Continued progress on 2024 priorities with good financial and

operational performance; all divisions delivered underlying sales

growth in Q3; on track to meet full year expectations.

Highlights

- Advancing our 2024 strategic priorities:

- Progressing in Enterprise: signed a new meaningful

multi-year enterprise deal with ServiceNow and expanded our

partnership with Degreed.

- Scaling AI across our products and services: double-digit

year-over-year billings growth in Higher Education products with AI

study tools, and developing English Language Learning Teaching Pal

to create customised lesson content and activities.

- Underlying Group sales growth1: up 5% in Q3, resulting in 3%

growth for the nine-month period, excluding OPM2 and Strategic

Review3 businesses.

- Delivered a comprehensive performance: all divisions grew in

Q3, including Higher Education.

- On track to meet full-year expectations.

Omar Abbosh, Pearson’s Chief Executive, said:

“Pearson is delivering on the three priorities for 2024 that I

identified at the start of the year. First, our focus on

operational and financial performance has driven growth across all

divisions this quarter and we are on track to meet full-year

expectations. Second, we are accelerating our AI capabilities

across the business and starting to see the commercial benefit.

Third, expanded enterprise relationships with companies such as

ServiceNow demonstrate progress on our intention to expand in

workforce learning.”

Underlying sales growth1 of 3% for the nine months, 5% for

Q3, excluding OPM2 and Strategic Review3 businesses; 2% in

aggregate for the nine months

- Assessment & Qualifications sales were up 3% for the

nine-month period, with growth accelerating in Q3, as expected, and

all businesses contributing to growth.

- Virtual Learning sales were up 4% for Q3 due to 4% growth in

Virtual Schools, with 2024/25 academic enrolments up 4% on a same

school basis. Virtual Learning sales declined 4% for the nine-month

period attributable to the final portion of the OPM ASU contract in

the first half of 2023.

- Higher Education returned to growth in Q3 with sales up 4% and

is on track to grow for the full year, driven by the operational

and business changes implemented over the past 18 months. Higher

Education sales were flat for the nine-month period.

- English Language Learning sales were up 7% for the nine-month

period driven by a strong performance in Institutional. In Q3,

sales were up 2% with some Institutional sales moving to Q4.

- Workforce Skills sales were up 6% for the nine-month period and

also for Q3, with solid performances in both Vocational

Qualifications and Workforce Solutions.

Strong financial position

- Pearson’s financial position remains robust, with a strong

balance sheet.

- Moody’s recently upgraded Pearson’s long-term issuer rating to

Baa2 and moved the outlook to stable

- We completed our £500m share buyback with 7% of shares bought

back.

- We issued a £350m Educational Bond.

- The UK government and other parties have successfully appealed

against the 2019 European Commission decision that the UK

controlled foreign company group financing partial exemption

partially constitutes State Aid. This means that the £105m

previously paid in relation to this will be recovered at some point

in the future and we will release the related £63m tax provision in

2024, with the impact of the provision release captured outside of

adjusted earnings.

2024 outlook – full year guidance reaffirmed

- Group underlying sales growth, adjusted operating profit,

interest and tax outlook for 2024 remain in line with market

expectations4. As guided, free cash flow conversion is expected to

be 95-100%.

- We expect interest to be in line with guidance of c.£45m with

recovery of interest on the State Aid payment offset by increased

interest given our recent bond issue.

Financial summary Underlying growth for the third quarter

and nine months ended 30th September 2024 compared to the

equivalent period in 2023.

Sales

Q3

Nine months

Assessment & Qualifications

6%

3%

Virtual Learning

4%

(4)%

Higher Education

4%

0%

English Language Learning

2%

7%

Workforce Skills

6%

6%

Strategic Review

(100)%

(100)%

Total

4%

2%

Total, excluding OPM2 and Strategic

Review3

5%

3%

1Throughout this announcement growth rates

are stated on an underlying basis unless otherwise stated.

Underlying growth rates exclude currency movements, and portfolio

changes.

