Financial Highlights for the Fourth Quarter 2024:

- Total revenue of $328.7 million, up 14.8% versus 2023,

including $316.6 million of Shack sales and $12.1 million of

Licensing revenue.

- System-wide sales of $500.7 million, up 13.3% versus

2023.

- Same-Shack sales up 4.3% versus 2023.

- Operating income of $10.2 million.

- Restaurant-level profit(1) of $71.9 million, or 22.7% of

Shack sales.

- Net income of $9.3 million.

- Adjusted EBITDA(1) of $46.7 million.

- Net income attributable to Shake Shack Inc. of $8.7

million, or earnings of $0.21 per diluted share.

- Adjusted pro forma net income(1) of $11.6 million, or

earnings of $0.26 per fully exchanged and diluted share.

- Opened 19 new Company-operated Shacks and nine new licensed

Shacks.

Financial Highlights for the Fiscal Year 2024:

- Total revenue of $1,252.6 million, up 15.2% versus 2023,

including $1,207.6 million of Shack sales and $45.0 million

of Licensing revenue.

- System-wide sales of $1,922.7 million, up 13.0% versus

2023.

- Same-Shack sales up 3.6% versus 2023.

- Operating income of $3.0 million.

- Restaurant-level profit(1) of $257.9 million, or 21.4%

of Shack sales.

- Net income of $10.8 million.

- Adjusted EBITDA(1) of $175.6 million.

- Net income attributable to Shake Shack Inc. of $10.2

million, or earnings of $0.24 per diluted share.

- Adjusted pro forma net income(1) of $40.5 million, or

earnings of $0.92 per fully exchanged and diluted share.

- Opened 43 new Company-operated Shacks and 33 new licensed

Shacks.

Shake Shack Inc. (“Shake Shack” or the “Company”) (NYSE:

SHAK) has posted its results for the fourth quarter and the fiscal

year ended December 25, 2024 in a Shareholder Letter in the

Quarterly Results section of the Company's Investor Relations

website, which can be found here: Q4 2024 Shareholder Letter.

Shake Shack will host a conference call at 8:00 a.m. ET. Hosting

the call will be Robert Lynch, Chief Executive Officer, and

Katherine Fogertey, Chief Financial Officer. The conference call

can be accessed live over the phone by dialing (877) 407-0792, or

for international callers by dialing (201) 689-8263. A replay of

the call will be available until February 27, 2025 by dialing (844)

512-2921 or for international callers by dialing (412) 317-6671;

the passcode is 13750490.

The live audio webcast of the conference call will be accessible

in the Events & Presentations section of the Company's Investor

Relations website at investor.shakeshack.com. An archived replay of

the webcast will also be available shortly after the live event has

concluded.

(1)

Restaurant-level profit, Adjusted EBITDA

and Adjusted pro forma net income (loss) are non-GAAP measures. A

reconciliation to the most directly comparable financial measures

presented in accordance with GAAP is set forth in the schedules

accompanying this release. See “Non-GAAP Financial Measures”

below.

About Shake Shack

Shake Shack serves elevated versions of American classics using

only the best ingredients. It’s known for its delicious

made-to-order Angus beef burgers, crispy chicken, hand-spun

milkshakes, house-made lemonades, beer, wine, and more. With its

high-quality food at a great value, warm hospitality, and a

commitment to crafting uplifting experiences, Shake Shack quickly

became a cult-brand with widespread appeal. Shake Shack’s purpose

is to Stand For Something Good®, from its premium ingredients and

employee development, to its inspiring designs and deep community

investment. Since the original Shack opened in 2004 in NYC’s

Madison Square Park, the Company has expanded to over 570 locations

system-wide, including over 370 in 34 U.S. States and the District

of Columbia, and over 200 international locations across London,

Hong Kong, Shanghai, Singapore, Mexico City, Istanbul, Dubai,

Tokyo, Seoul and more.

Skip the line with the Shack App, a mobile ordering app

that lets you save time by ordering ahead! Guests can select their

location, pick their food, choose a pickup time and their meal will

be cooked-to-order and timed to arrival. Available on iOS and

Android.

