As filed with the Securities and Exchange Commission

on December 13, 2023

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

REV Group, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

26-3013415 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

| |

245 South Executive Drive,

Suite 100

Brookfield, WI 53005

(414) 290-0190 |

|

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

| |

Mark A. Skonieczny

President, Chief Executive Officer and Interim Chief Financial Officer

245 South Executive Drive, Suite 100

Brookfield, WI 53005

(414) 290-0190 |

|

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent For Service)

| |

Copies to: |

|

Derek J. Dostal, Esq.

Davis Polk & Wardwell

450 Lexington Avenue

New York, NY 10017

(212) 450-4000 |

|

Stephen Zamansky

General Counsel

245 South Executive Drive, Suite 100

Brookfield, WI 53005

(414) 290-0190 |

Approximate date of commencement of proposed

sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☒ |

|

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☐ |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration Statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended,

or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to

said Section 8(a), may determine.

The information in this prospectus is not complete and

may be changed. The selling securityholders may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED DECEMBER 13, 2023

PRELIMINARY PROSPECTUS

REV Group, Inc.

Common Stock

This prospectus relates to the resale from time

to time by the selling securityholders named in this prospectus or their permitted transferees (the “selling securityholders”)

of up to 28,272,855 shares of common stock of REV Group, Inc. (“REV”).

We are registering the offer and sale of the securities

held by the selling securityholders to satisfy certain registration rights we have granted. The selling securityholders may sell the securities

covered by this prospectus in a number of different ways and at varying prices. The specific terms of any offering of these securities,

including the public offering price, will be provided in supplements to this prospectus. You should read this prospectus and any prospectus

supplement, as well as the documents incorporated and deemed to be incorporated by reference in this prospectus and any prospectus supplement,

carefully before you invest.

The securities covered by this prospectus may

be sold on a continuous or delayed basis through one or more agents, dealers or underwriters as designated from time to time, or directly

to purchasers or through a combination of these methods. The selling securityholders reserve the sole right to accept, and together with

any agents, dealers and underwriters, reserve the right to reject, in whole or in part, any proposed purchase of securities. If any agents,

dealers or underwriters are involved in the sale of any securities, the applicable prospectus supplement will set forth any applicable

commissions or discounts. We will not receive any of the proceeds from the sale of the securities by the selling securityholders. We will

pay certain expenses associated with the registration of the securities covered by this prospectus, as described in the section titled

“Plan of Distribution.”

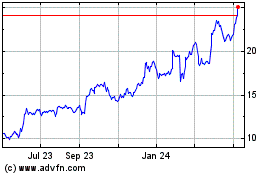

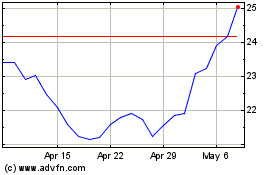

REV’s common stock is listed on the New

York Stock Exchange (“NYSE”) under the symbol “REVG.” On December 7, 2023 the last reported sale price of REV’s

common stock on the NYSE was $16.44 per share.

Investing in our securities

involves risks.

You should carefully consider the information referred to under the heading

“Risk Factors” on page 4 of this prospectus.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

table

of contents

Page

Our Company

REV is a leading designer, manufacturer, and distributor

of specialty vehicles and related aftermarket parts and services. We serve a diversified customer base, primarily in the United States

and Canada, through three segments: Fire & Emergency, Commercial, and Recreation. We provide customized vehicle solutions for applications,

including essential needs for public services (ambulances, fire apparatus, school buses, and transit buses), commercial infrastructure

(terminal trucks and industrial sweepers) and consumer leisure (recreational vehicles). Our diverse portfolio is made up of well-established

principal vehicle brands, including many of the most recognizable names within their industry. Several of our brands pioneered their specialty

vehicle product categories and date back more than 50 years.

REV Group, Inc. is a corporation organized under

the laws of the state of Delaware. Our principal executive offices are located at 245 South Executive Drive, Suite 100, Brookfield, WI

53005. Our telephone number at that address is (414) 290-0190. Our website address is www.revgroup.com. The information on, or

that can be accessed through, our website is not part of this prospectus or any accompanying prospectus supplement, and you should not

rely on any such information in making the decision whether to purchase any of our securities.

About this Prospectus

This prospectus is part of a registration statement

that we filed with the SEC utilizing a “shelf” registration process. Under this shelf process, we may sell any combination

of the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the

securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement and information incorporated by reference after the date of this prospectus

may also add, update or change information contained in this prospectus. You should read both this prospectus, any prospectus supplement

and any free writing prospectus, together with additional information described under the heading “Where You Can Find More Information.”

Neither we nor the selling securityholders have

authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any prospectus

supplement or free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the selling securityholders

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither

we nor the selling securityholders are making an offer of these securities in any jurisdiction where the offer is not permitted. You should

not assume that the information contained in or incorporated by reference in this prospectus, any prospectus supplement or in any such

free writing prospectus is accurate as of any date other than their respective dates. The terms “REV,” “the Company,”

“we,” “us,” and “our” refer to REV Group, Inc. and its subsidiaries.

Where You Can Find

More Information

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public from the SEC’s website at www.sec.gov.

Our common stock is listed and traded on the New York Stock Exchange, or “NYSE” under the symbol “REVG.” You may

also inspect the information we file with the SEC at the NYSE’s offices at 20 Broad Street, New York, New York 10005. Information

about us, including certain SEC filings, is also available at our website at investors.revgroup.com. However, the information on

our website is not a part of this prospectus or any accompanying prospectus supplement.

The SEC allows us to “incorporate by reference”

in this prospectus the information in other documents that we file with the SEC, which means that we can disclose important information

to you by referring you to those documents. The information incorporated or deemed to be incorporated by reference is considered to be

a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information

contained in documents filed earlier with the SEC or contained in this prospectus.

