- Consolidated revenues of $641.9 million; Earnings before taxes

of $31.6 million

- Adjusted EBITDA of $72.6 million

- Diluted EPS of $0.49; Non-GAAP Diluted EPS of $0.91

- Progressive Leasing GMV of $418.5 million, flat

year-over-year

- Raises full year consolidated revenue and earnings outlook

PROG Holdings, Inc. (NYSE:PRG), the fintech holding company for

Progressive Leasing, Vive Financial, Four Technologies, and Build,

today announced financial results for the first quarter ended March

31, 2024.

"We're pleased with our strong start to the year, with first

quarter financial performance exceeding our expectations, driven by

better-than-expected GMV, strong portfolio performance and

disciplined spending," said PROG Holdings President and CEO Steve

Michaels. "Despite continued sluggish retail demand in our leasable

categories, we have delivered a meaningful increase in balance of

share with key retail partners. Our continued investments in

marketing, sales, and technology to support our retail partners and

the consumer's need for flexible purchase options gives us the

confidence to project a low single digit GMV growth for the second

quarter, even in the face of this challenging macroeconomic

environment. We believe our financial strength, highlighted by

strong margins and cash flow, enables us to invest in these growth

initiatives while returning excess cash to shareholders through

dividends and share repurchases," concluded Michaels.

Consolidated Results

Consolidated revenues for the first quarter of 2024 were $641.9

million, a decrease of 2.0% from the same period in 2023, driven by

a lower gross leased asset balance entering the quarter.

Consolidated net earnings for the quarter were $22.0 million,

compared with $48.0 million in the prior year period. The decline

in net earnings was primarily driven by $18.0 million of

restructuring expense relating to our cost reduction actions we

executed in January. Adjusted EBITDA for the quarter decreased

19.1% to $72.6 million, or 11.3% of revenues, compared with $89.7

million, or 13.7% of revenues for the same period in 2023. The

year-over-year decline in adjusted EBITDA was driven primarily by

headwinds from portfolio performance returning to pre-pandemic

levels, and a smaller portfolio size during the first quarter.

Diluted earnings per share for the first quarter of 2024 were

$0.49, compared with $1.00 in the year ago period. On a non-GAAP

basis, diluted earnings per share were $0.91 in the first quarter

of 2024, compared with $1.11 for the same period in 2023. The

Company's weighted average shares outstanding assuming dilution in

the first quarter was 7.5% lower year-over-year.

Progressive Leasing Results

Progressive Leasing's first quarter GMV of $418.5 million was

flat compared to the same period in 2023. The provision for lease

merchandise write-offs for the quarter was 7.0%, within the

Company's 6%-8% targeted annual range.

Liquidity and Capital Allocation

PROG Holdings ended the first quarter of 2024 with cash of

$252.8 million and gross debt of $600 million. The Company

repurchased $24.4 million of its stock in the quarter at an average

price of $31.31 per share, leaving $475.6 million of repurchase

authorization under the $500 million share repurchase program.

Additionally, the Company paid a cash dividend of $0.12 per

share.

2024 Outlook

PROG Holdings is updating its full year 2024 outlook for revenue

and earnings as well as providing its outlook for revenues, net

earnings, adjusted EBITDA, GAAP diluted EPS, and non-GAAP diluted

EPS for the second quarter of 2024. This outlook assumes a

difficult operating environment with continued soft demand for

consumer durable goods, no material changes in the Company's

decisioning posture, no material increases in the unemployment rate

for our consumer, an effective tax rate for non-GAAP EPS of

approximately 30%, and no impact from additional share

repurchases.

