- Consolidated revenues of $592.2 million; Earnings before taxes

of $48.3 million

- Adjusted EBITDA of $72.3 million

- Diluted EPS of $0.77; Non-GAAP Diluted EPS of $0.92

- Progressive Leasing GMV of $454.5 million, 7.9% growth

year-over-year

- Raises full year consolidated revenue and earnings outlook

PROG Holdings, Inc. (NYSE:PRG), the fintech holding company for

Progressive Leasing, Vive Financial, Four Technologies, and Build

today announced financial results for the second quarter ended June

30, 2024.

"We are pleased to report a strong second quarter that exceeded

our outlook on all key metrics, particularly on GMV, which grew

7.9% year-over-year" said PROG Holdings President and CEO Steve

Michaels. "Second quarter GMV growth reflects our continued

investment in marketing, sales, and technology, and we believe we

are just beginning to see the benefits of these efforts.

Additionally, our application funnel improved as credit supply

above us has tightened. Despite a continued soft retail backdrop in

our leasable categories, we were able to grow GMV and improve our

balance of share at retail partners across both national and

regional accounts. As reflected in our revised outlook, we expect

the momentum we have seen in GMV to continue in the third quarter

and drive year-over-year revenue growth in the second half of 2024.

We are excited about the positive developments in our GMV

trajectory and our ability to effectively manage our portfolio

performance and spend levels to deliver shareholder value,"

concluded Michaels.

Consolidated Results

Consolidated revenues for the second quarter of 2024 remained

relatively flat at $592.2 million, a decrease of 0.1% from the same

period in 2023.

Consolidated net earnings for the quarter were $33.8 million,

compared with $37.2 million in the prior year period. The decline

in net earnings was primarily driven by headwinds from portfolio

performance returning to more normalized pre-pandemic levels, a

smaller portfolio size during the quarter, and $2.9 million of

restructuring expense related to our cost reduction actions during

the second quarter of 2024. Adjusted EBITDA for the quarter

decreased 3.7% to $72.3 million, or 12.2% of revenues, compared

with $75.0 million, or 12.7% of revenues for the same period in

2023. The year-over-year decline in adjusted EBITDA was driven

primarily by headwinds from portfolio performance returning to

pre-pandemic levels, and a smaller portfolio size during the

quarter, partially offset by a decrease in Progressive Leasing's

SG&A due to cost reduction actions executed in the first

quarter of 2024, along with disciplined spending.

Diluted earnings per share for the second quarter of 2024 were

$0.77, compared with $0.79 in the year ago period. On a non-GAAP

basis, diluted earnings per share were $0.92 in the second quarters

of 2024 and 2023. The Company's weighted average shares outstanding

assuming dilution in the second quarter was 6.8% lower

year-over-year.

Progressive Leasing Results

Progressive Leasing's second quarter GMV of $454.5 million was

up 7.9% compared to the same period in 2023. The provision for

lease merchandise write-offs for the quarter was 7.7%, within the

Company's 6%-8% targeted annual range.

Liquidity and Capital Allocation

PROG Holdings ended the second quarter of 2024 with cash of

$250.1 million and gross debt of $600 million. The Company

repurchased $36.7 million of its stock in the quarter at an average

price of $35.67 per share, leaving $438.8 million of repurchase

authorization under its $500 million share repurchase program.

Additionally, the Company paid a cash dividend of $0.12 per

share.

2024 Outlook

PROG Holdings is updating its full year 2024 outlook for revenue

and earnings as well as providing its outlook for revenues, net

earnings, adjusted EBITDA, GAAP diluted EPS and non-GAAP diluted

EPS for the third quarter of 2024. This outlook assumes a

continuation of the benefits from tightened credit above us, a

difficult operating environment with soft demand for leasable

consumer goods, no material changes in the Company's decisioning

posture, no material increase in the unemployment rate for our

consumer base, an effective tax rate for non-GAAP EPS of

approximately 28%, and no impact from additional share

repurchases.

