false000070882100007088212025-02-282025-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 28, 2025

PAR Technology Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-09720 | 16-1434688 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413-4991

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (315) 738-0600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | PAR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2025, PAR Technology Corporation (“Company”) issued a press release to report its financial results for the quarter and year ended December 31, 2024. A copy of the press release is attached to this current report on Form 8-K as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

There will be a conference call at 9:00 a.m. (Eastern) on February 28, 2025, during which management will discuss the Company’s financial results for the fourth quarter and year ended December 31, 2024. The conference call will be webcast live. To access the webcast, please visit the Investor Relations section of the Company's website at www.partech.com/investor-relations/. A recording of the webcast will be available on this site after the event.

The Company's quarterly earnings presentation containing additional information for the quarter ended December 31, 2024 is attached to this current report on Form 8-K as Exhibit 99.2.

Item 8.01 Other Events.

The Company will hold its 2025 Annual Meeting of Shareholders on Monday, June 2, 2025. Additional information regarding the Company's 2025 Annual Meeting of Shareholders will be disclosed in the Company's Proxy Statement to be filed with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PAR TECHNOLOGY CORPORATION |

| | (Registrant) |

| | |

| Date: | February 28, 2025 | /s/ Bryan A. Menar |

| | Bryan A. Menar |

| | Chief Financial Officer |

| | (Principal Financial Officer) |

Exhibit 99.1

| | | | | |

FOR RELEASE: CONTACT: | New Hartford, NY, February 28, 2025 Christopher R. Byrnes (315) 743-8376 chris_byrnes@partech.com, www.partech.com |

PAR TECHNOLOGY CORPORATION ANNOUNCES FOURTH QUARTER AND FULL YEAR 2024 RESULTS

•Annual Recurring Revenue (ARR)(1) grew to $276.0 million - total growth of 102% inclusive of organic growth of 21% from $136.9 million reported in Q4 '23

•Quarterly subscription service revenues increased 95% year-over-year, inclusive of organic growth of 25% from Q4 '23

•PAR acquired Delaget, LLC ("Delaget"), a leading provider of restaurant analytics and business intelligence solutions

New Hartford, NY - February 28, 2025 -- PAR Technology Corporation (NYSE: PAR) (“PAR Technology” or the “Company”) today announced its financial results for the fourth quarter and year ended December 31, 2024.

PAR CEO, Savneet Singh commented, "We delivered a strong fourth quarter, with 21% organic ARR growth year-over-year and our second consecutive quarter of positive Adjusted EBITDA, proving out our better together thesis. 2024 was a milestone year for PAR with what I believe is our best organic execution yet. That execution, combined with the addition of accretive modules, sets our company up to keep our flywheel moving aggressively for years to come. We continue to be confident in our ability to drive further long-term growth and deliver shareholder value."

| | | | | | | | | | | | | | | | | | | | | | | |

Q4 2024 Financial Highlights(2) | | | | | | | |

| (in millions, except % and per share amounts) | GAAP | | Non-GAAP(1) |

| Q4 2024 | Q4 2023 | vs. Q4 2023 | | Q4 2024 | Q4 2023 | vs. Q4 2023 |

| | | | | | | |

| Revenue | $105.0 | $69.9 | better 50.2% | | | | |

| Net Loss from Continuing Operations/Adjusted EBITDA | $(25.3) | $(21.5) | worse $3.8 million | | $5.8 | $(7.4) | better $13.1 million |

| Diluted Net Loss Per Share from Continuing Operations | $(0.68) | $(0.77) | better $0.09 | | $(0.00) | $(0.43) | better $0.43 |

| Subscription Service Gross Margin Percentage | 53.2% | 48.1% | better 5.1% | | 64.7% | 65.3% | worse 0.6% |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Full Year 2024 Financial Highlights(2) | | | | | | |

| (in millions, except % and per share amounts) | GAAP | | Non-GAAP(1) |

| 2024 | 2023 | vs. 2023 | | 2024 | 2023 | vs. 2023 |

| | | | | | | |

| Revenue | $350.0 | $276.7 | better 26.5% | | | | |

| Net Loss from Continuing Operations/Adjusted EBITDA | $(89.9) | $(81.6) | worse $8.3 million | | $(6.4) | $(38.4) | better $32.0 million |

| Diluted Net Loss Per Share from Continuing Operations | $(2.63) | $(2.96) | better $0.33 | | $(0.73) | $(1.96) | better $1.23 |

| Subscription Service Gross Margin Percentage | 53.5% | 48.0% | better 5.5% | | 65.9% | 66.4% | worse 0.5% |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1) See “Key Performance Indicators and Non-GAAP Financial Measures” for reconciliations and descriptions of non-GAAP financial measures to corresponding GAAP financial measures. Amounts presented in the reconciliations and other tables presented herein may not sum due to rounding.

(2) Results exclude historical results from our Government segment which are reported as discontinued operations.

The Company's key performance indicators ARR and Active Sites(1) are presented as two subscription service product lines:

•Engagement Cloud consisting of Punchh, PAR Retail, PAR Ordering, and Plexure product offerings.

•Operator Cloud consisting of PAR POS, PAR Payment Services, PAR Pay, PAR OPS (Data Central and Delaget), and TASK product offerings.