Revised 2024 Outlook

Previous 2024 Outlook

(In thousands, except per share

amounts)

Low

High

Low

High

PROG Holdings - Total Revenues

$

2,285,000

$

2,360,000

$

2,235,000

$

2,335,000

PROG Holdings - Net Earnings

97,500

108,000

89,500

105,000

PROG Holdings - Adjusted EBITDA

240,000

255,000

230,000

250,000

PROG Holdings - Diluted EPS

2.18

2.43

2.00

2.34

PROG Holdings - Diluted Non-GAAP EPS

2.85

3.10

2.70

3.00

Progressive Leasing - Total Revenues

2,210,000

2,265,000

2,160,000

2,240,000

Progressive Leasing - Earnings Before

Taxes

159,000

169,000

147,000

164,000

Progressive Leasing - Adjusted EBITDA

251,000

261,000

241,000

256,000

Vive - Total Revenues

55,000

65,000

55,000

65,000

Vive - Earnings Before Taxes

1,500

3,000

1,500

3,000

Vive - Adjusted EBITDA

3,000

5,000

3,000

5,000

Other - Total Revenues

20,000

30,000

20,000

30,000

Other - Loss Before Taxes

(20,000

)

(18,000

)

(20,000

)

(18,000

)

Other - Adjusted EBITDA

(14,000

)

(11,000

)

(14,000

)

(11,000

)

Three Months Ended

June 30, 2024

Outlook

(In thousands, except per share

amounts)

Low

High

PROG Holdings - Total Revenues

$

550,000

$

575,000

PROG Holdings - Net Earnings

26,000

29,000

PROG Holdings - Adjusted EBITDA

58,000

63,000

PROG Holdings - Diluted EPS

0.56

0.66

PROG Holdings - Diluted Non-GAAP EPS

0.65

0.75

Conference Call and Webcast

The Company has scheduled a live webcast and conference call for

Wednesday, April 24, 2024, at 8:30 A.M. ET to discuss its financial

results for the first quarter of 2024. To access the live webcast,

visit the Events and Presentations page of the Company’s Investor

Relations website, https://investor.progholdings.com/.

About PROG Holdings, Inc.

PROG Holdings, Inc. (NYSE:PRG) is a fintech holding company

headquartered in Salt Lake City, UT, that provides transparent and

competitive payment options to consumers. The Company owns

Progressive Leasing, a leading provider of e-commerce, app-based,

and in-store point-of-sale lease-to-own solutions, Vive Financial,

an omnichannel provider of second-look revolving credit products,

Four Technologies, a provider of Buy Now, Pay Later payment options

through its platform, Four, and Build, provider of personal credit

building products. More information on PROG Holdings and its

companies can be found at https://investor.progholdings.com/.

Forward-Looking Statements:

Statements in this news release regarding our business that are

not historical facts are "forward-looking statements" that involve

risks and uncertainties which could cause actual results to differ

materially from those contained in the forward-looking statements.

Such forward-looking statements generally can be identified by the

use of forward-looking terminology, such as "continued", "project",

"believe", "expects", "outlook", and similar forward-looking

terminology. These risks and uncertainties include factors such as

(i) continued volatility and challenges in the macro environment

and, in particular, the unfavorable effects on our business of

significant inflation, elevated interest rates, and fears of a

recession, and the impact of those headwinds on: (a) consumer

confidence and customer demand for the merchandise that our POS

partners sell, in particular consumer durables; (b) our customers’

disposable income and their ability to make the lease and loan

payments they owe the Company; (c) the availability of consumer

credit; and (d) our overall financial performance and outlook; (ii)

our businesses being subject to extensive laws and regulations,

including laws and regulations unique to the industries in which

our businesses operate, that may subject them to government

investigations and significant monetary penalties and

compliance-related burdens, as well as an increased focus by

federal, state and local regulators on the industries within which

our businesses operate, including with respect to consumer

protection, customer privacy, third party and employee fraud and

information security; (iii) deteriorating macroeconomic conditions

resulting in the algorithms and other proprietary decisioning tools

used in approving Progressive Leasing and Vive customers for leases

and loans no longer being indicative of their ability to perform,

which may limit the ability of those businesses to avoid lease and

loan charge-offs or may result in their reserves being insufficient

to cover actual losses; (iv) the impact of the cybersecurity

incident experienced by Progressive Leasing in September 2023 and

expenses incurred in connection with responding to the matter,

including the litigation filed in response to that incident, or any

regulatory proceedings that may result from the incident; (v) a

large percentage of the Company’s revenues being concentrated with

several of Progressive Leasing’s key POS partners; (vi) the risks

that Progressive Leasing will be unable to attract new POS partners

or retain and grow its business with its existing POS partners;