Revised 2024 Outlook

Previous 2024 Outlook

(In thousands, except per share

amounts)

Low

High

Low

High

PROG Holdings - Total Revenues

$

2,400,000

$

2,450,000

$

2,285,000

$

2,360,000

PROG Holdings - Net Earnings

110,500

116,000

97,500

108,000

PROG Holdings - Adjusted EBITDA

265,000

275,000

240,000

255,000

PROG Holdings - Diluted EPS

2.52

2.68

2.18

2.43

PROG Holdings - Diluted Non-GAAP EPS

3.25

3.40

2.85

3.10

Progressive Leasing - Total Revenues

2,325,000

2,355,000

2,210,000

2,265,000

Progressive Leasing - Earnings Before

Taxes

178,000

182,000

159,000

169,000

Progressive Leasing - Adjusted EBITDA

273,500

278,500

251,000

261,000

Vive - Total Revenues

55,000

65,000

55,000

65,000

Vive - Earnings Before Taxes

1,500

3,000

1,500

3,000

Vive - Adjusted EBITDA

3,000

5,000

3,000

5,000

Other - Total Revenues

20,000

30,000

20,000

30,000

Other - Loss Before Taxes

(20,000

)

(18,000

)

(20,000

)

(18,000

)

Other - Adjusted EBITDA

(11,500

)

(8,500

)

(14,000

)

(11,000

)

Three Months Ended

September 30, 2024 Outlook

(In thousands, except per share

amounts)

Low

High

PROG Holdings - Total Revenues

$

590,000

$

605,000

PROG Holdings - Net Earnings

27,000

30,000

PROG Holdings - Adjusted EBITDA

60,000

65,000

PROG Holdings - Diluted EPS

0.61

0.71

PROG Holdings - Diluted Non-GAAP EPS

0.70

0.80

Conference Call and Webcast

The Company has scheduled a live webcast and conference call for

Wednesday, July 24, 2024, at 8:30 A.M. ET to discuss its financial

results for the second quarter of 2024. To access the live webcast,

visit the Events and Presentations page of the Company’s Investor

Relations website, https://investor.progholdings.com/.

About PROG Holdings, Inc.

PROG Holdings, Inc. (NYSE:PRG) is a fintech holding company

headquartered in Salt Lake City, UT, that provides transparent and

competitive payment options to consumers. The Company owns

Progressive Leasing, a leading provider of e-commerce, app-based,

and in-store point-of-sale lease-to-own solutions, Vive Financial,

an omnichannel provider of second-look revolving credit products,

Four Technologies, a provider of Buy Now, Pay Later payment options

through its platform, Four, and Build, provider of personal credit

building products. More information on PROG Holdings and its

companies can be found at https://investor.progholdings.com/.

Forward Looking Statements:

Statements in this news release regarding our business that are

not historical facts are "forward-looking statements" that involve

risks and uncertainties which could cause actual results to differ

materially from those contained in the forward-looking statements.

Such forward-looking statements generally can be identified by the

use of forward-looking terminology, such as "continue", "believe",

"expects", "outlook", and similar forward-looking terminology.

