U.S. Futures Surge on Nvidia’s Stellar Performance, Global Markets Respond Positively

February 22 2024 - 6:05AM

IH Market News

On Thursday, U.S. futures were on the rise, driven by

significant gains from Nvidia (NASDAQ:NVDA) after

market close, following the semiconductor giant’s announcement of

surprisingly positive results and encouraging forecasts.

At 05:08 AM, Dow Jones futures (DOWI:DJI) were

up 73 points, or 0.19%. S&P 500 futures rose

1.14%, and Nasdaq-100 futures were up 2.01%. The

yield on 10-year Treasury bonds was at 4.307%.

In the commodities market, West Texas Intermediate crude oil for

April was up 0.60% at $78.38 per barrel. Brent crude for April rose

0.51%, near $83.45 per barrel. Iron ore traded on the Dalian

exchange fell 1.49% to $124.26 per metric ton. The benchmark iron

ore for March on the Singapore Exchange rose 0.15% to $119.25.

On Thursday, the U.S. economic agenda will be full of important

indicators. At 08:30 AM, the Chicago Fed will release the national

activity index for January. At the same time, the Department of

Labor will report last week’s unemployment insurance claims. At

09:45 AM, attention turns to the preliminary PMI indices from

S&P Global, which will assess activity in the industrial and

services sectors for February. The Department of Energy will reveal

the position of oil stocks at 11:00 AM, while the NAR, at 10:00 AM,

will bring January’s used residential real estate sales,

highlighting trends in the real estate sector.

Additionally, five Fed members will participate in public

events: Philip Jefferson (10 AM) and Patrick Harker (2 PM), and

after the market closes, Lisa Cook and Neel Kashkari (5 PM), along

with Christopher Waller (7.35 PM).

On Wednesday, U.S. markets experienced a volatile day, closing

mixed after a late recovery. The Nasdaq ended lower for the third

day, while the Dow and S&P 500 saw modest gains. Concerns about

interest rates, fueled by the cautious minutes from the Fed,

dominated the session. The hope for future rate cuts and optimism

ahead of Nvidia’s (NASDAQ:NVDA) results helped

reverse some of the early losses.

Asian markets closed higher, with Tokyo breaking its all-time

record, boosted by Nvidia’s success and Beijing’s measures to

strengthen markets. The Nikkei rose 2.19%, reflecting optimism in

technology and regional economic stability. In addition to Tokyo,

Shanghai advanced 1.27%, Hong Kong 1.45%, Seoul 0.41%, and

Australia saw a slight increase of 0.04%.

European markets are performing positively, focused on corporate

results, economic indicators, and inflationary trends. The

highlight is Rolls Royce (LSE:RR.) in London,

whose shares soared over 7% after the aerospace group doubled its

annual profits in 2023.

On the earnings front for Thursday, scheduled to present

financial reports before the market opens are

Moderna (NASDAQ:MRNA), Newmont

(NYSE:NEM), Nikola (NASDAQ:NKLA),

Fiverr (NYSE:FVRR), Wayfair

(NYSE:W), Cheniere (NYSE:LNG), Pioneer

Natural Resources (NYSE:PXD), among others.

After the market closes, reports from Block

(NYSE:SQ), Carvana (NYSE:CVNA), Mercado

Libre (NASDAQ:MELI), Nu Holdings

(NYSE:NU), Booking Holdings (NASDAQ:BKNG),

Intuit (NASDAQ:INTU), Live Nation

(NYSE:LYV), Vale (NYSE:VALE),

Ardelyx (NASDAQ:ARDX), and more are awaited.

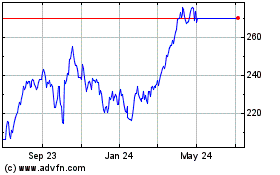

Pioneer Natural Resources (NYSE:PXD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pioneer Natural Resources (NYSE:PXD)

Historical Stock Chart

From Nov 2023 to Nov 2024