We incorporate by reference in this prospectus

the documents listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Securities

Exchange Act of 1934, as amended, or the “Exchange Act,” prior to the termination of the offering under this prospectus (provided,

however, that we are not incorporating, in each case, any documents or information deemed to have been “furnished” under Items

2.02, 7.01 or 9.01 on Form 8-K or other information deemed to have been “furnished” and not filed in accordance with SEC rules):

| · | Our Annual Report on Form 10-K for the fiscal year ended October 31, 2023 filed with the SEC on December 13, 2023. |

You may obtain a copy of any or all of the documents

referred to above which may have been or may be incorporated by reference into this prospectus (excluding certain exhibits to the documents)

at no cost to you by writing or telephoning us at the following address:

Investor Relations Department

REV Group, Inc.

245 South Executive Drive, Suite 100

Brookfield, WI 53005

1-888-738-4037

Cautionary Statement

on Forward-Looking Statements

This prospectus contains or incorporates by reference

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions

regarding the future of our business, future plans and strategies and other future conditions. Forward-looking statements can be identified

by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “target,” “potential,” “will,”

“would,” “could,” “should,” “continue,” “contemplate,” “aim” and

other similar expressions, although not all forward-looking statements contain these identifying words.

The forward-looking statements contained or incorporated

by reference in this prospectus are only predictions. A number of factors could cause actual results to differ materially from these statements,

including, but not limited to increases in interest rates, availability of credit, low consumer confidence, availability of labor, significant

increases in repurchase obligations, inadequate liquidity or capital resources, availability and price of fuel, a slowdown in the economy,

increased material and component costs, availability of chassis and other key component parts, sales order cancellations, slower than

anticipated sales of new or existing products, new product introductions by competitors, the effect of global tensions and integration

of operations relating to mergers and acquisitions activities. Important factors that could cause actual results and events to differ

materially from those indicated in the forward-looking statements include those described under the “Risk Factors” section

of this prospectus, in any accompanying prospectus supplement and in the filings made by us from time to time with the SEC or in materials

incorporated herein or therein.

We disclaim any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statements contained or incorporated by reference in this prospectus or to reflect any

changes in expectations or any change in events, conditions or circumstances on which any statement is based, except as required by law.

Risk Factors

An investment in our securities involves significant

risks. Before purchasing any securities, you should carefully consider and evaluate all of the information included and incorporated by

reference or deemed to be incorporated by reference in this prospectus or the applicable prospectus supplement, including the risk factors

incorporated by reference herein from our Annual Report on Form 10-K for the fiscal year ended October 31, 2023, as updated by annual,

quarterly and other reports and documents we file with the SEC that are incorporated by reference herein or in the applicable prospectus

supplement. Our business, financial position, results of operations or liquidity could be adversely affected by any of these risks.

Use of Proceeds

All of the common stock sold pursuant to this prospectus will be offered

and sold by the selling securityholders. We will not receive any of the proceeds from such sales.

Description of

Capital Stock

The following is a summary of our capital stock

and certain terms of our amended and restated certificate of incorporation and amended and restated bylaws. This discussion summarizes

some of the important rights of our stockholders but does not purport to be a complete description of these rights and may not contain

all of the information regarding our capital stock that is important to you. These rights can only be determined in full, and the descriptions

herein are qualified in their entirety, by reference to our amended and restated certificate of incorporation and amended and restated

bylaws, copies of which are filed with the SEC as exhibits to our Annual Report on Form 10-K for the year ended October 31, 2023, and

our Registration Statement on Form 8-A dated January 27, 2017.

General

Our authorized capital stock consists of 700,000,000

shares of capital stock, $0.001 par value per share, of which:

| · | 605,000,000 shares are designated as common stock; and |

| · | 95,000,000 shares are designated as preferred stock. |

The following description summarizes the material

terms of our securities. Because it is only a summary, it may not contain all the information that is important to you.

Common Stock

All issued and outstanding shares of our common

stock have been duly authorized, validly issued, fully paid, and non-assessable. All authorized but unissued shares of our common stock

are available for issuance by our Board of Directors without any further stockholder action, except as required by the listing standards

of the NYSE.

Voting Rights. Each holder of our common

stock is entitled to one vote per share on all matters to be voted upon by the stockholders. The holders of common stock do not have cumulative

voting rights in the election of directors.

Dividend Rights. Each holder of our common

stock is entitled to ratably receive dividends if, as, and when declared from time to time by our Board of Directors at its own discretion

out of funds legally available for that purpose, after payment of dividends required to be paid on outstanding preferred stock, if any.

Under Delaware law, we can only pay dividends either out of “surplus” or out of the current or the immediately preceding year’s

net profits. Surplus is defined as the excess, if any, at any given time, of the total assets of a corporation over its total liabilities

and statutory capital. The value of a corporation’s assets can be measured in a number of ways and may not necessarily equal their

book value.

Right to Receive Liquidation Distributions.

Upon our dissolution, liquidation, or winding-up, the assets legally available for distribution to our stockholders are distributable

ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential

rights and payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Shareholders Agreement. We are party to

an amended and restated shareholders agreement with (i) American Industrial Partners Capital Fund IV, LP, (ii) American Industrial Partners

Capital Fund IV (Parallel), LP and (iii) AIP/CHC Holdings, LLC (collectively, the “Sponsor”), and entities affiliated with

J.P. Morgan Securities LLC (the “JPM Holders”) and certain of our existing stockholders (the “Shareholders Agreement”).

Pursuant to the Shareholders Agreement, the Sponsor has certain rights so long as it beneficially owns at least 15% of the then outstanding

shares of our common stock, as described under “Selling Securityholders—Material Relationships with Selling Securityholders—Amended

and Restated Shareholders Agreement” in this prospectus and in the “Certain Relationships and Related Person Transactions—Amended

and Restated Shareholders Agreement” section of our Annual Report on Form 10-K for the fiscal year ended October 31, 2023.

Other Matters. The common stock has no

preemptive rights pursuant to the terms of our amended and restated certificate of incorporation and our amended and restated bylaws.

There are no redemption or sinking fund provisions applicable to the common stock. All outstanding shares of our common stock, including

the shares being offered by the selling stockholders identified in this prospectus, have been fully paid and non-assessable.

