John Standley to Step Down as Chief Executive

Officer Upon Appointment of Successor

Bryan Everett and Matt Schroeder Named COO and

CFO, Respectively

Kermit Crawford, President and COO, and Darren

Karst, CFO and CAO, Leaving the Company

Company Expects to Generate Annual Cost Savings

of $55 Million through Organizational Restructuring

Rite Aid Corporation (NYSE: RAD) announced today a leadership

transition plan and an organizational restructuring to better align

its structure with the Company’s operations and to reduce

costs.

As part of the leadership transition, John Standley will step

down as chief executive officer. The Board will promptly commence a

search process for a new CEO, and Standley will remain CEO until

the appointment of his successor.

Rite Aid also announced additional management changes, each of

which is effective immediately. Bryan Everett, chief operating

officer of Rite Aid Stores has been promoted to chief operating

officer of the Company, succeeding Kermit Crawford who is leaving

the Company. Matt Schroeder, chief accounting officer and

treasurer, has been promoted to chief financial officer. Schroeder

is succeeding Darren Karst who is leaving the Company this spring

after supporting a brief transition. Brian Hoover, group vice

president and controller, has been promoted to chief accounting

officer. Jocelyn Konrad, executive vice president, pharmacy, has

been promoted to executive vice president, pharmacy and retail

operations. Derek Griffith, executive vice president, store

operations is leaving the Company. Rite Aid also will consolidate

additional senior leadership roles resulting in the elimination of

certain positions.

In addition, the Company announced actions that will reduce

managerial layers and consolidate roles across the organization,

resulting in the elimination of approximately 400 full-time

positions, or more than 20% of the corporate positions located at

the Company’s headquarters and across the field organization.

Approximately two-thirds of the reductions will take place

immediately with the balance by the end of fiscal 2020. As a result

of the restructuring, Rite Aid expects to achieve annual cost

savings of approximately $55 million, of which approximately $42

million will be realized within fiscal year 2020. These cost

savings will serve to offset an expected reduction in income

associated with its diminishing obligations under the Transition

Services Agreement with Walgreen Co., which related to the prior

sale of stores. Rite Aid expects to incur a one-time restructuring

charge of approximately $38 million to achieve the targeted

cost savings.

"Rite Aid’s Board of Directors is committed to more closely

aligning the structure and leadership of the Company with our

present scale and today's announcement is an important step in

positioning Rite Aid for future success,” said Bruce Bodaken,

chairman of Rite Aid’s Board of Directors. “These are difficult

decisions and we recognize the implications they have for

individuals across our organization. However, it is imperative we

take action to reduce the cost of current operations and become a

more efficient and profitable company.”

“The Board believes that now is the right time to undertake a

leadership transition,” Bodaken continued. “We will be focused on

recruiting a leader that will best position Rite Aid to create

long-term value for shareholders. As we conduct the search process,

John has agreed to stay until we appoint his successor. We thank

John for his outstanding leadership in guiding the Company over the

past several years. His leadership and expertise has been critical

to ensuring the Company’s stability and success through an

extremely challenging environment. In addition, we are confident

that Bryan, Matt and our senior leadership team have the

capabilities and experience necessary to effectively guide Rite Aid

forward. On behalf of the Board, I want to thank Kermit, Darren,

and all the other departing associates for their service and

contributions to the Company.”

Bryan Everett Biography

Everett joined Rite Aid in August 2015 as executive vice

president of store operations and was promoted to chief operating

officer of Rite Aid Stores in 2017. Prior to joining Rite Aid, he

held multiple senior leadership positions at Target Corporation,

ultimately serving as senior vice president of store operations. In

this role, he focused on talent management, strategy development,

operational efficiency and integrated technology solutions. He also

led new format, new store and remodel programs while also

overseeing pharmacy and clinic operations. Before joining Target,

Everett also held store operations management positions at Fleming

Wholesale and ALDI Inc. Everett also serves as a member of The Rite

Aid Foundation Board of Directors.

Matt Schroeder Biography

Schroeder joined Rite Aid in 2000 as vice president of financial

accounting and was promoted to group vice president of strategy,

investor relations and treasurer, in 2010. In 2017, Schroeder was

promoted to senior vice president, chief accounting officer and

treasurer. Prior to joining the company, Schroeder worked for

Arthur Andersen, LLP, where he held several positions of increasing

responsibility, including audit senior and audit manager. He also

currently serves as treasurer of The Rite Aid Foundation, as well

as a member of its Board of Directors.

About Rite Aid Corporation

Rite Aid Corporation is one of the nation's leading drugstore

chains with fiscal 2018 annual revenues of $21.5 billion.

Information about Rite Aid, including corporate background and

press releases, is available through the company's website at

www.riteaid.com.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, both as amended by the Private Securities

Litigation Reform Act of 1995. Forward-looking statements may

generally be identified by the use of the words “anticipates,”

“expects,” “intends,” “plans,” “should,” “could,” “would,” “may,”

“will,” “believes,” “estimates,” “potential,” “target,” or

“continue” and variations or similar expressions. These statements

are based upon the current expectations and beliefs and are subject

to certain risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. These risks and uncertainties may include, but are not

limited to, our ability to successfully execute and achieve

benefits from our leadership transition plan and organizational

restructuring, including our chief executive officer search

process, and to manage the transition to a new chief executive

officer and other management; the potential for operational

disruptions due to, among other things, concerns of management,

employees, current and potential customers, other third parties

with whom we do business and shareholders; the success of any

changes to our business strategy that may be implemented under our

new chief executive officer and other management; our ability to

achieve cost savings through the organizational restructurings

within the anticipated timeframe, if at all; possible changes in

the size and components of the expected costs and charges

associated with the organizational restructuring plan; and the

outlook for and future growth of the Company. A detailed discussion

of assumptions and uncertainties are more fully described in Item

1A (Risk Factors) of our most recent Annual Report on

Form 10-K and in other documents that we file or furnish with

the Securities and Exchange Commission (the “SEC”), which you are

encouraged to read. Readers are cautioned not to place undue

reliance on any of these forward-looking statements. These

forward-looking statements speak only as of the date hereof. Rite

Aid undertakes no obligation to update any of these forward-looking

statements to reflect events or circumstances after the date of

this press release or to reflect actual outcomes, unless required

by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190312005911/en/

INVESTORS:Byron Purcell(717) 975-5809

MEDIA:Chris Savarese(717) 975-5718

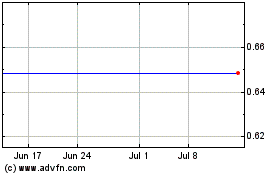

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2024 to May 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From May 2023 to May 2024