2We completed the sale of the Pearson

Online Learning Services (POLS) business in June 2023 and as such

have removed it from underlying measures throughout. Within this

specific measure we exclude our entire OPM business (POLS and ASU)

to aid comparison to guidance.

3Strategic Review is sales in

international courseware local publishing businesses which have

been wound down. As expected, there are no sales in these

businesses in 2024.

42024 consensus on the Pearson website

dated 30th August 2024; adjusted operating profit of £598m at £:$

1.27. Based on the strengthening of the £:$ rate, our average rate

for profits through the first 9 months of 2024 is 1.28. As a

reminder, every 1c movement in £:$ rate will equate to

approximately £5m adjusted operating profit impact.

Assessment & Qualifications In Assessment &

Qualifications, sales growth accelerated in Q3 to 6%, with the

business unit up 3% for the nine-month period.

Pearson VUE sales were up 3% for the nine-month period driven by

favorable mix and value-added services, with PDRI seeing good

growth. We have launched a new Generative AI Foundations

certification, to be delivered on Pearson VUE’s online testing

platform (OnVUE) and in physical test centres. This certificate

will equip professionals and students with the essential skills

needed to work with these technologies.

In US Student Assessment, sales were up 1% for the nine-month

period as phasing normalised.

In Clinical Assessment, sales were up 3% for the nine-month

period, due to pricing, digital product growth and successful new

product launches.

In UK and International Qualifications, sales were up 7% for the

nine-month period largely driven by volume, pricing and

International growth.

We continue to expect low to mid-single digit sales growth for

the full year.

Virtual Learning In Virtual Learning, sales were up 4%

for Q3 due to 4% growth in Virtual Schools with 2024/25 academic

enrolments up 4% on a same school basis. Virtual Learning sales

declined 4% for the nine-month period attributable to the final

portion of the OPM ASU contract in the first half of 2023.

In Virtual Schools, we previously announced the opening of 3 new

schools this year and a further 19 career programmes. This brings

our total number of schools to 40, with 24 career programmes,

across 30 states for the 2024/25 academic year. Students now have

access to expanded college and early career readiness offerings,

including through credentials via Credly, and college cost savings

via new partnerships with institutions like Southern New Hampshire

University.

We have also embedded AI study tools into our Virtual Schools

content so that when high school students struggle with quizzes and

practice tests, they can receive step-by-step help to walk them

through tough material.

Full year expectations for Virtual Schools remain unchanged with

sales expected to be down a similar rate to 2023 reflecting the

previously announced school losses. As a reminder, Q4 performance

will be impacted by the catch up in funding that we saw in Q4 last

year.

Higher Education In Higher Education, sales grew 4% in Q3

and were flat for the nine-month period, in line with

expectations.

In US Higher Education, Q3 sales growth was driven by gains in

adoption share, enrolments and pricing partially offset by mix

impacts and revenue deferral. In the nine-month period, there was

3% growth in US digital subscriptions and Inclusive Access growth

of 24%.

We continue to see good engagement with our AI study tools with

over 5 million student interactions in the nine-month period to

September following the roll out of our AI study tools. We extended

the AI study tools to more than 90 titles for Fall Back to School.

This has helped to drive double-digit billings growth

year-over-year in products with AI study tools.

On 1st October 2024, Pearson began to directly distribute our

proprietary Advanced Placement (AP®), Dual Enrollment, and Career

and Technical Education (CTE) materials into states and school

districts, which were previously distributed by a third party. The

dedicated sales team that Pearson has invested in will enable us to

expand and strengthen customer relationships with US school

administrators as the demand for college and career readiness

programmes grows.

We continue to expect sales growth for the full year.

English Language Learning In English Language Learning,

sales increased 2% for Q3 and 7% for the nine-month period.

Institutional performance continued to be strong for the

nine-month period, with particularly good growth in LATAM and

Middle East markets, albeit sales were down in Q3 due to phasing

shifts to Q4.

We are infusing AI into our English Language Learning division

with the development of Teaching Pal, an AI-powered tool designed

to simplify educators' work by creating customised lesson content

and activities, leveraging our trusted IP.