Preferred Stock

Pursuant to our amended and restated certificate

of incorporation, 95,000,000 shares of preferred stock are issuable from time to time, in one or more series, with the designations of

the series, the voting rights of the shares of the series (if any), the powers, preferences, or relative, participation, optional, or

other special rights (if any), and any qualifications, limitations or restrictions thereof as our Board of Directors from time to time

may adopt by resolution (and without further stockholder approval), subject to certain limitations. Each series will consist of that number

of shares as will be stated and expressed in the certificate of designations providing for the issuance of the stock of the series.

Registration Rights

We are party to a registration rights agreement

with the Sponsor, the JPM Holders and certain other existing stockholders, each of which is entitled to certain demand and piggyback registration

rights. See “Selling Securityholders—Material Relationships with Selling Securityholders—Registration Rights Agreement.”

Anti-Takeover Effects of Certain Provisions of Delaware Law, Our

Amended and Restated Certificate of Incorporation and Our Amended and Restated Bylaws

Certain provisions of Delaware law and certain

provisions included in our amended and restated certificate of incorporation and amended and restated bylaws summarized below may be deemed

to have an anti-takeover effect and may delay, deter, or prevent a tender offer or takeover attempt that a stockholder might consider

to be in its best interests, including attempts that might result in a premium being paid over the market price for the shares held by

stockholders.

Preferred Stock

Our amended and restated certificate of incorporation

contains provisions that permit our Board of Directors to issue, without any further vote or action by the stockholders, shares of preferred

stock in one or more series and, with respect to each such series, to fix the number of shares constituting the series and the designation

of the series, the voting rights (if any) of the shares of the series, and the powers, preferences, or relative, participation, optional,

and other special rights, if any, and any qualifications, limitations, or restrictions, of the shares of such series.

Classified Board

Our Board of Directors is divided into three classes

of directors, with each class as nearly equal in number as possible, serving staggered three year terms, other than directors which may

be elected by holders of preferred stock, if any.

Removal of Directors

Our amended and restated certificate of incorporation

provides that directors may be removed only for cause and only by the affirmative vote of holders of a majority of our then outstanding

stock.

Director Vacancies

Our amended and restated certificate of incorporation

authorizes only our Board of Directors to fill vacant directorships.

No Cumulative Voting

Our amended and restated certificate of incorporation

provides that stockholders do not have the right to cumulate votes in the election of directors.

Special Meetings of Stockholders

Our amended and restated bylaws and amended and

restated certificate of incorporation provide that special meetings of our stockholders may only be called by the Board of Directors.

Advance Notice Procedures for Director Nominations

Our amended and restated bylaws establish advance

notice procedures for stockholders seeking to nominate candidates for election as directors at an annual or special meeting of stockholders.

Although our amended and restated bylaws do not give the board of directors the power to approve or disapprove stockholder nominations

of candidates to be elected at an annual meeting, our amended and restated bylaws may have the effect of precluding the conduct of certain

business at a meeting if the proper procedures are not followed or may discourage or deter a potential acquirer from conducting a solicitation

of proxies to elect its own slate of directors or otherwise attempting to obtain control of our Company.

Action by Written Consent

Our amended and restated bylaws and amended and

restated certificate of incorporation provide that any action required or permitted to be taken by the stockholders must be effected at

a duly called annual or special meeting of stockholders and may not be effected by any consent in writing in lieu of a meeting of such

stockholders, subject to the rights of the holders of any series of preferred stock.

Amending Our Certificate of Incorporation and

Bylaws

Our amended and restated certificate of incorporation

and amended and restated bylaws may be amended by the affirmative vote of the holders of at least two thirds of our common stock.

Authorized but Unissued Shares

Our authorized but unissued shares of our common

stock and preferred stock will be available for future issuances without stockholder approval, except as required by the listing standards

of the NYSE, and could be utilized for a variety of corporate purposes, including future offerings to raise additional capital, acquisitions,

and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred stock could render more

difficult or discourage an attempt to obtain control of our Company by means of a proxy contest, tender offer, merger or otherwise.

Exclusive Jurisdiction

Our amended and restated certificate of incorporation

provides that, unless we consent to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the

sole and exclusive forum for any derivative action or proceeding brought on our behalf, any action asserting a claim of breach of fiduciary

duty owed by any of our directors, officers, or other employees to us or to our stockholders, any action asserting a claim arising pursuant

to the Delaware General Corporation Law (the “DGCL”), or any action asserting a claim governed by the internal affairs doctrine.

Business Combinations with Interested Stockholders

Subject to certain exceptions, Section 203 of

the DGCL prohibits a public Delaware corporation from engaging in a business combination (as defined in such section) with an “interested

stockholder” (defined generally as any person who beneficially owns 15% or more of the outstanding voting stock of such corporation

or any person affiliated with such person) for a period of three years following the time that such stockholder became an interested stockholder,

unless (i) prior to such time the Board of Directors of such corporation approved either the business combination or the transaction that

resulted in the stockholder becoming an interested stockholder; (ii) upon consummation of the transaction that resulted in the stockholder

becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of such corporation at the time

the transaction commenced (excluding for purposes of determining the voting stock of such corporation outstanding (but not the outstanding

voting stock owned by the interested stockholder) those shares owned (A) by persons who are directors and also officers of such corporation

and (B) by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject

to the plan will be tendered in a tender or exchange offer); or (iii) at or subsequent to such time the business combination is approved

by the Board of Directors of such corporation and authorized at a meeting of stockholders (and not by written consent) by the affirmative

vote of at least 66 2/3% of the outstanding voting stock of such corporation not owned by the interested stockholder.

A Delaware corporation may “opt out”

of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate

of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares.

We had expressly elected not to be governed by the “business combination” provisions of Section 203 of the DGCL, until after

such time as the Sponsor no longer beneficially owned at least 50% of our common stock. Since that time, such election was automatically

withdrawn and we are now governed by the “business combination” provisions of Section 203 of the DGCL.

Transfer Agent and Registrar

The transfer agent and registrar for our common

stock is Computershare Trust Company, N.A. The transfer agent and registrar’s address is 250 Royall Street, Canton, Massachusetts

02021.

Listing

Our shares of common stock are listed on the NYSE

under the symbol “REVG.”