Highlights of Engagement Cloud - Fourth Quarter 2024(1):

•ARR at end of Q4 '24 totaled $159.1 million

•Active Sites as of December 31, 2024 totaled 119.7 thousand

Highlights of Operator Cloud - Fourth Quarter 2024(1):

•ARR at end of Q4 '24 totaled $116.8 million

•Active Sites as of December 31, 2024 totaled 54.8 thousand

(1) See “Key Performance Indicators and Non-GAAP Financial Measures” below.

Earnings Conference Call.

There will be a conference call at 9:00 a.m. (Eastern) on February 28, 2025, during which management will discuss the Company's financial results for the fourth quarter ended December 31, 2024. The earnings conference call will be webcast live. To access the webcast, please visit the PAR Technology Investor Relations website at www.partech.com/investor-relations/. A recording of the webcast will be available on this site after the event.

About PAR Technology Corporation.

For over four decades, PAR Technology Corporation (NYSE: PAR) has been at the forefront of technology innovation in foodservice, helping businesses create exceptional guest experiences and connections. PAR’s comprehensive suite of software and hardware solutions, including point-of-sale, digital ordering, loyalty, back-office management, and payments, serves a diverse range of hospitality and retail clients across more than 110 countries. With its “Better Together” ethos, PAR continues to deliver unified solutions that drive customer engagement, efficiency, and growth, all to make it easier for PAR’s customers to manage their operations. To learn more, visit partech.com or connect with us on LinkedIn, X (formerly Twitter), Facebook, and Instagram. The Company's Environmental, Social, and Governance report can be found at https://www.partech.com/company/ESG.

Key Performance Indicators and Non-GAAP Financial Measures.

We monitor certain key performance indicators and non-GAAP financial measures in the evaluation and management of our business; certain key performance indicators and non-GAAP financial measures are provided in this press release because we believe they are useful in facilitating period-to-period comparisons of our business performance. Key performance indicators and non-GAAP financial measures do not reflect and should be viewed independently of our financial performance determined in accordance with GAAP. Key performance indicators and non-GAAP financial measures are not forecasts or indicators of future or expected results and should not have undue reliance placed upon them by investors.

Where non-GAAP financial measures are included in this press release, the most directly comparable GAAP financial measures and a detailed reconciliation between GAAP and non-GAAP financial measures is included in this press release under “Non-GAAP Financial Measures”.

Unless otherwise indicated, financial and operating data included in this press release is as of December 31, 2024.

As used in this press release,

“Annual Recurring Revenue” or “ARR” is the annualized revenue from subscription services, including subscription fees for our SaaS solutions and related software support, managed platform development services, and transaction-based payment processing services. We generally calculate ARR by annualizing the monthly subscription service revenue for all Active Sites as of the last day of each month for the respective reporting period. Our reported ARR is based on a constant currency, using the exchange rates established at the beginning of the year and consistently applied throughout the period and to comparative periods presented. For acquisitions made during each period, the constant currency rate applied is the exchange rate at the date of each acquisition's closure. There was no impact on our prior period ARR as a result of applying a constant currency as the exchange rate effects only began with the TASK Group Acquisition in 2024.

“Active Sites” represent locations active on PAR’s subscription services as of the last day of the respective reporting period.

Trademarks.

“PAR®,” “PAR POS®” (formerly “Brink POS®”), “Punchh®,” “PAR OrderingTM” (formerly “MENUTM”), "PAR OPSTM," “Data Central®," “DelagetTM,” "PAR RetailTM", "PAR® Pay”, “PAR® Payment Services”, and other trademarks identifying our products and services appearing in this press release belong to us.

Forward-Looking Statements.

This press release contains forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933, as amended, and the Private Securities Litigation Reform Act of 1995, the accuracy of such statements is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to the plans, strategies and objectives of management relating to PAR's growth, results of operations, and financial performance, including service and product offerings, the development, demand, market share, and competitive performance of our products and services, continued growth of our business, our ability to achieve and sustain profitability, acceleration or improvement of financial results, annual recurring revenue (ARR) growth, active sites, future efficiencies and scale economics, customer retention, capital investment and re-investment, expanding our addressable markets, cross-selling efforts, and anticipated benefits of acquisitions, divestitures, and capital markets transactions. These statements are neither promises nor guarantees but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements.

Factors, risks, trends and uncertainties that could cause actual results to differ materially from those expressed or implied by forward-looking statements include our ability to successfully develop or acquire and transition new products and services and enhance existing products and services to meet evolving customer needs and respond to emerging technological trends, including artificial intelligence (AI); our ability to successfully integrate acquisitions into our operations, and realize the anticipated benefits; macroeconomic trends, such as a recession or slowed economic growth, fluctuating interest rates, inflation, and changes in consumer confidence and discretionary spending; our ability to successfully expand our business or products into new markets or industries; geopolitical events, such the Russia-Ukraine war, tensions with China and between China and Taiwan, hostilities in the Middle East, including the Israel conflict(s), and uncertainty relating to new or increased tariffs or other trade restrictions implemented by the U.S. or retaliatory trade measures or tariffs implemented by other countries; and the other factors discussed in our most recent Annual Report on Form 10-K and our other filings with the Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to us on the date hereof. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