These risks and uncertainties include factors such as (i) continued

volatility and challenges in the macro environment and, in

particular, the unfavorable effects on our business of significant

inflation, elevated interest rates, and fears of a recession, and

the impact of those headwinds on: (a) consumer confidence and

customer demand for the merchandise that our POS partners sell, in

particular consumer durables; (b) our customers’ disposable income

and their ability to make the lease and loan payments they owe the

Company; (c) the availability of consumer credit; and (d) our

overall financial performance and outlook; (ii) our businesses

being subject to extensive laws and regulations, including laws and

regulations unique to the industries in which our businesses

operate, that may subject them to government investigations and

significant monetary penalties and compliance-related burdens, as

well as an increased focus by federal, state and local regulators

on the industries within which our businesses operate, including

with respect to consumer protection, customer privacy, third party

and employee fraud and information security; (iii) deteriorating

macroeconomic conditions resulting in the algorithms and other

proprietary decisioning tools used in approving Progressive Leasing

and Vive customers for leases and loans no longer being indicative

of their ability to perform, which may limit the ability of those

businesses to avoid lease and loan charge-offs or may result in

their reserves being insufficient to cover actual losses; (iv) the

impact of the cybersecurity incident experienced by Progressive

Leasing in September 2023 and expenses incurred in connection with

responding to the matter, including the litigation filed in

response to that incident, or any regulatory proceedings that may

result from the incident; (v) a large percentage of the Company’s

revenues being concentrated with several of Progressive Leasing’s

key POS partners; (vi) the risks that Progressive Leasing will be

unable to attract new POS partners or retain and grow its business

with its existing POS partners; (vii) Vive’s and Four’s business

models differing significantly from Progressive Leasing’s, which

creates specific and unique risks for each of the Vive and Four

businesses, including Vive’s reliance on a limited number of bank

partners to issue its credit products and each of Vive’s and Four’s

exposure to the unique regulatory risks associated with the laws

and regulations that apply to each of their businesses; (viii) our

ability to continue to protect confidential, proprietary, or

sensitive information, including the personal and confidential

information of our customers, which may be adversely affected by

cyber-attacks, employee or other internal misconduct, computer

viruses, electronic break-ins or "hacking", or similar disruptions,

any one of which could have a material adverse impact on our

results of operations, financial condition, and prospects; (ix) our

cost reduction initiatives may not be adequate or may have

unintended consequences that could be disruptive to our businesses,

including with respect to our global workforce strategy; (x) the

risk that our capital allocation strategy, including our current

stock repurchase and dividend programs, as well as any future debt

repurchase program, will not be effective at enhancing shareholder

value and may have an adverse impact on our cash reserves; (xi) the

loss of the services of our key executives or our inability to

attract and retain key talent, particularly with respect to our

information technology function, may have a material adverse impact

on our operations; (xii) increased competition from traditional and

virtual lease-to-own competitors and also from competitors of our

Vive segment; (xiii) the transactions offered by our Progressive

Leasing, Vive and/or Four businesses may be negatively

characterized by government officials, consumer advocacy groups or

the media; (xiv) real or perceived software or system errors,

failures, bugs, defects or outages, including those that may be

caused by third-party vendors, may adversely affect Progressive

Leasing, Vive or Four; and (xv) the other risks and uncertainties

discussed under "Risk Factors" in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, filed with

the SEC on February 21, 2024. Statements in this press release that

are "forward-looking" include without limitation statements about:

(i) the benefits we expect from our marketing, sales and technology

investments, including the timing of those benefits; (ii) our

expectations regarding GMV growth for the quarter ending September

30, 2024 and revenue growth for the second half of 2024; (iii) our

ability to continue investing in our business, including with

respect to marketing, sales and technology initiatives; (iv) our

ability to continue to effectively manage our portfolio and

spending levels to deliver shareholder value; and (v) our revised

full year 2024 outlook and our third quarter 2024 outlook. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Except as required by law, the Company undertakes no obligation to

update these forward-looking statements to reflect subsequent

events or circumstances after the date of this press release.

PROG Holdings, Inc.

Consolidated Statements of

Earnings

(In thousands, except per

share data)

(Unaudited) Three

Months Ended

(Unaudited) Six Months

Ended

June 30,

June 30,

2024

2023

2024

2023

REVENUES:

Lease Revenues and Fees

$

570,516

$

574,839

$

1,191,066

$

1,211,921

Interest and Fees on Loans Receivable

21,645

18,007

42,965

36,065

592,161

592,846

1,234,031

1,247,986

COSTS AND EXPENSES:

Depreciation of Lease Merchandise

384,799

384,874

816,370

820,313

Provision for Lease Merchandise

Write-offs

43,783

40,965

86,924

79,329

Operating Expenses

107,901

107,710

235,242

212,969

536,483

533,549

1,138,536

1,112,611

OPERATING PROFIT

55,678

59,297

95,495

135,375

Interest Expense, Net

(7,339

)

(7,283

)

(15,589

)

(15,774

)

EARNINGS BEFORE INCOME TAX

EXPENSE

48,339

52,014

79,906

119,601

INCOME TAX EXPENSE

14,565

14,796

24,166

34,350

NET EARNINGS

$

33,774

$

37,218

$

55,740

$

85,251

EARNINGS PER SHARE

Basic

$

0.79

$

0.80

$

1.29

$

1.81

Assuming Dilution

$

0.77

$

0.79

$

1.26

$

1.79

CASH DIVIDENDS DECLARED PER

SHARE:

Common Stock

$

0.12

$

—

$

0.24

$

—

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic

42,955

46,474

43,325

47,160

Assuming Dilution

43,721

46,896

44,124

47,514

PROG Holdings, Inc.