(vii) Vive’s and Four’s business models differing significantly

from Progressive Leasing’s, which creates specific and unique risks

for each of the Vive and Four businesses, including Vive’s reliance

on a limited number of bank partners to issue its credit products

and each of Vive’s and Four’s exposure to the unique regulatory

risks associated with the laws and regulations that apply to each

of their businesses; (viii) our ability to continue to protect

confidential, proprietary, or sensitive information, including the

personal and confidential information of our customers, which may

be adversely affected by cyber-attacks, employee or other internal

misconduct, computer viruses, electronic break-ins or "hacking", or

similar disruptions, any one of which could have a material adverse

impact on our results of operations, financial condition, and

prospects; (ix) our cost reduction initiatives may not be adequate

or may have unintended consequences that could be disruptive to our

businesses, including with respect to our global workforce

strategy; (x) the risk that our capital allocation strategy,

including our current stock repurchase and dividend programs, as

well as any future debt repurchase program, will not be effective

at enhancing shareholder value and may have an adverse impact on

our cash reserves; (xi) the loss of the services of our key

executives or our inability to attract and retain key talent,

particularly with respect to our information technology function,

may have a material adverse impact on our operations; (xii)

increased competition from traditional and virtual lease-to-own

competitors and also from competitors of our Vive segment; (xiii)

the transactions offered by our Progressive Leasing, Vive and/or

Four businesses may be negatively characterized by government

officials, consumer advocacy groups or the media; (xiv) real or

perceived software or system errors, failures, bugs, defects or

outages, including those that may be caused by third-party vendors,

may adversely affect Progressive Leasing, Vive or Four; and (xv)

the other risks and uncertainties discussed under "Risk Factors" in

the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the SEC on February 21, 2024.

Statements in this press release that are "forward-looking" include

without limitation statements about: (i) our expectations regarding

GMV growth for the quarter ending June 30, 2024; (ii) our ability

to continue investing in our business, including with respect to

key growth initiatives; (iii) our expectations regarding returning

excess cash to shareholders, including through dividends and/or

share repurchases, and the benefits expected therefrom and (iv) our

revised full year 2024 outlook and our second quarter 2024 outlook.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. Except as required by law, the Company undertakes no

obligation to update these forward-looking statements to reflect

subsequent events or circumstances after the date of this press

release.

PROG Holdings, Inc.

Consolidated Statements of

Earnings

(In thousands, except per

share data)

(Unaudited)

Three Months

Ended

March 31,

2024

2023

REVENUES:

Lease Revenues and Fees

$

620,550

$

637,082

Interest and Fees on Loans Receivable

21,320

18,058

641,870

655,140

COSTS AND EXPENSES:

Depreciation of Lease Merchandise

431,571

435,439

Provision for Lease Merchandise

Write-offs

43,141

38,364

Operating Expenses

127,341

105,259

602,053

579,062

OPERATING PROFIT

39,817

76,078

Interest Expense, Net

(8,250

)

(8,491

)

EARNINGS BEFORE INCOME TAX

EXPENSE

31,567

67,587

INCOME TAX EXPENSE

9,601

19,554

NET EARNINGS

$

21,966

$

48,033

EARNINGS PER SHARE

Basic

$

0.50

$

1.00

Assuming Dilution

$

0.49

$

1.00

CASH DIVIDENDS DECLARED PER

SHARE:

Common Stock

$

0.12

$

—

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic

43,695

47,854

Assuming Dilution

44,528

48,139

PROG Holdings, Inc.