###

PAR TECHNOLOGY CORPORATION

CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands, except share amounts)

| | | | | | | | | | | |

| Assets | December 31, 2024 | | December 31, 2023 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 108,117 | | | $ | 37,183 | |

| Cash held on behalf of customers | 13,428 | | | 10,170 | |

| Short-term investments | 524 | | | 37,194 | |

| Accounts receivable – net | 59,726 | | | 42,679 | |

| Inventories | 21,861 | | | 23,560 | |

| Other current assets | 14,390 | | | 8,123 | |

| Current assets of discontinued operations | — | | | 21,690 | |

| Total current assets | 218,046 | | | 180,599 | |

| Property, plant and equipment – net | 14,107 | | | 15,524 | |

| Goodwill | 887,459 | | | 488,918 | |

| Intangible assets – net | 237,333 | | | 93,969 | |

| Lease right-of-use assets | 8,221 | | | 3,169 | |

| Other assets | 15,561 | | | 17,642 | |

| Noncurrent assets of discontinued operations | — | | | 2,785 | |

| Total Assets | $ | 1,380,727 | | | $ | 802,606 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| | | |

| Accounts payable | $ | 34,784 | | | $ | 25,599 | |

| Accrued salaries and benefits | 22,487 | | | 14,128 | |

| Accrued expenses | 13,938 | | | 3,533 | |

| Customers payable | 13,428 | | | 10,170 | |

| Lease liabilities – current portion | 2,256 | | | 1,120 | |

| Customer deposits and deferred service revenue | 24,944 | | | 9,304 | |

| Current liabilities of discontinued operations | — | | | 16,378 | |

| Total current liabilities | 111,837 | | | 80,232 | |

| Lease liabilities – net of current portion | 6,053 | | | 2,145 | |

| Long-term debt | 368,355 | | | 377,647 | |

| Deferred service revenue – noncurrent | 1,529 | | | 4,204 | |

| Other long-term liabilities | 21,243 | | | 3,603 | |

| Noncurrent liabilities of discontinued operations | — | | | 1,710 | |

| Total liabilities | 509,017 | | | 469,541 | |

| | | |

| Shareholders’ equity: | | | |

Preferred stock, $.02 par value, 1,000,000 shares authorized, none outstanding | — | | | — | |

| Common stock, $.02 par value, 116,000,000 shares authorized; 40,187,671 and 29,386,234 shares issued, 38,717,366 and 28,029,915 outstanding at December 31, 2024 and December 31, 2023, respectively | 798 | | | 584 | |

| Additional paid in capital | 1,085,473 | | | 625,154 | |

| Equity consideration payable | 108,182 | | | — | |

| Accumulated deficit | (279,943) | | | (274,956) | |

| Accumulated other comprehensive loss | (20,951) | | | (939) | |

Treasury stock, at cost, 1,470,305 and 1,356,319 shares at December 31, 2024 and December 31, 2023, respectively | (21,849) | | | (16,778) | |

| Total shareholders’ equity | 871,710 | | | 333,065 | |

| Total Liabilities and Shareholders’ Equity | $ | 1,380,727 | | | $ | 802,606 | |

See notes to consolidated financial statements included in the Company's annual report on Form 10-K for the year ended December 31, 2024 (the “Annual Report”).

PAR TECHNOLOGY CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended

December 31, |

| |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues, net: | | | | | | | |

| Subscription service | $ | 64,262 | | | $ | 32,897 | | | $ | 207,422 | | | $ | 122,597 | |

| Hardware | 26,048 | | | 24,400 | | | 87,040 | | | 103,391 | |

| Professional service | 14,695 | | | 12,603 | | | 55,520 | | | 50,726 | |

| | | | | | | |

| Total revenues, net | 105,005 | | | 69,900 | | | 349,982 | | | 276,714 | |

| Cost of sales: | | | | | | | |

| Subscription service | 30,095 | | | 17,080 | | | 96,519 | | | 63,735 | |

| Hardware | 19,336 | | | 17,317 | | | 65,923 | | | 80,319 | |

| Professional service | 10,567 | | | 11,289 | | | 41,416 | | | 43,214 | |

| | | | | | | |

| Total cost of sales | 59,998 | | | 45,686 | | | 203,858 | | | 187,268 | |

| Gross margin | 45,007 | | | 24,214 | | | 146,124 | | | 89,446 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 10,471 | | | 9,508 | | | 41,708 | | | 38,513 | |

| General and administrative | 31,002 | | | 19,213 | | | 108,898 | | | 72,139 | |

| Research and development | 17,432 | | | 14,493 | | | 67,258 | | | 58,356 | |

| Amortization of identifiable intangible assets | 2,875 | | | 465 | | | 8,452 | | | 1,858 | |

| Adjustment to contingent consideration liability | — | | | (1,700) | | | (600) | | | (9,200) | |

| Gain on insurance proceeds | (348) | | | — | | | (495) | | | (500) | |

| Total operating expenses | 61,432 | | | 41,979 | | | 225,221 | | | 161,166 | |

| Operating loss | (16,425) | | | (17,765) | | | (79,097) | | | (71,720) | |

| Other income (expense), net | 2,856 | | | (369) | | | 1,146 | | | (485) | |

| Loss on extinguishment of debt | (6,560) | | | (635) | | | (6,560) | | | (635) | |