Consolidated Balance

Sheets

(In thousands, except share

data)

(Unaudited)

June 30, 2024

December 31,

2023

ASSETS:

Cash and Cash Equivalents

$

250,134

$

155,416

Accounts Receivable (net of allowances of

$64,682 in 2024 and $64,180 in 2023)

61,453

67,879

Lease Merchandise (net of accumulated

depreciation and allowances of $434,348 in 2024 and $423,466 in

2023)

563,594

633,427

Loans Receivable (net of allowances and

unamortized fees of $48,937 in 2024 and $50,022 in 2023)

119,322

126,823

Property and Equipment, Net

21,505

24,104

Operating Lease Right-of-Use Assets

4,116

9,271

Goodwill

296,061

296,061

Other Intangibles, Net

81,776

91,664

Income Tax Receivable

10,354

32,918

Deferred Income Tax Assets

2,368

2,981

Prepaid Expenses and Other Assets

50,024

50,711

Total Assets

$

1,460,707

$

1,491,255

LIABILITIES & SHAREHOLDERS’

EQUITY:

Accounts Payable and Accrued Expenses

$

150,337

$

151,259

Deferred Income Tax Liabilities

87,252

104,838

Customer Deposits and Advance Payments

34,746

35,713

Operating Lease Liabilities

13,605

15,849

Debt

592,914

592,265

Total Liabilities

878,854

899,924

SHAREHOLDERS' EQUITY:

Common Stock, Par Value $0.50 Per Share:

Authorized: 225,000,000 Shares at June 30, 2024 and December 31,

2023; Shares Issued: 82,078,654 at June 30, 2024 and December 31,

2023

41,039

41,039

Additional Paid-in Capital

347,552

352,421

Retained Earnings

1,338,201

1,293,073

1,726,792

1,686,533

Less: Treasury Shares at Cost

Common Stock: 39,763,190 Shares at June

30, 2024 and 38,404,527 at December 31, 2023

(1,144,939

)

(1,095,202

)

Total Shareholders’ Equity

581,853

591,331

Total Liabilities & Shareholders’

Equity

$

1,460,707

$

1,491,255

PROG Holdings, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Six Months Ended June

30,

2024

2023

OPERATING ACTIVITIES:

Net Earnings

$

55,740

$

85,251

Adjustments to Reconcile Net Earnings to

Cash Provided by Operating Activities:

Depreciation of Lease Merchandise

816,370

820,313

Other Depreciation and Amortization

14,515

15,895

Provisions for Accounts Receivable and

Loan Losses

174,822

161,237

Stock-Based Compensation

13,737

12,260

Deferred Income Taxes

(16,973

)

(21,190

)

Impairment of Assets

6,018

—

Non-Cash Lease Expense

(1,603

)

(1,482

)

Other Changes, Net

(155

)

(2,506

)

Changes in Operating Assets and

Liabilities:

Additions to Lease Merchandise

(836,084

)

(803,250

)

Book Value of Lease Merchandise Sold or

Disposed

89,549

82,096

Accounts Receivable

(145,312

)

(132,460

)

Prepaid Expenses and Other Assets

377

(857

)

Income Tax Receivable and Payable

26,206

(44

)

Accounts Payable and Accrued Expenses

(5,113

)

(5,442

)

Customer Deposits and Advance Payments

(967

)

(4,441

)

Cash Provided by Operating Activities

191,127

205,380

INVESTING ACTIVITIES:

Investments in Loans Receivable

(172,513

)

(90,746

)

Proceeds from Loans Receivable

158,644

84,491

Outflows on Purchases of Property and

Equipment

(3,999

)

(4,388

)

Other Proceeds

46

13

Cash Used in Investing Activities

(17,822

)

(10,630

)

FINANCING ACTIVITIES:

Dividends Paid

(10,346

)

—

Acquisition of Treasury Stock

(61,177

)

(71,836

)

Issuance of Stock Under Stock Option and

Employee Purchase Plans

799

606

Cash Paid for Shares Withheld for Employee

Taxes

(7,863

)

(2,533

)

Debt Issuance Costs

—

(29

)

Cash Used in Financing Activities

(78,587

)

(73,792

)

Increase in Cash and Cash Equivalents

94,718

120,958

Cash and Cash Equivalents at Beginning of

Period

155,416

131,880

Cash and Cash Equivalents at End of

Period

$

250,134

$

252,838

Net Cash Paid During the Period:

Interest

$

18,461

$

18,531

Income Taxes

$

12,728

$

53,624

PROG Holdings, Inc.

