XIAMEN, China, Sept. 7, 2020 /PRNewswire/ -- Qudian Inc.

("Qudian" or "the Company" or "We") (NYSE: QD), a leading

technology platform empowering the enhancement of online consumer

finance experience in China, today

announced its unaudited financial results for the quarter ended

June 30, 2020.

Second Quarter 2020 Operational Highlights:

- Total number of registered users as of June 30,

2020 reached 80.8 million, representing an increase of

6.4% from June 30, 2019

- Number of outstanding borrowers[1] from loan book

business and transaction services business as of June 30, 2020 decreased by 12.5% to 5.0 million

from 5.7 million as of March 31,

2020 as a result of the conservative and prudent strategy

which the Company has deployed

- Total outstanding loan balance from loan book

business[2] decreased by 36.4% to RMB9.7

billion as of June 30, 2020, compared

to the outstanding balance as of March 31,

2020; Total outstanding loan balance from transaction

serviced on open platform decreased by 25.4% to RMB9.8 billion as of June

30, 2020, compared to the outstanding balance as of

March 31, 2020

- Amount of transactions from loan book business for

this quarter decreased by 5.9% to RMB4.2

billion from the first quarter of 2020; Amount of

transactions from transaction serviced on open platform for

this quarter decreased by 72.3% to RMB0.7

billion from the first quarter of 2020

- Weighted average loan tenure for our loan book business

was 4.7 months for this quarter, compared with 8.4 months for the

first quarter of 2020; Weighted average loan tenure for

transactions serviced on open platform was 10.6 months for this

quarter, compared with 11.2 months for the first quarter of

2020

|

[1] Outstanding borrowers are

borrowers who have outstanding loans as of a particular date,

including outstanding borrowers from both loan book business and

transaction services business. Transaction services business,

relates to various services, including credit assessment, referral

and post-origination services, provided through our open platform,

which was launched in the second half of 2018.

[2] Includes (i) off and on balance

sheet loans directly or indirectly funded by our institutional

funding partners or our own capital, net of cumulative write-offs

and (ii) does not include auto loans from Dabai Auto

business.

|

Second Quarter 2020 Financial Highlights:

- Total revenues were RMB1,167.0

million (US$165.2 million),

representing a decrease of 47.4% from the same period of last

year

- Net income decreased by 84.3% year-on-year to RMB179.2 million (US$25.4

million), or RMB0.68

(US$0.10) per diluted ADS

- Non-GAAP net income[3] decreased by 97.4%

year-on-year to RMB29.9 million

(US$4.2 million), or RMB0.12 (US$0.02)

per diluted ADS

|

[3] For more information on this

Non-GAAP financial measure, please see the table captioned

"Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth

at the end of this press release.

|

"We continued the prudent operation of our cash credit business

during the second quarter of 2020," said Mr. Min Luo, Founder, Chairman and Chief Executive

Officer of Qudian. "In light of unstable market conditions during

the period, we adopted an extremely stringent approach for loan

approvals while keeping focused on decreasing exposure to credit

market risks. As such, our loan book business, as compared with the

first quarter, maintained loan transaction volume that was

relatively flat during the period. Meanwhile, as some of our

institutional funding partners tightened their credit assessments,

transaction volume on our open platform decreased by approximately

70% sequentially."

"In the second quarter, we completed a strategic investment in

Secoo. We look forward to generating synergies in the luxury

consumer business," said Ms. Sissi

Zhu, Vice President of Investor Relations of Qudian.

"Given the still challenging and fast-evolving market

environment for our credit loan business and, in an effort to

mitigate risk, we will remain strict with our credit approval

standards when operating our loan book business. Despite headwinds,

we are taking appropriate actions to protect our net assets while

actively exploring market opportunities for future growth," Ms. Zhu

concluded.

Second Quarter Financial Results

Total revenues were RMB1,167.0 million (US$165.2 million), representing a decrease of

47.4% from RMB2,220.7 million for the

second quarter of 2019.

Financing income totaled RMB580.9 million (US$82.2

million), representing a decrease of 41.0% from

RMB984.4 million for the

second quarter of 2019, as a result of a decrease in average

on-balance sheet loan balance.