Selling Securityholders

This prospectus relates to the possible resale

by the selling securityholders of up to 28,272,855 shares of our common stock. The selling securityholders may from time to time offer

and sell any or all of the common stock set forth below pursuant to this prospectus. When we refer to the “selling securityholders”

in this prospectus, we mean the persons listed in the tables below, and the pledgees, donees, transferees, assignees, successors and others

who later come to hold any of the selling securityholders’ interest in our securities after the date of this prospectus.

The table below sets forth, as of the date of

this prospectus, the name of the selling securityholders for which we are registering shares of common stock for resale to the public,

and the aggregate principal amount that the selling securityholders may offer pursuant to this prospectus. Unless otherwise indicated,

the address of each selling securityholder listed in the table below is c/o American Industrial Partners, 450 Lexington Avenue, 40th Floor,

New York, New York 10017. The common stock issued to the selling securityholders are subject to transfer restrictions, as described herein.

We cannot advise you as to whether the selling

securityholders will in fact sell any or all of such shares of common stock. In addition, the selling securityholders may sell, transfer

or otherwise dispose of, at any time and from time to time, the shares of common stock in transactions exempt from the registration requirements

of the Securities Act after the date of this prospectus, subject to applicable law and transfer restrictions, as described herein.

Selling securityholder information for each additional

selling securityholder, if any, will be set forth by prospectus supplement to the extent required prior to the time of any offer or sale

of such selling securityholder’s securities pursuant to this prospectus. Any prospectus supplement may add, update, substitute,

or change the information contained in this prospectus, including the identity of each selling securityholder and the number of shares

registered on its behalf. A selling securityholder may sell all, some or none of such securities in this offering. See “Plan of

Distribution.”

Except where noted, we have based percentage ownership

of our common stock prior to this offering on 59,505,829 shares of common stock issued and outstanding as of December 7, 2023.

| |

Common

Stock

Beneficially Owned(1)

|

Common

Stock

Registered

Hereby |

Common

Stock

Beneficially Owned

After Sale of All Common

Stock Offered Hereby(1)

|

|

Name

of Selling Securityholder |

Shares |

Percentage |

Shares |

Percentage |

| Funds associated with AIP Fund IV(2) |

27,562,505 |

46.3% |

27,562,505 |

— |

— |

| Jorge Amador(3) |

10,045 |

* |

10,045 |

— |

— |

| Paul Bamatter(4) |

150,000 |

* |

150,000 |

— |

— |

| Eric Baroyan(5) |

35,157 |

* |

35,157 |

— |

— |

| John Becker(6) |

118,028 |

* |

118,028 |

— |

— |

| Trusts associated with the estate of Sparsh Bhargava(7) |

2,511 |

* |

2,511 |

— |

— |

| Dino Cusumano(8) |

118,030 |

* |

118,030 |

— |

— |

| Daniel Davis(9) |

10,045 |

* |

10,045 |

— |

— |

| Ben DeRosa(10) |

35,157 |

* |

35,157 |

— |

— |

| Justin Fish(11) |

17,511 |

* |

17,511 |

— |

— |

| Ryan Hodgson(12) |

5,023 |

* |

5,023 |

— |

— |

| Richard Hoffman(13) |

10,045 |

* |

10,045 |

— |

— |

| Kim Marvin(14) |

118,030 |

* |

118,030 |

— |

— |

| Joel Rotroff(15) |

20,511 |

* |

20,511 |

— |

— |

| Graham Sullivan(16) |

35,157 |

* |

35,157 |

— |

— |

| Randall Swift(17) |

25,100 |

* |

25,100 |

— |

— |

| (1) | The shares of our common stock beneficially owned are reported on the basis of regulations of the SEC governing the determination

of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a “beneficial owner” of a security

if that person has or shares voting power, which includes the power to vote, or direct the voting of, such security, or investment power,

which includes the power to dispose of, or to direct the disposition of, such security. Under these rules, more than one person may be

deemed beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person

has no economic interest. Except as otherwise indicated in these footnotes, each of the beneficial owners has, to our knowledge, sole

voting and investment power with respect to the indicated shares of common stock. For purposes of this table, except where noted we have

assumed that none of the beneficial owners has purchased shares of our common stock in the open market. Under the regulations of the SEC,

a person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within

60 days. Securities that can be so acquired are deemed to be outstanding

for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. |

| (2) | Represents 27,562,505 shares of common stock held directly or indirectly by American Industrial Partners Capital Fund IV, LP. (“Fund

IV”), American Industrial Partners Capital Fund IV (Parallel), LP (“Parallel Fund”) and AIP/CHC Holdings, LLC (“AIP

Holdings” and, together with Fund IV and Parallel Fund, the “AIP Funds”). AIPCF IV, LLC (“AIP GP”) is the

general partner of Fund IV and the Parallel Fund. Mr. Cusumano, Mr. Marvin and Mr. Becker are senior managing members of AIP GP. They

are also managing members of AIP/CHC Investors, LLC, which is the managing member of AIP Holdings. As a result of the above, Mr. Cusumano,

Mr. Marvin and Mr. Becker may be deemed to share voting and dispositive power with respect to the shares held by the AIP Funds. Mr. Cusumano

currently serves as a member of the Board of REV. Each of the individuals listed herein disclaim beneficial ownership of the shares of

common stock held by the AIP Funds except to the extent of any pecuniary interest therein. The AIP Funds may be deemed to be a “group”

within the meaning of Rule 13d-5 of the Exchange Act of 1934. |

| (3) | Mr. Amador has been a partner at AIP, LLC, which is an affiliate of the AIP Funds (“AIP”) since 2013. |

| (4) | Mr. Bamatter has served as a member of the Board of REV since 2016. He has also been a partner at AIP since 2005 and was the chief

financial officer of AIP from 2005 to 2018. |

| (5) | Reflects 31,641 shares of common stock held by Eric Baroyan and 3,516 shares of common stock held by the Eric Baroyan 2010 Long-Term

Trust. Eric Baroyan, as trustee of the Eric Baroyan 2010 Long-Term Trust, may be deemed to share voting power and dispositive power over

the shares held by the Eric Baroyan 2010 Long-Term Trust. Mr. Baroyan has been a partner at AIP since 2010. |

| (6) | Reflects 55,473 shares of common stock held by John Becker and 62,555 shares of common stock held by the John Becker 2010 Long-Term