Definitions

The following definitions apply to these terms as used in this

release:

"Shack sales" is defined as the aggregate sales of food,

beverages, gift card breakage income and Shake Shack branded

merchandise at domestic Company-operated Shacks and excludes sales

from licensed Shacks.

“System-wide sales” is an operating measure and consists of

sales from Company-operated Shacks and licensed Shacks. The Company

does not recognize the sales from licensed Shacks as revenue. Of

these amounts, revenue is limited to licensing revenue based on a

percentage of sales from licensed Shacks, as well as certain

up-front fees, such as territory fees and opening fees.

"Same-Shack sales" represents Shack sales for the comparable

Shack base, which is defined as the number of Company-operated

Shacks open for 24 full fiscal months or longer. For consecutive

days that Shacks were temporarily closed, the comparative period

was also adjusted.

"Restaurant-level profit," a non-GAAP measure, also formerly

referred to as Shack-level operating profit, is defined as Shack

sales less Shack-level operating expenses including Food and paper

costs, Labor and related expenses, Other operating expenses and

Occupancy and related expenses.

"Restaurant-level profit margin," a non-GAAP measure, also

formerly referred to as Shack-level operating profit margin, is

defined as Shack sales less Shack-level operating expenses

including Food and paper costs, Labor and related expenses, Other

operating expenses and Occupancy and related expenses as a

percentage of Shack sales.

“EBITDA,” a non-GAAP measure, is defined as Net income (loss)

before interest expense (net of interest income), Income tax

expense (benefit), and Depreciation and amortization expense.

“Adjusted EBITDA,” a non-GAAP measure, is defined as EBITDA (as

defined above), excluding equity-based compensation expense,

Impairments, loss on disposal of assets, and Shack closures,

amortization of cloud-based software implementation costs, as well

as certain non-recurring items that the Company does not believe

directly reflect its core operations and may not be indicative of

the Company's recurring business operations.

"Adjusted pro forma net income," a non-GAAP measure, represents

Net income (loss) attributable to Shake Shack Inc. assuming the

full exchange of all outstanding SSE Holdings, LLC membership

interests ("LLC Interests") for shares of Class A common stock,

adjusted for certain non-recurring items that the Company does not

believe are directly reflected to its core operations and may not

be indicative of its recurring business operations.

SHAKE SHACK INC.

CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share amounts)

December 25

2024

December 27

2023

ASSETS

Current assets

Cash and cash equivalents

$

320,714

$

224,653

Marketable securities

—

68,561

Accounts receivable, net

19,687

16,847

Inventories

6,014

5,404

Prepaid expenses and other current

assets

21,801

18,967

Total current assets

368,216

334,432

Property and equipment, net of accumulated

depreciation of $457,186 and $376,760, respectively

551,600

530,995

Operating lease assets

424,611

398,296

Deferred income taxes, net

341,586

326,208

Other assets

10,958

15,926

TOTAL ASSETS

$

1,696,971

$

1,605,857

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

23,609

$

22,273

Accrued expenses

63,005

54,742

Accrued wages and related liabilities

25,422

20,945

Operating lease liabilities, current

55,739

49,004

Other current liabilities

19,538

17,103

Total current liabilities

187,313

164,067

Long-term debt

246,683

245,636

Long-term operating lease liabilities

494,499

464,533

Liabilities under tax receivable

agreement, net of current portion

247,017

235,613

Other long-term liabilities

27,833

26,638

Total liabilities

1,203,345

1,136,487

Commitments and contingencies

Stockholders' equity:

Preferred stock, no par value—10,000,000

shares authorized; none issued and outstanding as of December 25,

2024 and December 27, 2023.

—

—

Class A common stock, $0.001 par

value—200,000,000 shares authorized; 40,068,068 and 39,474,315

shares issued and outstanding as of December 25, 2024 and December

27, 2023, respectively.

40

39

Class B common stock, $0.001 par

value—35,000,000 shares authorized; 2,455,713 and 2,834,513 shares

issued and outstanding as of December 25, 2024 and December 27,

2023, respectively.

