Reaffirms full-year 2024 financial guidance,

including 1.8x Net Debt Leverage by year end

Quad/Graphics, Inc. (NYSE: QUAD) (“Quad” or the “Company”), a

global marketing experience company, today reported results for the

first quarter ended March 31, 2024.

Recent Highlights

- Realized Net Sales of $655 million in the first quarter of 2024

compared to $767 million in 2023, and recognized a Net Loss of $28

million or $0.60 Diluted Loss Per Share for the first quarter of

2024.

- Achieved Non-GAAP Adjusted EBITDA of $51 million in the first

quarter of 2024 compared to $60 million in the first quarter of

2023, and reported $0.10 Adjusted Diluted Earnings Per Share for

the first quarter of 2024.

- Completed restructuring actions that are expected to generate

$60 million of cost savings in 2024.

- Announced In-Store Connect, a new retail solution that aims to

advance the in-store shopping experience by creating digital

interactions throughout physical retail environments.

- Launched Household Fusion™, a first-of-its-kind postal

optimization program created to offset continued U.S. Postal

Service rate hikes and further differentiate Quad as a market

innovator.

- Introduced the next evolution of the Company’s media agency,

Rise, which brings together its full range of media and owned data

services under one brand.

- Fitch corporate credit rating outlook revised to “Positive”

from “Stable,” indicating future potential upgrade from current

‘B+’ rating in recognition of Quad’s strong financial and

operational performance.

- Declared quarterly dividend of $0.05 per share.

- Reaffirms full-year 2024 financial guidance.

Joel Quadracci, Chairman, President and CEO of Quad, said: “Our

first quarter results were in-line with our expectations, and we

remain confident in our ability to achieve our full-year 2024

financial guidance. We continue to focus on growing our offerings,

including strategic investments in innovative solutions and

superior talent, while proactively managing ongoing revenue

challenges that include external factors such as significant postal

rate increases and continued economic uncertainty that negatively

impact print volumes.

“During Q1, we announced our entry into the next big advertising

channel – retail media networks or RMNs. EMARKETER predicts ad

spend in omnichannel RMNs will grow to over $100 billion by 2027.

Our solution, called Quad In-Store Connect, advances the in-store

shopping experience by taking the best elements of digital commerce

and bringing it into physical retail environments. Retailers and

consumer packaged goods companies now have the ability to deliver

engaging brand messages and promotions right at the store shelf –

the most critical moment in the purchasing decision. We are excited

to announce our partnership with The Save Mart Companies, the

largest private regional grocer on the West Coast, to launch its

in-store retail media network, and are in talks with several other

retailers. We look forward to demonstrating how In-Store Connect

can generate value for clients as we strive to become the industry

standard for in-store RMNs.

“Also during Q1, we unveiled Household Fusion™, a

first-of-its-kind postal optimization program we proactively

created to offset continued U.S. Postal Service rate hikes. This

solution combines various marketing mail from different brands or,

separately, various magazines from different publishers into a

single package delivered to one address, creating significant

postage savings. Clients like PWX Solutions, a direct marketing and

production partnership formed between Hearst and Condé Nast, are

enthusiastic about this solution, which reduces costs from one of a

marketer’s biggest budget lines.

“Additionally, we recently introduced the next evolution of our

media agency, Rise, which brings together our full range of media

and owned data services under one brand so we’re even better

equipped to solve client pain points. This evolution creates a

truly differentiated offering in the market, including a modern

integrated data stack that has privacy at its core and is resilient

to industry challenges, like the deprecation of the third-party

cookie.

“To reiterate, I am confident in our team, our strategy and our

future as a marketing experience company. We are unwavering in our

focus to enhance Quad’s financial strength and create value for all

our stakeholders.”

Added Tony Staniak, Chief Financial Officer: “We reaffirm our

full-year guidance and remain focused on delivering for our clients

while enhancing our financial position, such as through our recent

restructuring actions, including plant capacity and labor reduction

initiatives, that we anticipate will generate $60 million in cost

savings in 2024. We continue to expect strong cash generation,

which we will use to further reduce Net Debt and achieve 1.8x Net

Debt Leverage by the end of the year. We are pleased that our

strong balance sheet and long-term commitment to debt reduction was

recognized by Fitch Ratings, who recently revised our corporate

credit rating outlook to Positive from Stable, indicating a

potential future upgrade from our current ‘B+’ rating. In addition

to lowering debt, we will continue to invest in accelerating our

competitive position as an MX company while returning capital to

shareholders through our regular quarterly dividend, and we expect

to be opportunistic in terms of our future share repurchases.”

