Form 8-K - Current report

July 19 2024 - 11:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report July 19, 2024 |

SAN JUAN BASIN ROYALTY TRUST

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Texas |

001-08032 |

75-6279898 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

Argent Trust Company, Trustee 3838 Oak Lawn Ave. Suite 1720 Dallas, Texas 75219 |

(Address of Principal Executive Offices, including zip code) |

|

Registrant’s Telephone Number, Including Area Code: (855) 588-7839 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Units |

|

SJT |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 19, 2024, the San Juan Basin Royalty Trust (the "Trust") issued a press release, a copy of which is attached hereto as Exhibit 99.1, announcing that it would not declare a monthly cash distribution to the holders of its units of beneficial interest ("Units") for July 2024 due to lower natural gas prices and increased production costs that exceeded proceeds during the production month of May 2024.

In accordance with general instruction B.2 to Form 8-K, the information in this Form 8-K shall be deemed “furnished” and not “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

: |

|

By: |

ARGENT TRUST COMPANY, AS TRUSTEE FOR THE SAN JUAN BASIN ROYALTY TRUST (Registrant) |

|

|

|

|

Date: |

July 19, 2024 |

By: |

/S/ NANCY WILLIS |

|

|

|

Nancy Willis Director of Royalty Trust Services |

News Release

San Juan Basin Royalty Trust Declares No Cash Distribution for July 2024 and Announces Production Costs in Excess of Proceeds

DALLAS, Texas, July 19, 2024 – Argent Trust Company, as the trustee (the “Trustee”) of the San Juan Basin Royalty Trust (the “Trust”) (NYSE: SJT), today reported that it will not declare a monthly cash distribution to the holders of its Units of beneficial interest (the “Unit Holders”) due to excess production costs for the Trust’s subject interests (“Subject Interests”) during the production month of May 2024, as well as lower natural gas pricing. Excess production costs occur when production costs and capital expenditures exceed the gross proceeds for a certain period. Excess production costs for this reporting period are due primarily to significant lease operating expenses and capital expenditures associated with Hilcorp San Juan L.P.’s (“Hilcorp”) 2024 capital project plan.

Hilcorp reported $2,518,037 of total revenue from the Subject Interests for the production month of May 2024, consisting of $2,242,475 of gas revenues and $275,562 of oil revenues. For the Subject Interests, Hilcorp reported $6,183,810 of production costs (excluding excess production costs) for the production month of May 2024, consisting of $2,507,667 of lease operating expenses, $391,862 of severance taxes, and $3,284,281 of capital costs.

Hilcorp will charge the excess production costs of approximately $4,888,522 gross ($3,666,391 net to the Trust) to the next month’s distribution. No cash distributions will be made by the Trust until future net proceeds are sufficient to pay then-current Trust liabilities and replenish cash reserves. This month’s Trust administrative expenses totaled $53,688. Interest income received by the Trust in the amount of $6,482 will be applied to cover a portion of this month’s Trust administrative expenses, with cash reserves utilized to pay the remaining administrative expenses.

Based upon information provided to the Trust by Hilcorp, gas volumes for the subject interests for May 2024 totaled 1,970,451 Mcf (2,189,390 MMBtu), as compared to 1,788,912 Mcf (1,987,680 MMBtu) for April 2024. Dividing gas revenues by production volume yielded an average gas price for May 2024 of $1.14 per Mcf ($1.02 per MMBtu), as compared to an average gas price for April 2024 of $1.24 per Mcf ($1.12 per MMBtu).

Pursuant to the Amended and Restated Royalty Trust Indenture, dated December 12, 2007 (as amended on February 15, 2024, by the First Amendment to the Amended and Restated Royalty Trust Indenture), the Trustee is authorized to retain, in its sole discretion, a cash reserve for payment of Trust liabilities that are contingent or uncertain or otherwise not currently due and payable. To cover Trust expenses during any period of revenue shortfall, which has resulted and may continue to result from lower commodity prices and increased capital expenditures and lease operating expenses under Hilcorp’s 2024 capital project plan for the Subject Interests, the Trustee increased the cash reserves in March and April of 2024, such that total cash reserves were $1.8 million as of April 30, 2024. Interest income and cash reserves were utilized to pay Trust administrative expenses in May and June of 2024. This month, cash reserves in the amount of $47,206 will be utilized to cover the balance of Trust administrative expenses which will bring the balance of cash reserves maintained by the Trustee to $1,420,537. Prior to any future distributions to Unit Holders, the Trustee plans to replenish the cash reserves and continue to increase the cash reserves to $2.0 million.

Production from the Subject Interests continues to be gathered, processed, and sold under market sensitive and customary agreements, as recommended for approval by the Trust’s Consultant. The Trustee continues to engage with Hilcorp regarding its ongoing accounting and reporting to the Trust, and the Trust’s third-party compliance auditors continue to audit payments made by Hilcorp to the Trust, inclusive of sales revenues, production costs, capital expenditures, adjustments, actualizations, and recoupments. The Trust’s auditing process has also included detailed analysis of Hilcorp’s pricing and rates charged. As previously disclosed in the Trust’s filings, these revenues and costs (along with all costs) are the subject of the Trust’s ongoing comprehensive audit process by the Trust’s professional

consultants and outside counsel to analyze compliance with all the underlying operative Trust agreements and evaluate potential remedies in the event there is suspected non-compliance.

Forward Looking Statements. Except for historical information contained in this news release, the statements in this news release are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements generally are accompanied by words such as “estimates,” “anticipates,” “could,” “plan,” or other words that convey the uncertainty of future events or outcomes. Forward-looking statements and the business prospects of San Juan Basin Royalty Trust are subject to a number of risks and uncertainties that may cause actual results in future periods to differ materially from the forward-looking statements. These risks and uncertainties include, among other things, certain information provided to the Trust by Hilcorp, volatility of oil and gas prices, governmental regulation or action, litigation, and uncertainties about estimates of reserves. These and other risks are described in the Trust’s reports and other filings with the Securities and Exchange Commission.

Contact: San Juan Basin Royalty Trust

Argent Trust Company, Trustee

Nancy Willis, Director of Royalty Trust Services

Toll-free: (855) 588-7839 or (866) 809-4553

Fax: (214) 559-7010

Website: www.sjbrt.com

Email: royaltytrustgroup@argenttrust.com

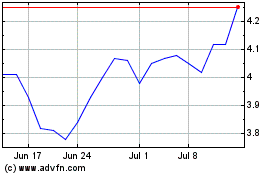

San Juan Basin Royalty (NYSE:SJT)

Historical Stock Chart

From Oct 2024 to Nov 2024

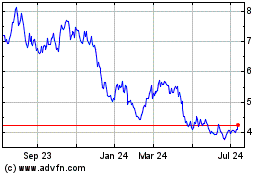

San Juan Basin Royalty (NYSE:SJT)

Historical Stock Chart

From Nov 2023 to Nov 2024