2

3

Additional paid-in capital

442,993

426,601

Retained earnings

26,984

16,777

Accumulated other comprehensive loss

(1

)

(3

)

Total stockholders' equity attributable to

Shake Shack Inc.

470,018

443,417

Non-controlling interests

23,608

25,953

Total equity

493,626

469,370

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

1,696,971

$

1,605,857

SHAKE SHACK INC.

CONSOLIDATED STATEMENTS OF

INCOME

(UNAUDITED)

(in thousands, except per share

amounts)

Thirteen Weeks Ended

Fifty-Two Weeks Ended

December 25

2024

December 27

2023

December 25

2024

December 27

2023

Shack sales

$

316,632

96.3

%

$

275,775

96.3

%

$

1,207,561

96.4

%

$

1,046,819

96.3

%

Licensing revenue

12,052

3.7

%

10,468

3.7

%

45,047

3.6

%

40,714

3.7

%

TOTAL REVENUE

328,684

100.0

%

286,243

100.0

%

1,252,608

100.0

%

1,087,533

100.0

%

Shack-level operating expenses(1):

Food and paper costs

88,578

28.0

%

80,289

29.1

%

339,940

28.2

%

305,041

29.1

%

Labor and related expenses

85,104

26.9

%

78,599

28.5

%

338,750

28.1

%

304,254

29.1

%

Other operating expenses

47,008

14.8

%

41,097

14.9

%

178,381

14.8

%

149,449

14.3

%

Occupancy and related expenses

24,047

7.6

%

21,162

7.7

%

93,069

7.7

%

79,846

7.6

%

General and administrative expenses

41,099

12.5

%

35,816

12.5

%

149,047

11.9

%

129,542

11.9

%

Depreciation and amortization expense

25,809

7.9

%

24,538

8.6

%

102,468

8.2

%

91,242

8.4

%

Pre-opening costs

5,118

1.6

%

5,128

1.8

%

15,547

1.2

%

19,231

1.8

%

Impairments, loss on disposal of assets,

and Shack closures

1,711

0.5

%

909

0.3

%

32,368

2.6

%

3,007

0.3

%

TOTAL EXPENSES

318,474

96.9

%

287,538

100.5

%

1,249,570

99.8

%

1,081,612

99.5

%

INCOME (LOSS) FROM OPERATIONS

10,210

3.1

%

(1,295

)

(0.5

)%

3,038

0.2

%

5,921

0.5

%

Other income, net

3,241

1.0

%

3,271

1.1

%

13,251

1.1

%

12,776

1.2

%

Interest expense

(512

)

(0.2

)%

(476

)

(0.2

)%

(2,045

)

(0.2

)%

(1,717

)

(0.2

)%

INCOME BEFORE INCOME TAXES

12,939

3.9

%

1,500

0.5

%

14,244

1.1

%

16,980

1.6

%

Income tax expense (benefit)

3,606

1.1

%

(5,753

)

(2.0

)%

3,424

0.3

%

(4,010

)

(0.4

)%

NET INCOME

9,333

2.8

%

7,253

2.5

%

10,820

0.9

%

20,990

1.9

%

Less: Net income attributable to

non-controlling interests

623

0.2

%

30

—

%

613

—

%

726

0.1

%

NET INCOME ATTRIBUTABLE TO SHAKE SHACK

INC.

$

8,710

2.6

%

$

7,223

2.5

%

$

10,207

0.8

%

$

20,264

1.9

%

Earnings per share of Class A common

stock:

Basic

$

0.22

$

0.18

$

0.26

$

0.51

Diluted

$

0.21

$

0.17

$

0.24

$

0.48

Weighted-average shares of Class A common

stock outstanding:

Basic

40,047

39,470

39,830

39,419

Diluted

41,872

43,944

44,203

43,899

_________________

(1)

As a percentage of Shack sales.