First Quarter 2024 Financial Results

- Net Sales were $655 million in the first quarter of 2024, a

decrease of 15% compared to the same period in 2023 primarily due

to lower paper, print and agency solutions sales, including the

loss of a large grocery client.

- Net Loss was $28 million in the first quarter of 2024 compared

to Net Loss of $25 million in the first quarter of 2023. The

decrease is primarily due to lower sales and higher restructuring

and impairment charges, partially offset by benefits from improved

manufacturing productivity, savings from cost reduction initiatives

and lower income tax expense.

- Adjusted EBITDA was $51 million in the first quarter of 2024 as

compared to $60 million in the same period in 2023. The decrease

was primarily due to lower sales, partially offset by benefits from

improved manufacturing productivity and savings from cost reduction

initiatives.

- Adjusted Diluted Earnings Per Share was $0.10 in the first

quarter of 2024, as compared to $0.15 in the first quarter of 2023,

primarily due to lower adjusted net earnings, partially offset by

the beneficial impact from the Company repurchasing Class A shares

totaling approximately 11% of its outstanding shares since the

second quarter of 2022.

- Net Cash Used in Operating Activities was $52 million in the

first quarter of 2024, compared to $51 million in the first quarter

of 2023. Free Cash Flow improved $9 million from last year to

negative $70 million in the first quarter of 2024 primarily due to

reduced capital expenditures. As a reminder, the Company

historically generates most of its Free Cash Flow in the fourth

quarter of the year.

- Net Debt increased by $74 million to $544 million at March 31,

2024, as compared to $470 million at December 31, 2023, primarily

due to the negative $70 million Free Cash Flow in the first quarter

of 2024. We continue to expect to reduce Net Debt to approximately

$405 million, or 1.8x Net Debt Leverage, at the end of this

year.

Dividend

Quad’s next quarterly dividend of $0.05 per share will be

payable on June 7, 2024, to shareholders of record as of May 22,

2024.

2024 Guidance

The Company’s full-year 2024 financial guidance is unchanged and

is as follows:

Financial Metric

2024 Guidance

Annual Net Sales Change

5% to 9% decline

Full-Year Adjusted EBITDA

$205 million to $245 million

Free Cash Flow

$50 million to $70 million

Capital Expenditures

$60 million to $70 million

Year-End Debt Leverage Ratio (1)

Approximately 1.8x

(1) Debt Leverage Ratio is calculated at

the midpoint of the Adjusted EBITDA guidance.

Conference Call and Webcast Information

Quad will hold a conference call at 8:30 a.m. ET on Wednesday,

May 1, to discuss first quarter 2024 financial results. The call

will be hosted by Joel Quadracci, Quad Chairman, President and CEO,

and Tony Staniak, Quad CFO. As part of the conference call, Quad

will conduct a question-and-answer session.

Participants can pre-register for the webcast by navigating to

https://dpregister.com/sreg/10188208/fc3ba69b40. Participants will

be given a unique PIN to gain access to the call, bypassing the

live operator. Participants may pre-register at any time, including

up to and after the call start time.

Alternatively, participants may dial in on the day of the call

as follows:

- U.S. Toll-Free: 1-877-328-5508

- International Toll: 1-412-317-5424

An audio replay of the call will be posted on the Investors

section of Quad’s website shortly after the conference call ends.

In addition, telephone playback will also be available until June

1, 2024, accessible as follows:

- U.S. Toll-Free: 1-877-344-7529

- International Toll: 1-412-317-0088

- Replay Access Code: 5378708

About Quad

Quad (NYSE: QUAD) is a global marketing experience company that

helps brands make direct consumer connections, from household to

in-store to online. Supported by state-of-the-art technology and

data-driven intelligence, Quad uses its suite of media, creative

and production solutions to streamline the complexities of

marketing and remove friction from wherever it occurs in the

marketing journey. Quad tailors its uniquely flexible, scalable and

connected solutions to clients’ objectives, driving cost

efficiencies, improving speed to market, strengthening marketing

effectiveness, and delivering value on client investments.