We continue to expect high-single digit sales growth for the

full year.

Workforce Skills In Workforce Skills, sales increased 6%

for Q3 and the nine-month period.

There was solid performance in both the Vocational

Qualifications and Workforce Solutions businesses.

Pearson has many of the assets that enterprises need to address

their problems in talent planning, talent sourcing and talent

development, and through bundling our existing products we can

unlock synergies across the company. We have recently signed a

meaningful multi-year deal with ServiceNow. The first phase is

aimed at reshaping how their employees and professional communities

develop and verify critical skills and drive productivity in the

era of AI, using Pearson’s research, insights and Credly

capabilities.

We are also expanding our partnership with Degreed through

integrating Faethm data sets into Degreed’s platform, offering

real-time insights into the most relevant skills across industries,

allowing companies to benchmark skills, identify gaps, and

prioritise key areas for upskilling.

Contacts

Investor Relations

Jo Russell

+44 (0) 7785 451 266

Alex Shore

+44 (0) 7720 947 853

Gemma Terry

+44 (0) 7841 363 216

Brennan Matthews

+1 (332) 238 8785

Media

Teneo

Ed Cropley

+44 (0) 7492 949 346

Pearson

Laura Ewart

+44 (0) 7798 846 805

Virtual event

Pearson’s 2024 nine month trading update

is taking place today at 08:30 (GMT). Register to receive log in

details: https://pearson.connectid.cloud/register

About Pearson At Pearson, our purpose is simple: to help

people realise the life they imagine through learning. We believe

that every learning opportunity is a chance for a personal

breakthrough. That’s why our Pearson employees are committed to

creating vibrant and enriching learning experiences designed for

real-life impact. We are the world’s lifelong learning company,

serving customers with digital content, assessments,

qualifications, and data. For us, learning isn’t just what we do.

It’s who we are. Visit us at pearsonplc.com.

Notes Forward looking statements: Except for the

historical information contained herein, the matters discussed in

this statement include forward-looking statements. In particular,

all statements that express forecasts, expectations and projections

with respect to future matters, including trends in results of

operations, margins, growth rates, overall market trends, the

impact of interest or exchange rates, the availability of

financing, anticipated cost savings and synergies and the execution

of Pearson’s strategy, are forward-looking statements. By their

nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in future. They are based on numerous assumptions regarding

Pearson’s present and future business strategies and the

environment in which it will operate in the future. There are a

number of factors which could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements, including a number of factors outside

Pearson’s control. These include international, national and local

conditions, as well as competition. They also include other risks

detailed from time to time in Pearson’s publicly-filed documents

and you are advised to read, in particular, the risk factors set

out in Pearson’s latest annual report and accounts, which can be

found on its website (www.pearsonplc.com). Any forward-looking

statements speak only as of the date they are made, and Pearson

gives no undertaking to update forward-looking statements to

reflect any changes in its expectations with regard thereto or any

changes to events, conditions or circumstances on which any such

statement is based. Readers are cautioned not to place undue

reliance on such forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029832586/en/

Investor Relations Jo Russell +44 (0) 7785 451 266 Alex

Shore +44 (0) 7720 947 853 Gemma Terry +44 (0) 7841 363 216 Brennan

Matthews +1 (332) 238 8785

Media Teneo Ed Cropley +44 (0) 7492 949 346

Pearson Laura Ewart +44 (0) 7798 846 805

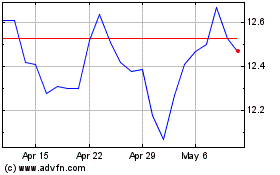

Pearson (NYSE:PSO)

Historical Stock Chart

From Dec 2024 to Jan 2025

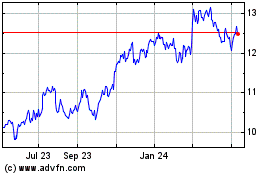

Pearson (NYSE:PSO)

Historical Stock Chart

From Jan 2024 to Jan 2025