SHAKE SHACK INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(UNAUDITED)

(in thousands)

Fifty-Two Weeks Ended

December 25

2024

December 27

2023

OPERATING ACTIVITIES

Net income (loss) (including amounts

attributable to non-controlling interests)

$

10,820

$

20,990

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization expense

102,468

91,242

Amortization of debt issuance costs

1,047

1,047

Amortization of cloud computing assets

2,138

1,798

Non-cash operating lease cost

77,432

67,781

Equity-based compensation

15,915

14,888

Deferred income taxes

(1,054

)

(9,074

)

Non-cash interest

(102

)

116

Gain on sale of equity securities

—

(81

)

Net amortization of discount on

held-to-maturity securities

(440

)

(1,620

)

Impairments, loss on disposal of assets,

and Shack closures

32,368

3,007

Changes in operating assets and

liabilities:

Accounts receivable

(2,839

)

(2,970

)

Inventories

(610

)

(1,220

)

Prepaid expenses and other current

assets

(2,629

)

(2,253

)

Other assets

(2,896

)

(6,307

)

Accounts payable

3,356

687

Accrued expenses

6,644

9,513

Accrued wages and related liabilities

4,477

3,328

Other current liabilities

(712

)

(2,809

)

Operating lease liabilities

(77,167

)

(58,216

)

Other long-term liabilities

2,939

2,292

NET CASH PROVIDED BY OPERATING

ACTIVITIES

171,155

132,139

INVESTING ACTIVITIES

Purchases of property and equipment

(135,499

)

(146,167

)

Purchases of held-to-maturity

securities

—

(94,019

)

Maturities of held-to-maturity marketable

securities

69,420

27,078

Purchases of equity securities

—

(690

)

Sales of equity securities

—

81,478

NET CASH USED IN INVESTING

ACTIVITIES

(66,079

)

(132,320

)

FINANCING ACTIVITIES

Payments on principal of finance

leases

(3,964

)

(3,272

)

Distributions paid to non-controlling

interest holders

(482

)

(162

)

Net proceeds from stock option

exercises

1,627

744

Employee withholding taxes related to net

settled equity awards

(6,198

)

(2,994

)

NET CASH USED IN FINANCING

ACTIVITIES

(9,017

)

(5,684

)

Effect of exchange rate changes on cash

and cash equivalents

2

(3

)

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS

96,061

(5,868

)

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD

224,653

230,521

CASH AND CASH EQUIVALENTS AT END OF

PERIOD

$

320,714

$

224,653

SHAKE SHACK INC. NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

To supplement the Consolidated Financial Statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles ("GAAP"), the Company uses the following

non-GAAP financial measures: Restaurant-level profit,

Restaurant-level profit margin, EBITDA, adjusted EBITDA, adjusted

EBITDA margin, adjusted pro forma net income and adjusted pro forma

earnings per fully exchanged and diluted share (collectively the

"non-GAAP financial measures").

Restaurant-Level Profit

Restaurant-level profit, also formerly referred to as

Shack-level operating profit, is defined as Shack sales less

Shack-level operating expenses including Food and paper costs,

Labor and related expenses, Other operating expenses and Occupancy

and related expenses.

How This Measure Is Useful

When used in conjunction with GAAP financial measures,

Restaurant-level profit and Restaurant-level profit margin are

supplemental measures of operating performance that the Company

believes are useful measures to evaluate the performance and

profitability of its Shacks. Additionally, Restaurant-level profit

and Restaurant-level profit margin are key metrics used internally

by management to develop internal budgets and forecasts, as well as

assess the performance of its Shacks relative to budget and against

prior periods. It is also used to evaluate employee compensation as

it serves as a metric in certain performance-based employee bonus

arrangements. The Company believes presentation of Restaurant-level

profit and Restaurant-level profit margin provides investors with a

supplemental view of its operating performance that can provide

meaningful insights to the underlying operating performance of the

Shacks, as these measures depict the operating results that are

directly impacted by the Shacks and exclude items that may not be

indicative of, or are unrelated to, the ongoing operations of the

Shacks. It may also assist investors to evaluate the Company's

performance relative to peers of various sizes and maturities and

provides greater transparency with respect to how management

evaluates the business, as well as the financial and operational

decision-making.