Consolidated Balance

Sheets

(In thousands, except share

data)

(Unaudited)

March 31,

2024

December 31,

2023

ASSETS:

Cash and Cash Equivalents

$

252,826

$

155,416

Accounts Receivable (net of allowances of

$64,272 in 2024 and $64,180 in 2023)

62,043

67,879

Lease Merchandise (net of accumulated

depreciation and allowances of $420,395 in 2024 and $423,466 in

2023)

557,419

633,427

Loans Receivable (net of allowances and

unamortized fees of $47,684 in 2024 and $50,022 in 2023)

117,928

126,823

Property and Equipment, Net

21,862

24,104

Operating Lease Right-of-Use Assets

4,474

9,271

Goodwill

296,061

296,061

Other Intangibles, Net

86,014

91,664

Income Tax Receivable

11,592

32,918

Deferred Income Tax Assets

2,473

2,981

Prepaid Expenses and Other Assets

48,974

50,711

Total Assets

$

1,461,666

$

1,491,255

LIABILITIES & SHAREHOLDERS’

EQUITY:

Accounts Payable and Accrued Expenses

$

139,843

$

151,259

Deferred Income Tax Liabilities

95,674

104,838

Customer Deposits and Advance Payments

33,518

35,713

Operating Lease Liabilities

14,952

15,849

Debt

592,589

592,265

Total Liabilities

876,576

899,924

SHAREHOLDERS' EQUITY:

Common Stock, Par Value $0.50 Per Share:

Authorized: 225,000,000 Shares at March 31, 2024 and December 31,

2023; Shares Issued: 82,078,654 at March 31, 2024 and December 31,

2023

41,039

41,039

Additional Paid-in Capital

346,650

352,421

Retained Earnings

1,309,702

1,293,073

1,697,391

1,686,533

Less: Treasury Shares at Cost

Common Stock: 38,904,934 Shares at March

31, 2024 and 38,404,527 at December 31, 2023

(1,112,301

)

(1,095,202

)

Total Shareholders’ Equity

585,090

591,331

Total Liabilities & Shareholders’

Equity

$

1,461,666

$

1,491,255

PROG Holdings, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Three Months Ended March

31,

2024

2023

OPERATING ACTIVITIES:

Net Earnings

$

21,966

$

48,033

Adjustments to Reconcile Net Earnings to

Cash Provided by Operating Activities:

Depreciation of Lease Merchandise

431,571

435,439

Other Depreciation and Amortization

8,018

7,979

Provisions for Accounts Receivable and

Loan Losses

85,405

78,665

Stock-Based Compensation

6,642

5,415

Deferred Income Taxes

(8,656

)

(10,360

)

Impairment of Assets

6,018

—

Non-Cash Lease Expense

(615

)

(739

)

Other Changes, Net

115

(814

)

Changes in Operating Assets and

Liabilities:

Additions to Lease Merchandise

(400,479

)

(399,289

)

Book Value of Lease Merchandise Sold or

Disposed

44,916

40,225

Accounts Receivable

(68,520

)

(61,249

)

Prepaid Expenses and Other Assets

1,829

(5,087

)

Income Tax Receivable and Payable

21,076

26,295

Accounts Payable and Accrued Expenses

(11,358

)

(4,501

)

Customer Deposits and Advance Payments

(2,195

)

(2,593

)

Cash Provided by Operating Activities

135,733

157,419

INVESTING ACTIVITIES:

Investments in Loans Receivable

(76,963

)

(43,045

)

Proceeds from Loans Receivable

75,448

44,128

Outflows on Purchases of Property and

Equipment

(2,096

)

(1,678

)

Proceeds from Property and Equipment

14

5

Cash Used in Investing Activities

(3,597

)