Quarterly Revenues by

Segment

(In thousands)

(Unaudited)

Three Months Ended

June 30, 2024

Progressive Leasing

Vive

Other

Consolidated Total

Lease Revenues and Fees

$

570,516

$

—

$

—

$

570,516

Interest and Fees on Loans Receivable

—

15,421

6,224

21,645

Total Revenues

$

570,516

$

15,421

$

6,224

$

592,161

(Unaudited)

Three Months Ended

June 30, 2023

Progressive Leasing

Vive

Other

Consolidated Total

Lease Revenues and Fees

$

574,839

$

—

$

—

$

574,839

Interest and Fees on Loans Receivable

—

17,187

820

18,007

Total Revenues

$

574,839

$

17,187

$

820

$

592,846

PROG Holdings, Inc.

Six Months Revenues by

Segment

(In thousands)

(Unaudited)

Six Months Ended

June 30, 2024

Progressive Leasing

Vive

Other

Consolidated Total

Lease Revenues and Fees

$

1,191,066

$

—

$

—

$

1,191,066

Interest and Fees on Loans Receivable

—

31,471

11,494

42,965

Total Revenues

$

1,191,066

$

31,471

$

11,494

$

1,234,031

(Unaudited)

Six Months Ended

June 30, 2023

Progressive Leasing

Vive

Other

Consolidated Total

Lease Revenues and Fees

$

1,211,921

$

—

$

—

$

1,211,921

Interest and Fees on Loans Receivable

—

34,340

1,725

36,065

Total Revenues

$

1,211,921

$

34,340

$

1,725

$

1,247,986

PROG Holdings, Inc.

Gross Merchandise Volume by

Quarter

(In thousands)

(Unaudited)

Three Months Ended June

30,

2024

2023

Progressive Leasing

$

454,508

$

421,220

Vive

35,757

39,850

Other

56,139

14,600

Total GMV

$

546,404

$

475,670

Use of Non-GAAP Financial Information:

Non-GAAP net earnings, non-GAAP diluted earnings per share, and

adjusted EBITDA are supplemental measures of our performance that

are not calculated in accordance with generally accepted accounting

principles in the United States ("GAAP"). Non-GAAP diluted earnings

per share for the full year 2024 outlook excludes intangible

amortization expense, restructuring expenses, costs related to the

cybersecurity incident, and accrued interest on an uncertain tax

position related to Progressive Leasing's $175 million settlement

with the FTC in 2020. Non-GAAP diluted earnings per share for the

third quarter 2024 outlook excludes intangible amortization expense

and accrued interest on an uncertain tax position related to

Progressive Leasing's $175 million settlement with the FTC in 2020.

Non-GAAP net earnings and non-GAAP diluted earnings per share for

the three and six months ended June 30, 2024 exclude intangible

amortization expense, restructuring expenses, costs related to the

cybersecurity incident, and accrued interest on an uncertain tax

position related to Progressive Leasing's $175 million settlement

with the FTC in 2020. Non-GAAP net earnings and non-GAAP diluted

earnings per share for the three and six months ended June 30, 2023

exclude intangible amortization expense, restructuring expenses,

regulatory insurance recoveries, and accrued interest on an

uncertain tax position related to Progressive Leasing's $175

million settlement with the FTC in 2020. The amount for the

after-tax non-GAAP adjustment, which is tax effected using our

statutory tax rate, can be found in the reconciliation of net

earnings and earnings per share assuming dilution to non-GAAP net

earnings and earnings per share assuming dilution table in this

press release.

The Adjusted EBITDA figures presented in this press release are

calculated as the Company’s earnings before interest expense, net,

depreciation on property and equipment, amortization of intangible

assets and income taxes. Adjusted EBITDA for the three and six

months ended June 30, 2024 and full year 2024 outlook excludes

stock-based compensation expense, restructuring expenses, and costs

related to the cybersecurity incident. Adjusted EBITDA for the

three and six months ended June 30, 2023 excludes stock-based

compensation expense, restructuring expenses, and regulatory

insurance recoveries. Adjusted EBITDA for third quarter 2024

outlook excludes stock-based compensation expense. The amounts for

these pre-tax non-GAAP adjustments can be found in the segment

EBITDA tables in this press release.

