By Nina Trentmann

Mark Hawkins is handing over the reins of Salesforce.com Inc.'s

finance function after helping lead the technology company through

a period of relentless growth while displaying that often rare

combination of methodical focus and people skills.

After a 40-year career in finance, Mr. Hawkins is retiring as

Salesforce -- a provider of customer-relationship-management

software -- looks to expand its kit of workplace tools. Amy Weaver,

previously the company's chief legal officer, will take over as

chief financial officer Monday.

The San Francisco-based company, which hit a market

capitalization of more than $200 billion during Mr. Hawkins's more

than six years as CFO, in December agreed to buy collaboration

platform provider Slack Technologies Inc. for $27.7 billion.

Salesforce is awaiting regulatory approval for the deal.

Mr. Hawkins, who will remain with Salesforce until October as

CFO emeritus, is expecting his second grandson and working on a

book with his sons describing their walks and after-dinner

conversations over the years. The 61-year-old said he wants more

time for his family after decades spent in demanding roles with

increasing workloads, as the CFO role became more strategic over

the course of his career.

"I think the role has changed a lot," Mr. Hawkins said, adding

that today's CFOs have to deal with a broader range of issues than

in the past, including environmental, social and governance topics.

Finance chiefs no longer just count the beans. They also play a key

role in framing corporate strategies as their businesses face

shifting consumer tastes, technological change and growing pressure

from shareholders.

The coronavirus pandemic has added to the lists of

responsibilities, with companies having to raise billions of

dollars to bolster their balance sheets, cut jobs and transform

their operations for a post-Covid-19 future. "Everyone in the world

had to pivot, and the CFO is going through the same experience,"

Mr. Hawkins said. "It's a big, hard job."

Mr. Hawkins kept extensive lists of people he would meet with on

a one-on-one basis, and had his calendar planned a year out, former

colleagues said. "He always took notes and six months later, he

flipped through them and said, 'We discussed this,'" said Debbie

Clifford, the finance chief of software maker SurveyMonkey who

worked under Mr. Hawkins during his time as CFO of software and

services company Autodesk Inc.

Having that structure helped her former boss be effective even

as his duties increased, Ms. Clifford said. "Mark was always

looking over the next hill," she said. Mr. Hawkins brought a

long-term plan to the finance organizations at Autodesk and

Salesforce, and ideas on how to achieve goals in two, three or five

years' time, former co-workers said.

Mr. Hawkins said he always searched for patterns. "It's about

discerning patterns, about being all in what you are doing," he

said. He analyzed and solved complicated tasks -- for example,

advancing the shift to a subscription-based model at Autodesk -- by

breaking them down into parts and tackling them. One of his mottos

is "better, better, never done."

"Every time he found something that worked, he thought about how

he could scale it," said Sue Savage, the CFO of software company

Blue Yonder Group and a former colleague of Mr. Hawkins at

Autodesk.

When Salesforce announced Mr. Hawkins's planned retirement

during an earnings call Dec. 1, Chief Executive Marc Benioff said,

"Mark, you set the foundation," adding, "We all know that it takes

a great CFO to help scale a company that well."

Bret Taylor, the company's chief operating officer, said Mr.

Hawkins was a stabilizing force at Salesforce. "There is a lot of

intentional chaos when a company is growing as fast as we are," Mr.

Taylor said in an interview.

During his career, Mr. Hawkins also served as group controller

at Hewlett-Packard Co., vice president of finance at Dell

Technologies Inc. and CFO at software company Logitech

International SA.

At Salesforce, Mr. Hawkins provided additional disclosures and

insights to investors, said Mark Moerdler, a senior analyst at

Bernstein Research. "Mark has done a really good job being more

communicative with the Street," Mr. Moerdler said.

Ms. Weaver, Mr. Hawkins's successor at Salesforce, described him

as unflappable and able to work through difficult work situations,

for example, when negotiating a deal while at a corporate event and

without a proper room to work in. One time, a Volkswagen Passat

belonging to Ms. Weaver's son served as a makeshift office while

the two were working together on a transaction.

Mr. Hawkins handled conflicts without much drama, former

colleagues said. "He used to say 'focus on the work,' not the

challenging people and personalities," said Ms. Clifford.

Former colleagues recall a skill that not all finance chiefs

have: his ability to remember names and connect with people on a

personal level. Catherine Lesjak, the former CFO of HP Inc.,

recounts the card Mr. Hawkins sent her daughter when she left

Salesforce to go to business school. "I think this is somewhat

unusual," Ms. Lesjak said. "CFOs can sometimes lack the softer

skills."

Mr. Hawkins is the founding chair of the U.S. chapter of

Accounting for Sustainability, an initiative by the Prince of Wales

aimed at making companies' strategies and business processes more

sustainable. He also runs marathons.

"We have come a long way," Mr. Hawkins said of his time at

Salesforce, pointing to the growth of its workforce to about 54,000

employees, up from 16,000 when he joined. "I think it is always

about the team," he said.

Aaron Tilley contributed to this article.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

February 01, 2021 08:44 ET (13:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

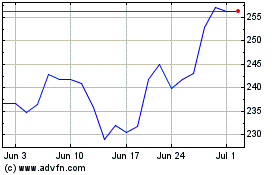

Salesforce (NYSE:CRM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Sep 2023 to Sep 2024