Prologis Offers to Buy Duke Realty in Nearly $24 Billion Deal

May 10 2022 - 9:20AM

Dow Jones News

By Will Feuer

Prologis Inc. said it has made an offer to buy Duke Realty Corp.

in an all-stock deal valuing Duke at $61.68, or about $23.71

billion.

Shareholders of Duke Realty, a real-estate investment trust that

specializes in industrial properties, would receive 0.466 shares of

Prologis stock for each share of Duke Realty they own.

Prologis said its offer is valued at $61.68 per Duke Realty

share, based on Prologis's closing price on Monday, and represents

a premium of 29%.

Prologis, a REIT that specializes in logistics and warehouse

properties, said it sent a letter to Duke on Nov. 29 with a buyout

offer. Since then, Prologis said Duke Realty did not substantively

engage with the offer. Prologis said it upped its offer on May 3,

but Duke Realty rejected the offer the same day.

"We are confident that the proposed combination will be a

win-win for our respective shareholders," Prologis Co-Founder and

Chief Executive Hamid Moghadam said.

Shares of Duke Realty jumped 20% in premarket trading, to $57.25

a share, following the disclosure of the offer. Prologis stock fell

more than 1%, to $130.46 a share.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

May 10, 2022 09:05 ET (13:05 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

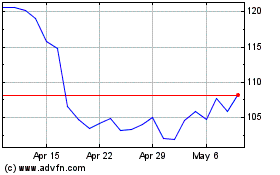

Prologis (NYSE:PLD)

Historical Stock Chart

From Jun 2024 to Jul 2024

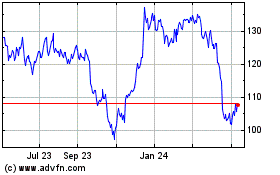

Prologis (NYSE:PLD)

Historical Stock Chart

From Jul 2023 to Jul 2024