| Interest expense, net | (3,412) | | | (1,779) | | | (10,167) | | | (6,931) | |

| Loss from continuing operations before income taxes | (23,541) | | | (20,548) | | | (94,678) | | | (79,771) | |

| Benefit from (provision for) income taxes | (1,752) | | | (975) | | | 4,768 | | | (1,848) | |

| Net loss from continuing operations | (25,293) | | | (21,523) | | | (89,910) | | | (81,619) | |

| Net income from discontinued operations | 4,236 | | | 2,894 | | | 84,923 | | | 11,867 | |

| Net loss | $ | (21,057) | | | $ | (18,629) | | | $ | (4,987) | | | $ | (69,752) | |

| | | | | | | |

| Net income (loss) per share (basic and diluted): | | | | | | | |

| Continuing operations | $ | (0.68) | | | $ | (0.77) | | | $ | (2.63) | | | $ | (2.96) | |

| Discontinued operations | 0.11 | | | 0.10 | | | 2.49 | | | 0.43 | |

| Total | $ | (0.57) | | | $ | (0.67) | | | $ | (0.14) | | | $ | (2.53) | |

| | | | | | | |

| Weighted average shares outstanding (basic and diluted) | 37,197 | | | 27,968 | | | 34,155 | | | 27,552 | |

See notes to consolidated financial statements included in the Annual Report.

PAR TECHNOLOGY CORPORATION

SUPPLEMENTAL INFORMATION

(unaudited)

Non-GAAP Financial Measures

In addition to disclosing financial results in accordance with GAAP, this press release contains references to the non-GAAP financial measures below. We believe these non-GAAP financial measures provide investors with useful supplemental information about our operating performance, enable comparison of financial trends and results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating our business and measuring our performance. The income tax effect of the below adjustments, with the exception of non-recurring income taxes, were not tax-effected due to the valuation allowance on all of our net deferred tax assets.

Our non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations from these results should be carefully evaluated. Additionally, these measures may not be comparable to similarly titled measures disclosed by other companies.

| | | | | | | | |

| Non-GAAP Measure or Adjustment | Definition | Usefulness to management and investors |

| Non-GAAP subscription service gross margin percentage | Represents subscription service gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. | We believe that non-GAAP subscription service gross margin percentage and adjusted EBITDA provide useful perspectives with respect to the Company's core operating performance and ongoing cash earnings by adjusting for certain non-cash and non-recurring charges that may not be indicative of our financial performance. |

| Adjusted EBITDA | Represents net loss before income taxes, interest expense and depreciation and amortization adjusted to exclude certain non-cash and non-recurring charges that may not be indicative of our financial performance. |

| Non-GAAP diluted net loss per share | Represents net loss per share excluding amortization of acquired intangible assets and certain non-cash and non-recurring charges that may not be indicative of our financial performance. | We believe that adjusting our diluted net loss per share to remove non-cash and non-recurring charges provides a useful perspective with respect to the Company's operating performance as well as comparisons to past and competitor operating results. |

| Stock-based compensation | Consists of non-cash charges related to our employee equity incentive plans. | We exclude stock-based compensation because management does not view these non-cash charges as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. |

| Contingent consideration | Adjustment reflects a non-cash reduction to the fair market value of the contingent consideration liability related to our acquisition of MENU Technologies AG (the "MENU Acquisition"). | We exclude changes to the fair market value of our contingent consideration liability because management does not view these non-cash, non-recurring charges as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. |

| | | | | | | | |

| Non-GAAP Measure or Adjustment | Definition | Usefulness to management and investors |

| Transaction costs | Adjustment reflects non-recurring professional fees incurred in transaction due diligence and integration, including costs incurred in the acquisitions of Stuzo Blocker, Inc., Stuzo Holdings, LLC and their subsidiaries (the "Stuzo Acquisition"), TASK Group Holdings Limited, and Delaget (the "Delaget Acquisition") | We exclude professional fees incurred in corporate development and integration because management does not view these non-recurring charges, which are inconsistent in size and are significantly impacted by the timing and valuation of our transactions, as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance, comparisons to past and competitor operating results, and additional means to evaluate expense trends. |

| Gain on insurance proceeds | Adjustment reflects the gain on insurance proceeds due to the settlement of legacy claims. | We exclude these non-recurring adjustments because management does not view these costs as part of our core operating performance. These adjustments facilitate a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. |

| Severance | Adjustment reflects severance tied to non-recurring restructuring events included in cost of sales, sales and marketing expense, general and administrative expense, and research and development expense. |

| |

| Litigation expense | Adjustment reflects the release of a loss contingency and settlement expenses for legal matters. |

| Loss on extinguishment of debt | Adjustment reflects loss on extinguishment of debt related to the conversion of the 4.500% Convertible Senior Notes due 2024 and a portion of the 2.875% Convertible Senior Notes due 2026. |

| Discontinued operations | Adjustment reflects income from discontinued operations related to the disposition of our Government segment. |