(590

)

FINANCING ACTIVITIES:

Dividends Paid

(5,221

)

—

Acquisition of Treasury Stock

(24,437

)

(36,472

)

Issuance of Stock Under Stock Option and

Employee Purchase Plans

123

—

Shares Withheld for Tax Payments

(5,191

)

(2,393

)

Cash Used in Financing Activities

(34,726

)

(38,865

)

Increase in Cash and Cash Equivalents

97,410

117,964

Cash and Cash Equivalents at Beginning of

Period

155,416

131,880

Cash and Cash Equivalents at End of

Period

$

252,826

$

249,844

Net Cash Paid (Received) During the

Period:

Interest

$

224

$

268

Income Taxes

$

(3,836

)

$

2,532

PROG Holdings, Inc.

Quarterly Revenues by

Segment

(In thousands)

(Unaudited)

Three Months Ended

March 31, 2024

Progressive Leasing

Vive

Other

Consolidated Total

Lease Revenues and Fees

$

620,550

$

—

$

—

$

620,550

Interest and Fees on Loans Receivable

—

16,051

5,269

21,320

Total Revenues

$

620,550

$

16,051

$

5,269

$

641,870

(Unaudited)

Three Months Ended

March 31, 2023

Progressive Leasing

Vive

Other

Consolidated Total

Lease Revenues and Fees

$

637,082

$

—

$

—

$

637,082

Interest and Fees on Loans Receivable

—

17,153

905

18,058

Total Revenues

$

637,082

$

17,153

$

905

$

655,140

PROG Holdings, Inc.

Gross Merchandise Volume by

Quarter

(In thousands)

(Unaudited)

Three Months Ended March

31,

2024

2023

Progressive Leasing

$

418,512

$

418,683

Vive

31,602

36,530

Other

48,791

13,607

Total GMV

$

498,905

$

468,820

Use of Non-GAAP Financial Information:

Non-GAAP net earnings, non-GAAP diluted earnings per share, and

adjusted EBITDA are supplemental measures of our performance that

are not calculated in accordance with generally accepted accounting

principles in the United States ("GAAP"). Non-GAAP diluted earnings

per share for the full year 2024 outlook excludes intangible

amortization expense, restructuring expenses, and accrued interest

on an uncertain tax position related to Progressive Leasing's $175

million settlement with the FTC in 2020. Non-GAAP diluted earnings

per share for the second quarter 2024 outlook excludes intangible

amortization expense and accrued interest on an uncertain tax

position related to Progressive Leasing's $175 million settlement

with the FTC in 2020. Non-GAAP net earnings and non-GAAP diluted

earnings per share for the three months ended March 31, 2024

exclude intangible amortization expense, restructuring expenses,

costs related to the cybersecurity incident, and accrued interest

on an uncertain tax position related to Progressive Leasing's $175

million settlement with the FTC in 2020. Non-GAAP net earnings and

non-GAAP diluted earnings per share for the three months ended

March 31, 2023 exclude intangible amortization expense,

restructuring expenses, regulatory insurance recoveries, and

accrued interest on an uncertain tax position related to

Progressive Leasing's $175 million settlement with the FTC in 2020.

The amount for the after-tax non-GAAP adjustment, which is tax

effected using our statutory tax rate, can be found in the

reconciliation of net earnings and earnings per share assuming

dilution to non-GAAP net earnings and earnings per share assuming

dilution table in this press release.

The Adjusted EBITDA figures presented in this press release are

calculated as the Company’s earnings before interest expense, net,

depreciation on property and equipment, amortization of intangible

assets and income taxes. Adjusted EBITDA for the three months ended

March 31, 2024 excludes stock-based compensation expense,

restructuring expenses, and costs related to the cybersecurity

incident. Adjusted EBITDA for full year 2024 outlook excludes

stock-based compensation expense and restructuring expenses.