Management believes that non-GAAP net earnings, non-GAAP diluted

earnings per share, and adjusted EBITDA provide relevant and useful

information, and are widely used by analysts, investors and

competitors in our industry as well as by our management in

assessing both consolidated and business unit performance.

Non-GAAP net earnings, non-GAAP diluted earnings, and adjusted

EBITDA provide management and investors with an understanding of

the results from the primary operations of our business by

excluding the effects of certain items that generally arose from

larger, one-time transactions that are not reflective of the

ordinary earnings activity of our operations or transactions that

have variability and volatility of the amount. We believe the

exclusion of stock-based compensation expense provides for a better

comparison of our operating results with our peer companies as the

calculations of stock-based compensation vary from period to period

and company to company due to different valuation methodologies,

subjective assumptions and the variety of award types. This measure

may be useful to an investor in evaluating the underlying operating

performance of our business.

Adjusted EBITDA also provides management and investors with an

understanding of one aspect of earnings before the impact of

investing and financing charges and income taxes. These measures

may be useful to an investor in evaluating our operating

performance because the measures:

- Are widely used by investors to measure a company’s operating

performance without regard to items excluded from the calculation

of such measure, which can vary substantially from company to

company depending upon accounting methods, book value of assets,

capital structure and the method by which assets were acquired,

among other factors.

- Are used by rating agencies, lenders and other parties to

evaluate our creditworthiness.

- Are used by our management for various purposes, including as a

measure of performance of our operating entities and as a basis for

strategic planning and forecasting.

Non-GAAP financial measures, however, should not be used as a

substitute for, or considered superior to, measures of financial

performance prepared in accordance with GAAP, such as the Company’s

GAAP basis net earnings and diluted earnings per share and the GAAP

revenues and earnings before income taxes of the Company’s

segments, which are also presented in the press release. Further,

we caution investors that amounts presented in accordance with our

definitions of non-GAAP net earnings, non-GAAP diluted earnings per

share, and adjusted EBITDA may not be comparable to similar

measures disclosed by other companies, because not all companies

and analysts calculate these measures in the same manner.

PROG Holdings, Inc.

Reconciliation of Net Earnings

and Earnings Per Share Assuming Dilution to Non-GAAP Net

Earnings and Earnings Per Share Assuming Dilution

(In thousands, except per

share amounts)

(Unaudited)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net Earnings

$

33,774

$

37,218

$

55,740

$

85,251

Add: Intangible Amortization Expense

4,239

5,723

9,889

11,447

Add: Restructuring Expense

2,886

963

20,900

1,720

Add: Costs Related to the Cybersecurity

Incident

116

—

232

—

Less: Regulatory Insurance Recoveries

—

—

—

(525

)

Less: Tax Impact of Adjustments(1)

(1,883

)

(1,738

)

(8,066

)

(3,287

)

Add: Accrued Interest on FTC Settlement

Uncertain Tax Position

1,078

970

2,156

1,940

Non-GAAP Net Earnings

$

40,210

$

43,136

$

80,851

$

96,546

Earnings Per Share Assuming Dilution

$

0.77

$

0.79

$

1.26

$

1.79

Add: Intangible Amortization Expense

0.10

0.12

0.23

0.24

Add: Restructuring Expense

0.07

0.02

0.47

0.04

Add: Costs Related to the Cybersecurity

Incident

—

—

0.01

—

Less: Regulatory Insurance Recoveries

—

—

—

(0.01

)

Less: Tax Impact of Adjustments(1)

(0.04

)

(0.04

)

(0.18

)

(0.07

)

Add: Accrued Interest on FTC Settlement

Uncertain Tax Position

0.02

0.02

0.05

0.04

Non-GAAP Earnings Per Share Assuming

Dilution(2)

$

0.92

$

0.92

$

1.83

$

2.03

Weighted Average Shares Outstanding

Assuming Dilution

43,721

46,896

44,124

47,514

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Quarterly Segment

EBITDA

(In thousands)

(Unaudited)

Three Months Ended

June 30, 2024

Progressive Leasing

Vive

Other

Consolidated Total

Net Earnings

$

33,774

Income Tax Expense(1)

14,565

Earnings (Loss) Before Income Tax

Expense

$

53,966

$

631

$

(6,258

)

48,339

Interest Expense, Net

7,655

—

(316

)

