Prologis Lifts 2023 Earnings, Occupancy Outlook

April 18 2023 - 9:03AM

Dow Jones News

By Dean Seal

Prologis Inc. raised its annual earnings and occupancy guidance

on Tuesday with the expectation that demand will remain steady.

The San Francisco-based industrial-property landlord expects

earnings to be between $3.10 and $3.25, up 10 cents from the low

and high ends of its prior outlook.

Core funds from operations, a measure of operating performance,

are projected to be at least $5.42, up 2 cents from previous

guidance, and as high as $5.50.

Prologis forecasts average occupancy across its owned and

managed portfolio to be between 97% and 97.5%, raising the low end

of its prior projection by half a percentage point.

The company also raised its general and administrative expense

forecast by 2% at the midpoint to between $380 million and $390

million.

Chief Executive Hamid R. Moghadam said demand remains healthy

despite "some moderating in terms of decision-making," and that the

company is operating cautiously. Prologis expects that any dent in

demand would overlap with a deceleration in new deliveries,

maintaining momentum for high occupancy and continued rent growth

next year, he said.

Shares ticked up less than 1% to $124 in premarket trading.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

April 18, 2023 08:48 ET (12:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

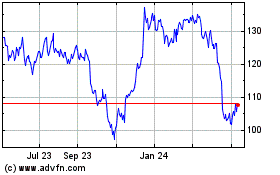

Prologis (NYSE:PLD)

Historical Stock Chart

From Jun 2024 to Jul 2024

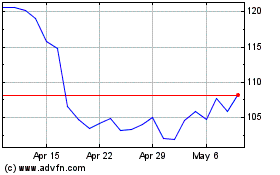

Prologis (NYSE:PLD)

Historical Stock Chart

From Jul 2023 to Jul 2024