Adjusted EBITDA for second quarter 2024 outlook excludes

stock-based compensation expense. Adjusted EBITDA for the three

months ended March 31, 2023 excludes stock-based compensation

expense, restructuring expenses, and regulatory insurance

recoveries. The amounts for these pre-tax non-GAAP adjustments can

be found in the segment EBITDA tables in this press release.

Management believes that non-GAAP net earnings, non-GAAP diluted

earnings per share, and adjusted EBITDA provide relevant and useful

information, and are widely used by analysts, investors and

competitors in our industry as well as by our management in

assessing both consolidated and business unit performance.

Non-GAAP net earnings, non-GAAP diluted earnings, and adjusted

EBITDA provide management and investors with an understanding of

the results from the primary operations of our business by

excluding the effects of certain items that generally arose from

larger, one-time transactions that are not reflective of the

ordinary earnings activity of our operations or transactions that

have variability and volatility of the amount. We believe the

exclusion of stock-based compensation expense provides for a better

comparison of our operating results with our peer companies as the

calculations of stock-based compensation vary from period to period

and company to company due to different valuation methodologies,

subjective assumptions and the variety of award types. This measure

may be useful to an investor in evaluating the underlying operating

performance of our business.

Adjusted EBITDA also provides management and investors with an

understanding of one aspect of earnings before the impact of

investing and financing charges and income taxes. These measures

may be useful to an investor in evaluating our operating

performance because the measures:

- Are widely used by investors to measure a company’s operating

performance without regard to items excluded from the calculation

of such measure, which can vary substantially from company to

company depending upon accounting methods, book value of assets,

capital structure and the method by which assets were acquired,

among other factors.

- Are used by rating agencies, lenders and other parties to

evaluate our creditworthiness.

- Are used by our management for various purposes, including as a

measure of performance of our operating entities and as a basis for

strategic planning and forecasting.

Non-GAAP financial measures, however, should not be used as a

substitute for, or considered superior to, measures of financial

performance prepared in accordance with GAAP, such as the Company’s

GAAP basis net earnings and diluted earnings per share and the GAAP

revenues and earnings before income taxes of the Company’s

segments, which are also presented in the press release. Further,

we caution investors that amounts presented in accordance with our

definitions of non-GAAP net earnings, non-GAAP diluted earnings per

share, and adjusted EBITDA may not be comparable to similar

measures disclosed by other companies, because not all companies

and analysts calculate these measures in the same manner.

PROG Holdings, Inc.

Reconciliation of Net Earnings

and Earnings Per Share Assuming Dilution to Non-GAAP Net Earnings

and Earnings Per Share Assuming Dilution

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Net Earnings

$

21,966

$

48,033

Add: Intangible Amortization Expense

5,650

5,724

Add: Restructuring Expense

18,014

757

Add: Costs Related to the Cybersecurity

Incident

116

—

Less: Regulatory Insurance Recoveries

—

(525

)

Less: Tax Impact of Adjustments(1)

(6,183

)

(1,549

)

Add: Accrued Interest on FTC Settlement

Uncertain Tax Position

1,078

970

Non-GAAP Net Earnings

$

40,641

$

53,410

Earnings Per Share Assuming Dilution

$

0.49

$

1.00

Add: Intangible Amortization Expense

0.13

0.12

Add: Restructuring Expense

0.40

0.02

Add: Costs Related to the Cybersecurity

Incident

—

—

Less: Regulatory Insurance Recoveries

—

(0.01

)

Less: Tax Impact of Adjustments(1)

(0.14

)

(0.03

)

Add: Accrued Interest on FTC Settlement

Uncertain Tax Position

0.02

0.02

Non-GAAP Earnings Per Share Assuming

Dilution(2)

$

0.91

$

1.11

Weighted Average Shares Outstanding

Assuming Dilution

44,528

48,139

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Quarterly Segment

EBITDA

(In thousands)

(Unaudited)