| Impairment loss | Adjustment reflects impairment loss related to the discontinuance of the Brink POS trademark and the impairment of internally developed software costs not meeting the general release threshold as a result of acquiring go-to-market software in the MENU Acquisition. |

| Other (income) expense, net | Adjustment reflects foreign currency transaction gains and losses and other non-recurring income and expenses recorded in other (income) expense, net in the accompanying statements of operations. |

| Non-recurring income taxes | Adjustment reflects a partial release of our deferred tax asset valuation allowance resulting from the Stuzo Acquisition and Delaget Acquisition. | We exclude these non-cash and non-recurring adjustments for purposes of calculating non-GAAP diluted net loss per share because management does not view these costs as part of our core operating performance. These adjustments facilitate a useful evaluation of our current operating performance, comparisons to past and competitor operating results, and additional means to evaluate expense trends. |

| Non-cash interest | Adjustment reflects non-cash amortization of issuance costs and discount related to the Company's long-term debt. |

| Acquired intangible assets amortization | Adjustment reflects amortization expense of acquired developed technology included within cost of sales and amortization expense of other acquired intangible assets. |

The tables below provide reconciliations between net loss and adjusted EBITDA, diluted net loss per share and non-GAAP diluted net loss per share, and subscription service gross margin percentage and non-GAAP subscription service gross margin percentage.

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | Three Months Ended December 31, | | Year Ended

December 31, |

| Reconciliation of Net Loss to Adjusted EBITDA | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss | $ | (21,057) | | | $ | (18,629) | | | $ | (4,987) | | | $ | (69,752) | |

| Discontinued operations | (4,236) | | | (2,894) | | | (84,923) | | | (11,867) | |

| Net loss from continuing operations | (25,293) | | | (21,523) | | | (89,910) | | | (81,619) | |

| Provision for (benefit from) income taxes | 1,752 | | | 975 | | | (4,768) | | | 1,848 | |

| Interest expense, net | 3,412 | | | 1,779 | | | 10,167 | | | 6,931 | |

| Depreciation and amortization | 11,205 | | | 6,881 | | | 37,907 | | | 27,014 | |

| | | | | | | |

| Stock-based compensation | 7,905 | | | 3,747 | | | 24,487 | | | 14,291 | |

| | | | | | | |

| Contingent consideration | — | | | (1,700) | | | (600) | | | (9,200) | |

| Litigation expense | — | | | (808) | | | — | | | (808) | |

| Transaction costs | 2,351 | | | 2,273 | | | 8,454 | | | 2,273 | |

| Gain on insurance proceeds | (348) | | | — | | | (495) | | | (500) | |

| Severance | 1,088 | | | — | | | 2,769 | | | 253 | |

| Loss on extinguishment of debt | 6,560 | | | 635 | | | 6,560 | | | 635 | |

| Impairment loss | — | | | — | | | 225 | | | — | |

| Other (income) expense, net | (2,856) | | | 369 | | | (1,146) | | | 485 | |

| Adjusted EBITDA | $ | 5,776 | | | $ | (7,372) | | | $ | (6,350) | | | $ | (38,397) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share amounts) | Three Months Ended December 31, | | Year Ended

December 31, | | | | |

| Reconciliation between GAAP and Non-GAAP diluted net loss per share | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Diluted net loss per share | $ | (0.57) | | | $ | (0.67) | | | $ | (0.14) | | | $ | (2.53) | | | | | |

| Discontinued operations | (0.11) | | | (0.10) | | | (2.49) | | | (0.43) | | | | | |

| Diluted net loss per share from continuing operations | (0.68) | | | (0.77) | | | (2.63) | | | (2.96) | | | | | |

| Non-recurring income taxes | 0.03 | | | — | | | (0.19) | | | — | | | | | |

| Non-cash interest | 0.02 | | | 0.02 | | | 0.07 | | | 0.08 | | | | | |

| Acquired intangible assets amortization | 0.24 | | | 0.16 | | | 0.84 | | | 0.66 | | | | | |

| Stock-based compensation | 0.21 | | | 0.13 | | | 0.72 | | | 0.52 | | | | | |

| | | | | | | | | | | |

| Contingent consideration | — | | | (0.06) | | | (0.02) | | | (0.33) | | | | | |

| Litigation expense | — | | | (0.03) | | | — | | | (0.03) | | | | | |

| Transaction costs | 0.06 | | | 0.08 | | | 0.25 | | | 0.08 | | | | | |

| Gain on insurance proceeds | (0.01) | | | — | | | (0.01) | | | (0.02) | | | | | |

| Severance | 0.03 | | | — | | | 0.08 | | | 0.01 | | | | | |

| Loss on extinguishment of debt | 0.18 | | | 0.02 | | | 0.19 | | | 0.02 | | | | | |

| Impairment loss | — | | | — | | | 0.01 | | | — | | | | | |

| Other (income) expense, net | (0.08) | | | 0.01 | | | (0.03) | | | 0.02 | | | | | |

| Non-GAAP diluted net loss per share | $ | (0.00) | | | $ | (0.43) | | | $ | (0.73) | | | $ | (1.96) | | | | | |

| | | | | | | | | | | |

| Diluted weighted average shares outstanding | 37,197 | | | 27,968 | | | 34,155 | | | 27,552 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended

December 31, |

Reconciliation between GAAP and Non-GAAP

Subscription Service Gross Margin Percentage | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Subscription Service Gross Margin Percentage | 53.2 | % | | 48.1 | % | | 53.5 | % | | 48.0 | % |

| Depreciation and amortization | 11.3 | % | | 16.9 | % | | 12.2 | % | | 18.1 | % |

| Stock-based compensation | 0.1 | % | | 0.3 | % | | 0.1 | % | | 0.3 | % |

| Severance | 0.1 | % | | — | % | | 0.1 | % | | — | % |

| Non-GAAP Subscription Service Gross Margin Percentage | 64.7 | % | | 65.3 | % | | 65.9 | % | | 66.4 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

partech.com Q4 ‘24 Earnings Presentation February 28, 2025 NYSE: PAR 1

partech.com Forward-Looking Statements. This presentation contains forward-looking statements made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, Section 27A of the Securities Act of 1933, as amended, and the Private Securities Litigation Reform Act of 1995, the accuracy of such statements is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to the plans, strategies and objectives of management relating to PAR's growth, results of operations, and financial performance, including service and product offerings, the development, demand, market share, and competitive performance of our products and services, continued growth of our business, our ability to achieve and sustain profitability, acceleration or improvement of financial results, annual recurring revenue (ARR) growth, active sites, future efficiencies and scale economics, customer retention, capital investment and re-investment, expanding our addressable markets, cross-selling efforts, and anticipated benefits of acquisitions, divestitures, and capital markets transactions. These statements are neither promises nor guarantees but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Factors, risks, trends and uncertainties that could cause actual results to differ materially from those expressed or implied by forward-looking statements include our ability to successfully develop or acquire and transition new products and services and enhance existing products and services to meet evolving customer needs and respond to emerging technological trends, including artificial intelligence (AI); our ability to successfully integrate acquisitions into our operations, and realize the anticipated benefits; macroeconomic trends, such as a recession or slowed economic growth, fluctuating interest rates, inflation, and changes in consumer confidence and discretionary spending; our ability to successfully expand our business or products into new markets or industries; geopolitical events, such the Russia-Ukraine war, tensions with China and between China and Taiwan, hostilities in the Middle East, including the Israel conflict(s), and uncertainty relating to new or increased tariffs or other trade restrictions implemented by the U.S. or retaliatory trade measures or tariffs implemented by other countries; and the other factors discussed in our most recent Annual Report on Form 10-K and our other filings with the Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this presentation, which are based on information available to us on the date hereof. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law. Industry and Market Data. Market, industry, and other data included in this presentation are from or based on our own internal good faith estimates and research, and on publicly available publications, research, surveys and studies conducted by third parties, which we believe are reliable, but have not independently verified. Similarly, while we believe our internal estimates and research are reliable, we have not independently verified our internal estimates or research. While we are not aware of any misstatements regarding any market, industry, or other data used by us or expressed in this presentation, such information, because it has not been verified or, by its nature - market surveys, estimates, projections or similar data, are inherently subject to uncertainties, and actual results may differ materially from the assumptions and circumstances reflected in this information. Key Performance Indicators and Non-GAAP Financial Measures.(1) We monitor certain key performance indicators and non-GAAP financial measures in the evaluation and management of our business; certain key performance indicators and non-GAAP financial measures are provided in this presentation as we believe they are useful in facilitating period-to-period comparisons of our business performance. Key performance indicators and non-GAAP financial measures do not reflect and should be viewed independently of our financial performance determined in accordance with GAAP. Key performance indicators and non-GAAP financial measures are not forecasts or indicators of future or expected results and should not have undue reliance placed upon them by investors. Where non-GAAP financial measures are included in this presentation, the most directly comparable GAAP financial measures and a detailed reconciliation between GAAP and non- GAAP financial measures is included in the Appendix to this presentation. Unless otherwise indicated, financial and operating data included in this presentation is as of December 31, 2024. Trademarks. “PAR®,” “PAR POS®” (formerly “Brink POS®”), “Punchh®,” “PAR OrderingTM” (formerly “MENUTM”), "PAR OPSTM," “Data Central®," “DelagetTM,” "PAR RetailTM", "PAR® Pay”, “PAR® Payment Services”, and other trademarks identifying our products and services appearing in this presentation belong to us. This presentation may also contain trade names and trademarks of other companies. Our use of such other companies’ trade names or trademarks is not intended to imply any endorsement or sponsorship by these companies of us or our products or services. (1) See Appendix for Non-GAAP reconciliations and Key Performance Indicators 2

partech.com Our Journey … So Far ... 3 GLOBAL FOOD SERVICE PURE PLAY • Acquired loyalty provider PAR Retail, international solutions TASK and Plexure, and analytics and intelligence provider Delaget • Sold Government segment to become a pure play food service tech company 1980s+ EARLY INNOVATION • Founded in 1968 as a DoD tech contractor • Pioneered the first commercial POS 2018 2019 SOFTWARE RENAISSANCE • Restructured PAR, new team, mission, values • Recapitalized PAR to invest in SaaS • Acquired Data Central • Shifted focus to SaaS $11.3M Q4 2018 ▲ 2020 2021 2022 BUILDING A UNIFIED PLATFORM • Launched PAR Payments • Acquired Punchh in April 2021, a leader in loyalty and guest engagement solutions • Acquired PAR Ordering (formerly MENU), an omnichannel ordering solution • Crossed 100k active sites ▲ $33.5M Q4 2020 2023 2024+ $19.2M Q4 2019 ▲ $136.9M Q4 2023 ▲$88.2M Q4 2021 ▲ ▲ $111.4M Q4 2022 ▲ $276.0M Q4 2024 (Dollar values represent ARR)