Trust. John Becker, as trustee of the John Becker 2010 Long-Term Trust, may be deemed to share voting power and dispositive power over

the shares held by the John Becker 2010 Long-Term Trust. Mr. Becker has also been a senior managing member of AIP GP since 2006, a managing

member of AIP/CHC Investors, LLC since 2008 and a partner at AIP since 2005. |

| (7) | Reflects 1,255 shares of common stock held by the Umesh K. Bhargava Revocable Trust dated August 4, 2017 and 1,256 shares of common

stock held by the Nibha Bhargava Revocable Trust dated August 4, 2017. Each of Umesh K. Bhargava and Nibha Bhargava serves as co-trustees

of the two trusts. |

| (8) | Mr. Cusumano has served as a member of the Board of REV since 2008. He has also been a senior managing member of AIP GP since 2006,

a managing member of AIP/CHC Investors, LLC since 2008 and a partner at AIP since 2005. |

| (9) | Reflects 9,243 shares of common stock held by Daniel Davis and 802 shares of common stock held by the Main Trust under the Daniel

Davis 2012 Long-Term Trust. Daniel Davis, as trustee of the Main Trust under the Daniel Davis 2012 Long-Term Trust, may be deemed to share

voting power and dispositive power over the shares held by the Main Trust under the Daniel Davis 2012 Long-Term Trust. Mr. Davis has been

a partner at AIP since 2013. |

| (10) | Mr. DeRosa has been a partner at AIP since 2011. |

| (11) | Mr. Fish served as a member of the Board of REV from 2016 to 2023. He has been a partner at AIP since 2013. |

| (12) | Mr. Hodgson was previously a partner at AIP until 2020. |

| (13) | Mr. Hoffman has been a partner at AIP since 2013. |

| (14) | Mr. Marvin served as a member of the Board of REV from 2008 to 2020. He has also been a senior managing member of AIP GP since 2006,

a managing member of AIP/CHC Investors, LLC since 2008 and a partner at AIP since 2005. |

| (15) | Mr. Rotroff has served as a member of the Board of REV since 2016. He has also been a partner at AIP since 2013. |

| (16) | Reflects 26,368 shares of common stock held by Graham Sullivan and 8,789 shares of common stock held by the Graham Grosvenor Sullivan

2012 Long-Term Trust. Graham Sullivan, as trustee of the Graham Grosvenor Sullivan 2012 Long-Term Trust, may be deemed to share voting

power and dispositive power over the shares held by the Graham Grosvenor Sullivan 2012 Long-Term Trust. |

| (17) | Mr. Swift has served as a member of the Board of REV since 2020. He has also been a partner at AIP since 2015. |

Material Relationships with Selling Securityholders

The description of our relationships with the

selling securityholders and their affiliates set forth under “Item 13. Certain Relationships and Related Transactions, and Director

Independence” in our Annual Report on Form 10-K for the fiscal year ended October 31, 2023 is incorporated by reference herein.

Amended and Restated Shareholders Agreement

We are party to the Shareholders Agreement with

the Sponsor, the JPM Holders and certain of our existing stockholders that we entered into in connection with our IPO. Pursuant to the

Shareholders Agreement, the Sponsor has the following rights so long as it beneficially owns at least 15% of the then outstanding shares

of our common stock:

| · | to nominate the greater of five members of the Board or a majority of our directors; |

| · | to designate the Chairman of our Board and one member to each of the audit committee, the compensation committee and the nominating

and corporate governance committee; |

| · | to approve the commencement of any proceeding for the voluntary dissolution, winding up or bankruptcy of the Company or any material

subsidiary; |

| · | to approve any non-pro rata reduction to the share capital of the Company or any material subsidiary, except as required by law; |

| · | to approve amendments to the amended and restated certificate of incorporation and amended and restated bylaws that would change the

name of the Company, its jurisdiction of incorporation, the location of its principal executive offices, the purpose or purposes for which

the Company is incorporated or the approval requirements as provided in the Shareholders Agreement; |

| · | to approve special dividends greater than $10 million; |

| · | to approve any merger, amalgamation or consolidation of the Company or the spin-off of a business of the Company with assets in excess

of 15% of the consolidated assets or revenues of the Company and its subsidiaries; |

| · | the sale, conveyance, transfer or other disposition of all or more than 15% of the consolidated assets or revenues of the Company

and its subsidiaries; and |

| · | any designation to the Board contrary to the Shareholders Agreement or the amended and restated certificate of incorporation and amended

and restated bylaws. |

In addition, for so long as the Sponsor beneficially

owns at least 15% of the then outstanding shares of our common stock, the Sponsor is entitled to certain information rights, including

the right to consult with and advise senior management, to receive quarterly and annual financial statements and to review our books and

records. We are also required to cooperate with the Sponsor in connection with certain pledges of our shares or grants of security interests

in respect thereof, including in connection with margin loans.

The Shareholders Agreement also provides for the

reimbursement of certain expenses that the Sponsor incurs in connection with providing management services to us. During fiscal year 2023,

reimbursements of expenses to the Sponsor for management services totaled $0.3 million.

The Shareholders Agreement will automatically

terminate when the Sponsor ceases to beneficially own, directly or indirectly, at least 15% of the then outstanding shares of our common

stock.

Registration Rights Agreement

We are party to a registration rights agreement

with the Sponsor, the JPM Holders and certain other existing stockholders (each, a “Stockholder” and together, the “Stockholders”),

each of which is entitled to certain demand and piggyback registration rights. As of December 7, 2023, the Stockholders held an aggregate

of approximately 28,272,855 million shares of our common stock, or approximately 46.3% of the voting power of our common stock outstanding.

The registration rights described below will expire on the date on which the securities subject to the registration rights agreement may

be sold by the holder in a single transaction pursuant to Rule 144 promulgated under the Securities Act.

Demand Registration Rights. Subject to

certain requirements and other limitations in the registration rights agreement, the Sponsor may request that we register all or a portion

of their shares. Any such request must cover a quantity of shares with an anticipated aggregate offering price of at least $50.0 million.