Three Months Ended

March 31, 2024

Progressive Leasing

Vive

Other

Consolidated Total

Net Earnings

$

21,966

Income Tax Expense(1)

9,601

Earnings (Loss) Before Income Tax

Expense

$

35,453

$

918

$

(4,804

)

31,567

Interest Expense, Net

8,567

—

(317

)

8,250

Depreciation

1,810

166

392

2,368

Amortization

5,421

—

229

5,650

EBITDA

51,251

1,084

(4,500

)

47,835

Stock-Based Compensation

4,711

338

1,593

6,642

Restructuring Expense

18,014

—

—

18,014

Costs Related to the Cybersecurity

Incident

116

—

—

116

Adjusted EBITDA

$

74,092

$

1,422

$

(2,907

)

$

72,607

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

(Unaudited)

Three Months Ended

March 31, 2023

Progressive Leasing

Vive

Other

Consolidated Total

Net Earnings

$

48,033

Income Tax Expense(1)

19,554

Earnings (Loss) Before Income Tax

Expense

$

71,051

$

2,163

$

(5,627

)

67,587

Interest Expense, Net

8,200

291

—

8,491

Depreciation

1,905

168

182

2,255

Amortization

5,421

—

303

5,724

EBITDA

86,577

2,622

(5,142

)

84,057

Stock-Based Compensation

3,553

288

1,574

5,415

Restructuring Expense

757

—

—

757

Regulatory Insurance Recoveries

(525

)

—

—

(525

)

Adjusted EBITDA

$

90,362

$

2,910

$

(3,568

)

$

89,704

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Reconciliation of Revised Full

Year 2024 Outlook for Adjusted EBITDA

(In thousands)

Fiscal Year 2024

Ranges

Progressive Leasing

Vive

Other

Consolidated Total

Estimated Net Earnings

$97,500 - $108,000

Income Tax Expense(1)

43,000 - 46,000

Projected Earnings (Loss) Before Income

Tax Expense

$159,000 - $169,000

$1,500 - $3,000

$(20,000) - $(18,000)

140,500 - 154,000

Interest Expense, Net

31,000 - 29,000

—

—

31,000 - 29,000

Depreciation

8,000

500

2,000

10,500

Amortization

17,000

—

1,000

18,000

Projected EBITDA

215,000 - 223,000

2,000 - 3,500

(17,000) - (15,000)

200,000 - 211,500

Stock-Based Compensation

18,000 - 20,000

1,000 - 1,500

3,000 - 4,000

22,000 - 25,500

Restructuring Expense

18,000

—

—

18,000

Projected Adjusted EBITDA

$251,000 - $261,000

$3,000 - $5,000

$(14,000) - $(11,000)

$240,000 - $255,000

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Reconciliation of Previous

Full Year 2024 Outlook for Adjusted EBITDA

(In thousands)

Fiscal Year 2024

Ranges

Progressive Leasing

Vive

Other

Consolidated Total

Estimated Net Earnings

$89,500 - $105,000

Income Tax Expense(1)

39,000 - 44,000

Projected Earnings (Loss) Before Income

Tax Expense

$147,000 - $164,000

$1,500 - $3,000

$(20,000) - $(18,000)

128,500 - 149,000

Interest Expense, Net

31,000 - 29,000

—

—

31,000 - 29,000

Depreciation

8,000

500

2,000

10,500

Amortization

17,000

—

1,000

18,000

Projected EBITDA

203,000 - 218,000

2,000 - 3,500

(17,000) - (15,000)

188,000 - 206,500

Stock-Based Compensation

18,000 - 20,000

1,000 - 1,500

3,000 - 4,000

22,000 - 25,500

Restructuring Expense

20,000 - 18,000

—

—

20,000 - 18,000

Projected Adjusted EBITDA

$241,000 - $256,000

$3,000 - $5,000

$(14,000) - $(11,000)

