Phillips 66 Partners to Acquire $1.3 Billion in Assets From Parent

October 11 2016 - 1:54PM

Dow Jones News

By Ezequiel Minaya

Phillips 66 Partners LPP (PSXP), a master limited partnership

formed to own some of Phillips 66′s (PSX) oil pipelines and other

assets, said Tuesday it had acquired some 30 pipelines and terminal

systems from its parent company in a so-called dropdown deal valued

at $1.3 billion.

The Houston-based partnership said it would finance the deal

with a combination of debt and $196 million in new units--which

trade on exchanges like common shares--issued to Phillips 66. The

deal is expected to close this month and be immediately accretive

to unitholders, the partnership said.

"As our largest dropdown acquisition to date, this represents a

milestone for the partnership and will provide additional fee-based

income and diversity to our already strong midstream portfolio,"

said Phillips 66 Partners Chief Executive Greg Garland.

Many companies that own energy infrastructure--pipelines,

storage tanks, rail terminals--have spun them off in master limited

partnerships, which don't pay corporate income taxes and distribute

available cash to their investors.

Master limited partnerships need fresh sources of cash to pay

out to investors. They get the money by buying new

businesses--often in deals with their parent companies known as

dropdowns.

--Alison Sider contributed to this article

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

October 11, 2016 13:39 ET (17:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

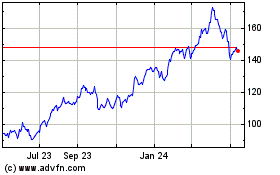

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Dec 2024 to Jan 2025

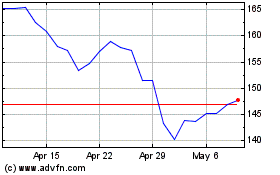

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Jan 2024 to Jan 2025