Quad employs approximately 13,000 people in 14 countries and

serves approximately 2,700 clients including industry leading

blue-chip companies that serve both businesses and consumers in

multiple industry verticals, with a particular focus on commerce,

including retail, consumer packaged goods, and direct-to-consumer;

financial services; and health. Quad is ranked as the 14th largest

agency company in the U.S. by Ad Age (2023), and the second-largest

commercial printer in North America, according to Printing

Impressions (2023).

For more information about Quad, including its commitment to

ongoing innovation, culture and sustainable impact, visit

quad.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements include statements regarding,

among other things, our current expectations about the Company’s

future results, financial condition, sales, earnings, free cash

flow, margins, objectives, goals, strategies, beliefs, intentions,

plans, estimates, prospects, projections and outlook of the Company

and can generally be identified by the use of words or phrases such

as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,”

“plan,” “foresee,” “project,” “believe,” “continue” or the

negatives of these terms, variations on them and other similar

expressions. These forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause

actual results to be materially different from those expressed in

or implied by such forward-looking statements. Forward-looking

statements are based largely on the Company’s expectations and

judgments and are subject to a number of risks and uncertainties,

many of which are unforeseeable and beyond our control.

The factors that could cause actual results to materially differ

include, among others: the impact of decreasing demand for printing

services and significant overcapacity in a highly competitive

environment creates downward pricing pressures and potential

under-utilization of assets; the impact of increased business

complexity as a result of the Company’s transformation to a

marketing experience company; the impact of changes in postal

rates, service levels or regulations, including delivery delays;

the impact of fluctuations in costs (including labor and

labor-related costs, energy costs, freight rates and raw materials,

including paper and the materials to manufacture ink) and the

impact of fluctuations in the availability of raw materials,

including paper, parts for equipment and the materials to

manufacture ink; the impact macroeconomic conditions, including

inflation, high interest rates and recessionary concerns, as well

as cost and labor pressures, distribution challenges and the price

and availability of paper, have had, and may continue to have, on

the Company’s business, financial condition, cash flows and results

of operations (including future uncertain impacts); the inability

of the Company to reduce costs and improve operating efficiency

rapidly enough to meet market conditions; the impact of a

data-breach of sensitive information, ransomware attack or other

cyber incident on the Company; the fragility and decline in overall

distribution channels; the failure to attract and retain qualified

talent across the enterprise; the impact of digital media and

similar technological changes, including digital substitution by

consumers; the failure of clients to perform under contracts or to

renew contracts with clients on favorable terms or at all; the

impact of risks associated with the operations outside of the

United States (“U.S.”), including trade restrictions, currency

fluctuations, the global economy, costs incurred or reputational

damage suffered due to improper conduct of its employees,

contractors or agents, and geopolitical events like war and

terrorism; the failure to successfully identify, manage, complete

and integrate acquisitions, investment opportunities or other

significant transactions, as well as the successful identification

and execution of strategic divestitures; the impact negative

publicity could have on our business and brand reputation;

significant capital expenditures and investments may be needed to

sustain and grow the Company’s platforms, processes, systems,

client and product technology, marketing and talent, and to remain

technologically and economically competitive; the impact of the

various restrictive covenants in the Company’s debt facilities on

the Company’s ability to operate its business, as well as the

uncertain negative impacts macroeconomic conditions may have on the

Company’s ability to continue to be in compliance with these

restrictive covenants; the impact of an other than temporary

decline in operating results and enterprise value that could lead

to non-cash impairment charges due to the impairment of property,

plant and equipment and other intangible assets; the impact of

regulatory matters and legislative developments or changes in laws,

including changes in cybersecurity, privacy and environmental laws;

the impact on the holders of Quad’s class A common stock of a

limited active market for such shares and the inability to

independently elect directors or control decisions due to the

voting power of the class B common stock; and the other risk

factors identified in the Company’s most recent Annual Report on

Form 10-K, which may be amended or supplemented by subsequent

Quarterly Reports on Form 10-Q or other reports filed with the

Securities and Exchange Commission.