Limitations of the Usefulness of this Measure

Restaurant-level profit and Restaurant-level profit margin may

differ from similarly titled measures used by other companies due

to different methods of calculation. Presentation of

Restaurant-level profit and Restaurant-level profit margin is not

intended to be considered in isolation or as a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP. Restaurant-level profit excludes certain

costs, such as General and administrative expenses and Pre-opening

costs, which are considered normal, recurring cash operating

expenses and are essential to support the operation and development

of the Company's Shacks. Therefore, this measure may not provide a

complete understanding of the Company's operating results as a

whole and Restaurant-level profit and Restaurant-level profit

margin should be reviewed in conjunction with the Company's GAAP

financial results. A reconciliation of Restaurant-level profit to

Income (loss) from Operations, the most directly comparable GAAP

financial measure, is set forth below.

Thirteen Weeks Ended

Fifty-Two Weeks Ended

(dollar amounts in thousands)

December 25

2024

December 27

2023

December 25

2024

December 27

2023

Income (loss) from operations

$

10,210

$

(1,295

)

$

3,038

$

5,921

Less:

Licensing revenue

12,052

10,468

45,047

40,714

Add:

General and administrative expenses

41,099

35,816

149,047

129,542

Depreciation and amortization expense

25,809

24,538

102,468

91,242

Pre-opening costs

5,118

5,128

15,547

19,231

Impairments, loss on disposal of assets,

and Shack closures

1,711

909

32,368

3,007

Adjustment:

Employee benefit charges(1)

—

—

453

—

Restaurant-level profit

$

71,895

$

54,628

$

257,874

$

208,229

Total revenue

$

328,684

$

286,243

$

1,252,608

$

1,087,533

Less: Licensing revenue

12,052

10,468

45,047

40,714

Shack sales

$

316,632

$

275,775

$

1,207,561

$

1,046,819

Restaurant-level profit margin(2)

22.7

%

19.8

%

21.4

%

19.9

%

_________________

(1)

Expenses related to California healthcare

charges for fiscal 2020 through 2023 which do not represent fiscal

2024 Labor and related expenses.

(2)

As a percentage of Shack sales.

SHAKE SHACK INC. NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

EBITDA and Adjusted EBITDA

EBITDA, a non-GAAP measure, is defined as Net income before

interest expense (net of interest income), Income tax expense

(benefit) and Depreciation and amortization expense. Adjusted

EBITDA, a non-GAAP measure, is defined as EBITDA (as defined above)

excluding equity-based compensation expense, Impairments, loss on

the disposal of assets, and Shack closures, amortization of

cloud-based software implementation costs, as well as certain

non-recurring items that the Company does not believe directly

reflect its core operations and may not be indicative of the

Company's recurring business operations.

How These Measures Are Useful

When used in conjunction with GAAP financial measures, EBITDA

and adjusted EBITDA are supplemental measures of operating

performance that the Company believes are useful measures to

facilitate comparisons to historical performance and competitors'

operating results. Adjusted EBITDA is a key metric used internally

by management to develop internal budgets and forecasts and also

serves as a metric in its performance-based equity incentive

programs and certain bonus arrangements. The Company believes

presentation of EBITDA and adjusted EBITDA provides investors with

a supplemental view of the Company's operating performance that

facilitates analysis and comparisons of its ongoing business

operations because they exclude items that may not be indicative of

the Company's ongoing operating performance.

Limitations of the Usefulness of These Measures

EBITDA and adjusted EBITDA may differ from similarly titled

measures used by other companies due to different methods of

calculation. Presentation of EBITDA and adjusted EBITDA is not

intended to be considered in isolation or as a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP. EBITDA and adjusted EBITDA exclude certain

normal recurring expenses. Therefore, these measures may not

provide a complete understanding of the Company's performance and

should be reviewed in conjunction with the GAAP financial measures.

A reconciliation of EBITDA and adjusted EBITDA to Net income, the

most directly comparable GAAP measure, is set forth below.

