Prologis Posts 2Q Earnings Beat, Higher Revenue

July 18 2022 - 9:01AM

Dow Jones News

By Dean Seal

Prologis Inc. posted second-quarter earnings on Monday that beat

Wall Street expectations, along with higher rental revenue and an

uptick in average occupancy.

The San Francisco-based industrial-property landlord said net

earnings attributable to shareholders was $610 million, or 82 cents

a share, up from $599 million, or 81 cents a share, in the same

period a year ago. Analysts surveyed by FactSet had expected

earnings of 65 cents a share.

Core funds from operations attributable to shareholders, a

measure of operating performance, was $1.11 a share, in line with

analyst expectations and up from $1.01 last year.

Total revenue climbed to $1.25 billion from $1.15 billion in the

same quarter of 2021. Rental income rose to $1.09 billion from

$1.01 billion.

Average occupancy in Prologis's owned and managed portfolio was

97.6%, up from 97.4% last quarter.

"The pandemic drove record demand for the past two years, which

translated into all-time low vacancies and unprecedented rent

growth," Chief Executive Hamid R. Moghadam said Monday. "As

conditions normalize, we are still seeing healthy demand that

rivals past peak cycles and, informed by our proprietary data

insights, we expect strong demand for our properties to

continue."

Shares rose 1.4% to $122.69 in premarket trading.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

July 18, 2022 08:46 ET (12:46 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

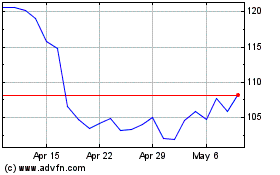

Prologis (NYSE:PLD)

Historical Stock Chart

From Jun 2024 to Jul 2024

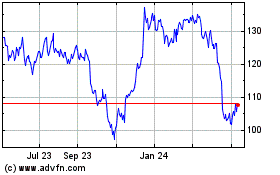

Prologis (NYSE:PLD)

Historical Stock Chart

From Jul 2023 to Jul 2024