Except to the extent required by the federal securities laws,

the Company undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Non-GAAP Financial Measures

This press release contains financial measures not prepared in

accordance with generally accepted accounting principles (referred

to as non-GAAP), specifically Adjusted EBITDA, Adjusted EBITDA

Margin, Free Cash Flow, Net Debt, Debt Leverage Ratio and Adjusted

Diluted Earnings Per Share. Adjusted EBITDA is defined as net

earnings (loss) excluding interest expense, income tax expense,

depreciation and amortization and restructuring, impairment and

transaction-related charges. Adjusted EBITDA Margin is defined as

Adjusted EBITDA divided by net sales. Free Cash Flow is defined as

net cash provided by (used in) operating activities less purchases

of property, plant and equipment. Debt Leverage Ratio is defined as

total debt and finance lease obligations less cash and cash

equivalents (Net Debt) divided by the last twelve months of

Adjusted EBITDA. Adjusted Diluted Earnings Per Share is defined as

earnings (loss) before income taxes excluding restructuring,

impairment and transaction-related charges and adjusted for income

tax expense at a normalized tax rate, divided by diluted weighted

average number of common shares outstanding.

The Company believes that these non-GAAP measures, when

presented in conjunction with comparable GAAP measures, provide

additional information for evaluating Quad’s performance and are

important measures by which Quad’s management assesses the

profitability and liquidity of its business. These non-GAAP

measures should be considered in addition to, not as a substitute

for or superior to, net earnings (loss) as a measure of operating

performance or to cash flows provided by (used in) operating

activities as a measure of liquidity. These non-GAAP measures may

be different than non-GAAP financial measures used by other

companies. Reconciliation to the GAAP equivalent of these non-GAAP

measures are contained in tabular form on the attached unaudited

financial statements.

QUAD/GRAPHICS, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

For the Three Months Ended March

31, 2024 and 2023

(in millions, except per share

data)

(UNAUDITED)

Three Months Ended March

31,

2024

2023

Net sales

$

654.8

$

766.5

Cost of sales

521.3

617.5

Selling, general and administrative

expenses

83.1

89.2

Depreciation and amortization

28.6

33.7

Restructuring, impairment and

transaction-related charges

32.5

26.0

Total operating expenses

665.5

766.4

Operating income (loss)

(10.7

)

0.1

Interest expense

15.2

16.3

Net pension income

(0.2

)

(0.4

)

Loss before income taxes

(25.7

)

(15.8

)

Income tax expense

2.4

8.8

Net loss

$

(28.1

)

$

(24.6

)

Loss per share

Basic and diluted

$

(0.60

)

$

(0.50

)

Weighted average number of common

shares outstanding

Basic and diluted

47.2

49.2

QUAD/GRAPHICS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

As of March 31, 2024 and December

31, 2023

(in millions)

(UNAUDITED) March 31,

2024

December 31,

2023

ASSETS

Cash and cash equivalents

$

10.2

$

52.9

Receivables, less allowances for credit

losses

302.7

316.2

Inventories

180.6

178.8

Prepaid expenses and other current

assets

56.3

39.8

Total current assets

549.8

587.7

Property, plant and equipment—net

601.8

620.6

Operating lease right-of-use

assets—net

91.8

96.6

Goodwill

100.3

103.0

Other intangible assets—net

17.7

21.8

Other long-term assets

62.3

80.0

Total assets

$

1,423.7

$

1,509.7

LIABILITIES AND SHAREHOLDERS’

EQUITY

Accounts payable

$

359.8

$

373.6

Other current liabilities

174.0

237.6

Short-term debt and current portion of

long-term debt

71.5

151.7

Current portion of finance lease

obligations

2.4

2.5

Current portion of operating lease

obligations

23.6

25.4

Total current liabilities

631.3

790.8

Long-term debt

473.9

362.5

Finance lease obligations

6.0

6.0

Operating lease obligations

74.6

77.2

Deferred income taxes

5.9

5.1

Other long-term liabilities

142.8

148.6

Total liabilities

1,334.5

1,390.2

Shareholders’ equity

Preferred stock

—

—

Common stock

1.4

1.4

Additional paid-in capital

838.0

842.7

Treasury stock, at cost

(28.7

)

(33.1

)

Accumulated deficit

(604.6

)

(573.9

)

Accumulated other comprehensive loss

(116.9

)

(117.6

)