Thirteen Weeks Ended

Fifty-Two Weeks Ended

(dollar amounts in thousands)

December 25

2024

December 27

2023

December 25

2024

December 27

2023

Net income

$

9,333

$

7,253

$

10,820

$

20,990

Depreciation and amortization expense

25,809

24,538

102,468

91,242

Interest (income) expense, net

474

(562

)

1,284

(726

)

Income tax expense (benefit)

3,606

(5,753

)

3,424

(4,010

)

EBITDA

39,222

25,476

117,996

107,496

Equity-based compensation

4,376

3,668

15,915

15,093

Amortization of cloud-based software

implementation costs

561

478

2,138

1,798

Impairments, loss on disposal of assets,

and Shack closures

1,711

909

32,368

3,007

Restatement costs(1)

778

—

2,378

—

CEO transition costs

38

206

679

206

Employee benefit charges(2)

—

—

453

—

Legal settlements(3)

—

(385

)

—

619

Severance

—

—

—

211

Other(4)

8

1,065

3,652

3,386

Adjusted EBITDA

$

46,694

$

31,417

$

175,579

$

131,816

Adjusted EBITDA margin(5)

14.2

%

11.0

%

14.0

%

12.1

%

_________________

(1)

Expenses incurred related to the

restatement of prior periods in the 2023 Form 10-K.

(2)

Expenses related to California healthcare

charges for fiscal 2020 through 2023 which do not represent fiscal

2024 Labor and related expenses.

(3)

Expenses incurred to establish accruals

related to the settlements of legal matters.

(4)

Expenses incurred for professional fees

related to non-recurring matters.

(5)

Calculated as a percentage of Total

revenue, which was $328.7 million and $1,252.6 million for the

thirteen and fifty-two weeks ended December 25, 2024, respectively,

and $286.2 million and $1,087.5 million for the thirteen and

fifty-two weeks ended December 27, 2023, respectively.

SHAKE SHACK INC. NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

Adjusted Pro Forma Net Income (Loss) and Adjusted Pro Forma

Earnings (Loss) Per Fully Exchanged and Diluted Share

Adjusted pro forma net income represents Net income attributable

to Shake Shack Inc. assuming the full exchange of all outstanding

SSE Holdings, LLC membership interests ("LLC Interests") for shares

of Class A common stock, adjusted for certain non-recurring items

that the Company does not believe are directly related to its core

operations and may not be indicative of recurring business

operations. Adjusted pro forma earnings per fully exchanged and

diluted share is calculated by dividing adjusted pro forma net

income by the weighted-average shares of Class A common stock

outstanding, assuming the full exchange of all outstanding LLC

Interests, after giving effect to the dilutive effect of

outstanding equity-based awards.

How These Measures Are Useful

When used in conjunction with GAAP financial measures, adjusted

pro forma net income and adjusted pro forma earnings per fully

exchanged and diluted share are supplemental measures of operating

performance that the Company believes are useful measures to

evaluate performance period-over-period and relative to its

competitors. By assuming the full exchange of all outstanding LLC

Interests, the Company believes these measures facilitate

comparisons with other companies that have different organizational

and tax structures, as well as comparisons period over period

because it eliminates the effect of any changes in Net income

attributable to Shake Shack Inc. driven by increases in its

ownership of SSE Holdings, which are unrelated to the Company's

operating performance, and excludes items that are non-recurring or

may not be indicative of ongoing operating performance.

Limitations of the Usefulness of These Measures

Adjusted pro forma net income and adjusted pro forma earnings

per fully exchanged and diluted share may differ from similarly

titled measures used by other companies due to different methods of

calculation. Presentation of adjusted pro forma net income and

adjusted pro forma earnings per fully exchanged and diluted share

should not be considered alternatives to Net income and earnings

(loss) per share, as determined under GAAP. While these measures

are useful in evaluating the Company's performance, it does not

account for the earnings (loss) attributable to the non-controlling

interest holders and therefore does not provide a complete

understanding of the Net income attributable to Shake Shack Inc.

Adjusted pro forma net income and adjusted pro forma earnings per

fully exchanged and diluted share should be evaluated in

conjunction with GAAP financial results. A reconciliation of

adjusted pro forma net income to Net income attributable to Shake

Shack Inc., the most directly comparable GAAP measure, and the

computation of adjusted pro forma earnings per fully exchanged and

diluted share are set forth below.