7,339

Depreciation

1,651

166

441

2,258

Amortization

4,009

—

230

4,239

EBITDA

67,281

797

(5,903

)

62,175

Stock-Based Compensation

6,135

360

600

7,095

Restructuring Expense

258

—

2,628

2,886

Costs Related to the Cybersecurity

Incident

116

—

—

116

Adjusted EBITDA

$

73,790

$

1,157

$

(2,675

)

$

72,272

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

(Unaudited)

Three Months Ended

June 30, 2023

Progressive Leasing

Vive

Other

Consolidated Total

Net Earnings

$

37,218

Income Tax Expense(1)

14,796

Earnings (Loss) Before Income Tax

Expense

$

55,422

$

1,758

$

(5,166

)

52,014

Interest Expense, Net

7,117

166

—

7,283

Depreciation

1,795

182

216

2,193

Amortization

5,421

—

302

5,723

EBITDA

69,755

2,106

(4,648

)

67,213

Stock-Based Compensation

4,899

294

1,652

6,845

Restructuring Expense

963

—

—

963

Adjusted EBITDA

$

75,617

$

2,400

$

(2,996

)

$

75,021

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Six Month Segment

EBITDA

(In thousands)

(Unaudited)

Six Months Ended

June 30, 2024

Progressive Leasing

Vive

Other

Consolidated Total

Net Earnings

$

55,740

Income Tax Expense(1)

24,166

Earnings (Loss) Before Income Tax

Expense

$

89,419

$

1,549

$

(11,062

)

79,906

Interest Expense, Net

16,222

—

(633

)

15,589

Depreciation

3,461

332

833

4,626

Amortization

9,430

—

459

9,889

EBITDA

118,532

1,881

(10,403

)

110,010

Stock-Based Compensation

10,846

698

2,193

13,737

Restructuring Expense

18,272

—

2,628

20,900

Costs Related to the Cybersecurity

Incident

232

—

—

232

Adjusted EBITDA

$

147,882

$

2,579

$

(5,582

)

$

144,879

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

(Unaudited)

Six Months Ended

June 30, 2023

Progressive Leasing

Vive

Other

Consolidated Total

Net Earnings

$

85,251

Income Tax Expense(1)

34,350

Earnings (Loss) Before Income Tax

Expense

$

126,473

$

3,921

$

(10,793

)

119,601

Interest Expense, Net

15,317

457

—

15,774

Depreciation

3,700

350

398

4,448

Amortization

10,842

—

605

11,447

EBITDA

156,332

4,728

(9,790

)

151,270

Stock-Based Compensation

8,452

582

3,226

12,260

Restructuring Expense

1,720

—

—

1,720

Regulatory Insurance Recoveries

(525

)

—

—

(525

)

Adjusted EBITDA

$

165,979

$

5,310

$

(6,564

)

$

164,725

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Reconciliation of Revised Full

Year 2024 Outlook for Adjusted EBITDA

(In thousands)

Fiscal Year 2024

Ranges

Progressive Leasing

Vive

Other

Consolidated Total

Estimated Net Earnings

$110,500 - $116,000

Income Tax Expense(1)

49,000 - 51,000

Projected Earnings (Loss) Before Income

Tax Expense

$178,000 - $182,000

$1,500 - $3,000

$(20,000) - $(18,000)

159,500 - 167,000

Interest Expense, Net

31,000

—

(1,000)

30,000

Depreciation

7,000

500

2,000

9,500

Amortization

17,000

—

1,000

18,000

Projected EBITDA

233,000 - 237,000

2,000 - 3,500

(18,000) - (16,000)

217,000 - 224,500

Stock-Based Compensation

22,000 - 23,000

1,000 - 1,500

4,000 - 5,000

27,000 - 29,500

Restructuring Expense

18,500

—

2,500

21,000

Projected Adjusted EBITDA

$273,500 - $278,500

$3,000 - $5,000

$(11,500) - $(8,500)

$265,000 - $275,000

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Reconciliation of Previously

Revised Full Year 2024 Outlook for Adjusted EBITDA

(In thousands)

Fiscal Year 2024

Ranges

Progressive Leasing

Vive

Other

Consolidated Total

Estimated Net Earnings

$97,500 - $108,000

Income Tax Expense(1)