Total shareholders’ equity

89.2

119.5

Total liabilities and shareholders’

equity

$

1,423.7

$

1,509.7

QUAD/GRAPHICS, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

For the Three Months Ended March

31, 2024 and 2023

(in millions)

(UNAUDITED)

Three Months Ended March

31,

2024

2023

OPERATING ACTIVITIES

Net loss

$

(28.1

)

$

(24.6

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

28.6

33.7

Impairment charges

12.6

9.5

Stock-based compensation

1.8

1.0

Gain on the sale or disposal of property,

plant and equipment, net

(0.9

)

(0.1

)

Deferred income taxes

0.3

10.3

Other non-cash adjustments to net loss

0.3

0.5

Changes in operating assets and

liabilities

(66.8

)

(80.9

)

Net cash used in operating activities

(52.2

)

(50.6

)

INVESTING ACTIVITIES

Purchases of property, plant and

equipment

(17.9

)

(28.7

)

Cost investment in unconsolidated

entities

(0.2

)

(0.3

)

Proceeds from the sale of property, plant

and equipment

1.7

7.1

Other investing activities

0.5

(4.5

)

Net cash used in investing activities

(15.9

)

(26.4

)

FINANCING ACTIVITIES

Proceeds from issuance of long-term

debt

52.8

—

Payments of current and long-term debt

(101.0

)

(7.4

)

Payments of finance lease obligations

(0.8

)

(0.3

)

Borrowings on revolving credit

facilities

468.3

413.8

Payments on revolving credit

facilities

(389.1

)

(343.5

)

Purchases of treasury stock

—

(0.3

)

Equity awards redeemed to pay employees’

tax obligations

(2.1

)

(1.7

)

Payment of cash dividends

(2.4

)

(0.1

)

Other financing activities

(0.2

)

(0.2

)

Net cash provided by financing

activities

25.5

60.3

Effect of exchange rates on cash and cash

equivalents

(0.1

)

0.2

Net decrease in cash and cash

equivalents

(42.7

)

(16.5

)

Cash and cash equivalents at beginning of

period

52.9

25.2

Cash and cash equivalents at end of

period

$

10.2

$

8.7

QUAD/GRAPHICS, INC.

SEGMENT FINANCIAL INFORMATION

For the Three Months Ended March

31, 2024 and 2023

(in millions)

(UNAUDITED)

Net Sales

Operating

Income (Loss)

Restructuring,

Impairment and

Transaction-Related

Charges (1)

Three months ended March 31,

2024

United States Print and Related

Services

$

578.9

$

(1.3

)

$

31.6

International

75.9

3.4

0.8

Total operating segments

654.8

2.1

32.4

Corporate

—

(12.8

)

0.1

Total

$

654.8

$

(10.7

)

$

32.5

Three months ended March 31,

2023

United States Print and Related

Services

$

657.6

$

7.3

$

22.5

International

108.9

7.7

2.6

Total operating segments

766.5

15.0

25.1

Corporate

—

(14.9

)

0.9

Total

$

766.5

$

0.1

$

26.0

______________________________

(1)

Restructuring, impairment and

transaction-related charges are included within operating income

(loss).

QUAD/GRAPHICS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

EBITDA, EBITDA MARGIN, ADJUSTED

EBITDA AND ADJUSTED EBITDA MARGIN

For the Three Months Ended March

31, 2024 and 2023

(in millions, except margin

data)

(UNAUDITED)

Three Months Ended March

31,

2024

2023

Net loss

$

(28.1

)

$

(24.6

)

Interest expense

15.2

16.3

Income tax expense

2.4

8.8

Depreciation and amortization

28.6

33.7

EBITDA (non-GAAP)

$

18.1

$

34.2

EBITDA Margin (non-GAAP)

2.8

%

4.5

%

Restructuring, impairment and

transaction-related charges (1)

32.5

26.0

Adjusted EBITDA (non-GAAP)

$

50.6

$

60.2

Adjusted EBITDA Margin

(non-GAAP)

7.7

%

7.9

%

______________________________

(1)

Operating results for the three

months ended March 31, 2024 and 2023, were affected by the

following restructuring, impairment and transaction-related

charges:

Three Months Ended March

31,

2024

2023

Employee termination charges (a)

$

13.7

$

13.1

Impairment charges (b)

12.6

9.5

Transaction-related charges (c)

0.5

0.6

Integration costs (d)

0.1

0.5

Other restructuring charges (e)

5.6

2.3

Restructuring, impairment and

transaction-related charges

$

32.5

$

26.0

______________________________

(a)

Employee termination charges were

related to workforce reductions through facility consolidations and

separation programs.