$230,000 - $250,000

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Non-GAAP Financial

Information

Reconciliation of the Three

Months Ended June 30, 2024 Outlook for Adjusted EBITDA

(In thousands)

Three Months Ended

June 30, 2024

Outlook

Consolidated Total

Estimated Net Earnings

$26,000 - $29,000

Income Tax Expense(1)

11,000 - 12,000

Projected Earnings Before Income Tax

Expense

37,000 - 41,000

Interest Expense, Net

8,000 - 7,500

Depreciation

2,500

Amortization

4,000

Projected EBITDA

51,500 - 55,000

Stock-Based Compensation

6,500 - 8,000

Projected Adjusted EBITDA

$58,000 - $63,000

(1)

Taxes are calculated on a consolidated

basis and are not identifiable by Company segment.

PROG Holdings, Inc.

Reconciliation of Revised Full

Year 2024 Outlook for Earnings Per Share

Assuming Dilution to Non-GAAP

Earnings Per Share Assuming Dilution

Full Year 2024

Low

High

Projected Earnings Per Share Assuming

Dilution

$

2.18

$

2.43

Add: Projected Intangible Amortization

Expense

0.41

0.41

Add: Projected Interest on FTC Settlement

Uncertain Tax Position

0.07

0.07

Add: Projected Restructuring Expense

0.41

0.41

Subtract: Tax Effect on Non-GAAP

Adjustments(1)

(0.21

)

(0.21

)

Projected Non-GAAP Earnings Per Share

Assuming Dilution(2)

$

2.85

$

3.10

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

PROG Holdings, Inc.

Reconciliation of Previous

Full Year 2024 Outlook for Earnings Per Share

Assuming Dilution to Non-GAAP

Earnings Per Share Assuming Dilution

Full Year 2024

Low

High

Projected Earnings Per Share Assuming

Dilution

$

2.00

$

2.34

Add: Projected Intangible Amortization

Expense

0.40

0.40

Add: Projected Interest on FTC Settlement

Uncertain Tax Position

0.07

0.07

Add: Projected Restructuring Expense

0.44

0.40

Subtract: Tax Effect on Non-GAAP

Adjustments(1)

(0.22

)

(0.21

)

Projected Non-GAAP Earnings Per Share

Assuming Dilution(2)

$

2.70

$

3.00

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

PROG Holdings, Inc.

Reconciliation of the Three

Months Ended June 30, 2024 Outlook for Earnings Per Share

Assuming Dilution to Non-GAAP

Earnings Per Share Assuming Dilution

Three Months Ended

June 30, 2024

Low

High

Projected Earnings Per Share Assuming

Dilution

$

0.56

$

0.66

Add: Projected Intangible Amortization

Expense

0.09

0.09

Add: Projected Interest on FTC Settlement

Uncertain Tax Position

0.02

0.02

Subtract: Tax Effect on Non-GAAP

Adjustments(1)

(0.02

)

(0.02

)

Projected Non-GAAP Earnings Per Share

Assuming Dilution(2)

$

0.65

$

0.75

(1)

Adjustments are tax-effected using an

assumed statutory tax rate of 26%.

(2)

In some cases, the sum of individual EPS

amounts may not equal total non-GAAP EPS calculations due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424397279/en/

Investor Contact John A. Baugh, CFA Vice President,

Investor Relations john.baugh@progleasing.com

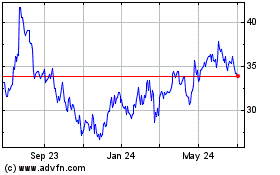

PROG (NYSE:PRG)

Historical Stock Chart

From Nov 2024 to Dec 2024

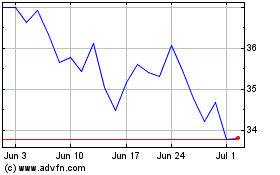

PROG (NYSE:PRG)

Historical Stock Chart

From Dec 2023 to Dec 2024