A.M. Best Affirms Credit Ratings of Spirit Insurance Company and Radius Insurance Company

November 16 2016 - 1:41PM

Business Wire

A.M. Best has affirmed the Financial Strength Rating of A

(Excellent) and the Long-Term Issuer Credit Ratings of “a” of

Spirit Insurance Company (Spirit) (Burlington, VT)

and Radius Insurance Company (Radius) (Cayman Islands). The

outlook of these Credit Ratings (ratings) is stable.

The rating affirmations reflect Spirit’s and Radius’ excellent

risk-adjusted capitalization, sound risk management practices,

history of profitable business written from a predecessor captive,

as well as the position they hold as the captive insurers for their

ultimate parent, Phillips 66 [NYSE: PSX]. The ratings also

consider the level of commitment on the part of Phillips 66, whose

management incorporates Spirit and Radius as core elements in its

overall risk management program.

Partially offsetting these positive rating factors are Spirit’s

and Radius’ exposure to large losses due to the limits offered on

their respective policies and their significant dependence on

reinsurance protection. In addition, Spirit’s terrorism risk

exposure remains relatively high on a gross basis.

Spirit provides property damage, business interruption and

excess liability insurance to Phillips 66 and affiliates and

subsidiaries related to domestic U.S. operations only, while Radius

provides similar coverage (property damage, business interruption,

excess liability), as well as marine hull and cargo insurance to

Phillips 66 and affiliates, and subsidiaries related to non-U.S.

risks in which Phillips 66 has ownership interests.

Business is written separately by Spirit and Radius, and each

company has a history of strong underwriting results and operating

returns. The captives’ loss experience has remained favorable due

in part to no material catastrophe events and the strong loss

control programs at the parent. Phillips 66 conducts periodic

reviews of Spirit’s and Radius’ potential loss exposures through an

industrial risks specialist. Although the majority of Spirit’s

capital is loaned to its parent, there is limited counterparty risk

due to the affiliation of the two companies and the alignment of

interests.

Additionally, Spirit provides terrorism coverage to its parent.

While terrorism risk exposure remains relatively high on a gross

basis, concerns are mitigated by reinsurance protection afforded by

the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA).

However, due to the temporary nature of TRIPRA, A.M. Best will

continue to monitor the company’s gross terrorism risk exposure

over time as it relates to the company’s risk management practices

and overall capacity.

A.M. Best remains the leading rating agency of alternative risk

transfer entities, with more than 200 such vehicles rated in the

United States and throughout the world. For current Best’s Credit

Ratings and independent data on the captive and alternative risk

transfer insurance market, please visit www.ambest.com/captive.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2016 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161116006392/en/

A.M. BestAlexander Sarfo, +1 908-439-2200, ext.

5779Senior Financial

Analystalexander.sarfo@ambest.comorGary A. Davis, +1

908-439-2200, ext.

5665Directorgary.davis@ambest.comorChristopher

Sharkey, +1 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy, +1

908-439-2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

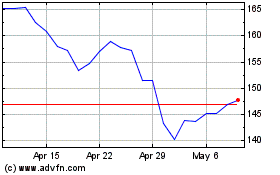

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Dec 2024 to Jan 2025

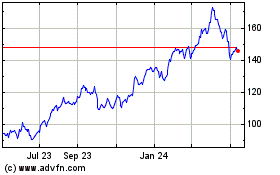

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Jan 2024 to Jan 2025