partech.com • Unified technology platform offering integrated solutions and sophisticated data insights • Pairs with our state of the art hardware offerings for a complete tech stack • Supported by our comprehensive professional service offerings to drive a positive customer experience Building a Unified Experience... Leading To 4

partech.com PAR's Success Will Be Driven by our Flywheel 5

partech.com Financial Review Fourth Quarter 2024 Highlights 6

partech.com Q4 2024 Highlights 7 • Consistent delivery on strong organic ARR growth 21% organic ARR growth1 2 • Cross-sell traction creating meaningful revenue opportunity from existing and potential future whitespace Continued Adjusted EBITDA profitability 3 Cross-sell traction 4 Delaget Acquisition • Adjusted EBITDA of $5.8 million in Q4 2024 • Completed the acquisition of Delaget, LLC ("Delaget”), a leading provider of restaurant analytics and business intelligence solutions • Proven track record of strategic M&A, with the recent acquisitions of PAR Retail, TASK Group, and Delaget significantly expanding PAR’s TAM into convenience stores and international markets5 Repeatable M&A motion

partech.com Q4 2024 Revenue Breakout Revenue by Offering 24.8% 61.2% 14.0% Hardware Subscription Service Professional Service ARR by Subscription Product Line 42.3% 57.7% Operator Cloud Engagement Cloud 8

partech.com Strong Organic & Inorganic ARR Growth Year-over-year metrics are for the quarter ended 12/31/2024 compared to the quarter ended 12/31/2023. Please see Appendix — Key Performance Indicators for more information on ARR. 136.9 144.7 151.8 160.2 165.2 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 136.9 185.7 192.2 248.1 276.0 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 9 Organic ARR 21% Y/Y Growth Total ARR 102% Y/Y Growth ($'000,000)

partech.com Resilient ARR Growth Across Product Lines Year-over-year metrics are for the quarter ended 12/31/2024 compared to the quarter ended 12/31/2023. Please see Appendix — Key Performance Indicators for more information on ARR. 73.1 78.5 84.2 93.4 116.8 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 63.8 107.2 107.9 154.7 159.1 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 10 Operator Cloud 60% Y/Y Growth Engagement Cloud 150% Y/Y Growth ($'000,000)

partech.com Driving Margin Expansion (1) Non-GAAP Subscription Service Gross Margin percentage and Non-GAAP Consolidated Gross Margin percentage are Non-GAAP financial measures. Please see Appendix for a detailed reconciliation to Subscription Service Gross Margin percentage and Consolidated Gross Margin percentage (GAAP). Year-over-year metrics are for the quarter ended 12/31/2024 compared to the quarter ended 12/31/2023. 65.3% 65.7% 66.4% 66.8% 64.7% Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 11 Non-GAAP Subscription Service Gross Margin Percentage(1) 43.1% 45.6% 49.3% 51.8% 50.3% Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 720 Basis Point Y/Y Margin Expansion Non-GAAP Consolidated Gross Margin Percentage(1)

partech.com As We Grow, Efficiency Improves (1) Adjusted EBITDA is a Non-GAAP financial measure. Please see Appendix for a detailed reconciliation from net income (loss) to Adjusted EBITDA. (7.4) (10.2) (4.3) 2.4 5.8 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 12 Adjusted EBITDA(1) ($000,000) Continued Adjusted EBITDA Growth Q4 5.8M

partech.com Q4 ‘24 Financials Consolidated Highlights • 86% increase in gross margin from Q4 2023 • $13.1 million increase in Adjusted EBITDA(1) from Q4 2023 • $3.4 million increase in Adjusted EBITDA(1) from Q3 2024 Subscription Service Highlights • 102% increase in ARR from Q4 2023 • 95% increase in revenue from Q4 2023 Three Months Ended December 31 (in thousands) 2024 2023 Revenues, net: Subscription service $ 64,262 $ 32,897 Hardware 26,048 24,400 Professional service 14,695 12,603 Total revenues, net 105,005 69,900 Total gross margin 45,007 24,214 Operating expenses: Sales and marketing 10,471 9,508 General and administrative 31,002 19,213 Research and development 17,432 14,493 Amortization of identifiable intangible assets 2,875 465 Adjustment to contingent consideration liability — (1,700) Gain on insurance proceeds (348) — Total operating expenses 61,432 41,979 Other income (expense), net 2,856 (369) Loss on extinguishment of debt (6,560) (635) Interest expense, net (3,412) (1,779) Loss from continuing operations before provision for income taxes (23,541) (20,548) Provision for income taxes (1,752) (975) Net loss from continuing operations (25,293) (21,523) Net income from discontinued operations 4,236 2,894 Net loss (21,057) (18,629) Non-GAAP adjustments 26,833 11,257 Adjusted EBITDA(1) 5,776 (7,372) 13 (1) Adjusted EBITDA is a Non-GAAP financial measure. Please see Appendix for a detailed reconciliation from net income (loss) to Adjusted EBITDA.