(b)

Impairment charges were for

certain property, plant and equipment no longer being utilized in

production as a result of facility consolidations and other

capacity reduction activities, as well as operating lease

right-of-use assets.

(c)

Transaction-related charges

consisted of professional service fees related to business

acquisition and divestiture activities.

(d)

Integration costs were primarily

costs related to the integration of acquired companies.

(e)

Other restructuring charges

primarily include costs to maintain and exit closed facilities, as

well as lease exit charges.

In addition to financial measures prepared in accordance with

accounting principles generally accepted in the United States of

America (GAAP), this earnings announcement also contains non-GAAP

financial measures, specifically EBITDA, EBITDA Margin, Adjusted

EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Net Debt, Debt

Leverage Ratio and Adjusted Diluted Earnings Per Share. The Company

believes that these non-GAAP measures, when presented in

conjunction with comparable GAAP measures, provide additional

information for evaluating Quad’s performance and are important

measures by which Quad’s management assesses the profitability and

liquidity of its business. These non-GAAP measures should be

considered in addition to, not as a substitute for or superior to,

net earnings (loss) as a measure of operating performance or to

cash flows provided by (used in) operating activities as a measure

of liquidity. These non-GAAP measures may be different than

non-GAAP financial measures used by other companies.

QUAD/GRAPHICS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

FREE CASH FLOW

For the Three Months Ended March

31, 2024 and 2023

(in millions)

(UNAUDITED)

Three Months Ended March

31,

2024

2023

Net cash used in operating activities

$

(52.2

)

$

(50.6

)

Less: purchases of property, plant and

equipment

17.9

28.7

Free Cash Flow (non-GAAP)

$

(70.1

)

$

(79.3

)

In addition to financial measures prepared in accordance with

accounting principles generally accepted in the United States of

America (GAAP), this earnings announcement also contains non-GAAP

financial measures, specifically EBITDA, EBITDA Margin, Adjusted

EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Net Debt, Debt

Leverage Ratio and Adjusted Diluted Earnings Per Share. The Company

believes that these non-GAAP measures, when presented in

conjunction with comparable GAAP measures, provide additional

information for evaluating Quad’s performance and are important

measures by which Quad’s management assesses the profitability and

liquidity of its business. These non-GAAP measures should be

considered in addition to, not as a substitute for or superior to,

net earnings (loss) as a measure of operating performance or to

cash flows provided by (used in) operating activities as a measure

of liquidity. These non-GAAP measures may be different than

non-GAAP financial measures used by other companies.

QUAD/GRAPHICS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

NET DEBT AND DEBT LEVERAGE

RATIO

As of March 31, 2024 and December

31, 2023

(in millions, except ratio)

(UNAUDITED) March 31,

2024

December 31,

2023

Total debt and finance lease obligations

on the condensed consolidated balance sheets

$

553.8

$

522.7

Less: Cash and cash equivalents

10.2

52.9

Net Debt (non-GAAP)

$

543.6

$

469.8

Divided by: trailing twelve months

Adjusted EBITDA (non-GAAP) (1)

$

224.1

$

233.7

Debt Leverage Ratio (non-GAAP)

2.43

x

2.01

x

______________________________

(1)

The calculation of Adjusted

EBITDA for the trailing twelve months ended March 31, 2024, and

December 31, 2023, was as follows:

Add

Subtract

Year Ended

Three Months Ended

Trailing Twelve Months

Ended

December 31,

2023(a)

(UNAUDITED) March 31,

2024

(UNAUDITED) March 31,

2023

(UNAUDITED) March 31,

2024

Net loss

$

(55.4

)

$

(28.1

)

$

(24.6

)

$

(58.9

)

Interest expense

70.0

15.2

16.3

68.9

Income tax expense

12.8

2.4

8.8

6.4

Depreciation and amortization

128.8

28.6

33.7

123.7

EBITDA (non-GAAP)

$

156.2

$

18.1

$

34.2

$

140.1

Restructuring, impairment and

transaction-related charges

77.5

32.5

26.0

84.0

Adjusted EBITDA (non-GAAP)

$

233.7

$

50.6

$

60.2

$

224.1

______________________________

(a)

Financial information for the

year ended December 31, 2023, is included as reported in the

Company’s 2023 Annual Report on Form 10-K filed with the SEC on

February 22, 2024.