To the extent we are a well-known seasoned issuer, the Stockholders making a demand registration may also request that we file an automatic

shelf registration statement on Form S-3 that covers the registrable securities requested to be registered. Depending on certain conditions,

we may defer a demand registration for up to 90 days in any 12-month period. These demand registration rights remain available to the

Sponsor but are no longer available to the remaining Stockholders, since upon completion of the secondary offering in June 2021, the Stockholders

ceased to beneficially own a majority of the Company’s common stock.

Piggyback Registration Rights. In the event

that we propose to register any of our securities under the Securities Act, either for our account or for the account of our other security

holders, the Stockholders will be entitled to certain piggyback registration rights allowing each to include its shares in the registration,

subject to certain marketing and other limitations. As a result, whenever

we propose to file a registration statement under the Securities Act, the holders of these shares are entitled to notice of the registration.

Transfer Restrictions. The registration

rights agreement contains certain transfer restrictions applicable to the parties thereto. Without the consent of the Sponsor, and subject

to certain exceptions, no party to the registration rights agreement is permitted to transfer their shares of our common stock except

in a registered offering being conducted pursuant to, and in accordance with the terms of, the registration rights agreement.

Expenses; Indemnification. The registration

rights agreement provides that we must pay all registration expenses (other than the underwriting discounts and commissions) in connection

with effecting any demand registration or shelf registration. The registration rights agreement contains customary indemnification and

contribution provisions.

Indemnification Agreements

Our amended and restated certificate of incorporation

and our amended and restated bylaws provide that we will indemnify our directors and officers to the fullest extent permitted under Delaware

law. In addition, we have entered into customary indemnification agreements with our directors and executive officers. These agreements

require us to indemnify these individuals and, in certain cases, affiliates of such individuals, to the fullest extent permissible under

Delaware law against liabilities that may arise by reason of their service to us or at our direction, and to advance expenses incurred

as a result of any proceeding against them as to which they could be indemnified.

Plan of Distribution

The selling securityholders may sell the securities

in one or more of the following ways (or in any combination) from time to time:

| · | through underwriters or dealers; |

The securities may be sold in one or more transactions

at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices relating to prevailing

market prices or at negotiated prices.

We will describe in a prospectus supplement the

particular terms of any offering of the securities, including the following:

| · | the names of any underwriters or agents; |

| · | the proceeds that the selling securityholders will receive from the sale; |

| · | any discounts and other items constituting underwriters’ or agents’ compensation; and |

| · | any discounts or concessions allowed or reallowed or paid to dealers. |

If the selling securityholders use underwriters

in the sale, such underwriters will acquire the securities for their own account. The underwriters may resell the securities in one or

more transactions, at a fixed price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices relating

to prevailing market prices or at negotiated prices.

The securities may be offered to the public through

underwriting syndicates represented by managing underwriters or by underwriters without a syndicate. The obligations of the underwriters

to purchase the securities will be subject to certain conditions. In such offerings, the underwriters may be obligated to purchase all

the securities of the series offered if any of the securities are purchased.

The selling securityholders may sell securities

through agents or dealers designated by them. Any agent or dealer involved in the offer or sale of the securities for which this prospectus

is delivered will be named, and any commissions payable by the selling securityholders to that agent or dealer will be set forth, in the

prospectus supplement. Unless indicated in the prospectus supplement, the agents will agree to use their reasonable efforts to solicit

purchases for the period of their appointment and any dealer will purchase securities from the selling securityholders as principal and

may resell those securities at varying prices to be determined by the dealer.

The selling securityholders also may sell securities

directly. In this case, no underwriters or agents would be involved.

Underwriters, dealers and agents that participate

in the distribution of the securities may be underwriters as defined in the Securities Act, and any discounts or commissions received

by them from the selling securityholders and any profit on the resale of the securities by them may be treated as underwriting discounts

and commissions under the Securities Act.

The selling securityholders may enter into agreements

with the underwriters, dealers and agents to indemnify them against certain civil liabilities, including liabilities under the Securities

Act or to contribute with respect to payments which the underwriters, dealers or agents may be required to make, and to reimburse them

for certain expenses.

Underwriters, dealers and agents may engage in

transactions with, or perform services for, us or our subsidiaries in the ordinary course of their businesses.

In order to facilitate the offering of the securities,

any underwriters or agents, as the case may be, involved in the offering of such securities may engage in transactions that stabilize,

maintain or otherwise affect the price of such securities or other securities the prices of which may be used to determine payments on

the securities. Specifically, the underwriters or agents, as the case may be, may overallot in connection with the offering, creating

a short position in such securities for their own account. In addition, to cover overallotments or to stabilize the price of the securities

or of such other securities, the underwriters or agents, as the case may be, may bid for, and purchase, such securities in the open market.

Finally, in any offering of such securities through a syndicate of underwriters, the underwriting syndicate may reclaim selling concessions

allotted to an underwriter or a dealer for distributing such securities in the offering if the syndicate repurchases previously distributed

securities in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may

stabilize or maintain the market price of the securities above independent market levels. The underwriters or agents, as the case may

be, are not required to engage in these activities, and may end any of these activities at any time.

The selling securityholders may solicit offers

to purchase securities directly from, and we may sell securities directly to, institutional investors or others. The terms of any of those

sales, including the terms of any bidding or auction process, if utilized, will be described in the applicable prospectus supplement.

We cannot and will not give any assurances as

to the liquidity of the trading market for any of our securities.

Validity of Securities

The validity of the securities in respect of which

this prospectus is being delivered will be passed on for us by Davis Polk & Wardwell LLP or such other counsel as may be specified

in the applicable prospectus supplement.

Experts

The consolidated financial statements of REV Group,

Inc. as of October 31, 2023 and 2022 and for each of the years in the three-year period ended October 31, 2023 and the effectiveness of

internal control over financial reporting as of October 31, 2023 incorporated in this Prospectus by reference from the REV Group, Inc.