partech.com Appendix 14

partech.com 3 Months Ended Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Subscription Service Gross Margin Percentage 48.1% 51.6% 53.1% 55.3% 53.2% Add: Depreciation and amortization 16.9% 13.9% 13.1% 11.4% 11.3% Add: Stock-based compensation 0.3% 0.1% 0.2% 0.1% 0.1% Add: Severance —% 0.1% —% —% 0.1% Non-GAAP Subscription Service Gross Margin Percentage 65.3% 65.7% 66.4% 66.8% 64.7% May not sum/recalculate due to rounding. Non-GAAP Subscription Service Gross Margin Percentage Reconciliation 15

partech.com 3 Months Ended Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Consolidated Gross Margin Percentage 34.6% 37.2% 41.0% 44.5% 42.9% Add: Depreciation and amortization 8.2% 7.9% 7.6% 7.1% 7.0% Add: Stock-based compensation 0.3% 0.2% 0.4% 0.2% 0.1% Add: Severance —% 0.3% 0.3% —% 0.3% Non-GAAP Consolidated Gross Margin Percentage 43.1% 45.6% 49.3% 51.8% 50.3% May not sum/recalculate due to rounding. Non-GAAP Consolidated Gross Margin Percentage Reconciliation 16

partech.com (in thousands) 3 Months Ended Q4'24 Q3'24 Q2'24 Q1'24 Q4'23 Net income (loss) $(21,057) $(19,832) $54,190 $(18,288) $(18,629) Discontinued operations (4,236) (832) (77,777) (2,078) (2,894) Net loss from continuing operations (25,293) (20,664) (23,587) (20,366) (21,523) Provision for (benefit from) income taxes 1,752 653 612 (7,785) 975 Interest expense, net 3,412 3,417 1,630 1,708 1,779 Depreciation and amortization 11,205 10,575 8,834 7,293 6,881 Stock-based compensation 7,905 5,887 6,286 4,410 3,747 Contingent consideration — — (600) — (1,700) Litigation expense — — — — (808) Transaction costs 2,351 1,125 1,573 3,405 2,273 Gain on insurance proceeds (348) (147) — — — Loss on extinguishment of debt 6,560 — — — 635 Severance 1,088 (48) 294 1,434 — Impairment loss — 225 — — — Other expense (income), net (2,856) 1,400 610 (300) 369 Adjusted EBITDA $5,776 $2,423 $(4,348) $(10,201) $(7,372) 17 Net Income (Loss) to Adjusted EBITDA Reconciliation

partech.com 1. Foodservice market ready for disruption • Large TAM in restaurants with ~1m locations in the US spending 2-3% of total revenue on technology1 • Enterprise foodservice playing “catch-up” in adopting new technology and anticipate this technology spend to ramp • The industry shift to cloud technology has led to an explosion in new technology from Voice AI to marketing technology 2. Meeting market need with a Unified Experience • Today technology is driving a wedge between restaurants and their guests • Brands are shifting to well integrated vendors and more targeted guest interactions • There is an opportunity to create an integrated solution with unified data that enables restaurants to have 1:1 relationship with their guests • Industry seeking vendor consolidation and platform experience and reduce single-product providers 3. ARR at scale with strong SaaS metrics • Through both organic and inorganic strategies, ARR has reached $276.0M with significant opportunity to expand within existing customers and win new business • Hyper-focus on stringent OpEx spend management with real ROI mindset (1) Source: Technomic Investment Thesis 18

partech.com • Annual Recurring Revenue or "ARR” is the annualized revenue from subscription services, including subscription fees for our SaaS solutions and related software support, managed platform development services, and transaction-based payment processing services. We generally calculate ARR by annualizing the monthly subscription service revenue for all Active Sites as of the last day of each month for the respective reporting period. Our reported ARR is based on a constant currency, using the exchange rates established at the beginning of the year and consistently applied throughout the period and to comparative periods presented. For acquisitions made during each period, the constant currency rate applied is the exchange rate at the date of each acquisition's closure. There was no impact on our prior period ARR as a result of applying a constant currency as the exchange rate effects only began with the TASK Group Acquisition in 2024. • “Active Sites” represent locations active on PAR’s subscription services as of the last day of the respective reporting period. • “Non-GAAP Subscription Service Gross Margin Percentage” represents subscription service gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. • “Non-GAAP Consolidated Gross Margin Percentage” represents consolidated gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. • “Adjusted EBITDA” represents net income (loss) before income taxes, interest expense and depreciation and amortization adjusted to exclude certain non-cash and non-recurring charges that may not be indicative of our financial performance Key Performance Indicators 19

partech.com Thank You! 20

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

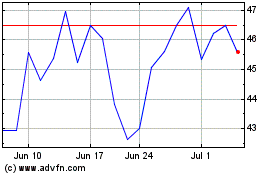

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Feb 2025 to Mar 2025

PAR Technology (NYSE:PAR)

Historical Stock Chart

From Mar 2024 to Mar 2025