Loan facilitation income and other related income

decreased by 58.2% to RMB255.1

million (US$36.1 million) from

RMB609.7 million for the second

quarter of 2019, as a result of the reduction of transaction volume

of off-balance sheet loans this quarter, partially offset by

reclassification of guarantee income in accordance with

ASC326.

Transaction services fee and other related income

decreased to RMB4.1 million

(US$0.6 million) from RMB398.1 million for the second quarter

of 2019, mainly as a result of a substantial decrease in the

transaction amount of open platform.

Sales income substantially increased to

RMB293.3 million (US$41.5 million) from RMB123.5 million for the second quarter of

2019, mainly due to the launch of the Wanlimu e-commerce

platform.

Sales commission fee decreased by 84.9% to

RMB14.4 million (US$2.0 million) from RMB95.6 million for the second quarter of

2019, due to a decrease in the amount of merchandise credit

transaction.

Total operating costs and expenses increased by

2.4% to RMB982.4 million

(US$139.0 million) from RMB959.1 million for the second quarter of

2019.

Cost of revenues increased by 28.0% to

RMB366.4 million (US$51.9 million) from RMB286.1 million for the second quarter of 2019,

primarily due to an increase in cost of goods sold related to the Wanlimu e-commerce

platform.

Sales and marketing expenses increased by

101.7% to RMB156.8 million

(US$22.2 million) from RMB77.7 million for the second quarter of

2019, primarily due to marketing expenses incurred by the Wanlimu

e-commerce platform.

General and administrative

expenses increased by 11.9% to RMB75.3 million (US$10.7 million) from RMB67.3

million for the second quarter of 2019.

Research and development

expenses decreased by 10.5% to RMB56.3 million (US$8.0 million) from RMB62.9 million for the second quarter of

2019.

Provision for receivables and other

assets increased by 5.0% to RMB519.0

million (US$73.5 million)

from RMB494.5 million for the second quarter of

2019. The increase was primarily due to an increase in

past-due on-balance sheet outstanding principal receivables

compared to the second quarter of 2019.

As of June 30, 2020, the total balance of outstanding

principal and financing service fee receivables for on-balance

sheet transactions for which any installment payment was more than

30 calendar days past due was RMB1,166.5

million (US$165.1 million), and

the balance of allowance for principal and financing service fee

receivables at the end of the period was RMB2,050.3

million (US$290.2 million),

indicating M1+ Delinquency Coverage Ratio of 1.8x.

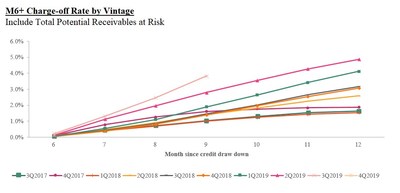

The following charts display the "vintage charge-off rate."

Total potential receivables at risk vintage charge-off rate refers

to, with respect to on- and off-balance sheet transactions

facilitated under the loan book business during a specified time

period, the total potential outstanding principal balance of the

transactions that are delinquent for more than 180 days up to

twelve months after origination, divided by the total initial

principal of the transactions facilitated in such vintage.

Delinquencies may increase or decrease after such 12-month

period.

Current receivables at risk vintage charge-off rate refers to,

with respect to on- and off-balance sheet transactions facilitated

under the loan book business during a specified time period, the

actual outstanding principal balance of the transactions that are

delinquent for more than 180 days up to twelve months after

origination, divided by the total initial principal of the

transactions facilitated in such vintage. Delinquencies may

increase or decrease after such 12-month period.

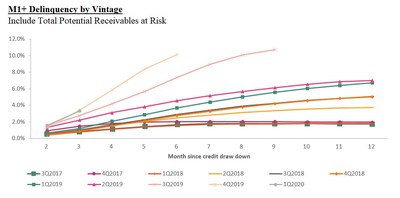

Total potential receivables at risk M1+ delinquency rate by

vintage refers to, with respect to on- and off-balance sheet

transactions facilitated under the loan book business during a

specified time period, the total potential outstanding principal

balance of the transactions that are delinquent for more than 30

days up to twelve months after origination, divided by the total

initial principal of the transactions facilitated in such vintage.

Delinquencies may increase or decrease after such 12-month

period.