Annual Report on Form 10-K for the year ended October 31, 2023 have been audited by RSM US LLP, an independent registered public accounting

firm, as stated in their report thereon incorporated herein by reference, and have been incorporated in this Prospectus and Registration

Statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses

payable in connection with the sale of the securities being registered hereby, all of which will be paid by REV Group, Inc. (“REV”)

(except any underwriting discounts and commissions and expenses incurred by the selling securityholders in disposing of the securities).

All amounts are estimates except the Securities and Exchange Commission (the “SEC”) registration fee.

| | |

Amount to

be paid |

| SEC registration fee | |

$ | 9,496 | * |

| Printing | |

| 15,000 | |

| Legal fees and expenses (including Blue Sky fees) | |

| 50,000 | |

| Transfer agent and registrar fees | |

| 10,000 | |

| Accounting fees and expenses | |

| 20,000 | |

| Miscellaneous | |

| 5,000 | |

| TOTAL | |

$ | 109,496 | |

_______________

*Excludes offset of registration fees previously paid with respect

to a prior registration statement pursuant to Rule 457(p) under the Securities Act of 1933, as amended (see Exhibit 107 to this registration

statement).

Item 15. Indemnification of Directors and Officers

Registrants Incorporated Under the Delaware General

Corporation Law

REV is a Delaware corporation. Section 102(b)(7)

of the Delaware General Corporation Law (the “DGCL”) enables a corporation to eliminate or limit the personal liability of

a director to the corporation or its stockholders for monetary damages for breach of the director’s fiduciary duty, except:

| · | for any breach of the director’s duty of loyalty to the corporation or its stockholders; |

| · | for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; |

| · | pursuant to Section 174 of the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases

or redemptions); or |

| · | for any transaction from which the director derived an improper personal benefit. |

In accordance with Section 102(b)(7) of the DGCL,

the Certificate of Incorporation includes a provision eliminating, to the fullest extent permitted by the DGCL, the liability of each

corporation’s directors to such corporation or its stockholders for monetary damages for breach of fiduciary as director.

Section 145(a) of the DGCL empowers a corporation

to indemnify any present or former director, officer, employee or agent of the corporation, or any individual serving at the corporation’s

request as a director, officer, employee or agent of another organization, who was or is a party or is threatened to be made a party to

any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than

an action by or in the right of the corporation), against expenses (including attorneys’ fees), judgments, fines and amounts paid

in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding provided that such

director, officer, employee or agent acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, the

best interests of the corporation, and, with respect to any criminal action or proceeding, provided further

that such director, officer, employee or agent had no reasonable cause to believe his or her conduct was unlawful.

The DGCL provides that the indemnification described

above shall not be deemed exclusive of any other indemnification that may be granted by a corporation pursuant to its by-laws, disinterested

directors’ vote, stockholders’ vote, agreement or otherwise. The DGCL also provides corporations with the power to purchase

and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving

at the request of the corporation in a similar capacity for another corporation, partnership, joint venture, trust or other enterprise,

against any liability asserted against him or her in any such capacity, or arising out of his or her status as such, whether or not the

corporation would have the power to indemnify him or her against such liability as described above.

In accordance with Section 145(a) of the DGCL,

REV’s by-laws provide that every person who was or is a party or is threatened to be made a party to or is involved in any action,

suit, or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that such person is or was serving

as a director or officer of the corporation or is or was serving at the request of the corporation as a director or officer of another

corporation, or as its representative in a joint venture, trust or other enterprise, shall be indemnified and held harmless to the fullest

extent legally permissible under the DGCL against all expenses, liabilities and losses (including attorneys’ fees, judgments, fines

and amounts paid or to be paid in settlement) reasonably incurred or suffered by such person in connection therewith. Expenses incurred

by a director or officer in defending such an action, suit or proceeding shall be paid by the corporation in advance of the final disposition

of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such person to repay any amount if it is ultimately

determined that such director or officer is not entitled to indemnification by the corporation as authorized by the relevant sections

of the DGCL.

Pursuant to REV’s by-laws, REV may maintain

a directors’ and officers’ insurance policy which insures the directors or officers of such corporation and those serving

at the request of such corporation as a director, officer, employee or agent of another enterprise, against liability asserted against

such persons in such capacity whether or not such directors or officers have the right to indemnification pursuant to Delaware law. REV

currently has a policy providing directors and officers liability insurance in certain circumstances.

In addition, REV has entered into separate indemnification

agreements with certain of its current and former directors and executive officers. The indemnification agreements provide generally that

REV will indemnify and advance expenses to the fullest extent permitted by applicable law. Each director and executive officer party to

an indemnification agreement is entitled to be indemnified against all expenses, judgments, penalties and amounts paid in settlement actually

and reasonably incurred.

Item 16. Exhibits and Financial Statement Schedules

Reference is hereby made to the attached Exhibit

Index, which is incorporated herein by reference.

Item 17. Undertakings

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made of securities registered hereby, a post-effective amendment to

this registration statement: |

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth

in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided, however, that paragraphs (i), (ii) and (iii)

above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic

reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (A) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of

the date the filed prospectus was deemed part of and included in the registration statement; and |

| (B) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance

on Rule 430B relating to an offering made pursuant to Rule 415(a)(l)(i), (vii), or (x) for the purpose of providing the information required

by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier

of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering

described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement

to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement

or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the

registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement

that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such effective date. |

| (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial

distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule

424; |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to

by the undersigned registrant; |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each

filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and,

where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act

of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrants pursuant to the foregoing provisions, or otherwise, the registrants have been advised that in the opinion of

the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection with the securities being registered, the registrants will, unless

in the opinion of their counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication

of such issue. |

EXHIBIT INDEX

*

Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Brookfield, State of Wisconsin, on December 13, 2023.