43,000 - 46,000

Projected Earnings (Loss) Before Income

Tax Expense

$159,000 - $169,000

$1,500 - $3,000

$(20,000) - $(18,000)

140,500 - 154,000

Interest Expense, Net

31,000 - 29,000

—

—

31,000 - 29,000

Depreciation

8,000

500

2,000

10,500

Amortization

17,000

—

1,000

18,000

Projected EBITDA

215,000 - 223,000

2,000 - 3,500

(17,000) - (15,000)

200,000 - 211,500

Stock-Based Compensation

18,000 - 20,000

1,000 - 1,500

3,000 - 4,000

22,000 - 25,500

Restructuring Expense

18,000

—

—

18,000

Projected Adjusted EBITDA

$251,000 - $261,000

$3,000 - $5,000

$(14,000) - $(11,000)

$240,000 - $255,000

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Reconciliation of the Three

Months Ended September 30, 2024 Outlook for Adjusted EBITDA

(In thousands)

Three Months Ended

September 30, 2024 Outlook

Consolidated Total

Estimated Net Earnings

$27,000 - $30,000

Income Tax Expense(1)

12,000 - 13,000

Projected Earnings Before Income Tax

Expense

39,000 - 43,000

Interest Expense, Net

7,500

Depreciation

2,500

Amortization

4,000

Projected EBITDA

53,000 - 57,000

Stock-Based Compensation

7,000 - 8,000

Projected Adjusted EBITDA

$60,000 - $65,000

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Reconciliation of Revised Full

Year 2024 Outlook for Earnings Per Share

Assuming Dilution to Non-GAAP

Earnings Per Share Assuming Dilution

Full Year 2024

Low

High

Projected Earnings Per Share Assuming

Dilution

$

2.52

$

2.68

Add: Projected Intangible Amortization

Expense

0.41

0.41

Add: Projected Interest on FTC Settlement

Uncertain Tax Position

0.07

0.07

Add: Projected Restructuring Expense

0.48

0.48

Subtract: Tax Effect on Non-GAAP

Adjustments(1)

(0.23

)

(0.23

)

Projected Non-GAAP Earnings Per Share

Assuming Dilution(2)

$

3.25

$

3.40

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

PROG Holdings, Inc.

Reconciliation of Previously

Revised Full Year 2024 Outlook for Earnings Per Share

Assuming Dilution to Non-GAAP

Earnings Per Share Assuming Dilution

Full Year 2024

Low

High

Projected Earnings Per Share Assuming

Dilution

$

2.18

$

2.43

Add: Projected Intangible Amortization

Expense

0.41

0.41

Add: Projected Interest on FTC Settlement

Uncertain Tax Position

0.07

0.07

Add: Projected Restructuring Expense

0.41

0.41

Subtract: Tax Effect on Non-GAAP

Adjustments(1)

(0.21

)

(0.21

)

Projected Non-GAAP Earnings Per Share

Assuming Dilution(2)

$

2.85

$

3.10

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

PROG Holdings, Inc.

Reconciliation of the Three

Months Ended September 30, 2024 Outlook for Earnings Per

Share

Assuming Dilution to Non-GAAP

Earnings Per Share Assuming Dilution

Three Months Ended

September 30, 2024

Low

High

Projected Earnings Per Share Assuming

Dilution

$

0.61

$

0.71

Add: Projected Intangible Amortization

Expense

0.09

0.09

Add: Projected Interest on FTC Settlement

Uncertain Tax Position

0.02

0.02

Subtract: Tax Effect on Non-GAAP

Adjustments(1)

(0.02

)

(0.02

)

Projected Non-GAAP Earnings Per Share

Assuming Dilution(2)

$

0.70

$

0.80

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724341262/en/

Investor Contact John A. Baugh, CFA Vice President,

Investor Relations john.baugh@progleasing.com

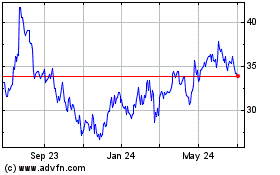

PROG (NYSE:PRG)

Historical Stock Chart

From Nov 2024 to Dec 2024

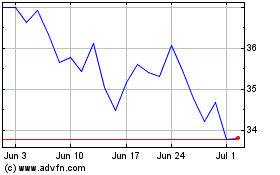

PROG (NYSE:PRG)

Historical Stock Chart

From Dec 2023 to Dec 2024