Current receivables at risk M1+ delinquency rate by vintage

refers to, with respect to on- and off-balance sheet transactions

facilitated under the loan book business during a specified time

period, the actual outstanding principal balance of the

transactions that are delinquent for more than 30 days up to twelve

months after origination, divided by the total initial principal of

the transactions facilitated in such vintage. Delinquencies may

increase or decrease after such 12-month period.

Income from operations decreased to

RMB312.4 million (US$44.2 million) from RMB1,264.2 million for the second quarter of

2019.

Net income attributable to

Qudian's

shareholders was RMB179.2

million (US$25.4 million), or

RMB0.68 (US$0.10) per diluted ADS.

Non-GAAP net income attributable to Qudian's

shareholders was RMB29.9

million (US$4.2 million), or

RMB0.12 (US$0.02) per diluted ADS.

Cash Flow

As of June 30, 2020, the Company

had cash and cash equivalents of RMB1,066.0

million (US$150.9 million) and

restricted cash

of RMB510.8 million (US$72.3 million). Restricted cash mainly

represents (i) cash held by the consolidated trusts through

segregated bank accounts; and (ii) security deposits held in

designated bank accounts for the guarantee of off-balance sheet

transactions. Such restricted cash is not available to fund the

general liquidity needs of the Company.

For the second quarter of 2020, net cash provided by

operating activities was RMB317.3

million (US$44.9 million),

mainly attributable to net income of RMB179.2 million (US$25.4

million) and the collection of repayments of service

fees from transactions facilitated in 2019. Net cash used in

investing activities was RMB724.9 million (US$102.6 million), mainly due to investments in

short-term wealth management products and purchase of equity method

investments. Net cash used in financing activities

was RMB53.9

million (US$7.6 million), mainly

due to repurchase of convertible bond.

Update on Share Repurchase and Convertible Bond

Repurchase

As of the date of this release, the Company has repurchased and

cancelled total principal amount of convertible senior notes of

US$199 million. The Company has

cumulatively completed total share repurchases of approximately

US$572.8 million. As of

June 30, 2020, the total number of

ordinary shares outstanding was 253,729,349.

Strategic Investment in Secoo

In June 2020, the Company made a

strategic investment in Secoo Holding Limited ("Secoo") of up to

US$100 million. As of June 30, 2020, the total amounts had been fully

paid. The Company has elected the fair value option to measure its

equity method investment in Secoo. All subsequent changes in fair

value are reported in earnings.

Regulation Update

On August 20, 2020, the Supreme

People's Court of China issued the

Decisions of the Supreme People's Court to Amend the Provisions on

Several Issues concerning the Application of Law in the Trial of

Private Lending Cases ("Decisions"), effective immediately, which

set the court protected one-year interest rate cap at four times

that of the Loan Prime Rate ("LPR") for private lending.

According to the Decisions, the interest rate cap is not

applicable to the lending business of financial institutions and

their branches that have been established with the approval of

financial regulatory authorities. Rather, this new policy is

generally interpreted as only being applicable to private lending,

while our business almost entirely involves financial institutions.

However, it is important to note that the Decisions are newly

promulgated, and the policy is subject to further clarifications by

courts and regulatory authorities. If the same interest rate cap

were applied to our business as required by relevant courts or

regulatory authorities, our profitability may suffer a material

adverse impact, and we could incur net losses.

For the complete text of the Decisions, please refer to

http://www.court.gov.cn/fabu-xiangqing-249031.html. The information

contained on this website is not a part of this press release.

Conference Call

The Company's management will host an earnings conference call

on September 7, 2020 at 7:00 AM U.S. Eastern Time, (7:00 PM Beijing/Hong Kong Time). Details for

the conference call are as follows:

|

Title of

Event:

|

Qudian Inc. Second

Quarter 2020 Earnings Conference Call

|

|

Conference

ID:

|

8489234

|

|

Registration

link:

|

http://apac.directeventreg.com/registration/event/8489234

|

For participants who wish to join the call, please complete the

online registration at least 15 minutes prior to the scheduled call

start time. Upon registration, participants will receive the

conference call access information, including participant dial-in

numbers, a Direct Event Passcode, a unique Registrant ID, and an

e-mail with detailed instructions to join the conference call.