Thirteen Weeks Ended

Fifty-Two Weeks Ended

(in thousands, except per share

amounts)

December 25

2024

December 27

2023

December 25

2024

December 27

2023

Numerator:

Net income attributable to Shake Shack

Inc.

$

8,710

$

7,223

$

10,207

$

20,264

Adjustments:

Reallocation of Net income attributable to

non-controlling interests from the assumed exchange of LLC

Interests(1)

623

30

613

726

Restatement costs(2)

778

—

2,378

—

CEO transition costs

38

206

679

206

Employee benefit charges(3)

—

—

453

—

Impairment charge and Shack

closures(4)

1,191

—

29,348

—

Legal settlements

—

(385

)

—

619

Severance

—

—

—

211

Other(5)

8

1,065

3,652

3,386

Tax impact of above adjustments(6)

269

(7,108

)

(6,785

)

(9,254

)

Adjusted pro forma net income

$

11,617

$

1,031

$

40,545

$

16,158

Denominator:

Weighted-average shares of Class A common

stock outstanding—diluted

41,872

43,944

44,203

43,899

Adjustments:

Assumed exchange of LLC Interests for

shares of Class A common stock(1)

2,456

—

—

—

Adjusted pro forma fully exchanged

weighted-average shares of Class A common stock

outstanding—diluted

44,328

43,944

44,203

43,899

Adjusted pro forma loss per fully

exchanged share—diluted

$

0.26

$

0.02

$

0.92

$

0.37

Thirteen Weeks Ended

Fifty-Two Weeks Ended

December 25

2024

December 27

2023

December 25

2024

December 27

2023

Earnings per share of Class A common

stock—diluted

$

0.21

$

0.17

$

0.24

$

0.48

Non-GAAP adjustments(7)

0.05

(0.15

)

0.68

(0.11

)

Adjusted pro forma earnings per fully

exchanged share—diluted

$

0.26

$

0.02

$

0.92

$

0.37

_________________

(1)

Assumes the exchange of all outstanding

LLC Interests for shares of Class A common stock, resulting in the

elimination of the non-controlling interest and recognition of the

net income attributable to non-controlling interests.

(2)

Expenses incurred related to the

restatement of prior periods in the 2023 Form 10-K.

(3)

Expenses related to California healthcare

charges for fiscal 2020 through 2023 which do not represent fiscal

2024 Labor and related expenses.

(4)

Expenses incurred related to Shack

closures during fiscal 2024.

(5)

Expenses incurred for professional fees

related to non-recurring matters.

(6)

Represents the tax effect of the

aforementioned adjustments and pro forma adjustments to reflect

corporate income taxes at assumed effective tax rates of 22.3% and

20.1% for the thirteen and fifty-two weeks ended December 25, 2024,

respectively, and 56.8% and 24.5% for the thirteen and fifty-two

weeks ended December 27, 2023, respectively. Amounts include

provisions for U.S. federal income taxes, certain LLC entity-level

taxes and foreign withholding taxes, assuming the highest statutory

rates apportioned to each applicable state, local and foreign

jurisdiction.

(7)

Represents the per share impact of

non-GAAP adjustments for each period. Refer to the reconciliation

of Adjusted pro forma net income above, for additional

information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219067306/en/

Media:

Meg Davis, Shake Shack mcastranova@shakeshack.com

Investor Relations:

Melissa Calandruccio, ICR Michelle Michalski, ICR (844) SHACK-04

(844-742-2504) investor@shakeshack.com

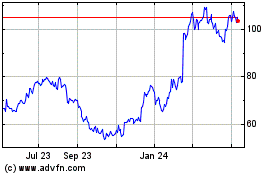

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From Jan 2025 to Feb 2025

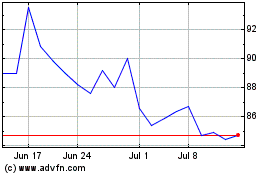

Shake Shack (NYSE:SHAK)

Historical Stock Chart

From Feb 2024 to Feb 2025