk of environmental liability is inherent in our production activities. These laws and regulations govern, among other things, the generation, use, storage, registration, handling, and disposal of chemicals and waste materials, the presence of specified substances in electrical products, the emission and discharge of hazardous materials into the ground, air, or water, the cleanup of contaminated sites, including any contamination that results from spills due to our failure to properly dispose of chemicals and other waste materials, and the health and safety of our employees. We are required to obtain environmental permits from governmental authorities for certain operations.

The export of our products internationally from our production facilities subjects us to environmental laws and regulations concerning the import and export of chemicals and hazardous substances such as the Toxic Substances Control Act and Regulation (EC) No 1907/2006 of the European Parliament and of the Council of 18 December 2006 concerning the Registration, Evaluation, Authorisation and Restriction of Chemicals. These laws and regulations require the evaluation and registration of certain chemicals that we ship along with, or that form a part of, our systems and other products.

Export and Trade Matters

We are subject to and must comply with applicable export control, various trade restrictions, including trade and economic sanctions, and anti-corruption laws and regulations imposed by governments around the world with jurisdiction over our operations, including the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act 2010, and the International Traffic in Arms Regulations ("ITAR") administered by the Directorate of Defense Trade Controls which governs military items listed on the United States Munitions List. For example, in accordance with trade sanctions administered by the Office of Foreign Assets Control and the U.S. Department of Commerce, we are prohibited from engaging in transactions involving certain persons and certain designated countries or territories. In addition, our products are subject to export regulations that can involve significant compliance time and may add additional overhead cost to our products. In recent years the United States government has had a renewed focus on export matters related to additive manufacturing. Some of our products are already more tightly controlled for export, and other of our products may in the future become more tightly controlled for export. For example, the Export Control Reform Act of 2018 and regulatory guidance thereunder have imposed additional controls and may result in the imposition of further additional controls, on the export of certain “emerging and foundational technologies.” Our current and future products may be subject to these heightened regulations, which could increase our compliance costs.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on the Investor Relations section of our website at investors.shapeways.com as soon as reasonably practicable after we file such material with the Securities and Exchange Commission, or the SEC. The information on, or that can be accessed through, our website is not part of this Report. We have included our website address as an inactive textual reference only. The SEC also maintains a website that contains reports and other information regarding issuers, such as Shapeways, that file materials electronically with the SEC. The SEC’s website is located at www.sec.gov.

Item 1A. Risk Factors

An investment in our securities involves a high degree of risk. You should consider carefully all of the risks described below, together with the other information contained in this Report, including our financial statements and related notes, before making a decision to invest in our securities. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risk Factor Summary

•We have a history of losses and may not achieve or maintain profitability in the future.

•There is substantial doubt as to our ability to continue as a going concern. We will require substantial additional capital to finance our operations, and this capital might not be available on acceptable terms, if at all.

•We may not be successful in identifying and implementing one or more strategic alternatives for our business, and any strategic alternative that we may consummate could have material adverse consequences for us.

•If we are unable to achieve our cost-reduction goals, we may need to perform additional cost-reduction measures such as a further reduction in force.

•We face significant competition and expect to face increasing competition in many aspects of our business, which could cause our operating results to suffer.

•The digital manufacturing industry is a relatively new and emerging market and it is uncertain whether it will gain widespread acceptance.

•Our attempts to continue to expand our business into existing and new markets and geographies may not be successful.

•We derive a significant portion of our revenue from business conducted outside the United States and are subject to the risks of doing business outside the United States.

•An active, liquid trading market for our common stock may not be sustained.

•Our issuance of additional shares of common stock or convertible securities may dilute your ownership of us and could adversely affect our stock price.

•Future sales, or the perception of future sales, of our common stock by us or our existing stockholders in the public market could cause the market price for our common stock to decline.

•Our operating results and financial condition may fluctuate on a quarterly and annual basis.

•Our stock price has been and may continue to be volatile or may decline regardless of our operating performance. You may lose some or all of your investment.

•If securities or industry analysts publish inaccurate or unfavorable research or reports about our business, our stock price and trading volume could decline.

•Failure to attract, integrate and retain additional personnel in the future could harm our business.

•Interruptions, delays in service or inability to increase capacity, including internationally, at third-party data center facilities could adversely affect our business and reputation.

•Interruptions to or other problems with our website user interface, information technology systems, manufacturing processes, or other operations could damage our reputation and brand and substantially harm our business and results of operations.

•As part of our growth strategy, we may continue to acquire or make investments in other businesses, patents, technologies, products, or services. We may not realize the anticipated benefits of such investments and integration of these investments may disrupt our business and divert management attention.

•The loss of one or more key members of our management team or personnel could harm our business.

•Our actual results may be significantly different from our projections, estimates, targets or forecasts.

Risks Related to Our Business

We have a history of losses and may not achieve or maintain profitability in the future.

We experienced a net loss of $43.9 million and $20.2 million for the years ended December 31, 2023 and 2022, respectively. As of December 31, 2023, we had an accumulated deficit of $176.9 million. We believe we may continue to incur operating losses and negative cash flow in the near-term.