Additionally, a live and archived webcast of the conference call

will be available on the Company's investor relations website at

http://ir.qudian.com.

A replay of the conference call will be accessible approximately

two hours after the conclusion of the live call until September 14, 2020, by dialing the following

telephone numbers:

|

U.S.:

|

+1-855-452-5696

(toll-free) / +1-646-254-3697

|

|

|

|

International:

|

+61-2-8199-0299

|

|

|

Hong Kong,

China:

|

800-963-117

(toll-free) / +852-3051-2780

|

|

|

|

Mainland

China:

|

400-632-2162

(toll-free) / 800-870-0205 (toll-free)

|

|

|

|

Passcode:

|

8489234

|

|

|

|

|

|

|

|

|

|

About Qudian Inc.

Qudian Inc. ("Qudian") is a leading technology platform

empowering the enhancement of online consumer finance experience in

China. The Company's mission is to

use technology to make personalized credit accessible to hundreds

of millions of young, mobile-active consumers in China who need access to small credit for

their discretionary spending but are underserved by traditional

financial institutions due to lack of traditional credit data or

high cost of servicing. Qudian's credit solutions enable licensed,

regulated financial institutions and ecosystem partners to offer

affordable and customized loans to this young generation of

consumers.

For more information, please

visit http://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income/loss, a Non-GAAP financial measure,

in evaluating our operating results and for financial and

operational decision-making purposes. We believe that adjusted net

income/loss helps identify underlying trends in our business by

excluding the impact of share-based compensation expenses, which

are non-cash charges, and convertible bonds buyback income. We

believe that adjusted net income/loss provides useful information

about our operating results, enhances the overall understanding of

our past performance and future prospects and allows for greater

visibility with respect to key metrics used by our management in

its financial and operational decision-making.

Adjusted net income/loss is not defined under U.S. GAAP and are

not presented in accordance with U.S. GAAP. This Non-GAAP financial

measure has limitations as analytical tools, and when assessing our

operating performance, cash flows or our liquidity, investors

should not consider them in isolation, or as a substitute for net

loss / income, cash flows provided by operating activities or other

consolidated statements of operation and cash flow data prepared in

accordance with U.S. GAAP.

We mitigate these limitations by reconciling the Non-GAAP

financial measure to the most comparable U.S. GAAP performance

measure, all of which should be considered when evaluating our

performance.

For more information on this Non-GAAP financial measure, please

see the table captioned "Unaudited Reconciliation of GAAP and

Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts

into U.S. dollars ("US$") at specified rates solely for the

convenience of the reader. Unless otherwise stated, all

translations from RMB to US$ were made at the rate

of RMB7.0651 to US$1.00, the noon buying rate in effect

on June 30, 2020 in the H.10

statistical release of the Federal Reserve Board. The Company makes

no representation that the RMB or US$ amounts referred could be

converted into US$ or RMB, as the case may be, at any particular

rate or at all.

Statement Regarding Preliminary Unaudited Financial

Information

The unaudited financial information set out in this earnings

release is preliminary and subject to potential adjustments.

Adjustments to the consolidated financial statements may be

identified when audit work has been performed for the Company's

year-end audit, which could result in significant differences from

this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the "safe harbor" provisions of the

United States Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology

such as "will," "expects," "anticipates," "future," "intends,"

"plans," "believes," "estimates" and similar statements. Among

other things, the expectation of its collection efficiency and

delinquency, contain forward-looking statements. Qudian may also

make written or oral forward-looking statements in its periodic

reports to the SEC, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Qudian's

beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: Qudian's

goal and strategies; Qudian's expansion plans; Qudian's future

business development, financial condition and results of

operations; Qudian's expectations regarding demand for, and market

acceptance of, its credit products; Qudian's expectations regarding

keeping and strengthening its relationships with borrowers,

institutional funding partners, merchandise suppliers and other

parties it collaborate with; general economic and business

conditions; and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in Qudian's filings with the SEC. All information provided

in this press release and in the attachments is as of the date of

this press release, and Qudian does not undertake any obligation to

update any forward-looking statement, except as required under

applicable law.

For investor and media inquiries, please contact:

Qudian Inc.