In addition to financial measures prepared in accordance with

accounting principles generally accepted in the United States of

America (GAAP), this earnings announcement also contains non-GAAP

financial measures, specifically EBITDA, EBITDA Margin, Adjusted

EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Net Debt, Debt

Leverage Ratio and Adjusted Diluted Earnings Per Share. The Company

believes that these non-GAAP measures, when presented in

conjunction with comparable GAAP measures, provide additional

information for evaluating Quad’s performance and are important

measures by which Quad’s management assesses the profitability and

liquidity of its business. These non-GAAP measures should be

considered in addition to, not as a substitute for or superior to,

net earnings (loss) as a measure of operating performance or to

cash flows provided by (used in) operating activities as a measure

of liquidity. These non-GAAP measures may be different than

non-GAAP financial measures used by other companies.

QUAD/GRAPHICS, INC.

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

ADJUSTED DILUTED EARNINGS PER

SHARE

For the Three Months Ended March

31, 2024 and 2023

(in millions, except per share

data)

(UNAUDITED)

Three Months Ended March

31,

2024

2023

Loss before income taxes

$

(25.7

)

$

(15.8

)

Restructuring, impairment and

transaction-related charges

32.5

26.0

Adjusted net earnings, before income taxes

(non-GAAP)

6.8

10.2

Income tax expense at 25% normalized tax

rate

1.7

2.6

Adjusted net earnings (non-GAAP)

$

5.1

$

7.6

Basic weighted average number of common

shares outstanding

47.2

49.2

Plus: effect of dilutive equity incentive

instruments (non-GAAP)

2.6

2.1

Diluted weighted average number of common

shares outstanding (non-GAAP)

49.8

51.3

Adjusted diluted earnings per share

(non-GAAP) (1)

$

0.10

$

0.15

Diluted loss per share (GAAP)

$

(0.60

)

$

(0.50

)

Restructuring, impairment and

transaction-related charges per share

0.65

0.51

Income tax expense from condensed

consolidated statement of operations per share

0.05

0.17

Income tax expense at 25% normalized tax

rate per share

(0.03

)

(0.05

)

Effect of dilutive equity incentive

instruments

0.03

0.02

Adjusted diluted earnings per share

(non-GAAP) (1)

$

0.10

$

0.15

______________________________

(1)

Adjusted diluted earnings per share

excludes the following: (i) restructuring, impairment and

transaction-related charges and (ii) discrete income tax items.

In addition to financial measures prepared in accordance with

accounting principles generally accepted in the United States of

America (GAAP), this earnings announcement also contains non-GAAP

financial measures, specifically EBITDA, EBITDA Margin, Adjusted

EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Net Debt, Debt

Leverage Ratio and Adjusted Diluted Earnings Per Share. The Company

believes that these non-GAAP measures, when presented in

conjunction with comparable GAAP measures, provide additional

information for evaluating Quad’s performance and are important

measures by which Quad’s management assesses the profitability and

liquidity of its business. These non-GAAP measures should be

considered in addition to, not as a substitute for or superior to,

net earnings (loss) as a measure of operating performance or to

cash flows provided by (used in) operating activities as a measure

of liquidity. These non-GAAP measures may be different than

non-GAAP financial measures used by other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430625864/en/

Investor Relations Contact Don Pontes Executive Director

of Investor Relations 916-532-7074 dwpontes@quad.com

Media Contact Claire Ho Director of Marketing

Communications 414-566-2955 cho@quad.com

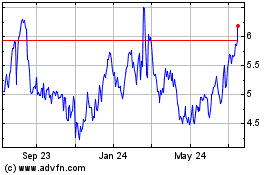

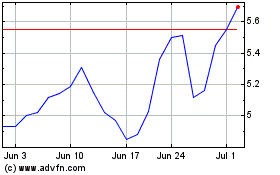

Quad Graphics (NYSE:QUAD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quad Graphics (NYSE:QUAD)

Historical Stock Chart

From Nov 2023 to Nov 2024