We may incur significant losses in the future for a number of reasons, including due to the other risks described in this Part I, Item 1A: “Risk Factors,” and we may encounter unforeseen expenses, difficulties, complications and delays and other unknown events. As a result, our losses may be larger than anticipated, we may incur significant losses for the foreseeable future, and we may never achieve or maintain profitability. Revenue growth and growth in our customer base may not be sustainable, and we may not achieve sufficient revenue to achieve or maintain profitability. If our future growth and operating performance fail to meet investor or analyst expectations, or if we continue to have future negative cash flow or losses resulting from our investment in acquiring customers or expanding our operations, this could have a material adverse effect on our business, financial condition and results of operations.

There is substantial doubt as to our ability to continue as a going concern. We will require substantial additional capital to finance our operations, and this capital might not be available on acceptable terms, if at all. If we are unable to raise substantial additional capital, our financial condition could be adversely affected and we may be forced to curtail our operations or pursue strategic alternatives.

The report of our independent registered public accounting firm on our consolidated financial statements for the fiscal year ended December 31, 2023 included within this Report includes an explanatory paragraph indicating that there is substantial doubt as to our ability to continue as a going concern within one year after the date that the consolidated financial statements are issued. As of December 31, 2023, we had $12.2 million in cash and cash equivalents and a decrease in net change in cash and cash equivalents during the year ended December 31, 2023 of $18.6 million. We have enacted cost savings measures to preserve capital, but to maintain an adequate amount of available liquidity and execute our current operating plan, we will need to raise substantial additional funds from external sources. We have not secured such funding at the time of this filing. We are exploring strategic alternatives for our business, any of which would be based upon various factors, including market conditions and our operating plans. See “—We may not be successful in identifying and implementing one or more strategic alternatives for our business, and any strategic alternative that we may consummate could have material adverse consequences for us.”

We may in the future elect to finance operations by selling equity or debt securities or borrowing money. If we raise funds through future issuances of equity, including through our existing at-the-market facility (the "ATM Facility"), or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities or debt securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. Any debt financing that we may secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. There can be no assurance that any future capital-raising opportunities will be available to us on acceptable terms on a timely basis, if at all. Due to the uncertainty in our ability to raise capital, we believe that there is substantial doubt as to our ability to continue as a going concern. If we are unable to obtain substantial additional funding, we may need to curtail our operations and planned activities in order to reduce costs, which could include a further reduction in workforce, portfolio optimization, and further reductions in other operating expenses. Doing so will likely have an unfavorable effect on our ability to execute on our business plan and have an adverse effect on our business, results of operations and future prospects. See “—If we are unable to achieve our cost-reduction goals, we may need to perform additional cost-reduction measures such as a further reduction in force.” Our ability to access any future capital is also dependent on the condition of the banking system and financial markets.

We may not be successful in identifying and implementing one or more strategic alternatives for our business, and any strategic alternative that we may consummate could have material adverse consequences for us.

Given our current financial condition, we are exploring strategic alternatives and potential options for our business (a “Strategic Transaction”), including, without limitation, a sale of a material portion of our assets, a merger, business combination, or other strategic transaction, and obtaining additional financing on a secured or unsecured basis. There can be no assurances that any particular Strategic Transaction, or series of Strategic Transactions, will be pursued, successfully consummated, lead to increased shareholder value, or achieve the anticipated results. We are continuing to evaluate strategic alternatives with regard to our manufacturing and software businesses, including, ongoing discussions with potential acquirors. We have not signed a definitive agreement with respect to either our software or manufacturing assets, and there can be no assurance that this process will result in any transaction.

In the event we successfully pursue a Strategic Transaction, the value that will be available to our various stakeholders, including our creditors and stockholders, is uncertain and our operations, our ability to develop and execute our business plan, our continuation as a going concern, and our ability to generate value for shareholders, if any, will be subject to the risks and uncertainties associated with any such transaction. Because of the risks and uncertainties associated with any Strategic Transaction, we cannot accurately predict or quantify the ultimate timing or impact of events that could occur. Any such Strategic Transaction may not be consistent with our stockholders’ expectations or may not ultimately be favorable for our stockholders, either in the shorter or longer term. Any failure in our efforts to consummate one or more Strategic Transactions could force us to delay, limit or terminate our operations, make additional reductions in our workforce or other restructuring intended to improve operational efficiencies and operating costs, liquidate all or a portion of our assets or pursue other strategic alternatives.

If we are unable to achieve our cost-reduction goals, we may need to perform additional cost-reduction measures such as a further reduction in force.

In December 2023, we completed a reduction in force as part of our cost-reduction initiatives that were initiated in the third quarter of 2023 to reduce operating expenses. These initiatives included a previous reduction in force completed in October 2023, a reduction in new hires, and a reduction in non-critical capital and discretionary operating expenditures. We believe these actions were necessary to streamline our organization and preserve cash; however, these expense reduction measures may yield unintended consequences and costs, such as the loss of institutional knowledge and expertise, attrition beyond our intended reduction-in-force, a reduction in morale among our remaining employees and the risk that we may not achieve the anticipated benefits, all of which may have an adverse effect on our results of operations or financial condition.