Tel: +86-592-591-1711

E-mail: ir@qudian.com

The Piacente Group, Inc.

Xi Zhang

Tel: +86 (10) 6508-0677

E-mail: qudian@tpg-ir.com

The Piacente Group, Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: qudian@tpg-ir.com

|

QUDIAN

INC.

|

|

Unaudited

Condensed Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30,

|

|

(In thousands except

for number

|

|

|

2019

|

|

2020

|

|

of shares and

per-share data)

|

|

|

(Unaudited)

|

|

(Unaudited)

|

(Unaudited)

|

|

|

|

RMB

|

|

RMB

|

US$

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

Financing

income

|

|

|

984,446

|

|

580,856

|

82,215

|

|

Sales

commission fee

|

|

|

95,602

|

|

14,404

|

2,039

|

|

Sales

income

|

|

|

123,536

|

|

293,292

|

41,513

|

|

Penalty

fee

|

|

|

9,394

|

|

19,335

|

2,736

|

|

Loan

facilitation income and other related income

|

|

609,651

|

|

255,063

|

36,102

|

|

Transaction

services fee and other related income

|

|

398,068

|

|

4,098

|

580

|

|

|

|

|

|

|

|

|

Total

revenues

|

|

|

2,220,697

|

|

1,167,048

|

165,185

|

|

|

|

|

|

|

|

|

Operating cost and

expenses:

|

|

|

|

|

|

|

|

Cost of

revenues

|

|

|

(286,135)

|

|

(366,381)

|

(51,858)

|

|

Sales and

marketing

|

|

|

(77,732)

|

|

(156,806)

|

(22,194)

|

|

General and

administrative

|

|

|

(67,326)

|

|

(75,334)

|

(10,663)

|

|

Research and

development

|

|

|

(62,882)

|

|

(56,265)

|

(7,964)

|

|

Changes in

guarantee liabilities and risk assurance liabilities(1)

|

29,473

|

|

191,420

|

27,094

|

|

Provision for

receivables and other assets

|

|

|

(494,454)

|

|

(519,014)

|

(73,462)

|

|

Total operating

cost and expenses

|

|

|

(959,056)

|

|

(982,380)

|

(139,047)

|

|

Other

operating income

|

|

|

2,570

|

|

127,698

|

18,074

|

|

|

|

|

|

|

|

|

Income from

operations

|

|

|

1,264,211

|

|

312,366

|

44,212

|

|

Interest and

investment (loss)/income, net

|

|

|

11,348

|

|

(65,758)

|

(9,307)

|

|

Foreign exchange

gain/(loss), net

|

|

|

(1,074)

|

|

4,960

|

702

|

|

Other

income

|

|

|

21,915

|

|

10,059

|

1,424

|

|

Other

expenses

|

|

|

(372)

|

|

(94)

|

(13)

|

|

|

|

|

|

|

|

|

Net income before

income taxes

|

|

|

1,296,028

|

|

261,533

|

37,018

|

|

Income tax

expenses

|

|

|

(152,622)

|

|

(82,371)

|

(11,659)

|

|

|

|

|

|

|

|

|

Net

income

|

|

|

1,143,406

|

|

179,162

|

25,359

|

|

|

|

|

|

|

|

|

Net income

attributable to Qudian Inc.'s

shareholders

|

|

|

1,143,406

|

|

179,162

|

25,359

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share

for Class A and Class B

ordinary shares:

|

|

|

|

|

|

|

|

Basic

|

|

|

4.03

|

|

0.71

|

0.10

|

|

Diluted

|

|

|

4.00

|

|

0.68

|

0.10

|

|

|

|

|

|

|

|

|

Earnings per ADS (1

Class A ordinary share

equals 1 ADSs):

|

|

|

|

|

|

|

|

Basic

|

|

|

4.03

|

|

0.71

|

0.10

|

|

Diluted

|

|

|

4.00

|

|

0.68

|

0.10

|

|

|

|

|

|

|

|

|

Weighted average

number of Class A and Class

B ordinary shares outstanding:

|

|

|

|

|

|

|

|

Basic

|

|

|

284,022,960

|

|

253,724,694

|

253,724,694

|

|

Diluted

|

|

|

285,735,609

|

|

272,190,273

|

272,190,273

|

|

|

|

|

|

|

|

|

Other

comprehensive (loss)/income:

|

|

|

|

|

|

|

|

Foreign currency

translation adjustment

|

|

|

9,755

|

|

(10,165)

|

(1,439)

|

|

|

|

|

|

|

|

|

Total

comprehensive income

|

|

|

1,153,161

|

|

168,997

|

23,920

|

|

|

|

|

|

|

|

|

Total

comprehensive income attributable

to Qudian Inc.'s shareholders

|

|

|

1,153,161

|

|

168,997

|

23,920

|

|

|

|

|

|

|

|

|

Note:

(1): The amount includes the change in fair value of the guarantee

liabilities accounted in accordance with ASC

815,"Derivative", and the change in risk assurance

liabilities accounted in accordance with ASC 450, "Contingencies"

and

ASC 460, "Guarantees".

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUDIAN

INC.

|

|

Unaudited

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March

31,

|

|

As of June

30,

|

|

|

(In thousands except

for number

|

|

|

2020

|

|

2020

|

|

|

of shares and

per-share data)

|

|

|

(Unaudited)

|

|

(Unaudited)

|

(Unaudited)

|

|

|

|

|

RMB

|

|

RMB

|

US$

|

|

|

ASSETS:

|

|

|

|

|

|

|

|

|

Current

assets:

|

|

|

|

|

|

|

|

|

Cash and cash

equivalents

|

|

|

1,516,175

|

|

1,065,977

|

150,879

|

|

|

Restricted

cash

|

|

|

540,440

|

|

510,795

|

72,298

|

|

|

Time

Deposits

|

|

|

235,083

|

|

-

|

-

|

|

|

Short-term

investments

|

|

|

1,232,850

|

|

2,287,840

|

323,823

|

|

|

|

|

|

|

|

|

|

|

Short-term loan

principal and financing service fee receivables

|

|

|

7,286,743

|

|

5,758,287

|

815,033

|

|

|

Short-term

finance lease receivables

|

|

|

353,186

|

|

339,838

|

48,101

|

|

|

Short-term

contract assets

|

|

|

1,543,687

|

|

731,478

|

103,534

|

|

|

Other current

assets

|

|

|

1,113,298

|

|

1,360,474

|

192,563

|

|

|

Total

current assets

|

|

|

13,821,462

|

|

12,054,689

|

1,706,231

|

|

|

|

|

|

|

|

|

|

|

Non-current

assets:

|

|

|

|

|

|

|

|

|

Long-term

finance lease receivables

|

|

|

144,900

|

|

45,544

|

6,446

|

|

|

Operating lease

right-of-use assets

|

|

|

142,596

|

|

139,039

|

19,680

|

|

|

Investment in

equity method investee

|

|

|

23,084

|

|

487,618

|

69,018

|

|

|

Long-term

investments

|

|

|

222,706

|

|

222,706

|

31,522

|

|

|

Property and

equipment, net

|

|

|

113,983

|

|

145,910

|

20,652

|

|

|

Intangible

assets

|

|

|

6,489

|

|

7,257

|

1,027

|

|

|

Long-term

contract assets

|

|

|

98,399

|

|

69,494

|

9,836

|

|

|

Deferred tax

assets

|

|

|

466,047

|

|

441,640

|

62,510

|

|

|

Other

non-current assets

|

|

|

16,216

|

|

6,837

|

968

|

|

|

Total

non-current assets

|

|

|

1,234,420

|

|

1,566,045

|

221,659

|

|

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

|

|

15,055,882

|

|

13,620,734

|

1,927,890

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUDIAN

INC.