| |

|

REV GROUP, INC. |

| |

|

|

| |

|

By: |

/s/ Mark A. Skonieczny |

| |

|

|

Name: |

Mark A. Skonieczny |

| |

|

|

Title: |

President, Chief Executive Officer and

Interim Chief Financial Officer |

KNOW ALL MEN BY THESE PRESENTS, that each person

whose signature appears below constitutes and appoints Stephen Zamansky, his true and lawful attorney-in-fact and agent, with full power

to act separately and full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities,

to sign any and all amendments (including post-effective amendments) to this registration statement and to file the same, with all exhibits

thereto, and all other documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact

and agent full power and authority to do and perform each and every act in person, hereby ratifying and confirming all that said attorney-in-fact

and agent or his substitute may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities, in the locations and

on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Mark A. Skonieczny |

|

President

Chief Executive Officer

Interim Chief Financial Officer

(Principal Executive and Financial Officer) |

|

December 13, 2023 |

| Mark A. Skonieczny |

|

|

| |

|

|

| /s/ Joseph F. LaDue |

|

Chief Accounting Officer

(Principal Accounting Officer) |

|

December 13, 2023 |

| Joseph F. LaDue |

| |

|

|

|

|

| |

|

|

| /s/ Paul Bamatter |

|

Director |

|

December 13, 2023 |

| Paul Bamatter |

| |

|

|

| /s/ Jean Marie “John” Canan |

|

Director |

|

December 13, 2023 |

| Jean Marie “John” Canan |

|

|

|

|

| |

|

|

| /s/ Dino Cusumano |

|

Director |

|

December 13, 2023 |

| Dino Cusumano |

|

|

|

|

| |

|

|

| /s/ Charles Dutil |

|

Director |

|

December 13, 2023 |

| Charles Dutil |

|

|

|

|

| |

|

|

| /s/ Maureen O’Connell |

|

Director |

|

December 13, 2023 |

| Maureen O’Connell |

|

|

|

|

| |

|

|

| /s/ Randall Swift |

|

Director |

|

December 13, 2023 |

| Randall Swift |

|

|

|

|

| |

|

|

| /s/ Joel Rotroff |

|

Director |

|

December 13, 2023 |

| Joel Rotroff |

|

|

|

|

| |

|

|

| /s/ Donn Viola |

|

Director |

|

December 13, 2023 |

| Donn Viola |

|

|

|

|

|

|

|

Exhibit 5.1 |

| |

+1 212 450 4000

davispolk.com

|

Davis Polk & Wardwell llp

450 Lexington Avenue

New York, NY 10017 |

|

December 13, 2023

REV Group, Inc.

245 South Executive Drive, Suite 100

Brookfield, WI 53005

Ladies and Gentlemen:

REV Group, Inc., a Delaware corporation (the “Company”),

is filing with the Securities and Exchange Commission a Registration Statement on Form S-3 (the “Registration Statement”)

for the purpose of registering under the Securities Act of 1933, as amended (the “Securities Act”), shares of common

stock, par value $0.001 per share (the “Common Stock”) of the Company for resale by the selling stockholders (the “Selling

Stockholders”) named in the prospectus which is a part of the Registration Statement.

We, as your counsel, have examined originals or copies of such documents,

corporate records, certificates of public officials and other instruments as we have deemed necessary or advisable for the purpose of

rendering this opinion.

In rendering the opinion expressed herein, we have, without independent

inquiry or investigation, assumed that (i) all documents submitted to us as originals are authentic and complete, (ii) all documents submitted

to us as copies conform to authentic, complete originals, (iii) all documents filed as exhibits to the Registration Statement that have

not been executed will conform to the forms thereof, (iv) all signatures on all documents that we reviewed are genuine, (v) all natural

persons executing documents had and have the legal capacity to do so, (vi) all statements in certificates of public officials and officers

of the Company that we reviewed were and are accurate and (vii) all representations made by the Company as to matters of fact in the documents

that we reviewed were and are accurate.

Based upon the foregoing, and subject to the additional assumptions

and qualifications set forth below, we advise you that, in our opinion, as of the date hereof, the shares of Common Stock have been validly

issued, and are fully paid and non-assessable.

In connection with the opinion expressed above, we have assumed that,

at or prior to the time of the delivery of any such security, (i) the Company shall remain validly existing as a corporation in good standing

under the laws of the State of Delaware; (ii) the Registration Statement shall have been declared effective and such effectiveness shall

not have been terminated or rescinded and (iii) there shall not have occurred any change in law affecting the validity or enforceability

of such security. We have also assumed that the terms of any security whose terms are established

| REV Group, Inc. | 2 | December 13, 2023 |

subsequent to the date hereof and the issuance, execution, delivery

and performance by the Company of any such security (a) require no action by or in respect of, or filing with, any governmental body,

agency or official and (b) do not contravene, or constitute a default under, any provision of applicable law or public policy or regulation

or any judgment, injunction, order or decree or any agreement or other instrument binding upon the Company.

We are members of the Bar of the State of New York and the foregoing

opinion is limited to the General Corporation Law of the State of Delaware.

We hereby consent to the filing of this opinion as an exhibit to the

Registration Statement referred to above and further consent to the reference to our name under the caption “Validity of Securities”

in the prospectus, which is a part of the Registration Statement. In giving this consent, we do not admit that we are in the category

of persons whose consent is required under Section 7 of the Securities Act.

Very truly yours,

/s/ Davis Polk & Wardwell LLP

Exhibit 23.1

We consent to the incorporation by reference in this Registration Statement

on Form S-3 and related Preliminary Prospectus of REV Group, Inc. of our reports dated December 13, 2023, relating to the consolidated

financial statements, and the effectiveness of internal control over financial reporting of REV Group, Inc. as it appears in our reports,

appearing in the Annual Report on Form 10-K of REV Group, Inc. for the year ended October 31, 2023.

We also consent to the reference to our firm under the headings "Experts"

in such Preliminary Prospectus.

/s/ RSM US LLP

Milwaukee, WI

December 13, 2023

Exhibit

107

Calculation

of Filing Fee Tables

Form

S-3

(Form

Type)

REV

Group, Inc.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| |

Security

Type |

Security

Class Title |

Fee

Calculation or Carry Forward Rule |

Amount

Registered |

Proposed

Maximum Offering Price Per Unit |

Maximum

Aggregate Offering Price |

Fee

Rate |

Amount

of Registration Fee |

| Newly

Registered Securities |

| Fees

to be Paid |

Equity |

Common

Stock |

Other |

28,272,855

(1) |

$16.27

(2) |

$459,999,350.90(2) |

$147.60

per $1,000,000 |

$67,895.90 |

| |

Total