In addition, although positions have been eliminated, the duties performed in these positions remain, and we may be unsuccessful in distributing the duties and obligations of departed employees among our remaining employees or to external service providers. We may also discover that the reductions in workforce and cost-cutting measures will make it difficult for us to pursue new opportunities and initiatives and require us to hire qualified replacement personnel, which may require us to incur additional and unanticipated costs and expenses. Our failure to successfully accomplish any of the above activities and goals may have a material adverse impact on our business, financial condition and results of operations. In addition, we may need to undertake additional workforce reductions or restructuring activities in the future.

If we are required to perform a further reduction in headcount, this could adversely impact employee retention and morale, including through a loss of continuity, a loss of accumulated knowledge and/or inefficiency during transitional periods. Laid-off employees could also make claims against us for additional compensation, causing us to incur additional expense. A reduction could also adversely impact our reputation as an employer and could make it difficult for us to hire new employees in the future.

We face significant competition and expect to face increasing competition in many aspects of our business, which could cause our operating results to suffer.

The digital manufacturing industry in which we operate is fragmented and competitive. We compete for customers with a wide variety of manufacturers, including those that use digital manufacturing and/or 3D printing equipment. Exclusivity arrangements in the digital manufacturing industry are uncommon; we have few exclusivity arrangements with our customers. Some of our existing and potential competitors are researching, designing, developing, and marketing other types of offerings that may render our existing or future services obsolete, uneconomical or less competitive. Existing and potential competitors may also have substantially greater financial, technical, marketing and sales, manufacturing, distribution, and other resources than we do, including name recognition, as well as experience and expertise in intellectual property rights and operating within certain international markets, any of which may enable them to compete effectively against us. For example, a number of companies that have substantial resources have announced that they are beginning digital manufacturing initiatives, which will further enhance the competition we face.

We cannot assure you that we will be able to maintain our current position or continue to compete successfully against current and future sources of competition. If we do not keep pace with technological change, demand for our offerings may decline, and our operating results may suffer.

The digital manufacturing industry is a relatively new and emerging market and it is uncertain whether it will gain widespread acceptance.

The emergence of the digital manufacturing industry is a relatively recent development, and the industry is characterized by rapid technological change. We have encountered and will continue to encounter challenges experienced by growing companies in a market subject to rapid innovation and technological change. While we intend to invest substantial resources to remain on the forefront of technological development, continuing advances in digital manufacturing technology, changes in customer requirements and preferences, and the emergence of new standards, regulations, and certifications could adversely affect adoption of our products either generally or for particular applications. If the digital manufacturing industry does not gain widespread acceptance, our business will be adversely affected.

Our attempts to continue to expand our business into existing and new markets and geographies may not be successful.

We seek to grow our business through, among other things, expanding our digital manufacturing capabilities into existing and new markets and expanding our offerings into new geographies. Our efforts to expand our offerings into

existing and new markets, including industrial, medical, automotive, and aerospace markets, and new geographies may not succeed. These attempts to expand our business increase the complexity of our business, require significant levels of investment, and can strain our management, personnel, operations, and systems. There can be no assurance that these business expansion efforts will develop as anticipated or that we will succeed, and if we do not, we may be unable to recover our investment, which could adversely impact our business, financial condition, and results of operations.

We may be unable to consistently manufacture our customers’ designs to the necessary specifications or in quantities necessary to meet demand at an acceptable cost or at an acceptable performance level and this could adversely affect our service availability, delivery, reliability, and cost.

As we introduce new materials and as our customers’ designs become increasingly sophisticated, it will become more difficult to provide products in the necessary quantities to meet customer expectations. We cannot assure you that we or our third-party manufacturers will be able to continue to consistently achieve the product specifications and quality that our customers expect. Any future unforeseen manufacturing problems, such as equipment malfunctions, aging components, component obsolescence, business continuity issues, quality issues with components and materials sourced from third party suppliers, or failures to strictly follow procedures or meet specifications, may have a material adverse effect on our brand, business, financial condition, and operating results. Furthermore, we or our third-party manufacturers may not be able to increase manufacturing to meet anticipated demand or may experience downtime or fail to timely deliver manufactured products to customers. If we fail to meet contractual terms with our customers, including terms related to time of delivery and performance specifications, we may be required to replace defective products and may become liable for damages, even if manufacturing or delivery was outsourced.

Our commercial contracts generally contain product warranties and limitations on liability and we carry liability insurance. However, commercial terms and our insurance coverage may not be adequate or available to protect our company in all circumstances, and we might not be able to maintain adequate insurance coverage for our business in the future at an acceptable cost. Any liability claim against us that is not covered by adequate insurance could adversely affect our consolidated results of operations and financial condition.

Our success depends on our ability to deliver services that meet the needs of customers and to effectively respond to changes in our industry.