|

|

Unaudited Condensed

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March

31,

|

|

As of June

30,

|

|

|

(In thousands except

for number

|

|

|

2020

|

|

2020

|

|

|

of shares and

per-share data)

|

|

|

(Unaudited)

|

|

(Unaudited)

|

(Unaudited)

|

|

|

|

|

RMB

|

|

RMB

|

US$

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND

SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

Current

liabilities:

|

|

|

|

|

|

|

|

|

Short-term

borrowings and interest payables

|

|

|

384,596

|

|

321,541

|

45,511

|

|

|

Short-term

lease liabilities

|

|

|

20,378

|

|

21,911

|

3,101

|

|

|

Accrued

expenses and other current liabilities

|

|

|

672,539

|

|

648,680

|

91,815

|

|

|

Guarantee

liabilities and risk assurance liabilities(1)

|

|

|

1,798,603

|

|

715,577

|

101,283

|

|

|

Income tax

payable

|

|

|

221,625

|

|

170,815

|

24,177

|

|

|

Total

current liabilities

|

|

|

3,097,741

|

|

1,878,524

|

265,888

|

|

|

|

|

|

|

|

|

|

|

Non-current

liabilities:

|

|

|

|

|

|

|

Deferred tax

liabilities

|

|

|

10,005

|

|

7,125

|

1,009

|

|

|

Convertible

senior notes

|

|

|

1,438,448

|

|

1,009,992

|

142,955

|

|

|

Long-term lease

liabilities

|

|

|

17,729

|

|

13,417

|

1,899

|

|

|

Long-term

borrowings and interest payables

|

|

|

23,888

|

|

54,338

|

7,691

|

|

|

|

|

|

|

|

|

|

|

Total

non-current liabilities

|

|

|

1,490,070

|

|

1,084,872

|

153,554

|

|

|

Total

liabilities

|

|

|

4,587,811

|

|

2,963,396

|

419,442

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

Class A

Ordinary shares

|

|

|

131

|

|

131

|

19

|

|

|

Class B

Ordinary shares

|

|

|

44

|

|

44

|

6

|

|

|

Treasury

shares

|

|

|

(369,227)

|

|

(369,227)

|

(52,261)

|

|

|

Additional

paid-in capital

|

|

|

3,981,385

|

|

4,001,654

|

566,397

|

|

|

Accumulated

other comprehensive loss

|

|

|

(14,342)

|

|

(24,506)

|

(3,469)

|

|

|

Retained

earnings

|

|

|

6,870,080

|

|

7,049,242

|

997,756

|

|

|

|

|

|

|

|

|

|

|

Total

shareholders' equity

|

|

|

10,468,071

|

|

10,657,338

|

1,508,448

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

AND SHAREHOLDERS' EQUITY

|

|

|

15,055,882

|

|

13,620,734

|

1,927,890

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

(1) The amount includes the balance of the guarantee liabilities

accounted in accordance with ASC 815,"Derivative", and the balance

of risk assurance liabilities accounted in accordance with ASC 450,

"Contingencies" and ASC 460, "Guarantees".

|

|

|

QUDIAN

INC.

|

|

Unaudited

Reconciliation of GAAP And Non-GAAP Results

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30,

|

|

|

|

2019

|

|

2020

|

|

(In thousands except

for number

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

(Unaudited)

|

|

of shares and

per-share data)

|

|

|

RMB

|

|

RMB

|

|

US$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net income

attributable to Qudian Inc.'s shareholders

|

|

1,143,406

|

|

179,162

|

|

25,359

|

|

Add: Share-based

compensation expenses

|

|

|

15,162

|

|

20,269

|

|

2,869

|

|

Less: Convertible

bonds buyback income

|

|

|

-

|

|

169,511

|

|

23,993

|

|

Non-GAAP net

income attributable to Qudian Inc.'s shareholders

|

|

1,158,568

|

|

29,920

|

|

4,235

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income

per share—basic

|

|

|

4.08

|

|

0.12

|

|

0.02

|

|

Non-GAAP net income

per share—diluted

|

|

|

4.05

|

|

0.12

|

|

0.02

|

|

Weighted average

shares outstanding—basic

|

|

|

284,022,960

|

|

253,724,694

|

|

253,724,694

|

|

Weighted average

shares outstanding—diluted

|

|

|

285,735,609

|

|

253,724,694

|

|

253,724,694

|

View original content to download

multimedia:http://www.prnewswire.com/news-releases/qudian-inc-reports-second-quarter-2020-unaudited-financial-results-301124967.html

View original content to download

multimedia:http://www.prnewswire.com/news-releases/qudian-inc-reports-second-quarter-2020-unaudited-financial-results-301124967.html

SOURCE Qudian Inc.